Stocks and Shares ISAs are the backbone of many investment portfolios. The tax-efficient features of a Stocks and Shares ISA, also known as an Investment ISA, mean any profits generated are free from capital gains and income tax. With market volatility as high as it is, and the potential for growth stocks to post stellar returns, it can pay off to use ISAs and avoid the risk of paying Capital Gains Tax (CGT) on any returns in excess of £12,300 per annum.

YOUR CAPITAL IS AT RISK

The vehicle, or wrapper, that Individual Savings Accounts represent make sense in terms of taxation, but there is still the tricky question of which assets to invest in and which broker to use. This report addresses these points and offers a step-by-step guide to understanding the factors that need to be considered. From there, it’s a case of tapping into the markets to find the best Stocks and Shares ISAs for 2021 and the trusted brokers that offer them.

Table of contents

- What is a Stocks and Shares ISA?

- What types of Stock and Shares ISA are There?

- Best Performing Stocks and Shares ISAs in 2021

- Fineco Bank – Best Stocks and Shares ISA to Invest in Now

- IG – Best Choice of Stocks and Shares ISAs

- Interactive Investors – Best Low-Cost Stocks and Shares ISA

- Hargreaves Lansdown – Best Stocks and Shares ISA for Consistent Returns

- How to Invest in a Stocks and Shares ISA

- Other Ways to Trade in Stocks Tax Free

- Conclusion

What is a Stocks and Shares ISA?

Imagine you have £50,000 to invest in the equity markets. After opening a trading account at a broker and turning your investment decisions into trading positions, the market moves in your favour and your portfolio increases in value to £70,000. If you had just bought those positions outright, then selling them and posting a £20,000 gain would see £7,700 of that profit liable to capital gains tax.

If you had gone through exactly the same process and opened a Stocks and Shares ISA account, then all of the £20,000 would be yours to keep. ISAs don’t make any difference to how and when you buy and sell – the market prices that apply to your portfolio are exactly the same. It’s just that the Investment ISA account ‘wrapper’ means you can take advantage of tax breaks.

The key takeaways relating to ISAs are:

- The ISA scheme is completely legit. It is supported by UK governments who want to incentivise the population to invest for their futures.

- The program is only open to UK citizens, but you can invest in non-UK assets. Any stock or share such as Apple Inc (AAPL) can be held in an Investment ISA as long as it is traded on a ‘recognised stock exchange’, in Apple’s case, the Nasdaq.

- UK adults can each invest up to £20,000 per year in an Investment ISA.

- You can pay money into your ISA using everyday payment processing agents and it’s also possible to set up direct debit schemes to support regular saving.

- You can withdraw funds from an ISA at any time, but unless your ISA is a ‘Flexible’ one, you can’t then put the money back in if you have already used your ISA subscription tax allowance for that year.

- If you move abroad, then depending on your destination, you might lose the right to continue investing new funds into your ISA. You won’t, however, be a forced seller and can keep it open for as long as you want.

- The average adult Investment ISA holds £9,331 and the total size of the Stocks and Shares ISA market is £22.6bn.

- That £22.6bn number is constantly changing. As the prices of the underlying assets change, so does the value of the holdings in an ISA. The ISA is only a tax-efficient vehicle with which to hold stocks and shares. Fundamental market-risk principles still apply.

- In a recent survey by Fineco, it is estimated that two out of three people are looking to switch their ISA provider this year. Another trend is that 53% of those asked expect to invest more in their ISA this year than they did in 2020–21. Competition between the brokers is hotting up, and there are some great deals on offer.

What types of Stock and Shares ISA are There?

Stocks and Shares ISAs are a great way to invest but choosing what goes in them is still the fundamental factor in play. Getting that part of the process right involves establishing your investment goals, investment time horizon and risk appetite. Then it’s a case of choosing one of the following types of investment strategies.

Individual Stock ISAs – As with non-ISA trading, you can use your broker to buy individual stocks and shares, or even just one. The only restriction is the £20,000 per annum cap on subscriptions. You have complete control over trading activity and the privilege and responsibility for making the right calls.

Tracker Fund ISAs – Broker platforms have made diversifying risk easy by offering ISA holders the opportunity to buy a fund that contains a basket of assets. These can be filtered in various ways, including geography (FTSE 100 Fund) or sector (Solar Power Companies). By investing in a fund, you mitigate single-stock risk, but at the same time, only have to make one transaction.

Tracker funds are passive, they simply try to replicate the performance of a benchmark index.

Managed Fund ISAs – It’s also possible to invest in a managed fund. In this instance, a fund manager will trade in and out of positions to try to use their skills and experience to enhance returns.

YOUR CAPITAL IS AT RISK

Best Performing Stocks and Shares ISAs in 2021

Fineco Bank – Best Stocks and Shares ISA to Invest in Now

Fineco Bank is regulated by the Bank of Italy and Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA). It specialises in Stocks and Shares ISAs and makes it easy for clients to put money into a range of investments, including Funds, Shares, ETFs and bonds.

Fineco is currently running a fees promotion, making now a good time to sign up with it. There is a 0% ISA platform fee until April 2022, a maximum annual platform fee of 0.25% from then on and a cap of £2.95 for shares, ETF and bonds ISAs.

Fineco has thousands of funds to choose from for your ISA and offers passive and actively managed products from a range of highly regarded fund managers.

One of the plus points of the Fineco service is the range of research and analysis tools it provides to help you choose the right asset for your ISA account. The PowerDesk platform is packed full of powerful software tools and the Fineco App allows you to keep on top of your investments using handheld devices.

- Zero platform fees for the first year

- Capped at 0.25% thereafter

- Zero withdrawal fees

- No set-up costs

- No minimum opening balance amount

Our pick of the ISAs on offer at Fineco is the M&G North American Value FAM Fund

One of the best ISA funds is the M&G North American Value FAM Fund, which invests mainly in shares of US and Canadian companies. Launched in 2018, it has returned 36.5% to investors over the last 12 months and 11% over the last three months.

The fund applies a ‘value strategy’, so it invests in companies deemed to be currently undervalued. It has a mandate to invest in companies of all sizes and in a range of sectors. Some of the sleeping giants of the North American corporate world could well be sounded out by the M&G investment team.

US fiscal and monetary policies designed to help the economy recover from the COVID pandemic are enormous in size and look set to not only kickstart the North American economy, but send it into overdrive.

YOUR CAPITAL IS AT RISK

IG – Best Choice of Stocks and Shares ISAs

IG is a big player in the broking sector. In total, it offers more than 17,000 markets in a range of instruments ranging from ETFs to Options. Leveraging off existing services, and its 40 years’ operating as a trusted broker, the firm has developed a range of ISAs, which is hard to beat.

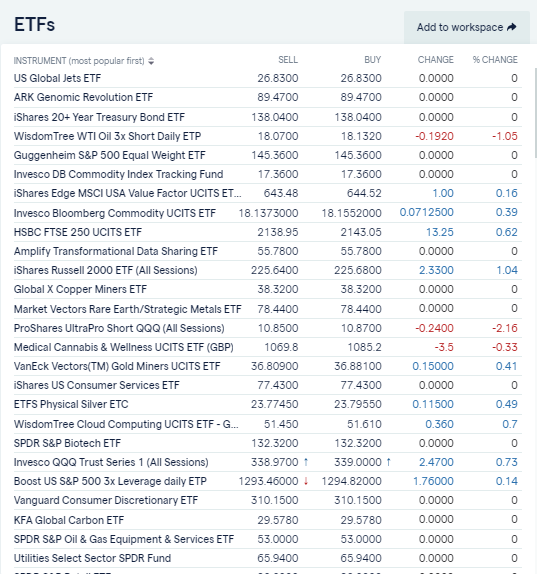

Exchange Traded Funds are popular among ISA investors as they offer a chance to focus investment in a particular sector or country. IG’s offering of more than 6,000 ETFs means that whatever area of the financial markets you want to back, IG has it covered.

Source: IG

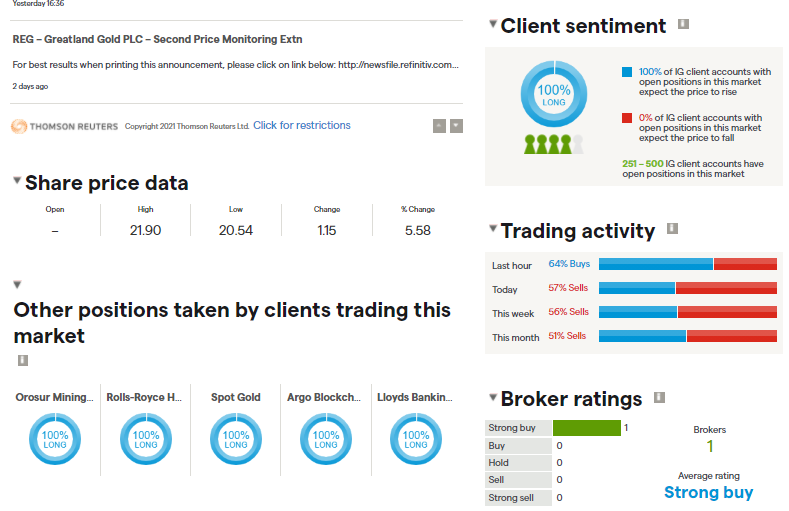

If you’re looking to split your ISA allowance of £20,000 across different strategies, then it’s worth noting IG supports trading in 8,000 different equity markets. The research and analysis on each of the names goes down to a granular level, including broker ratings, trader sentiment and balance sheet financials.

There is zero commission on share dealing in US markets, making it easy to bring some of the biggest stocks in the world into your ISA. Apple, Microsoft, Proctor & Gamble are popular targets, but they also provide markets in smaller growth stocks which might (or might not) be a good side-bet in terms of a buy-and-hold position.

Source: IG

IG isn’t the cheapest in terms of running costs, but skimping on fees does run the risk of being ‘penny wise and pound foolish’. You get what you pay for and the first-rate support structure and range of markets provide all the tools you’ll need to make an informed decision about which long-term investment is best for you.

Our pick of the ISA compatible instruments on offer at IG come from the Small Cap and Tech Stock sectors.

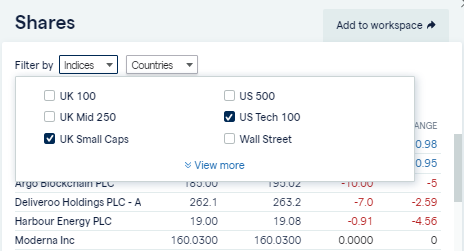

Filters on the IG Equity market monitor allow you to create a short-list from the US Tech 100 and UK Small Caps markets. Trying to pick potential big-winners is a high risk-return strategy, but the number of equities on offer allows you to build a portfolio of different names so that you can mitigate against single-stock risk.

Source: IG

Established investment advice would discourage investors from allocating more than a small percentage of their total wealth in these stocks and to be prepared to lose it all. But given that ISAs are designed to support long-term investment, the IG ISA is an ideal home for growth stocks that might come good. If they do, the returns are tax-free.

YOUR CAPITAL IS AT RISK

Interactive Investors – Best Low-Cost Stocks and Shares ISA

If you’re new to ISA investing, there is something to be said for using a platform that specialises in outlining what is involved in a clear and transparent way.

Interactive Investors is a well-established brand, but don’t let that get in the way of it making information on its products easy to access.

The fees for holding an ISA account are in line with the peer group, and being ‘flat fees’, don’t increase in size even if your investment performs well. Put simply, this means more of your money remains in your investment position.

The platform also offers clients one free trade per month and if you set up a direct debit for regular trading, there are no fees charged on that service either. For those looking to trade with that amount of frequency, it’s an offer that will prove attractive.

The good news on fees not only extends to new customers. Existing customers can add an ISA to their existing account at no extra cost.

This practical and welcome approach to T&Cs is backed up by one of the widest choices of investments and expert research and analysis tools.

Interactive Investors ISAs are set up to support trading in individual stocks and shares, funds, ETFs and investment trusts. The platform offers stocks and shares ISA performance tables to help you choose. It presents all the information in a straightforward way.

Our pick of the Interactive Investor ISA funds is the Baillie Gifford Positive Change C Acc fund.

Clients of Interactive Investors have been loading up on Baillie Gifford funds, with six out of the top 10 most popular funds being managed by BG. The Positive Change fund has generated a one-year total return of 86.32%.

The ethical approach to investments captures a current trend, which doesn’t look like slowing down anytime soon. Taking positions that factor in ecological, employment and corporate governance issues no longer leave you out of pocket and the Positive Change fund continues to produce returns greater than the benchmark Global fund.

YOUR CAPITAL IS AT RISK

Hargreaves Lansdown – Best Stocks and Shares ISA for Consistent Returns

Stocks and Shares ISAs don’t need to be about hitting home runs. With interest rates at record low levels, Investment ISAs that aim to generate a more conservative return are still sought after. For certain investor profiles, the best investment ISA is a Total Return fund, which selects assets designed to offer a return but also diversify risk.

The instruments in a Total Return fund can still include equities, especially those that have a reputation for paying dividends.

The price of the underlying stock still fluctuates, but the dividend can be fed back into your account as extra shares, which means your position snowballs. This type of reinvestment has historically been the secret to maximising returns. A lot of high-yield stocks are large-cap, blue-chip stocks, which offer a degree of security due to their critical mass and long-established business models.

Other asset groups which might be found in a Total Return fund include bonds, commodities and currencies. The fund manager looks to beat but not break the market by spotting and capitalising on long term macro trends.

Allocating some of your Investment ISA allowance to a strategy that provides some long-term stability can balance out higher risk positions. With some analysts forecasting that inflation or even stagflation could return to the global economy, having some funds allocated to a more conservative approach could be a good idea.

Our pick of the Hargreaves Lansdown Total Return ISA funds is Troy Asset Management’s Troy Trojan.

As the purpose of a Total Return fund is to offer steadier returns, there’s no need to search out one offering quirky features. The Troy Trojan fund is a classic Total Return fund that aims to generate consistent returns over the long-term. It invests in equities, corporate debt, forex, precious metals, money market instruments and government bonds.

Actively managed funds typically incur larger fees than passive ones because there is more going on behind the scenes.

YOUR CAPITAL IS AT RISK

How to Invest in a Stocks and Shares ISA

Whichever broker you choose, the process of setting up a stocks and shares ISA is pretty much the same.

- Sign up for an account– This process is typically done online and takes minutes to do. The onboarding process involves setting up a user-profile and, as ISAs are a tax-break, the broker will have processes in place to check that you don’t extend your total investment over the £20,000 per year allowance.

- Fund your account– Once your account is set up, it’s simply a case of wiring funds from your bank account into your broker account. This can be done using a variety of payment methods with wire transfer and debit card being popular options.

- Find your chosen market– The online broker platforms allow you to search and filter the different instruments so that you can fine-tune your search. Each instrument will be backed up by some key information reports covering the T&Cs involved with trading them. There will also be price charts and performance tables to allow you to run some last-minute checks on your investment strategy.

- Buy your Investment ISA product –This process will differ slightly depending on what asset group you are investing in. The ultimate result is that you’ll convert some of your cash pile into financial market assets, which will then fluctuate in value according to market price moves.

- Check and monitor your ISA investment –It’s prudent to check your trade details to ensure you bought what you wanted to. As ISAs are typically seen as being investments with a minimum holding period of five years, ongoing management may be light-touch but regular check-ups are advised and can be done from desktop or mobile app devices.

Other Ways to Trade in Stocks Tax Free

ISAs are one of the most convenient ways of trading tax-free, but there are others.

Spread betting, also offered by brokers including IG, is tax free for UK and Northern Ireland citizens. It works on the same principles as CFD trading but there is a more limited range of markets available.

CFD trading is subject to Capital Gains Tax, but trading UK shares in CFD form is exempt from Stamp Duty (SDRT), the 0.5% levy on UK share purchases.

In terms of Capital Gains Tax, it’s also worth remembering that each UK individual has an annual CGT allowance of £12,300, so if you don’t post realised profits in excess of that number, CGT will not apply.

The tax treatment of these products is considered in more detail here and does change over time. It also depends on your individual circumstances. If you are uncertain about the tax treatment of the product you want to trade, you should contact HMRC or seek independent tax advice.

Conclusion

Stocks and shares ISAs are long term investments and because of that, some forward planning is recommended. If you're in any doubt about the suitability of a stocks & shares ISA, you should seek independent financial advice. The process of accessing the markets and finding a reliable and cost-effective broker is more straightforward.

In terms of market prices, you might find you pick one of the best-performing stocks and shares ISAs, but nothing can be guaranteed, and the value of your assets can go down as well as up. But if they do go up, then holding them in a Stocks and Shares ISA means you stand to keep more of the gains.