The Singapore stock market is throwing up a range of interesting buying opportunities with analysts and researchers digging deep into the details of the firms that make up the Straits Times Index. A lot of the optimism comes from hopes that the Singapore economy will be one of the winners as the global economy returns to normal.

YOUR CAPITAL IS AT RISK

In addition, some of the individual firms look well-positioned to outperform the general market. Established blue-chip firms are being tipped for 10% stock price gains, while smaller firms could offer a chance for investors to scale up on risk-return. This review of the most recent price data and ratings will provide a shortlist of some of the best dividend stock Singapore has on offer, and how to trade them.

Best Singapore Stocks to Buy

- DBS Group Holdings Ltd

- AEM Holdings

- Keppel Holdings

- Singapore Telecommunications Ltd

- Aztech Global Limited

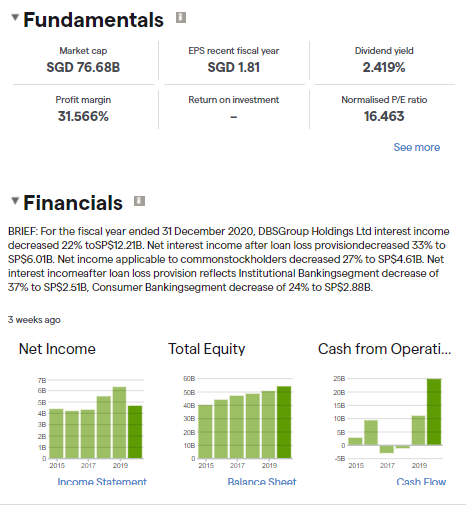

1. DBS Group Holdings Ltd

DBS is a multinational banking and financial services corporation. Its global client base means that if the Singapore economy does get up and running before those of other countries, DBS could make the most of the head start. The firm has weathered the COVID storm relatively well, and the financial sector as a whole would benefit from global interest rate levels rising as that helps improve their profit margins. Often tipped as a good Singapore dividend stock the firm has generated a near 3% yield for investors over the last four years.

The ‘safe pair of hands’ aspects of the business has led to it being overlooked, until now. It’s the highest-rated banking group stock in Asia and its most recent financial reports revealed a strong balance sheet. Analysts at investment banks OCBC, Maybank and CIMB recently raised their target prices by over 10%.

- 2020 – Reported dividend amount per share: 3.40%

- 2019 – Reported dividend amount per share: 5.01%

- 2018 – Reported dividend amount per share: 5.67%

- 2017 – Reported dividend amount per share: 2.10%

Source: Dividends

Source: IG

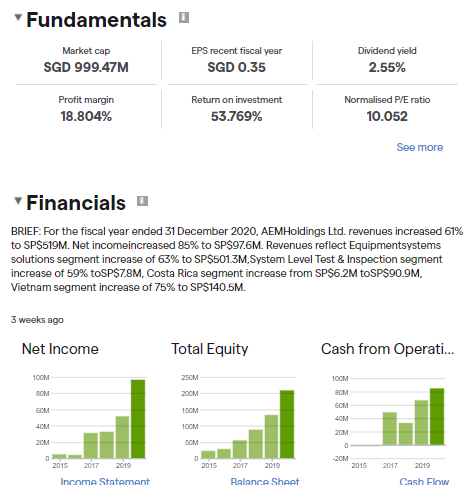

2. AEM Holdings

At the other end of the spectrum is a Singapore tech stock tipped by analysts at CIMB to sky-rocket by 32.8%. Currently trading at $3.56, AEM Holdings provides semiconductor solutions. The computer-chip sector has been volatile of late due to a worldwide shortage caused by supply struggling to keep up with demand, which spiked due to a shift to lockdown home-working. AEM doesn’t make the actual chips themselves but instead provides specialist services to chip manufacturers.

Currently trading at a P/E ratio some way below its peer group, the firm is attracting the attention of investment banks with DBS setting a target price of $4.73 and CIMB one of $4.63.

AEM offers more growth potential than DBS but the trade-off is that the dividend, while still being above the bank savings rate, is not as strong as that or the banking giant. Forecasts made by the firm in its 2021 Q1 financial statements point to some of the investment projects converting into revenue streams in 2022 and 2023.

“Technology acquisitions and in-house R&D bearing results with engineering engagements with 10 out of the top 20 semiconductor companies for potential volume ramp in FY2022 / 20232.” (Source: AEM Q1 Reports 2021)

Source: IG

- 2020 – Reported dividend amount per share: 2.28%

- 2019 – Reported dividend amount per share: 1.10%

- 2018 – Reported dividend amount per share: 2.25%

- 2017 – Reported dividend amount per share: 1.91%

Source: Dividends

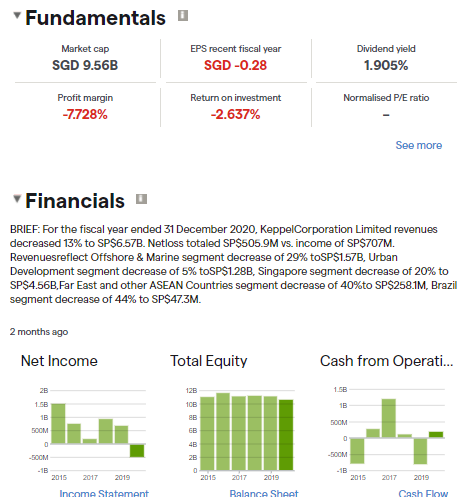

3. Keppel Corporation

Keppel’s mission statement is a little opaque. Its underlying mandate is stated to be “to deliver solutions for sustainable urbanisation safely, responsibly and profitably” (source: Keppel). Its businesses specialise in offshore & marine, property, infrastructure and asset management, to “offer a spectrum of innovative and sustainable solutions for the urban environment” (source: Keppel).

These well-meaning phrases haven’t, to date, inspired investors but that could be about to change. The share price has underperformed the wider market, but digging into the details of their operations reveals Keppel has some dynamic projects coming through the pipeline. Reasons to suggest the Keppel stock could very soon take off include the Q1 2021 announcement that it is in advanced talks with Brazil’s Petrobras to provide a $2.3bn floating production and storage unit.

From a technical analysis perspective, a break of the multi-year downward trend-line would be a bullish signal. With that line currently positioned around the $5.38 level, it’s some way below the price target of $6.20 set by CIMB analysts. The CIMB team have recently upgraded their rating on the stock, the previous price target being $5.85. If that break of the line does materialise there could well be an influx of buyers.

Source: IG

- 2020 – Reported dividend amount per share: 2.86%

- 2019 – Reported dividend amount per share: 4.38%

- 2018 – Reported dividend amount per share: 5.52%

- 2017 – Reported dividend amount per share: 3.81%

Source: Dividends

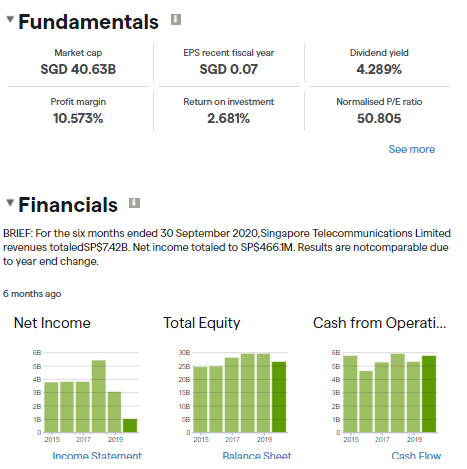

4. Singapore Telecommunications Ltd

Picking stocks that generate a healthy return and outperform the wider market isn’t easy. For beginners, in particular, one of the popular approaches is to rely on the thoughts and opinions of established investors. The DBS Equity Picks Program is one example of a team of analysts demonstrating a long-term track record of success. Past performance is not an indication of future returns, but the impressive performance of the DBSEPP scheme means it deserves some attention.

One notable feature is that one of the most recent picks, made on 21st May 2021, is Singapore Telecommunication. Singtel is a high-yield, blue-chip stock currently trading at price levels that DBS thinks make it hard to resist.

DBS marked out SingTel at a buy price of $2.42. Its valuation of the firm puts the baseline share price in the $2.35–$2.40 price range – so there is, according to its analysis, little downside risk. Potential for SingTel breaking its downward price move relates to business reorganisation plans. Suggestions are that SingTel is looking to offload operations in the US and Australia, including Amobee and Trustwave. This will allow the firm to focus on growing its future-friendly 5G offering.

Source: IG

The next set of financial results are expected to disappoint, but a lot of the bad news is already priced in. The deflated share price means the stock could, in 2021, return a dividend in the region of 4.5%, which makes it a pick for many high-yield investors. The possibility that the company restructuring acts as a catalyst for future growth makes it a potential win-win.

- 2020 – Reported dividend amount per share: 4.29%

- 2019 – Reported dividend amount per share: 7.11%

- 2018 – Reported dividend amount per share: 7.11%

- 2017 – Reported dividend amount per share: 8.33%

Source: Dividends

5. Aztech Global Limited

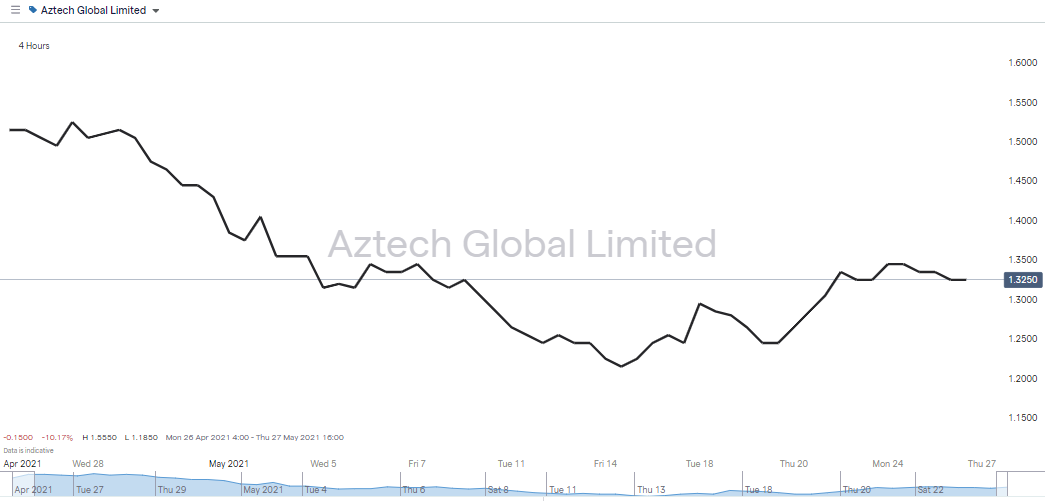

Tech-stock Aztech Global went public in March 2021 and its IPO was 16-times oversubscribed. Being a new entrant to the market and being associated with the high-growth Internet of Things (IoT) sector means Aztech Global is causing a bit of a stir. If IoT takes off as expected (by DBS) compound annual growth of the sector could be as high as 20.8% between 2019–2023.

If the business does get off to a good start, then there are many possible ways for it to diversify and grow. No one can be quite certain what new business lines and revenue streams might come out of IoT, but Aztech is in a good position to exploit them.

Currently trading in the region of $1.30, this hasn’t discouraged CIMB from setting a target price 44.15% higher at $1.91

It’s a relatively high-risk proposition, but the firm’s IPO price was $1.28 so those buying in now won’t feel they’ve already missed the juice in the trade. Dividends are less of a consideration for buyers of this stock with the financial reports stating the only recorded pay-out was in 2021 and represented a 1.52% yield. Instead, any profits are reinvested in new projects, which could help Aztech Global make the most of operating in one of the highest growth sectors in the economy.

How to Buy Stocks in Singapore

Most of the work associated with building a successful portfolio is done in the stock selection stage. The short-list of the best stocks to buy now in Singapore has candidates ranging from innovative tech start-ups to blue-chip banking giants.

One popular approach is to allocate capital across different names and sectors, as this can diversify risk and stabilise returns. It’s also possible to expand your search using the same Technical Analysis and Fundamental Analysis utilised by the analysts at the big investment banks.

If you want to practise building a portfolio, that is possible too. Trying out the free demo accounts offered by brokers offers a chance to get familiar with the mechanics of trading and test out your ideas. Even experienced traders continue to use demo accounts to try out new strategies prior to allocating hard cash to them. The funds you trade with are virtual, but the live prices are real-time, so you’ll very quickly be able to see if the market agrees with your decision.

Once your trades are executed, then it can be a case of sitting back and monitoring performance. For decades, buy-and-hold equity investments have produced much-welcomed returns for investors. There is one final stage to the process – choosing the right broker for your project. These are the simple steps to take to make sure you don’t make any slip-ups when putting the trades on.

1. Choose a Broker

The most important factor to consider when choosing a broker is the safety of your funds. There are scammers operating in the market and you do have to ensure you follow some basic rules. The first is to select a broker that is regulated by a tier-1 authority, such as one of the below:

- The Monetary Authority of Singapore (MAS)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

Another neat double-check is to visit the regulator’s site (such as this one here, MAS) to cross-reference any claims made by a broker to be regulated.

The functionality of trading platforms is fairly generic, but each broker offers a slightly different approach. Some specialise in different sectors and markets, while others offer more research or stronger client protection. Trying out a few different brokers using the free Demo accounts will allow you to test your short-list out in terms of user experience.

Best Brokers to buy Singapore Stocks:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some Singapore stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

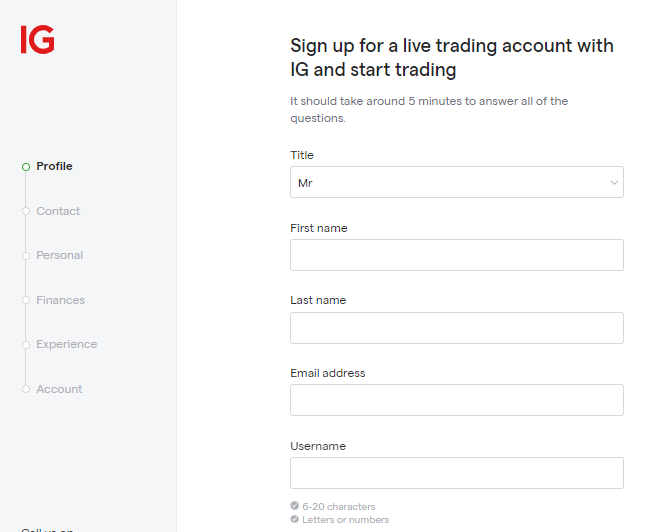

2. Open and Fund an Account

The account you set up with an online broker will be very much like any other bank account. Registration and ID verification can be done online – even from a handheld device.

If you set up with a regulated broker, then security protocols will be established to ensure only you have access to your account. Regulated brokers also have to comply with Anti-Money Laundering laws, which means that funds have to be returned from the account which initially sent them. That cuts down the risk of someone gaining access to your funds and sending money on to a rogue account.

Source: IG

The onboarding process typically takes less than 10 minutes to complete. The next stage is wiring funds to your new account. Most brokers offer a good range of payment processing options with debit and credit cards being among the most popular choices due to them typically resulting in immediate transfer of funds. The payment interfaces at brokers are set up to support beginners, there’s very little jargon and the experience is very similar to any other online transaction.

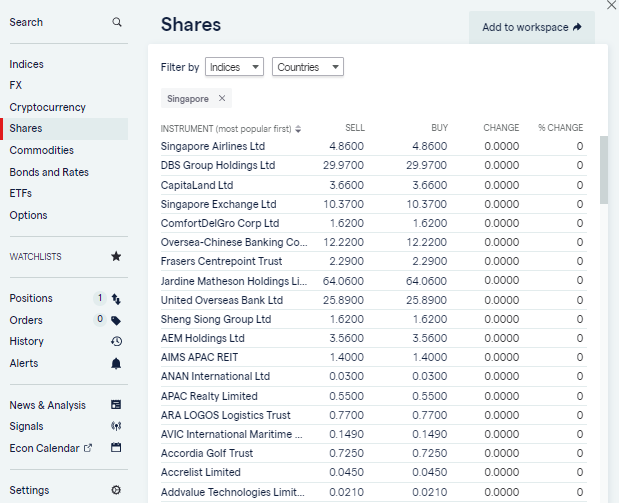

3. Open an Order Ticket and Set Your Position Size

Most broker sites have an emphasis on user-friendly functionality. At IG, for example. It’s possible to filter by country and pull up the entire list of more than a hundred Singapore stocks that the broker offers markets in. Stock picks in Singapore are a hot topic at the moment so having such a broad range to choose from is certainly a plus point.

Source: IG

Clicking on any of those markets takes you through to the dashboard for that stock where it’s possible to get an up-to-date picture of how it is trading. The trade-execution interface has data fields where you input the amount you want to buy, and a ‘Buy’ button to click or tap once you have checked all the details.

Source: IG

4. Set Your Stops & Limits

There are also other risk management tools that you can use. Stop-loss instructions are orders built into the system, which will automatically sell some or all of a position if price goes against you by a certain amount. You choose the level at which you want to cut your losses and you choose if and when they are applied. Take profit orders work in a similar fashion but lock in gains if price reaches your target.

Some buy-and-hold investors don’t use these tools. They take the view that a short-term price crash could kick them out of a position that might ultimately come good. The alternative view is that they allow traders to apply more discipline to their trading, and as they are automated, allow account holders to focus on other things rather than watch the markets 24/5.

5. Make Your Purchase

In some ways, the final step is clicking or tapping ‘Buy’. No matter if you’re using a desktop or mobile device, that is the point at which cash in your account is converted into a stock position – the value of that position being 100% dependant on market price. You can follow your position’s progress by accessing the P&L (profit and loss) report in the ‘Portfolio’ section of the site, which will display the different cash and equity holdings in your account.

You might want to set price alerts so that you receive email or SMS messages to keep you up to date with events. One action that you ought to do is double-check you traded what you intended to. Even experienced traders make ‘fat finger’ errors and if you, for example, input the wrong trade size, it’s best to correct that kind of error as soon as possible.

Summary

Interest in Singapore share-dealing has picked up thanks to the country’s exemplary handling of the COVID-19 pandemic. Singapore businesses now have the chance to build on that head-start and develop competitive advantages over their global competitors. It’s no surprise the market has caught the eye of local and overseas investors.

There are plenty of different companies and sectors to choose from, but those asking the question of what Singapore stocks to buy now might find guidance from the above short-list. Once the hard work of fine-tuning your selection has been completed, following the step-by-step rules of how to set up with a safe broker will take you into the markets in a few easy-to-follow steps.