While some gains have already been locked in, there is no reason to consider that further growth potential is capped. Identifying investment opportunities and picking out those names that are likely to outperform can optimise returns. This analysis of the best undervalued stocks to buy in India today will utilise technical and fundamental analysis to identify the five best stocks in India today.

Nifty 50 Stock Index Continues Its Upward Trend

Source: IG

Best Undervalued India Stocks

1. ABB India Ltd

ABB is a leading global technology company that is at the forefront of transforming social and industrial processes. The Switzerland-headquartered multinational firm has employees in more than 100 countries, and those in India are positioned to benefit from the electric vehicle (EV) revolution.

ABB India Ltd is setting up an ecosystem of charging stations for EVs in India, which is estimated to be a $3bn per year opportunity. It also looks well positioned to benefit from moves by some of India’s state governments, which have announced dedicated policies to support EV adoption and initiated tendering for charging stations.

ABB Share Price – 2015-2021

Source: IG

The EV opportunity is only one of ABB’s business lines, so investors can tap into a growth industry but also benefit from income streams from established business operations. The firm, which has been operating for 130 years, offers a combination of future and historical investor returns and is a market leader in connecting software to its electrification, robotics, automation and motion portfolios. ABB is on message in terms of the increasingly popular ethical investing as its aim is to push the boundaries of technology to drive performance to new levels.

ABB Share Price – 2020-2021 – Double-Bottom & Resistance

Source: IG

From a technical analysis perspective, the double-bottom pattern formed in October and November suggests that strong price support can be found in the region of CHF 30. This makes the recent price slide look like a dip to buy.

Resistance is in place at the year-to-date high of CHF 34.79, which brings the psychologically important ‘big number’ price level of CHF 35 into play. Any break above CHF 35 and the path of least resistance would appear to be upwards.

ABB has weathered the COVID-19 storm relatively well, and the tech sector has capitalised on the ‘new way of doing things’ that the pandemic brought about. The firm is currently generating a +3% dividend yield and has a relatively modest P/E ratio of 15.99, which means that there is room for further stock price gains before it begins to look overvalued.

ABB – Fundamentals

Source: IG

2. Infosys

A lot of the attention in India stocks comes from the economy being an incubator of innovative tech firms. By identifying growth markets and adopting an expansive outlook, firms such as Infosys have become global leaders in their field.

Bangalore-based Infosys has been operating for more than 40 years, so is a more secure option than a tech start-up, but COVID-19 and a rush to outsourcing helped it expand its global client base, which now extends over more than 50 countries. The firm provides IT, consulting and outsourcing services to big-name brands such as Goldman Sachs and employs more than 267,000 people.

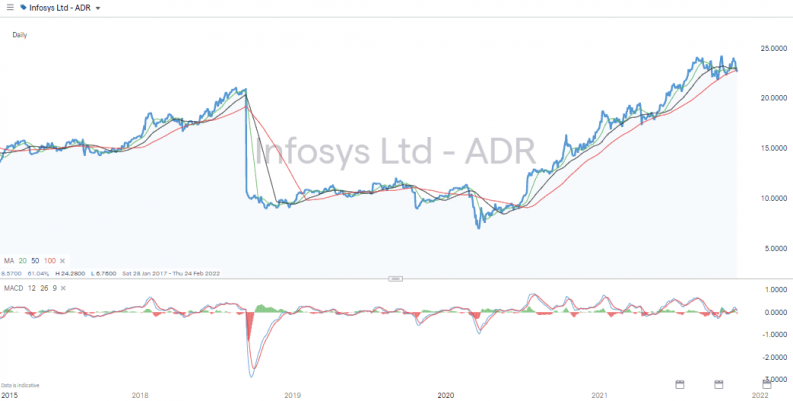

Infosys Share Price – 2015-2021

Source: IG

The many recent successes of Infosys have resulted in it outperforming the Nifty 50 index, with Infosys stock rising by more than 230% from the lows of March 2020. It also pays a healthy dividend, with the current yield being in the region of 1.78%. The P/E ratio is relatively high but is in line with the tech sector and supported by the improving balance sheet fundamentals.

Infosys – Balance Sheet

Source: IG

Highlights from the financial results for the six-month period up to 30th September 2021 include:

- Infosys Ltd ADR revenues increased 19% to RS574.98bn

- Net income increased 17% to RS106.16bn

- Revenues reflect Financial Services and Insurance (FS) segment increase of 23% to RS187.83bn

- Retail, Consumer packaged goods and Logistics (RCL) segment increase of 21% to RS85.05bn

- Manufacturing (MFG) segment increase of 32% to RS59.21bn

- North America segment increase of 21% to RS355.38bn

Source: IG

Infosys – Fundamentals

Source: IG

Infosys shares can be traded using local brokers or using the American Depositary Receipt (ADR) version of the stock, which is listed on the New York Stock Exchange and available to trade at offshore brokers.

3. Reliance Industries Ltd

Those looking to gain broad exposure to the India economy might want to add Reliance Industries to their shortlist of the best Indian stocks to buy. As the firm’s most recent investor statement states, “What is good for India is good for Reliance.”

Source: Reliance Industries Ltd

The Mumbai-based firm operates a diverse range of businesses, including energy, petrochemicals, gas production, retail, telecoms, textiles and media. It started out as a textiles and polyester manufacturer, but more than any other Indian firm, it demonstrates the benefits that can come from being open to capitalising on the ever-changing nature of the India economy.

Reliance Industries Share Price – 2015-2021

Source: IG

Reliance Industries has a “superior credit profile” (source: Reliance Industries Ltd) and relations with more than 100 banks and financial institutions. Using this strong base, it is continuing to develop innovative business lines in growth sectors and continues to develop ways to tap into the India success story.

As the firm states, it has:

“committed resources and ideas to a digital revolution, created world-class manufacturing assets that produce clean fuels and materials of the future and built a consumer-focused, integrated retail ecosystem. We have also joined forces with the best in the world, to bring the best of the world to India.”

Source: RIL

Between 2010 and 2020, Reliance traded in a relatively tight sideways price range. This was partly due to price needing to consolidate after its meteoric surge between 2005 and 2008. The long-term prospects for the India economy in general and Reliance specifically are introducing the idea that the Reliance Industries share price can challenge the all-time price high of 81.25 recorded in Jan 2008. That level will be associated with some stiff price resistance, but a break to the upside would do away with the last historical price resistance point.

Reliance Industries Weekly Share Price – 2000-2021 – Price Resistance Levels & SMA

Source: IG

Reliance Industries is a Fortune 500 company, and shares in it can be bought on the domestic exchange. However, in an effort to make things easier for international investors, offshore brokers offer a Global Depositary Receipt (GDR), which is available through offshore brokers.

4. Microsoft Corp

The US-based tech giant spotted the potential of India as early as 1990. The global giant has expanded its operations in the country, which now offer cloud, consulting, security, AI and language services to domestic and global clients. The long-term commitment of the firm and the extent to which it has gone to tap into Indian potential is best demonstrated by Project Bhasha, which was launched in 1998 to accelerate computing in Indian languages.

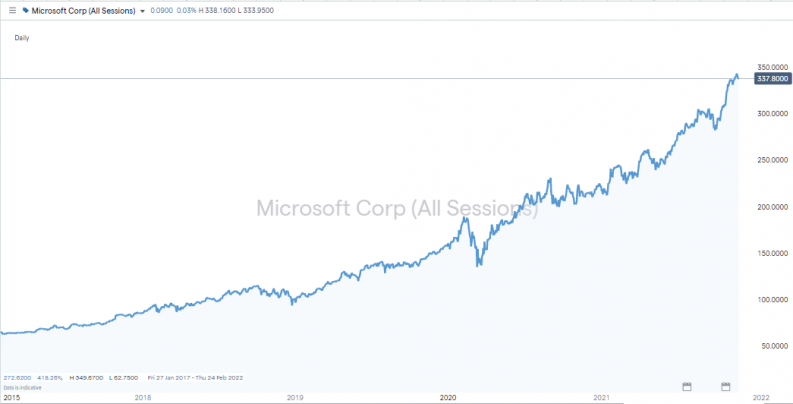

Microsoft Daily Share Price – 2015-2021

Source: IG

The potential for the cloud computing services division is a stand-out feature for investors. The sector benefited massively from COVID-9 triggering a move to remote working, and those emergency-inspired work habits are continuing to flourish despite the pandemic subsiding. In the three months up to the end of September, Microsoft’s Intelligent Cloud segment increased by 31% to $16.96bn.

Microsoft’s view is that “the key to realizing the vision for India’s growth has cloud at its core” (source: Microsoft). Microsoft has long been a market leader in cloud services, and has positioned three data centres in the country and developed relations with government and corporate partners. Cloud computing will be at the heart of the digital transformation of India, and Microsoft will be a major player in the game.

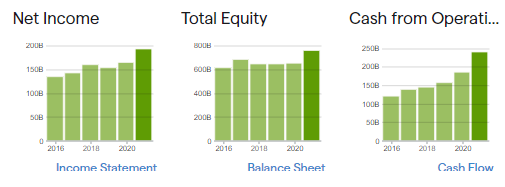

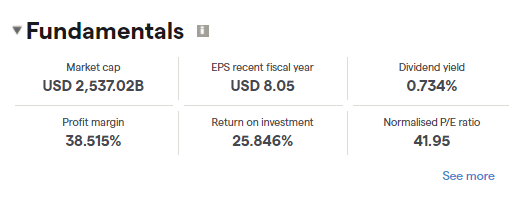

Microsoft – Fundamentals

Source: IG

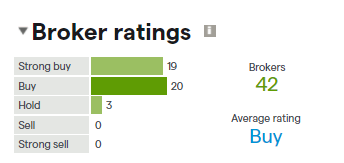

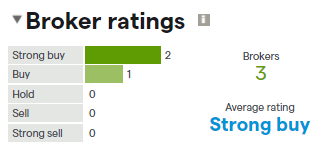

Microsoft’s P/E ratio of 41 is high compared to some other sectors but in line with the tech stock average, and its massive $2tn market capitalisation ensures that it has the financial clout to invest in new opportunities. With such a high-profile role in the stock market, it’s little surprise that 42 different analysts cover the stock, and the three lowest ratings out of that group are a ‘Hold’, with the remainder tipping the stock as a ‘Buy’ or ‘Strong Buy’.

Microsoft – Broker Ratings

Source: IG

Highlights from the financial results for the three-month period up to 30th September 2021 include:

- Microsoft Corporation revenues increased 22% to $45.32bn

- Net income increased 48% to $20.51bn

- Revenues reflect Intelligent Cloud segment increase of 31% to $16.96bn

- Productivity and Business Processes segment increase of 22% to $15.04bn

- Personal Computing segment increase of 12% to $13.31bn

- Other countries segment increase of 24% to $22.49bn

- US segment increase of 20% to $22.83bn

Source: IG

5. HDFC Bank Ltd

HDFC Bank Ltd is India’s largest private bank by assets and market capitalisation, and the third largest company on the Indian stock exchange. Incorporated in 1994, it now has 120,000 employees and is well positioned to benefit from future growth in the India economy. It has a strong focus on the retail sector and issues loans and credit cards to its millions of customers. While offering the relative security of being in the banking sector, the firm has an innovative approach and is investing in new technologies such as the digital payment products PayZapp and SmartBUY.

HDFC Bank Ltd Share Price 2020-2021

Source: IG

HDFC might not offer as much potential as some of the growth stocks on the list, but there is always place for a lower-risk-return proposition in a diversified portfolio. The HDFC share price has been consolidating through the second half of 2021, with company earnings announcements being interpreted as broadly positive for the stock.

HDFC Bank Ltd Share Price 2020-2021

Source: IG

The R80 price level has been tested once already this year, and investors will want to see that tested and broken before committing to the stock starting its next bull run.

HDFC Bank Ltd Fundamentals

Source: IG

The firm is covered by a small number of brokers, but its stock forecasts are positive, with the average rating being ‘Strong Buy’.

Source: IG

For the three months ended 31st March 2021, HDFC posted the below positive returns:

- Interest income increased 5% to RS1.276tn

- Net interest income after loan loss provision increased 11% to RS529.45bn

- Net income increased 25% to RS325.98bn

- Net interest income after loan loss provision reflects Wholesale Banking segment increase of 39% to RS126.16bn

- Retail Banking segment increase of 4% to RS391.94bn

Source: IG

How to Buy Stocks in India

Most of the work associated with building a successful portfolio is done in the research and analysis stage. The short list of the best stocks to buy now in India has candidates ranging from innovative tech start-ups to blue-chip banking giants. One tried-and-tested approach that is often recommended to beginners is to allocate capital across different firms and sectors in an effort to stabilise returns. Taking small positions in a lot of stocks also mitigates against single stock risk, the chance that one of the positions may go badly wrong.

Thanks to some revolutionary technological upgrades at online brokers, the trading experience is now extremely user-friendly and can be done from desktop or mobile devices. If you want to practice building a portfolio before using real cash, then that is also possible thanks to free-to-use demo accounts, which offer new and experienced traders a chance to get familiar with the mechanics of trading or a new broker. They’re a great way to test out new strategies and trading ideas, and as they use live prices, it is possible to very quickly see if the market agrees with your decisions.

Once your research is completed and trades have been executed, investing in India stocks can be a lot about sitting back and monitoring performance. There is, however, one final stage to the process: choosing the right broker. The functionality of the platforms, markets offered, and terms and conditions can vary from broker to broker, and it’s important to find a good fit. Of equal importance is the need to ensure that your broker can be trusted. Listed below are five simple steps to make sure that you don’t make any slip-ups when putting the trades on.

1. Choose a Broker

The most important factor to consider when choosing a broker is the security of your funds. You are sending cash to a third party, and there is nothing more disappointing than making a paper profit but finding out that you’ve been scammed. There are scammers operating in the market, and you do have to ensure that you follow some basic rules. The first is to select a broker that is regulated by a Tier-1 authority, such as one of the below:

- Monetary Authority of Singapore (MAS)

- Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

- Securities and Exchange Board of India (SEBI)

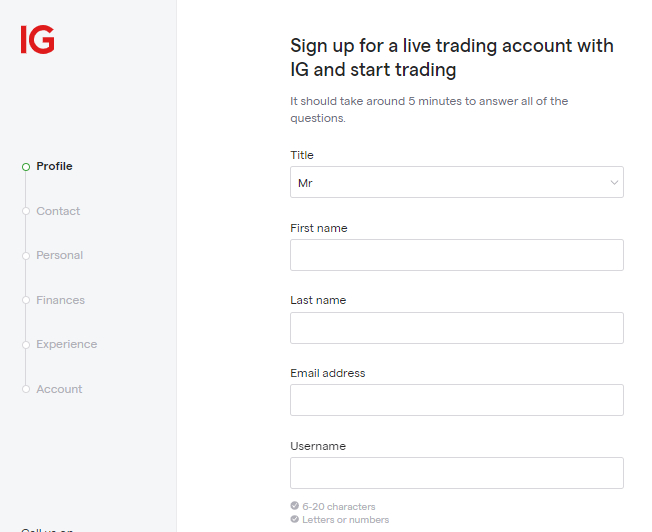

2. Open and Fund an Account

An account with a global online broker is very similar to any other online bank account. Registration and ID verification can be processed online – even from a handheld device. If you set up with a regulated broker, then security protocols will be in place to ensure that you, and only you, have access to your account.

Brokers regulated by Tier-1 authorities also have to comply with anti-money laundering (AML) laws, with one requirement being that funds have to be returned to the account from which they originally came. This cuts down the risk of someone gaining access to your funds and forwarding money on to a rogue account.

Source: IG

The onboarding process can take less than 10 minutes to complete, and the next stage involves wiring funds to your new account. Most brokers offer a good range of payment processing options, with debit and credit card being among the most popular choices. These payment methods are typically associated with immediate transfer of funds, but e-Payment options are increasingly popular. The payment interfaces at brokers are set up to support beginners; there’s very little jargon; most cash deposits are commission free; and the experience is very similar to any other online transaction.

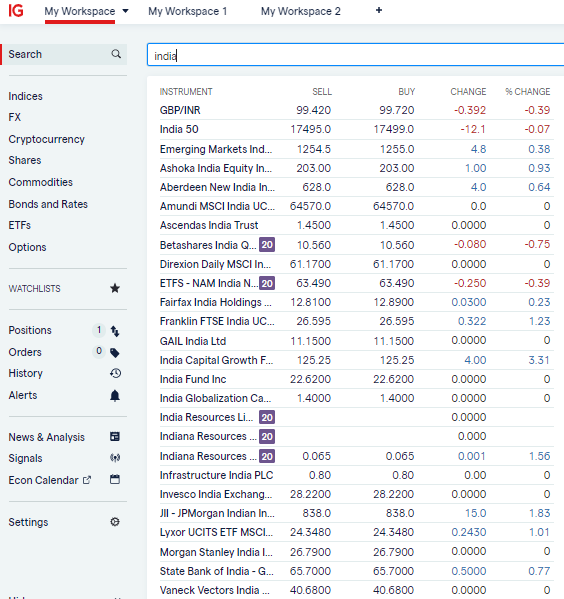

3. Open an Order Ticket and Set Your Position Size

Offshore broker platforms pride themselves on their user-friendly functionality. At IG, for example, it’s possible to filter by country and pull up an extensive list of India stocks in which the broker offers markets. Stock picks in India are a hot topic at the moment, so having a broad range to choose from is certainly a plus point.

Source: IG

Clicking on any of those listed markets takes you through to the dashboard for that stock where it’s possible to get an up-to-date view of how it’s trading. The trade-execution interface has data fields where you can input the quantity of any India stock you want to buy, and a ‘Buy’ button that when clicked or tapped executes the trade.

Source: IG

4. Set Your Stops & Limits

There are other risk management tools available to investors that can help enhance returns. Stop-loss instructions are orders built into the system that will automatically sell some or all of a position if price goes against you. You choose the price level at which you want to cut your losses, and they can be added and removed from trading positions at your discretion. Take-profit orders work in a similar fashion but lock in gains if price reaches a certain level.

Some buy-and-hold investors don’t use stop-loss and take-profit tools. They take the view that a short-term price crash could kick them out of a position that might ultimately come good. Fans of this alternative view can still apply some discipline to their trading by adopting other risk management protocols such as trading in small size and diversifying their portfolio. One advantage of automated instructions such as stop losses is that they allow account holders to focus on other things rather than watch the markets 24/5.

5. Make Your Purchase

Whether you’re using a desktop or mobile device, the final act of opening a new trade is clicking or tapping ‘buy’. At that point, some of your cash balance is converted into a stock position and the value of that position will be 100% dependent on market price.

It is possible to follow how a position progresses over time by accessing the P&L (profit and loss) report in the portfolio section of the site. This will display the different cash and equity holdings in an account. Some traders also opt to set price alerts so that they can keep up to date with market conditions.

One final check that is crucial to carry out is to double-check that you traded in the way that you intended to. Even experienced traders make ‘fat finger’ errors and click ‘sell’ instead of ‘buy’ or input the wrong amount. Any such errors are best corrected as soon as possible to avoid a simple mistake becoming a costly one.

Summary

Interest in Indian stocks has picked up thanks to the impressive returns from some of the top names in recent times. The market is attracting local and overseas investors, and looking for the next big thing involves carrying out some research – however, the process of buying Indian stocks has never been easier. Those who follow the simple guidelines around how to find a trusted broker will also find that buying Indian stocks has never been safer.

There is a healthy range of different companies and sectors to choose from, but those asking the question of what India stocks to buy now might find guidance from the above short list. Once the hard work of fine-tuning your selection has been completed, following the step-by-step guide will take you into the markets in just a few easy-to-follow steps.