There is little sign that the party is already over. A wide range of local and overseas investors are analysing the Singapore stock market, looking for opportunities, and there are still some stocks that look like they have to date been overlooked. Despite the broader market rising up, some stocks still appear undervalued. This review will lift the lid on five undervalued stocks in Singapore and how to start investing in these Singapore stocks.

Best Undervalued Singapore Stocks

- Dairy Farm International Holdings

- CDL Hospitality Trusts

- Wilmar International Ltd

- China Aviation Oil Singapore Corp Ltd

- Thai Beverage PCL

1. Dairy Farm International Holdings

Pan-Asian retail operation Dairy Farm International is part of the Jardine Matheson Group. Being at the heart of one of the worst hit sectors during the COVID pandemic has taken a toll on its share price. The group operates under five key brands including Maxim’s, Cold Storage, Shop ‘n Save and Manning’s and while it recorded total earnings in excess of $28bn in 2020, shopping malls have been out of favour with investors since March 2020.

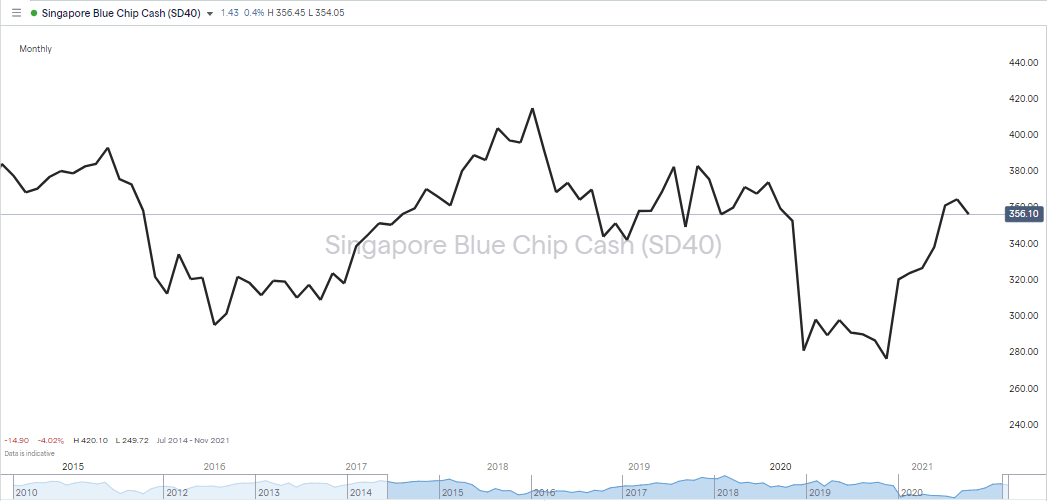

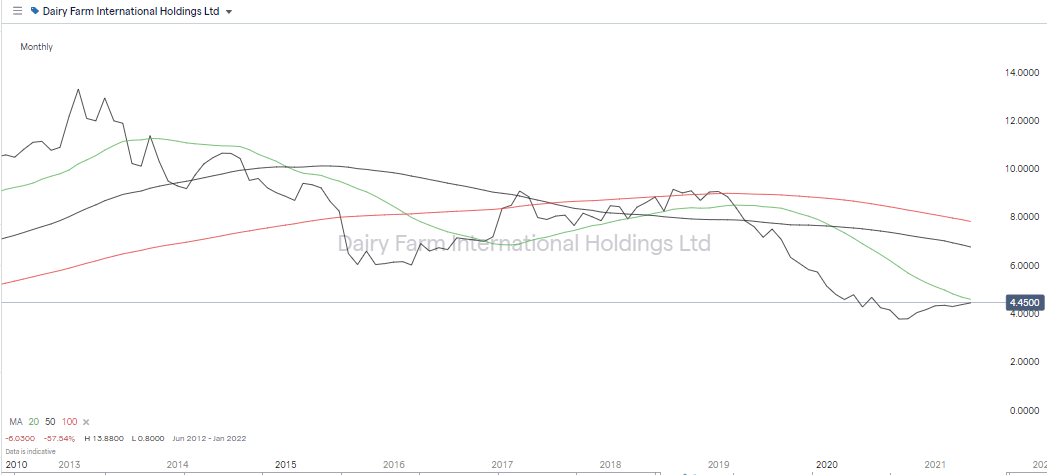

The monthly share price chart shows current price printing below the 20, 50 and 100 Simple Moving Averages. This is a bearish pattern, but recent upwards momentum suggests it could soon intersect the 20 SMA and potentially break to the upside.

Retail may have been out of favour for more than a year, but Dairy Farm does still have a market capitalisation of $6.02bn, which suggests some degree of critical mass and with that, security and resilience.

A relatively high dividend yield of 3.71% is a function of its share price, trading at $4.40 at the time of writing. If the retail sector is bottoming out of the COVID-inspired shock, there could be room for the share price to rise. It’s been a tough year and with some competitors in worse shape, this could be an opportunity for Dairy Farm International to make the kind of market share gains not typically associated with the sector.

2. CDL Hospitality Trusts

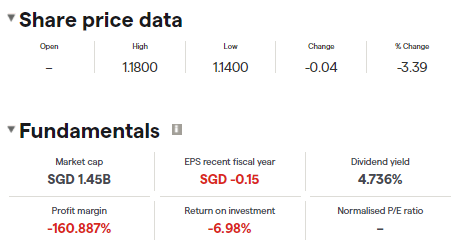

While Dairy Farm International struggled in the COVID pandemic due to reduced footfall, the consequences of the global lockdown resulted in an almost existential threat to hospitality/property firm CDL Hospitality Trusts.

Caught in the centre of the 2020 economic fallout, CDC, also known as CityDev saw revenues plummet as customers stayed away from its portfolio of hotels, conference centres, restaurants and shopping malls.

Business is predicted to bounce-back in 2021 with DBS analysts forecasting future annual revenue might even exceed the returns posted in 2019.

Source: IG

3. Wilmar International Ltd

Wilmar is a slightly different proposition. The multinational food producer operates more than 500 processing plants and employs in excess of 90,000 people. It also has a share price that has performed relatively well over the course of the last 12 months. Buying into Wilmar now is a chance to buy a dip in a success story – to take advantage of a short-term pause in an upward trend.

The 2020 year-end stock price of Wilmar was $4.65, and it started Q1 of 2021 strongly. The year-to-date high of $5.57 on 19th February points to the growth potential for the firm with the consensus target price among analysts being $6.24. The stock appears to be taking a breather and has since drifted back to $4.80, at the time of writing, which is marking it out as one of the most promising undervalued stocks in Singapore.

Source: IG

Q1 profits in 2021 were $450.2m, which compares very favourably to the $224.1m recorded in Q1 of 2020. The fundamentals are strong and optimising trade entry price sometimes involves stepping in as price action looks weakest.

Source: IG

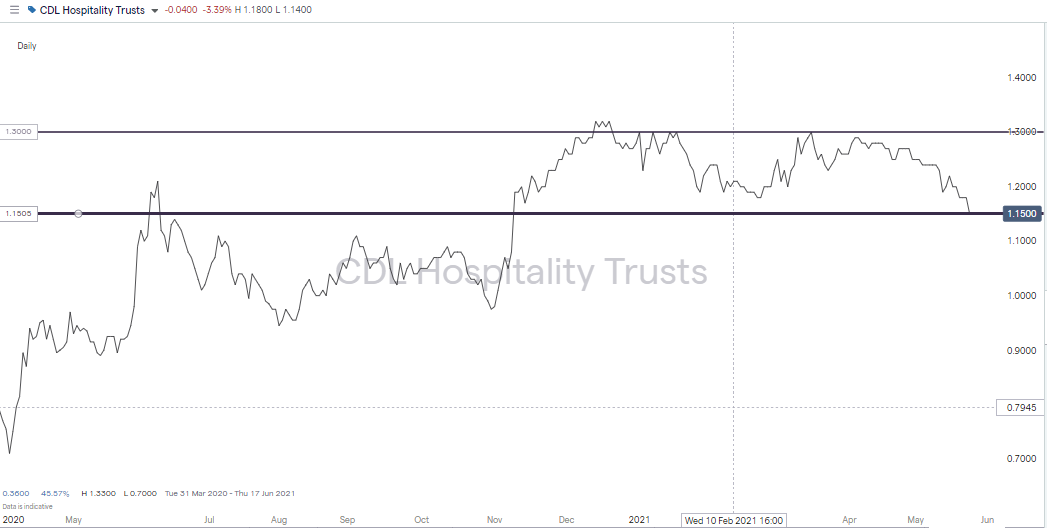

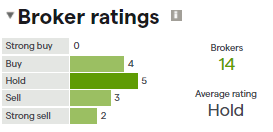

The share price has so far this year traded in a tight range of $1.15–$1.30. As long as the $1.15 support level holds, the stock looks positioned to benefit from good-news announcements as the global economy gradually returns to normal.

DBS tips the stock to come good and added it to its equity picks on 22nd April 2021. Its entry price of $1.24 was above current price levels, which means investors can step in and buy at levels even lower than DBS did. Generating a dividend yield of 4.736%, the stock represents a chance for those with a medium- to long-term outlook to benefit from the gradual unlocking of tourism, hospitality and retail sectors.

Source: IG

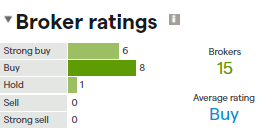

If that happens, the broker ratings, which currently average out as ‘hold’, could start shifting towards the ‘Buy’ end of the spectrum and generate a groundswell of buying pressure.

4. China Aviation Oil Singapore Corp Ltd

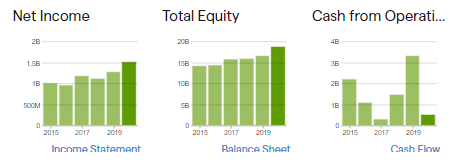

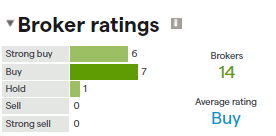

Searching out undervalued Singapore Stocks naturally leads to China Aviation Oil Singapore Corp Ltd (CNAO). The firm is the largest purchaser of jet fuel in the Asia-Pacific region, which makes it a direct-play on the aviation sector. If, or when, air travel takes off again it looks well positioned to make returns, which will drive up its share price. The firm is responsible for 90% of jet-fuel imports to China and has key contracts to supply Beijing, Shanghai and Guangzhou airports.

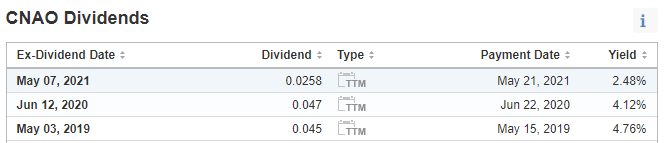

The air-travel play is a binary one. The risk of new COVID variants leading to further lock-downs hangs over the sector and accounts for a lot of the suppression of the CNAO share price. The fundamentals of the business do point to some potential security for investors. The dividend of 2.48% reflects the challenges faced in 2020, but the 4.12% and 4.76% paid in the previous two years points to the firm’s willingness to return cash to investors.

Source: IG

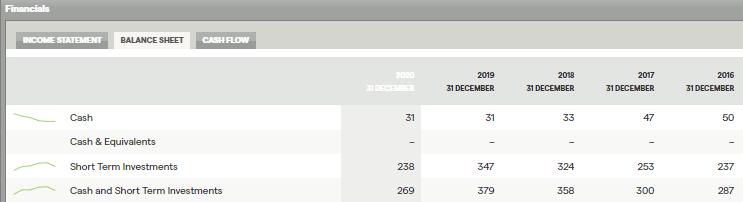

A return to more generous dividends could be on the cards. The firm’s most recent financial statements point to the drop in 2021 being down to a decision to maintain a strong balance sheet rather than an inability to pay. The ‘Cash & Short-Term Investments’ column of the CNAO accounts shows it has $269m in liquid assets, which, considering the events of 2020, is a relatively healthy position.

Source: IG

Over a long-term time-frame, annual dividend payments to investors sit around the 30% of profits level. So, if business picks up, investors look set to take a share of the uptick in revenues. That would draw more dividend investors into the stock and drive the price higher.

The daily price chart shows China Aviation Oil has recently broken the supporting trend line, which dates back to April 2020. Investors might want to monitor the situation to consider how firm a test of that line the recent move is. A break back above it would lead many to consider the current price slump an opportunity to buy a dip.

5. Thai Beverage PCL

Trading in the middle of a multi-year sideways price range, Thai Beverage is tipped by many to retest its highs and to have potential to break to the upside. At the time of writing, it has a market capitalisation of $17.55bn and generates a dividend in the region of 2.6%–3.6%. The potential for future gains stems from its position in the consumer discretionary sector, but also a change of approach by senior management.

The recent share price slide from $0.89 followed disappointing news regarding a planned re-organisation of the corporate structure. The firm’s intention to spin-out its brewery division was an open secret and helped drive the share price upwards. When these were officially put on ice due to the COVID situation worsening in Thailand some of the positive vibes around the stock dwindled away. There is little reason to suggest the plans are anything more than delayed so news of them being resurrected would again act as a catalyst for upwards share price movement.

Source: IG

Analyst price targets average out at $0.89, which would represent a 27.14% gain from the current $0.70 price level. To take a position in Thai Beverage or any other of the shortlisted undervalued Singapore stocks, follow the easy step-by-step guide below to make sure you choose the right broker.

How to Buy Stocks in Singapore

There are five simple steps to trading below. Following them helps make sure you sign up with a trusted broker and navigate through some of the potential hazards. The functionality of online broker sites is designed to support complete beginners, so working through the process methodically and safely is relatively easy to do.

1. Choose a Broker

The most important factor to consider when choosing a broker is whether the money you deposit will be safe. There’s no point making a profit on a trade if you signed up with an unregulated scam broker and get none of your cash back. Financial regulators oversee the markets and provide licenses to firms that meet certain criteria. By choosing a broker that is licensed by one of the below highly-regarded regulators, you are taking the first step towards trading safely.

- The Monetary Authority of Singapore (MAS)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The U.S. Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

To comply with the license terms of these regulators, brokers are required to hold enough cash to be viable, hold client funds in segregated accounts and carry out independent audits of their operations. These rubber-stamps are a useful way to ensure your preferred broker is legit but you can also consider the time the broker has been operating and the pros and cons discussed in broker reviews such as the ones found here.

The functionality of trading platforms is fairly generic and they pride themselves on being user-friendly. One of the easiest ways of establishing which one is a best fit for you is to take a few moments to sign up for a demo account. Accessing one of these usually requires providing little more than an email address, but once through to the platform you’ll be given virtual funds and be able to practise trading using live market prices. Demo accounts also provide an opportunity to familiarise yourself with how the process of trading works

Best Brokers to buy Singapore Stocks:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some Singapore stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

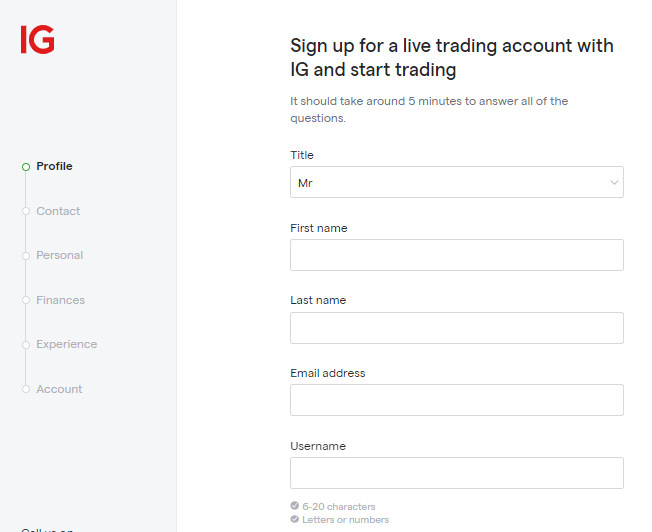

2. Open and Fund an Account

Upgrading from a demo account to a live account, or simply signing up for a live account from scratch is done online. The process is relatively straightforward and similar to any other online registration and can be done via a desktop device or a mobile handset. If you take the wise step of ensuring your broker is regulated, you’ll be asked a variety of questions so they can verify your ID and build a profile for you. This all helps them comply with their ‘client care’ conditions.

Regulated brokers also have to comply with anti-money laundering laws. These stipulate that any funds paid into a brokerage account can only be returned to the original source account. This move, intended to cut down on international money-laundering, provides a neat spin-off security feature for brokerage clients. It cuts down the risk of someone accessing your account and forwarding funds to a scammer account.

Source: IG

The online form filling process typically takes less than 10 minutes. After that it’s a case of funding your account by wiring funds using one of the payment processing options on offer. The simplest and fastest being debit or credit card, which are typically associated with an immediate transfer of funds. The payment interfaces at brokers are very similar to those used for any other online transaction, so getting your funds into your account and starting trading can be a fast and hassle-free experience.

3. Open an Order Ticket and Set Your Position Size

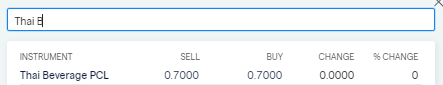

Once set up on the platform, it’s a case of finding the undervalued Singapore stocks that your research identified. You can do this by using the search function or filtering by country.

Source: IG

Each stock will have a dashboard, which includes price charts, latest news and company information. Entering the amount you want to buy into the appropriate data fields will move you on to the next step.

Source: IG

As the Singapore stock exchange operates during market hours you will either need to trade while it’s open, or set a limit order, which is a binding contract to buy at a certain price when the market next opens. This does require market price hitting the level you stipulate.

4. Set Your Stops & Limits

Stop Loss instructions and Take Profit orders are risk-management tools you can add to your trade instruction. You can state the price you are willing to sell your stock at and the system will automatically carry out your instruction if price reaches that level.

Stop-losses come into play if price moves against you, and protect you from making further losses. Take Profits lock in gains by selling out at a profit.

Some buy-and-hold investors who are playing a long-game don’t use these tools. They take the view that a short-term price crash might be something they want to ride out rather than close out their position.

5. Make Your Purchase

Once everything’s been checked, it is simply a case of clicking or tapping ‘Buy’, depending on what kind of device you are using. Cash in your account will be converted into a stock position and you’ll be able to watch the P&L (profit and loss) of that holding by accessing the Portfolio section of the platform.

It is essential to at this stage run some final checks. The online systems are robust and reliable, but human error can come into play and any errors are best rectified before price moves too far from where you traded.

Summary

Most of the work associated with building a portfolio of undervalued stocks is done in the stock selections stage. If you choose a safe broker, a lot of the post trade experience has a wait-and-see, feel to it. Out-of-fashion stocks can need a catalyst to change market sentiment, but when that does happen, momentum can be on your side. But patience might be needed.

For those that wish to invest in Singapore stocks, the basic principles of investment still apply, so spreading your capital allocation across a range of stock names can improve your chances of picking one that takes off. Other than that, it’s a case of keeping up to date with news events and monitoring the Technical Analysis and Fundamental Analysis methodologies used to identify the stocks in the first place.