However, there are signs of life in the telecom giant. Whether you’re an existing shareholder who bought shares and is now trying to scramble out of the position, or a new entrant looking to buy BT stocks at these low levels, there are plenty of reasons to monitor the situation.

This review will look into the reasons for potential BT share price strength. It will also outline how to go about buying and selling BT shares using a trusted broker.

Overview of BT

UK-based BT dates back to 1846 but came to popular attention in 1982 when the then state-run operator was nationalised. The equity holding of the firm was 100% government-owned until 1984 when 50.2% of the stock was sold to the public.

The IPO was something of a bonanza for investors who saw the BT share price quickly rally. Another notable feature was that the event brought many first-timers into share dealing and formed an important milestone regarding the democratisation of the financial markets.

The firm went on to have an eventful history. Its mobile operation, BT Cellnet, was spun out in 2001 and renamed O2. In the same year, the firm carried out Europe’s largest ever Rights Issue when £5.9bn was raised. It’s also been jilted at the altar by several suitors who had lined up ultimately unsuccessful mergers.

Institutional investors, such as pension funds have built considerable positions in the firm. The dividends paid out have been particularly attractive to them. BT has, though, always demonstrated a surprising amount of price volatility.

BT occupies a tricky position. It sits somewhere between being a utility and a tech company. It also now has operations in more than 180 countries.

Analysts can very easily come up with differing valuations. Is it a high-yield value stock or a tech-heavy growth stock? Add into the mix a legacy of government involvement and it’s understandable that the firm has seen its share price whipsaw around.

BT Shares: The Basics

BT Group is listed on the London Stock Exchange and has a market capitalisation in the region of £12bn. It is a member of the FTSE 100 index where it trades under the ticker LON:BT.A.

It is one of the world’s leading providers of communications services and solutions and the day-to-day business involves the provision of networked IT services. It also offers local, national and international telecommunications services to the domestic and commercial sectors. Recent growth plans have focussed on broadband, TV and internet products and services.

For the year ended 31 March 2020, BT Group’s reported revenue was £22.9bn with reported profit before taxation of £2.3bn. The firm had a mixed 2020 with the pandemic hindering its infrastructure operations, but home-working and lockdowns boosted the consumer-facing divisions.

BT – Five-year price chart

Source: IG

There are various factors that make it hard to establish if BT is undervalued or not.

- A history of high price volatility — Between 1996 and 2001, the BT share price went from £4 to £15, and back again to £5.

- Debt and investment — BT has a lot of network infrastructure to maintain and has historically taken on a lot of debt to finance that work. Its bids for 4G networks and TV sports rights have divided opinion. To some extent, you have to ‘speculate to accumulate’, but many in the City suggest BT has a bad habit of over-paying.

- Downward pressure on prices — Any rally in the BT share price is likely to be suppressed by long-term investors cutting their losses and selling into strength. The five-year price slide has left a lot of investors underwater and desperate to get out of positions.

- Dividends — BT is one of the best dividend stocks in the FTSE. In almost 40 years of trading, it’s only skipped one dividend. The events of 2020 did, however, lead to the firm stating it would be ‘rebasing’ future dividends, which translates as cutting future payouts to shareholders.

- Infrastructure commitments — A legacy of the firm’s former life as a nationalised utility is that it is often lumbered with carrying out major infrastructure upgrades. These include the ‘Fibre To The Door’ project, which demands capital expenditure of £400m–£600m per year and doesn’t necessarily benefit the BT bottom line.

- Small shareholders — There are still 800,000 small shareholders. For many, BT is the only stock they own and it’s hard to predict how this group will react to upward price pressure.

- Trend line break — From a technical perspective, the BT share price has recently broken a multi-year downward trend line.

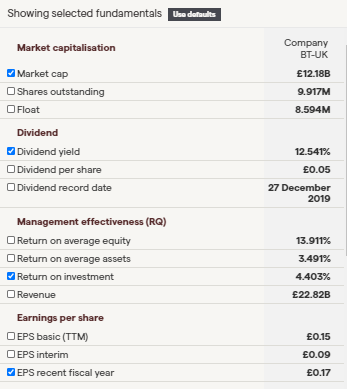

BT Fundamentals

Source: IG

Steps to Buy BT Shares

Online brokerage sites have revolutionised the investment sector and have made buying and selling shares incredibly user-friendly and low-cost. Good brokers also throw in research and learning materials to help you develop the skills needed to make a profit.

Once you’ve decided to buy shares in a company such as BT, all that is required is to register with a site, deposit funds and book a trade. It’s possible to access and manage your account using desktop machines or mobile Apps. If you’re just curious, then it takes seconds to sign up and practise trading using a risk-free Demo account which uses market prices to simulate real-trading, just using virtual funds.

1. Research BT Shares

BT tends to attract more buy-and-hold style investors than speculators. It can take time for the BT share price to react to catalysts. Whatever the time-frame of your strategy, the first step is to establish your valuation of the firm and if you want to buy BT shares or sell them.

This case study on fundamental analysis gives an insight into the life of a trade. It explores the types of tools used to spot an investment opportunity using publicly available information.

2. Find a Broker

Another source of trade tips and ideas will be your broker. Free research and news feeds are provided to clients, so that you can keep up to date with your position.

The quality and quantity of research can differ from broker to broker and trying out a few demo accounts with different platforms can help you establish which one is a good fit for you.

Regulated brokers with strong track records have the best quality research, they’re the real deal. Choosing a regulated broker will also help you avoid the risk of falling victim to a scam. A list of trusted FCA regulated brokers can be found here.

3. Open & Fund an Account

The registration process is super-easy and completed online. Regulated brokers have a duty of care to their clients so have to comply with Know Your Client (KYC) protocols. This is so the broker can build a profile of you and ensure they treat you in accordance with regulatory guidelines. Onboarding takes only minutes to complete and being asked questions relating to topics such as ‘any previous trading experience’ is a sign that your broker is well regulated.

After the form filling, it’s a case of depositing funds. Brokers offer a variety of payment methods, including credit/debit cards and bank transfers. Some of the payment methods are cheaper and quicker than others, so checking the T&Cs is a good idea.

4. Set Order Types

Trade execution functionality is similar across brokers. There are data fields where you input the details of the trade you want to execute, for example, the amount of BT shares you want to buy. This can be done by referencing the number of shares or amount of cash. There are additional order types that you can use to allow the system to automatically trade for you if price gets to a certain level.

- Market Order — An instruction to buy at current price levels.

- Limit Order — An instruction to automatically buy if price reaches a certain price level.

- Stop Loss — A risk management-related automated instruction to sell your position if price reaches a certain level.

- Take Profits — A built-in instruction to sell your position for a profit if and when price reaches a certain level.

These other order types are optional, but being aware of how they work can save you time and money. It’s also important to check if stop-losses or take profits are, for example, included as default settings or else you might check your account and find you unintentionally traded out of a position.

5. Select and Buy BT Shares

Once you’ve decided to buy BT shares, the final step is a simple click of a button or a tap of a screen. This article on the best time to trade offers insight into how you can finesse your trade entry point.

One tip from experienced traders is to check your positions straight after trading. If you’ve made a ‘fat finger’ error, then then it’s best to correct it before price moves too far.

Source: Plus 500

Best Brokers to Buy BT Shares:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookThe length of time you expect to hold your BT shares will determine whether you buy the shares outright or in Contract for Difference (CFD) form. This research report on the pros and cons of CFD vs share dealing explores that subject. The general rule is that if you intend to hold your investment for months and years rather than days or weeks, then buying BT shares outright will likely prove more cost-effective.

Fees When Buying BT Shares

The costs associated with share dealing have been driven down over many years as platforms try to develop market share. Fee schedules differ from broker to broker and finding one that provides a transparent breakdown of their T&Cs is a sign that they are comfortable with their position in the market. It pays to carry out effective due diligence and make sure you’re not overpaying on administrative fees, which can include:

- Payment processing charges — Most brokers don’t charge on deposits, but some do apply a fee on withdrawals.

- Third-party fees — These might apply if you choose a particular payment method. The fees don’t go to the broker but do need to be factored in as a potential expense item.

- Commissions — Most online brokers have moved away from charging a separate dealing commission when buying shares, but it is something to double-check.

- Bid-Offer spread — Rather than charging commission, most brokers make their money on the bid-offer spread, the difference between buying and selling prices. Some brokers have tighter spreads than others.

- FX conversion — Your brokerage account will be denominated in a particular base currency. If that is different from the currency of the account you use to fund it, then there will be charges relating to converting one currency to another. These may be fixed charges or built into the bid-offer spread on the currency conversion.

- Stamp Duty — Purchases of UK stocks, such as BT are subject to SDRT.

- Inactivity fees — Some, but not all brokers apply charges on your account if your account is dormant for a period of time. These can start kicking in after a little as three months. Inactivity can be defined in different ways. Most brokers require a trade to be executed but at Plus 500, for example, the broker considers just logging onto your account sufficient activity to avoid the charge.

- Financing costs — Buying shares outright avoids the overnight financing charges that are associated with trading CFDs.

| eToro | Plus 500 | Markets.com | AvaTrade | |

| Live Account Fee | No charge | No charge | No charge | No charge |

| Demo Account Fee | No charge | No charge | No charge | No charge |

| Bid Offer Spread – BT shares | 17p | 78p | 20p | 17p |

| Cash Deposit Fee | No charge | No charge | No charge | No charge |

| Cash Withdrawal Fee | Yes – $5 per transaction | No charge | No charge | No charge |

| Inactivity Fee | Yes – $10 per month after 12 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $50 per quarter after 3 months inactivity |

| FX Conversion Fee | Offers accounts in USD, only | Offers accounts in USD, GBP and EUR | Offers accounts in 14 base currencies incl. USD, GBP, EUR | Offers accounts in USD, GBP, EUR, CHF |

| Minimum Deposit | $200 (or equivalent) | $100 (or equivalent) | $250 (or equivalent) | $100 (or equivalent) |

Summary

Due to its size and history, BT is a stock that is often in the headlines. It divides opinion and classic valuation models currently mark BT shares as cheap but the multi-year share price slide deters some.

If the firm’s fortunes are about to change then it could be an opportunity for long-time shareholders to finally sell BT shares and exit positions. Those who are new to the situation and not holding loss-making positions face a more exciting proposition. Nothing is guaranteed, but now could be the time to step in and buy BT shares.

RELATED: