Developing an effective and low-cost vaccine to tackle the COVID-19 virus has put pharmaceutical giant AstraZeneca (LON:AZN) firmly in the spotlight. The world-changing ‘Oxford’ vaccine gave AstraZeneca a chance to show off its expertise and made it a household name. The truth is that many stock market investors were already watching the firm and making profits from their shareholdings.

YOUR CAPITAL IS AT RISK

AZN offers investors a blend of security and capital returns, and recent events look set to add momentum to a 10-year uptrend, making now the ideal time to buy AstraZeneca shares.

This review will break down the reasons why AstraZeneca shares might be just what the doctor ordered. It will also outline how to go about buying the shares using a trusted broker.

Table of contents

Overview of AstraZeneca

AstraZeneca plc is a British-Swedish multinational pharmaceutical and biopharmaceutical company, which is headquartered in Cambridge, England. It is a long-established pharma giant formed by the merger between Swedish Astra AB and British Zeneca Group in 1999. Since then, it’s expanded its operations via organic growth and by buying up other smaller firms.

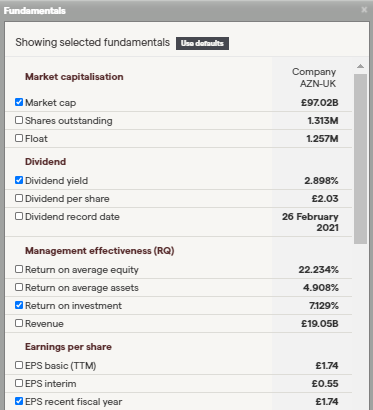

The market capitalisation of around $100bn puts it in the top five firms by size in the FTSE 100 index. Big-pharma is, however, a global industry full of heavy-hitters, and AZN ranks only 12th by size in the index of pharmaceutical companies across the world.

AstraZeneca Shares: The Basics

AstraZeneca’s primary listing is on the London Stock Exchange, where it trades under the ticker AZN, but it is also listed on a range of other exchanges, including the Nasdaq in New York. The secondary listings reflect the extent to which buying into the stock appeals to investors across the globe.

Investors considering taking a position in AZN aren’t faced with the question of whether AstraZeneca is a buy or a sell. The AZN share price doesn’t polarise opinion in the same way the price of Tesla stock or bitcoin does. It’s more a question of whether the returns can be bettered by taking positions in other stocks.

Source: IG

Companies with a 10-year share price similar to AZN are a popular target for professional investors such as pension funds. The question is whether the slow and steady approach fits your investment objectives. Conventional investment principles would say that having a portion of your capital allocated to a stock like AZN is an ideal way to make long-term returns.

If you buy in at the right time, when price dips, you can also make spectacular gains. From the low of June 2016 to the high of July 2020, the AZN share price rose in value by more than 175%. Not bad for a stock at the ‘safe-bet’ end of the investment spectrum, which, over the last five-years, has recorded dividend yields of between 2.6%–4.5%.

Source: IG

The strong fundamentals supporting the idea of taking a long position in AstraZeneca are backed up by technical indicators that point to the time to enter into a trade being right now.

- The weekly price chart shows price sitting on the 100 Simple Moving Average, a line that it has rarely traded below over a 10-year period.

- Trading volumes have, over the last 10 months, been greater than the preceding three years. As such, there is something of a buzz about the stock, which could translate into price momentum.

- The monthly price chart shows the AZN share price is sat on a significant, five-year trendline support level.

Source: IG

Other factors that will influence the AstraZeneca share price valuation include:

- No profits from Oxford — The ground-breaking Oxford vaccine will not add to the AZN bottom line. The firm has stated it will supply it at cost.

- Patent cliff — This term refers to pharma companies facing challenges due to their licenses to exclusively produce certain medicines expiring. R&D is expensive, and restricting the associated future revenue flow will hit long-term profits.

- Reputational risk — The big pharma sector as a whole is often criticised for making money from the medical misfortune of others. The decision to distribute the Oxford vaccine at cost should help AstraZeneca in this respect, at least in relation to its competitors.

Steps to Buy AstraZeneca Shares

Online brokers have revolutionised the investment sector and made buying and selling shares incredibly easy to do.

Once you’ve decided to buy shares in a company such as AstraZeneca, it takes a matter of minutes to set up an account and start trading. The below step-by-step guide explains how to go through the process and offers tips from experienced traders on how to get the best deal.

1. Research AstraZeneca Shares

AstraZeneca’s business model relies on multi-year medical trials coming to fruition and being successful or not. This means most investors apply the principles of fundamental analysis and look into the details of the firm’s operations.

This kind of research and learning material comes as part of the package. If you choose a good broker, they’ll also have news services to help you spot potential catalysts for a share price rally.

This case study of a trade based on fundamental analysis gives an insight into the process. It explores the types of freely available tools you can use to spot an investment opportunity.

2. Find a Broker

AstraZeneca’s size means most brokers offer markets in it. All of those listed in the below table do so. The quality and quantity of research can differ from broker to broker, as some prioritise value-added services such as research and customer support. Others focus on hammering down costs.

Trying out a few demo accounts with different platforms can help you establish which approach suits you and also allows you to put on a risk-free trade using virtual funds and getting a feel for holding a position.

Making the decision to use a regulated broker can be as important as deciding what stock to buy and when. There are, unfortunately, scammers operating in the market and if you make the wrong choice, you can lose all your funds.

AskTraders regularly reviews the different brokers operating in the sector and a list of trusted FCA regulated brokers can be found here.

3. Open & Fund an Account

The online registration process for setting up a brokerage account is designed to be as user-friendly as possible. Regulated brokers have a duty of care to their clients, so have to ask a series of Know Your Client (KYC) protocols. These questions allow them to build a client profile and apply client protection appropriate to your circumstances.

Onboarding takes only minutes to complete and being asked questions relating to topics such as ‘any previous trading experience’ is actually a good thing as it’s a sign you’re using a responsible broker.

After the form filling is completed, it’s simply a case of depositing funds. Brokers offer a variety of payment methods, such as credit/debit cards and bank transfer. Some of the payment methods are cheaper and faster than others, so checking the T&Cs is a good idea.

4. Set Order Types

The process used to buy or sell shares at a broker is very straightforward. All you need to do is locate the market you want to trade, such as AstraZeneca and the amount you want to buy or sell. This can be done by referencing the number of shares or the amount of cash.

There are additional order types that you can use to manage risk. These are instructions, which are built into the system so that the platform will automatically buy or sell if the AZN share price gets to a certain level.

- Market Order — An instruction to buy, open a new position at current price levels.

- Limit Order — An instruction to buy, open a new position if price reaches a certain price level.

- Stop Loss — An instruction to sell an existing position if price reaches a certain level.

- Take Profits — An instruction to reduce the size of an existing position if price reaches a certain level. This instruction locks in some profits by liquidising some (or all) of your holding and returning it back to cash.

These other order types are optional, but being aware of how they work means you can semi-automate your account management. This allows you to focus on the day job, but as they also manage risk, can also save you money.

One important tip is to check if stop-losses or take profits are included as default settings. At some brokers, they are, and if not adjusted, you might find you unintentionally traded out of a position.

5. Select and Buy AstraZeneca Shares

Once you’ve decided to buy AstraZeneca shares, the final step is a simple click of a button or a tap of a screen. This will convert your cash balance into an equity position and the value of your holding will fluctuate according to live market prices.

Optimising your trade entry point is always an advantage and this article on the best time to trade offers an insight into how to try and work your way into a position at the best price level.

Best Brokers to Buy AstraZeneca Shares:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookOne final tip, as practised by experienced traders, is to check your positions straight after executing a trade. If you’ve made a ‘fat finger’ error, then it’s best to spot and rectify it straight away.

Fees When Buying AstraZeneca Shares

The good news for retail investors is that the administrative costs associated with trading have, in recent years, been driven down a considerable extent. Online broker platforms have automated a lot of the processes, which makes them more efficient than ‘voice brokers’ ever were, and competition between firms is fierce.

Trading is hard enough without frittering away cash on charges you might be able to avoid. One way to minimise drag on performance is to select a broker with transparent fee schedules and check through the T&Cs. Below is a list of cost items to look out for.

- Payment processing charges — Most brokers don’t charge on deposits into online brokerage accounts, but some do apply a fee on withdrawals.

- Third-party fees — These might apply if you choose a particular payment method. They don’t go to the broker, but do need to be factored in. Opting for a different payment agent might help you avoid these.

- Commissions — Online stockbrokers have moved away from charging a separate dealing commission on share transactions, but it is something to double-check.

- Bid-Offer spread — Online brokers generate most of their revenue from the bid-offer spread, which is the difference between buying and selling prices. The width of the spread can vary from broker to broker and market to market.

- FX conversion — If you set up a USD-denominated trading account, but fund it by wiring GBP into the account, there will be costs associated with the conversion from one currency to the other. This also applies when you reverse the process and withdraw funds. If you can avoid currency conversions, you’ll avoid the charge.

- Stamp Duty — Purchases of UK stocks, such as AZN, are subject to SDRT.

- Inactivity fees — Some, but not all, brokers apply charges on your account if your account is dormant for a period of time. These can start kicking in after as little as three months and increase over time. ‘Inactivity’ can be defined in different ways, such as putting on a trade, but check the T&Cs as the broker — Plus 500, for example — considers just logging onto your account as sufficient ‘activity’ to avoid the charge.

- Financing costs — Buying shares outright avoids the overnight financing charges that are associated with trading CFDs. If you intend to hold your investment for months and years rather than days or weeks, then buying BT shares outright rather than in CFD form will likely prove more cost-effective. This research report on the pros and cons of CFD vs Share Dealing explores that subject in greater detail.

| eToro | Plus 500 | Markets.com | AvaTrade | |

|---|---|---|---|---|

| Live Account Fee | No charge | No charge | No charge | No charge |

| Demo Account Fee | No charge | No charge | No charge | No charge |

| Bid Offer Spread – AZN shares | 8.65p | 36.9p | 15p | 9.6p |

| Cash Deposit Fee | No charge | No charge | No charge | No charge |

| Cash Withdrawal Fee | Yes – $5 per transaction | No charge | No charge | No charge |

| Inactivity Fee | Yes – $10 per month after 12 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $50 per quarter after 3 months inactivity |

| FX Conversion Fee | Offers accounts in USD, only | Offers accounts in USD, GBP and EUR | Offers accounts in 14 base currencies incl. USD, GBP, EUR | Offers accounts in USD, GBP, EUR, CHF |

| Minimum Deposit | $200 (or equivalent) | $100 (or equivalent) | $250 (or equivalent) | $100 (or equivalent) |

Summary

The proposition to buy AstraZeneca shares is an attractive one. Previous performance is no guarantee of future returns, but the 10-year share price performance is impressive. Selling its Oxford vaccine at cost means it won’t profit from that program, but it does mean it has a valuable intangible asset in terms of the good-will towards the firm. This is never a bad thing for a big-pharma firm.

Accepting that the strategy is designed to provide a steady rather than a stellar return will be the final hurdle for many, but getting in on a dip in the share price can even result in ‘growth stock’ style returns. Technical indicators suggest the time to buy AstraZeneca shares is now, and choosing a trusted broker that offers security of funds is the final box to tick.