Online brokers have revolutionised the investment sector, so you don’t have to be a US citizen to tap into the gains. The five simple steps to follow are the same whether you are based in Singapore or San Francisco. They will help you make the right choice about what you invest in and how you do so. This user-friendly guide will outline that tried-and-tested way to optimise any potential gains and walk through how to buy the best US stocks in Singapore.

Step 1: Understand the Fundamentals

What Are Stocks?

If you own stock in a company, you own part of that company. Given the size of some of the giant US firms, you will most likely own just a small percentage of the total value, but you will be a shareholder, nonetheless.

Apple Inc, for example, has issued almost 17 billion shares in itself. Each share trades at approximately $128 so if you have $1,000 to invest, you’d be holding about eight shares of that 17 billion total. This is a tiny percentage of the total value of the company, but you will be entitled to a proportionately equal share of any profits generated by the company.

These profits are returned to investors in the form of dividends. Apple makes these payments to investors four times a year. Owning stock means you’ll also experience the same highs and lows of the company you’ve invested in. If the firm performs well, the stock price will go up and if things go in the other direction, you will see the stock price go down.

Differences Between US and Singapore Stocks

The core fundamentals of stocks and the rights to a share of the profits they provide to investors are the same regardless of whether you buy into US or Singapore firms. The governance standards of the firms in both countries are similar. This is also the case when it comes to the rules and regulations of the stock exchanges – such as the Nasdaq, New York Stock Exchange and the Singapore Exchange. What is different are the opportunities the underlying companies offer.

Different Investment Opportunities

US retail investors have historically been keen to invest in stocks. That pioneering approach has resulted in stock markets that have grown in terms of size and value.

The Russell 2000 index, for example, contains 2,000 US stock names, which have prospects more closely tied to the domestic market than big multinationals with an international approach. It’s a good place to hunt out stocks that could directly benefit from US domestic economic growth.

The weighted average market capitalisation of members of the Russell 2000 is still a sizeable $1.3bn. This means investors aren’t necessarily buying into firms that are risky due to their small size.

Liquidity levels

The more share trading in a market, the better the T&Cs for investors. Higher liquidity markets are associated with tighter bid-offer spreads and lower brokerage fees. ‘Busier’ is simple better for investors who benefit from the brokers competing between themselves for market share.

Growth Potential

Some of the biggest stocks in the world, the real success stories such as Amazon and Apple started out as small US-based operations. Amazon famously was founded in Jeff Bezos’ garage but grew to have a market capitalisation of $1.6tn. This kind of potential is, to some extent, down to unique characteristics found in the US economy.

Due to the size of the US economy, small firms can experience rapid growth without having to consider cross-border trade. US firms can be ‘incubated’ until they are ready to expand and become world leaders and such opportunities are more limited in the smaller Singapore economy.

Diversification

Splitting exposure between Singapore and US companies can even out investment gains, should one region outperform another. The global financial markets do tend to move in the same direction, but relative performance always differs.

A portfolio heavily weighted towards Singapore equity investments can be ‘hedged’ by allocating some capital to US names instead. Differences between the two countries in terms of politics and economic growth directly impact stock prices. By investing in both regions, there is potential to benefit from positive returns from one section of the portfolio, even if the other underperforms.

Share Size

If you wanted to buy one share of US stock market giant Berkshire Hathaway Inc at the start of 2021, you’d have needed around $343,000 available, whereas Cathay Pacific shares at the same time were trading near S$7 each.

One peculiarity of US stock market prices is they tend to be higher than in other countries, it’s just a traditional characteristic of the market. As not everyone has $343k to invest, some brokers have worked on breaking down barriers to entry and offer ‘fractional’ share trading. This allows investors to buy part of one share, not the whole amount. If you want to spread your investment across several different US stock names, it’s worth checking that your broker offers this service.

Basic Types of Stocks

To make things easier for themselves, investors break stocks down into different categories. The lines between the different groupings can be a bit blurred, for example, a ‘tech stock’ can also be a ‘blue-chip’ stock, but the terms used help traders get an immediate idea of a stock’s characteristics.

1. Blue Chip Stocks

Any firm operating in any sector or any country can be a blue-chip stock. The features that mean the blue-chip tag is applied is that they are large and have an established reputation in their industry. Blue-chips tend to be the largest stocks in the market and are often household names. Blue-chip stocks are often held by investors who want exposure to the stock market but want a relatively stable ride. Blue-chips can go bust, or at least lose some of their sparkle, but their size and reputation act as insurance against that happening.

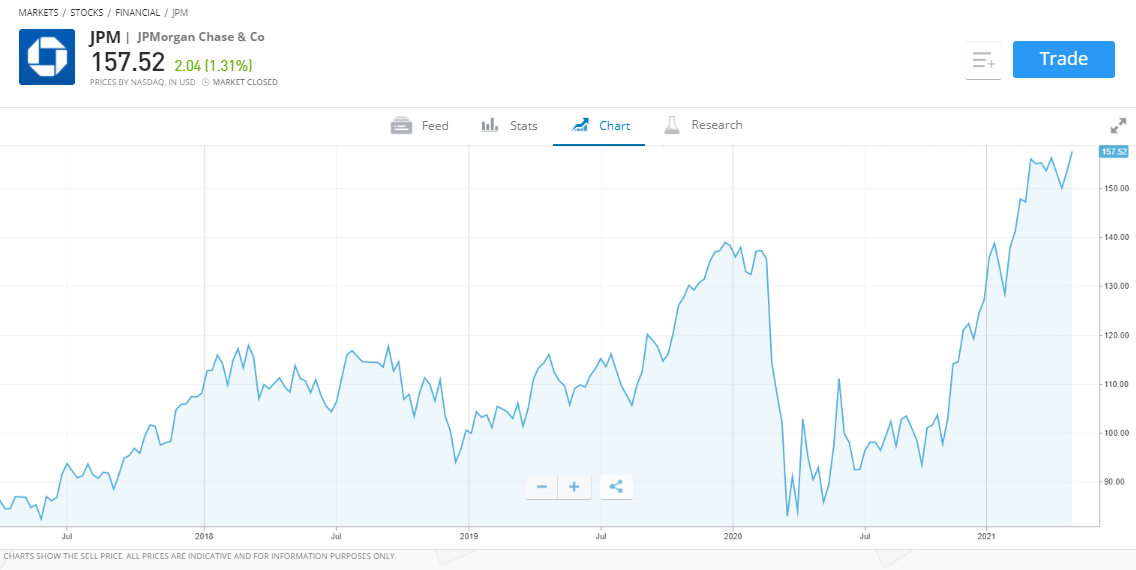

Procter & Gamble, Microsoft and Ford are all US blue-chip stocks, but our pick of the best US blue-chip to buy now is a banking giant with a market capitalisation of over $486bn.

*68% of retail CFD accounts lose money

JP Morgan Chase & Co — Our Pick for the Best US Blue Chip Stocks

In recent years, big banks have underperformed some other sectors, most notably tech stocks. The global economic environment and record low interest rates have been bad news for banks, which see profit margins squeezed when rates get close to zero. JP Morgan has weathered the storm and, even in tough trading conditions, reported profits in 2020 of $29.1bn. Its recent share price strength fits in with many buying into the firm on the back of predicted interest rate rises. If that happens, JPM will be in a good position to increase its revenues.

2. Defensive Stocks

Some firms are better than others at riding out the bumps in the road caused by global economic slow-downs. Tobacco giants such as Philip Morris sell products that have relatively inelastic demand. Even during the March 2021 COVID pandemic, demand for its products held firm.

Defensive firms generate stable earnings and consistent profits regardless of the state of the overall market. The downside to defensive stocks is they might not benefit as much as growth stocks during the good times, but a lot of investors include defensive stocks in their portfolio to balance out riskier positions.

*68% of retail CFD accounts lose money

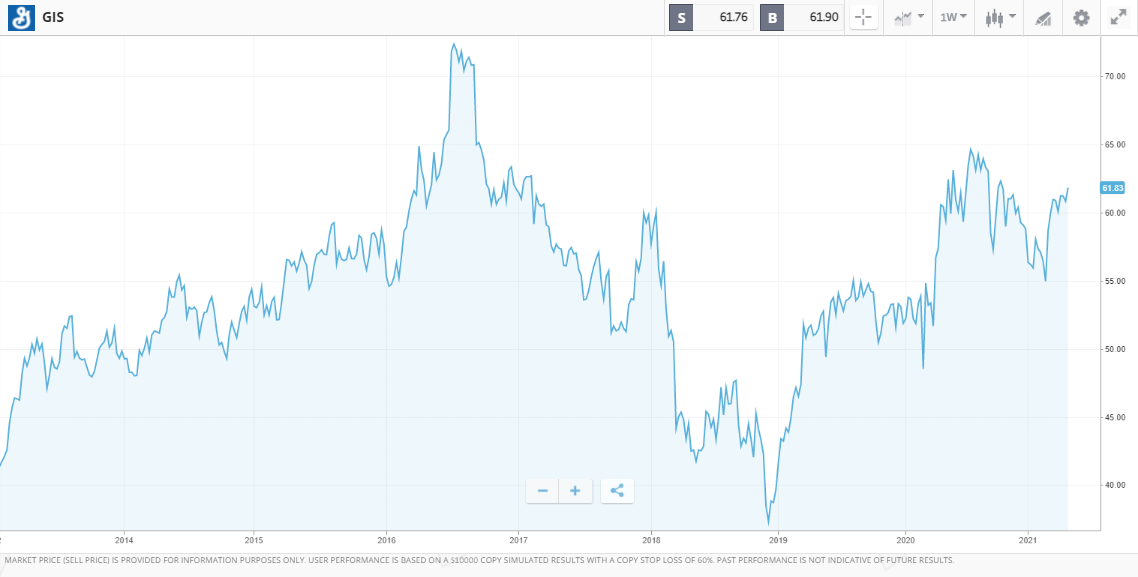

General Mills Inc — Our Pick for the Best US Defensive Stocks

General Mills sells products that everyone needs. Sales data confirms that, regardless of what’s going on elsewhere in the world, the firm’s revenue streams hold firm. Its retail brands include Cheerios cereal, Yoplait yogurt, and Häagen-Dazs ice cream. While the GM share price is sliding sideways, that is actually good news if you’re buying GM for the dividend. The dividend yield on GM is consistently over 3% per year and is improved if you get in at lower price levels such as those being seen now.

3. Income Stocks

Income stocks are those that return a larger than average amount of profits back to investors. How much of the company’s profits are paid in the form of dividends is decided by the corporation’s management, but the executives of some firms have track records of leaning towards doing just that.

This can be because the management doesn’t think there is much growth potential in their sector and that the firm isn’t investing in its own growth projects. As a result, income stocks are not known for having runaway share prices, but they can complement a portfolio and balance out returns from some other types of strategies.

*68% of retail CFD accounts lose money

Broadcom Inc — Our Pick for the Best US Income Stocks

The average dividend yield of stocks in the S&P 500 index is 1.5%, which is half of what semiconductor maker Broadcom Inc returns to investors. In fact, the firm, which also has enterprise software divisions, has increased its dividend nine years in a row. Over the past three years, Broadcom has grown Earnings Per Share 7% annually.

4. Growth Stocks

Growth stocks offer a greater risk-return ratio than the stocks considered so far. They tend to not pay dividends, instead, they reinvest cash in more risky ventures such as developing new products or expanding into foreign markets. These are expected to grow sales and earnings at a faster rate than the market average and are typically the ones that stick in the mind when people talk about the fantastic gains they’ve made in the markets. There are, of course, risks to factor in as well. If future growth prospects begin to fade, that can cause the share price to plummet now.

*68% of retail CFD accounts lose money

Zoom Video Communications Inc — Our Pick for the Best US Growth Stocks

The US market is a happy hunting ground for growth stocks. It has a track record of containing innovative and dynamic firms that seize on global opportunities. Zoom Video Communications is a fine example of what is on offer.

The firm had a very good pandemic. Its neat functionality left it in an ideal position to snap up a massive chunk of the booming home-working market. The speed of the transition to remote working meant millions of users chose Zoom as their video link of choice before the big players such as Microsoft could introduce new ideas to squeeze Zoom out of the market. The risk remains that Zoom’s prospects slide as some degree of normality returns, but on the other hand, it’s beginning to monetise its potential, as demonstrated by its Earnings Per Share (EPS) last year, rising by 1,640%.

5. Cyclical Stocks

If you’re of the opinion that there is going to be a post-COVID surge in economic activity, then cyclical stocks could be for you. Cyclical stocks are those whose fortunes are closely linked to the broader economy and include restaurants, hotel chains, airlines, home improvement, real-estate agencies, high-end clothing retailers, and automobile manufacturers. 2020 was a bad year for cyclical stocks, which means a lot of them are at price levels that are low in relation to their long-term track record.

Boeing— Our Pick for the Best US Cyclical Stocks

*68% of retail CFD accounts lose money

As mentioned earlier, some of the lines between the different categories of stocks can get a bit blurred. Our tip for the Best US Blue Chip Stock, JP Morgan, is also a cyclical stock, but if you’re looking to tap into the heart of the cyclical stock sector and the sometimes dramatic price swings, then aero-engine maker Boeing will get you there.

Boeing’s share price nose-dived in 2020 as much of the world’s population couldn’t even leave their house, let alone the country. In the space of about 12 months, the Boeing share price crashed from $400 to less than $100. It’s since recovered some ground but is yet to return to its pre-COVID levels.

6. Small Cap Stocks

A small cap US stock is generally regarded as being one that has a market capitalisation of between $300m and $2bn. That’s still a considerable size operation, but the attraction for investors is they may still have growth potential that exceeds the market average. Even Amazon, Apple and Tesla once belonged in this category prior to their share price surging even higher.

There are a lot of small cap US stocks to choose from and they cover an array of sectors, so finding small cap stocks is unlikely to be an issue. Filtering down the pool of candidates to a reasonably sized shortlist is likely to be a greater challenge.

*68% of retail CFD accounts lose money

ACM— Our Pick for the Best US Small Cap Stocks

Small cap US stocks have been leading the stock market recovery, with the Russell 2000 Index of smaller US firms outperforming the Nasdaq 100, S&P 500 and Dow Jones Industrial Average between April 2020–2021.

One firm leading that charge is ACM, the service provider to firms in the semiconductor sector. It makes specialist cleaning equipment for chip manufacturers and has a share price that is already on the move.

Step 2: Acquire Knowledge on Stocks of Your Choice

The Basics of Stock Trading

It’s worth getting to grips with how the current value of a stock is based on its future earnings. Investors are owners, so if the future income stream looks likely to grow the value of the stock, your hold today will increase. There is more benefit in buying into the firm and becoming a part-owner of it.

After you’ve bought your stock, you can hold it for as long as you want, continue to take a view on whether it is a good investment and when you sell it you will crystalise your profit or loss on the position.

Selecting US Stocks

The US is the home of stock trading. Americans have for decades been one of the most active populations in the world in terms of managing their own investments and, as a result, a thriving industry has built up and there are thousands of stocks to choose from. The fact that the US stock markets are so vast and easy to access is great news for investors, but the flip-side of this is that there is a need to use some filters to fine-tune your selection.

Fundamental Analysis

One of the main tools used to formulate investment decisions is fundamental analysis. This considers the ‘fundamentals’ of a firm’s business operations using publicly available information. As equities are, to a large extent, priced according to future revenue streams, two of the key metrics is Earnings Per Share and Price / Earnings Ratio.

- Earnings per share = Net Income / Number of Outstanding Shares

- Price / Earnings P/E ratio = Current Share Price / Earnings Per Share

Future revenues can only be guessed, but these formulae use the next best thing, which is the most recent earnings data. Most US firms report this information at the end of every quarter, so investors can get an up-to-date idea of how they are performing. It’s so important it even has its own name – ‘Earnings Season’. Any change in earnings performance can impact the price of shares, for example, an ‘earnings miss’ is taken to be a sign that future earnings might also be poor. The average P/E ratio of the US indices is a good benchmark to use.

If your target stock has a P/E ratio above the average, then it’s a sign that it’s a growth stock and investors are backing that stock to outperform the market in the future. You could also look at that same stock as being ‘expensive’ and some investors target stocks with P/E ratios below the average in the belief that they will catch up with the broader market.

Those investing in blue-chip, defensive and income stocks will also consider the dividend yield. Returns in those strategies rely heavily on the regular payments made to investors.

Studying past earnings makes the best out of the problem of investors not being able to see into the future. It does, however, involve looking in the rear-view mirror. For that reason, a lot of investment decisions made using fundamental analysis involve digging into company websites and broker research reports for news about new projects coming through the pipeline.

All of this information is widely available, but a good broker will help your decision making by presenting it in an easy-to-use format.

Technical Analysis

Technical analysis uses historical price data to try to predict future price moves. One of the key metrics are moving averages. There are even strategies based on using these price patterns and indicators to buy or sell.

Taking Boeing as an example, the stock price in April 2020 fell dramatically and moved a long way from the 100-day average price of the stock. Investors who bought that dip did so in the belief that the Boeing stock price would come back in line with the long-term average for the price. Within 12 months, they were proved to have made the correct call.

*68% of retail CFD accounts lose money

Fundamental and technical analysis are often used in conjunction. A popular approach is to study the fundamentals to identify targets and use technical analysis to help spot the best time to buy them.

Step 3. Build an Investment Portfolio

Investing in stock positions can be a roller-coaster ride and there are ways to manage the risks and emotions associated with that. A portfolio that produces lower volatility returns might not be as exciting as a big position backing a hunch, but in the long run, it’s more likely to be successful. One of the top tips from experienced investors is to take the emotion out of trading. That way, you are able to stick with your strategy and avoid panic-selling a position that suffers a short-term price slide but will ultimately come good.

Risk Tolerance

One of the first decisions to make involves assessing your investment aims and personal attitude to risk. If you’re looking to make long-term gains and are relatively risk-averse then blue-chips and dividend stocks might be your preference. Those with a higher risk-return would look to invest in US growth stocks and small-caps.

Diversification

The reality is that a lot of investors build a portfolio that is a blend of different types of stocks. It might still have a weighting towards one sector, but dividing your total cash pile across a range of names averages out returns. It also reduces single stock risk, which relates to an individual firm going bust. There are examples of big, apparently safe firms such as Enron going bust due to bad management.

Asset Allocation

One of the easiest ways to manage risk and enhance returns is to manage the amount of cash you invest. If you’re new to investing, it’s recommended to start small and build up positions gradually. You’ll soon find out at what level the P&L (profit and loss) swings become a distraction. Good online brokers don’t charge commissions on each trade so you can add to your position over time at no extra cost.

Step 4. Understand Two Types of Stock Gains

There are two different factors to consider when assessing your total return. The first is Capital Gain which is the difference between the price at which you buy and sell. The second is Dividend Income.

Some stocks, particularly growth stocks, don’t pay dividends, so your total profit or loss will be determined by the price you enter and exit the position. Until you sell out, any P&L will be ‘unrealised’ and the value of your holding will fluctuate in line with live market prices.

Strategies that invest in stocks and pay dividends also need to factor in the dividend payments made by the firms you hold. These can be re-invested in the position by buying more shares or taken as cash. If you opt for the latter option, your strategy’s total P&L will be a combination of capital gain and dividend profit.

Step 5. Choose a broker and open an account

1. Recommended Brokers

There are a lot of brokers to choose from due to the boom in online trading attracting new entrants into the sector. This is good news for investors because the competition between brokers has driven down costs. On the other hand, it can be hard to narrow down your choice of broker.

The most important factor to consider is security. Unfortunately, there are some scammers operating in the market and avoiding them is more important than making the right stock choice. One top tip is to ensure your broker is regulated by one of the below Tier-1 regulatory authorities.

Tier-1 Regulators:

- Monetary Authority of Singapore (MAS)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

The other way to check your broker’s credentials is to check out their history of trading. Some have been operating for decades, which means they have not only worked out what their clients want but have reputations they want to protect.

Best Brokers to buy Stocks:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

2. When to Choose a Demo Account

Filtering brokers by their trustworthiness is the most important step, but that will still leave you with a considerable shortlist. At this point, one of the best options is to try a few out by opening a demo account. This is easy to do and typically only involves supplying an email address. Some demo accounts can be set up in less than 20 seconds and once done, you get access to all the platform functionality.

The markets on offer, price feeds, charting tools and research notes in demo accounts are just the same as in live cash accounts. Not only do you get to establish the pros and cons of a broker but you also get to practise trading. Demo accounts are free to use and offer a risk-free way to develop all types of skills.

3. When to Choose a Real Account

Upgrading to a live account and trading real cash involves providing some additional personal information and wiring funds. The extra form filling is all done online and helps ensure only you have access to your account and that the broker complies with client care laws. Cash can be paid into accounts using a variety of payment methods. Credit and debit card payments usually result in funds instantly appearing in your new live account. Bank transfers can take up to 24 hours to process.

4. Additional Account Settings

The broker platforms have functionality that is designed to support beginners, so it is possible to work out how it works by clicking through the screens. Using a demo account to try this out and put on some test trades is recommended, but the process for real trading is just the same.

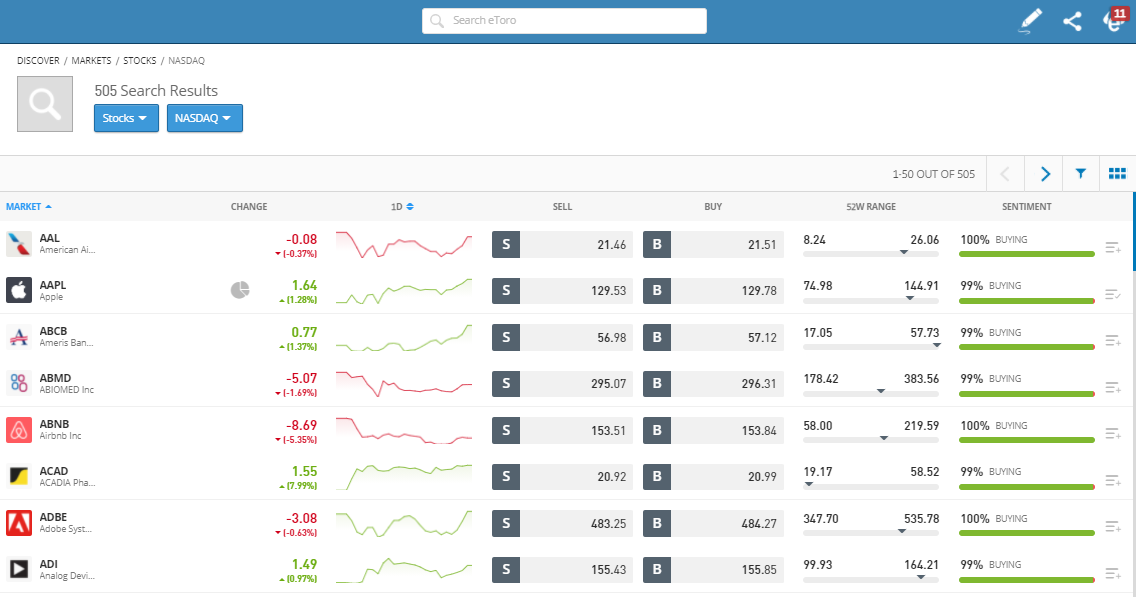

Setting 1. Locate Your Market

This can be done by scanning through the markets on offer or using the broker’s search tool. The broker eToro allows you to filter by exchange so you can find all the 505 Nasdaq stocks it offers in one place.

*68% of retail CFD accounts lose money

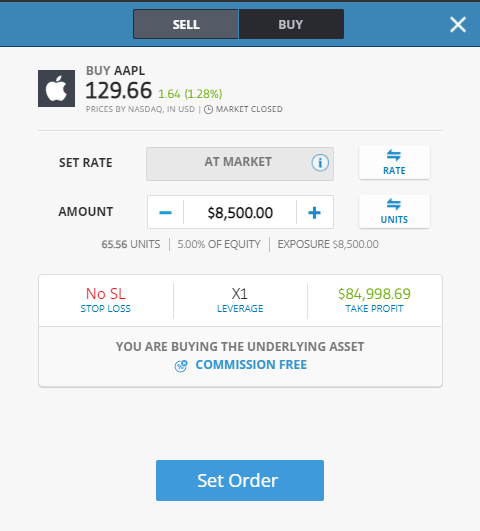

Setting 2. Open a Trade Ticket

The simplest way to buy US stocks is to enter the amount you want to buy and then clicking ‘buy’. There are other tools available to help you finesse your trade entry and manage risk.

Limit Orders – if you want to buy a US stock but think it is currently trading at a higher level than it should be, then you can enter into the system an instruction to buy at your preferred price. There’s no guarantee that price won’t continue rising, but if it does fall back, you’ll optimise your entry level.

Take Profit Orders – These are instructions built into the system to sell some or all of an existing position if price reaches your target level. This will close out your position and crystalise your gains.

Stop Loss Orders – If price goes against you, using a stop loss will close out your position at a loss, but ensure you don’t incur any more losses if price continues to fall. Using stop losses can help manage risk and means you don’t have to watch the markets 24/7. An alternative approach is to manage risk by trading in small size. That way, if price suddenly dips and then recovers, you won’t get stopped out of what was an otherwise good position.

Source: eToro

Setting 3. Final Checks & Buying Stocks

The entire process can be carried out using a handheld or desktop device, and after running final checks on your instruction, it’s just a case of clicking your mouse or tapping the screen on the ‘buy’ button.

Source: eToro

Setting 4. Post-Trade

If all goes to plan, you should be able to take a hands-off approach to managing your US stock investments. It’s wise to monitor news events relating to your investment, but most of the work is front-loaded and revolves around research, broker selection and practising using a demo account.

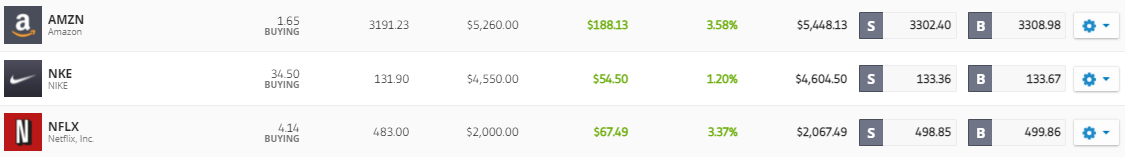

Before you move to that stage, it is crucial to check your trade. Any simple errors such as inputting the wrong amount or even clicking ‘sell’ instead of ‘buy’ are best fixed immediately, before the price moves too far. This can be done by accessing the portfolio section of the platform where all your positions and what they’re worth will be displayed.

Conclusion

US stock markets have been generating incredible returns for some investors and the good news is that they are very much ‘open for business’. Investors from all over the world can buy into them. If you’re looking to buy US stocks from Singapore, you’re not alone in spotting the opportunity. Singapore is the second-largest Asian investor in the US, and as of 2018, had a total of $73bn invested in the country.

The US economy is attractive because it is the world’s leading economic superpower and a lot of US firms are global players with instantly recognisable brands. Finding the right ones for you to invest is as simple as following these five easy steps to buying US stocks.