Red Bull, a global brand based in Austria, has been a prominent player in the energy drink market for almost four decades. Co-founded by Dietrich Mateschitz in the 1980s, Red Bull gained international recognition through its marketing campaigns that associated the drink with high-performance sports and adventure activities. As the company looks like great investment, we look into your option for investing in Red Bull shares.

YOUR CAPITAL IS AT RISK

Despite criticism regarding the high levels of caffeine and sugar in its drinks, Red Bull’s continued dominance in the market is a testament to the effectiveness of its marketing campaigns and its commitment to meeting the needs of its customers.

As Red Bull continues to expand its reach into new industries, it remains a prime example of successful brand building and marketing.

In this article, we will explore the following:

Table of contents

Is It Possible to Invest in Red Bull?

Red Bull’s impressive success in the beverage industry has sparked investor interest in the company, leading many to wonder if Red Bull shares are available to the public.

As the third most valuable beverage brand in the world, with an estimated brand value of over €6bn, Red Bull’s financial standing is undoubtedly impressive.

However, the company operates as a GmbH, which is a type of legal entity used in Germany and Austria that is equivalent to a private limited liability company. The term GmbH stands for ‘Gesellschaft mit beschränkter Haftung’ in German, which means ‘company with limited liability’.

Despite its high market position and strong sales, Red Bull currently has no need for external capital, meaning that the company has no plans to issue shares to the public. While this may disappoint investors hoping to buy into the company’s success, there are many other brands within the energy drinks space that offer investment opportunities.

Energy Drink Company Investment Options

Ultimately, Red Bull’s position as a privately held company has allowed it to maintain control over its brand and operations, while still achieving significant market success. Although there are no Red Bull shares available for purchase, the company’s continued growth and success remain an impressive feat within the beverage industry.

Monster Beverage: a Success Story in the Performance-Enhancing Drinks Market

Monster Beverage, one of Red Bull’s most well-known competitors, has a long history in the beverage industry. Originally founded as Hansen Natural in the 1930s, the company’s subsidiary, Monster, was established just before the turn of the millennium.

Since 2002, Monster has been a dominant player in the performance-enhancing drinks market, and its success was so impressive that Coca-Cola acquired a significant stake in the company in 2015, worth over $2bn.

Monster Energy’s stock (ticker symbol MNST) can be found and traded on the Nasdaq exchange, where it has been listed since the 1980s, but it was only after the energy drink’s commercial success that the stock began to soar.

Previously relegated to the penny stock segment, the company’s shares have risen in value to nearly $100 as of early 2022, with prospects for further growth.

YOUR CAPITAL IS AT RISK

Overall, Monster’s impressive success in the energy drinks market is a testament to the company’s innovative products, strategic partnerships and sound financial management. As a publicly traded company, Monster has attracted significant investor attention and is well positioned for continued growth.

Investing in National Beverage Corp: a Look at the Company’s Growth and Prospects

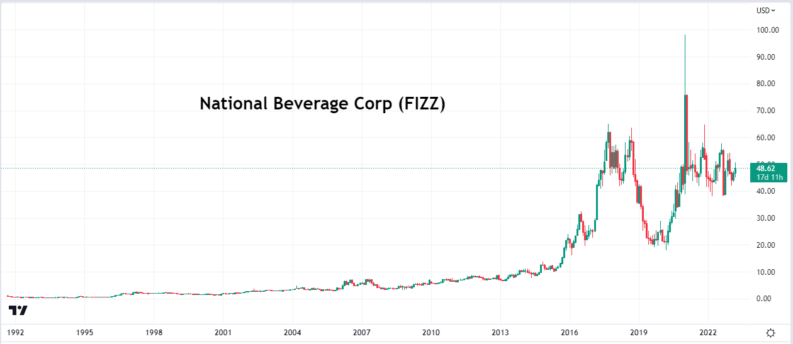

National Beverage Corp is another publicly traded company listed on the Nasdaq (ticker symbol FIZZ). The company has established itself as a leading player in the non-alcoholic beverage market, offering a range of products that cater to different consumer preferences and needs.

One of National Beverage Corp’s most popular products is ‘Rip It Energy’, a line of energy drinks that is marketed towards consumers seeking an effective and convenient way to boost their energy levels.

Available in a variety of flavours, such as Citrus X, Power and Sugar Free, these drinks are widely available at convenience stores and other retailers throughout the US.

In addition to its Rip It Energy line, National Beverage Corp also produces a range of other non-alcoholic beverages under well-known brands such as Shasta, Faygo and Everfresh. These products include soft drinks, flavoured waters and juices, among others.

National Beverage Corp’s success can be attributed in part to its effective marketing strategies, which include targeted advertising campaigns and sponsorships. Rip It Energy, in particular, has been marketed towards military personnel and other consumers with active lifestyles, which has helped the product gain a significant market share.

Financially, National Beverage Corp has performed well in recent years, with a net income of $34m for the third quarter of January 2022.

The company’s stock (FIZZ) has also performed strongly, with a market capitalisation of approximately $4.42bn and a price-to-earnings ratio of 27.98 as of March 2023. Over the past five years, the stock has generated returns of approximately 40%.

Overall, National Beverage Corp’s focus on producing high-quality, affordable beverages has enabled it to achieve solid revenue growth and profitability. With its Rip It Energy line and other popular brands, the company is well positioned to continue its success in the competitive non-alcoholic beverage market.

YOUR CAPITAL IS AT RISK

Investing in Energy Drink Companies: What You Need to Know

Investing in publicly listed companies that manufacture energy drinks such as Red Bull and Monster can provide opportunities for private investors seeking to benefit from their sales growth. However, it is important to conduct thorough research into the background of the corporations before investing. To make informed decisions, here are some key points to consider:

- Do not rely solely on the recommendations of others.

- Be prepared to commit a certain amount of capital over a fixed period of time.

- Consider funds invested as a long-term commitment to avoid premature sales due to liquidity issues.

- A well-diversified portfolio may take time to pay off, and reallocations should only be necessary on occasion.

- Index funds can be a viable option for small investors looking to participate in the stock market and mitigate risk.

By keeping these points in mind, private investors can navigate the stock market and potentially benefit from the growth of energy drink companies.

Conclusion

The energy drinks market has seen explosive growth in recent years, with brands such as Red Bull and Monster achieving enormous sales increases since their introduction to the global marketplace.

Red Bull, one of the most iconic energy drink brands, has achieved significant market success through clever marketing strategies, product innovation, and a dedication to meeting the needs of its customers.

Meanwhile, Monster Beverage has also established itself as a leader in the energy drinks market by focusing on innovative products, strategic partnerships and sound financial management. As a publicly traded company, Monster has attracted significant investor attention and is well positioned for continued growth and profitability.

National Beverage Corp is another publicly traded company that has established itself as a leading player in the non-alcoholic beverage market. The company’s focus on producing high-quality, affordable beverages has enabled it to achieve solid revenue growth and profitability, with popular products such as Rip It Energy gaining a significant market share.

While investing in energy drink companies can be a viable option for some investors, it is important to conduct thorough research and understand the risks involved. For investors who may not have the means to create a well-diversified portfolio that mitigates risks, index funds can be a viable option for gaining exposure to a diversified portfolio of stocks.

Overall, the energy drinks market is an exciting and dynamic industry with significant growth potential, and investors who are able to navigate the risks and opportunities effectively may be able to achieve generous returns over the long term.