Huawei generates annual revenues not out of line with market darling Apple Inc. (2021 revenue: $104bn in cash from operations and a further $75bn in the form of unlevered free cash flow), and like its US rival, it is expanding into new growth markets. Huawei is offering a ‘same-same-but-different’ option to Apple products, and better access to the China market means that there are plenty who would like to buy Huawei stock. The problem for them isn’t finding the optimal Huawei stock price to buy in at or determining how long they want to hold a position – instead, it’s more fundamental than that, as Huawei stock cannot be traded on the open market.

Who Owns Huawei Stock?

Huawei is owned by its employees. The current number of staff on the payroll totals over 194,000, but back in 2003, only 15,061 employees were shareholders. As the company grew, so did the number of shareholders, and by 2018, there were 96,768 registered shareholders, with 3,240 of that number being retirees.

The History of Huawei Ownership

This ownership structure dates back many years. In 1987, founder Ren Zhengfei raised ¥21,000 to establish Huawei and six initial investors each contributed ¥3,500. From the outset, employees were given the option to take a stake in the firm via an employee stock ownership plan (ESOP), and the five other initial investors gradually withdrew their investments in Huawei.

By 2018, the total shareholding of the firm had risen to 22.2 billion shares, with the founder holding a stake in the region of 1%. Like other employees, he is still building his Huawei stock position by taking up the option of engaging in the ongoing ESOP scheme.

Alternatives to Huawei

Investors who are disappointed that they haven’t been able to directly share in the success of Huawei can still use the firm as an indicator of which sectors could be good to invest in.

Best Mobile Phone Handset Manufacturer Like Huawei – Xiaomi Corporation

Huawei’s mobile phone handset operations are the cash cow that has financed expansion into a lot of other markets. In Q2 2020, Huawei’s phone division recorded handset sales that represented 20% of total global market share, though that number has since dropped and reached as low as 8.4% in Q4 of the same year.

Concerns about user privacy and the potential for Chinese authorities to tap into Huawei’s operations have put some consumers off buying Huawei handsets. The challenge facing Huawei can be flipped around and seen as good news for investors. The challenges facing Huawei open the door to investing in one of the other firms in the sector.

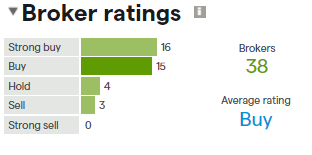

Xiaomi Corp Broker Ratings

Source: IG

Xiaomi Corporation offers a like-for-like proposition to Huawei but with fewer political headaches. The firm has some other personal electronics divisions but is very much a specialist handset manufacturer. Its prime markets are the production of mobile phones, smartphone software, set-top boxes and related accessories. Headquartered in Beijing, it also offers a way for international investors to gain access to the China mobile phone market, and the sales figures that the firm has been releasing speak for themselves.

Between Q4 2018 and Q3 2021, Xiaomi expanded its share of the global handset market from 6% to 13%. Over the same period, Samsung’s market share grew by only two percentage points from 18% to 20%, while Apple’s market share fell from 17% to 14%. Xiaomi is proving particularly adept at picking up new customers from the group of ‘Other’ manufacturers that do not make up the top five handset manufacturers. That group saw its market share fall from 45% to 33%.

Unlike Huawei, Xiaomi shares can be bought on the open market, with the firm having been listed on the Hong Kong stock market since July 2018. Xiaomi stock came to the market at a listing price of HK$17 per share and has traded within a range of HK$8.38 and HK$35.90.

Xiaomi Corporation – Share Price Chart 2018-2022 – Potential Breakout?

Source: IG

Investors looking to buy Xiaomi shares may want to wait until the price breaks out of its current downward price channel, but with the firm expanding market share at the rate it is, this could prove to be a great price entry point.

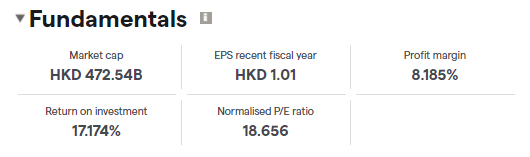

Xiaomi Corp Fundamentals

Source: IG

Best 5G Telecoms Infrastructure Alternative – Nokia

A lot of the FOMO relating to Huawei, and regrets about not being able to buy shares in the company, built up due to the firm’s position in the telecom infrastructure business. Mobile networks are constantly being upgraded and generate long-term revenue streams for the firms operating in the sector. The global rollout of 5G technology is set to provide a catalyst for share price growth, and only a handful of firms have the capacity and technological capability to capitalise on the network upgrade.

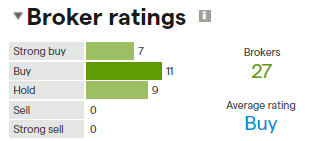

Nokia OYJ Broker Ratings

Source: IG

Firms operating in markets with high barriers to entry and a limited number of competitors can generate medium and long-term abnormal returns. In the case of the 5G rollout, opposition from Western governments to Huawei being involved in new networks has left two firms, Nokia and Ericsson, in prime position to get greater market share.

Nokia OYJ – Share Price Chart 2020-2022 – 5G Rollout

Source: IG

Nokia is the smaller of the two alternative operators but looks a better bet in terms of future share price growth. In January 2022, Nokia’s new management team announced to investors that it was raising revenue forecasts for the coming year largely thanks to the rollout of 5G networks. Supply side issues, in particular a shortage of the chips needed for the new 5G network, are easing, and between 28th October and the end of 2021, Nokia stock rose in value by 16.4%.

Nokia OYJ Fundamentals

Source: IG

Nokia’s primary stock listing is on the Nasdaq Helsinki exchange, where it trades under ticker NOKIA. International investors can invest in Nokia via the New York Stock Exchange-listed American depositary receipt (ADR), which trades under ticker NOK.

Best 5G Consumer Wearables and Consumer Electronics Firm Like Huawei – Apple Inc.

Other areas that Huawei has been expanding into include smartwatches, laptops and other consumer wearables. These divisions are in their growth stage, but considering that Huawei only started producing smartphones in 2004 and is now one of the dominant forces in the market, there appears every likelihood that these divisions could also experience exponential growth.

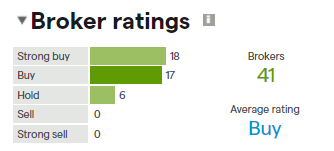

Apple Inc. Broker Ratings

Source: IG

Investing in a firm that doesn’t compete directly with Huawei in the value end of the market could be the best long-term bet. This makes Apple Inc. an attractive proposition, as the US-based manufacturer has found success from developing an intensely loyal consumer base that is happy to pay up for premium products.

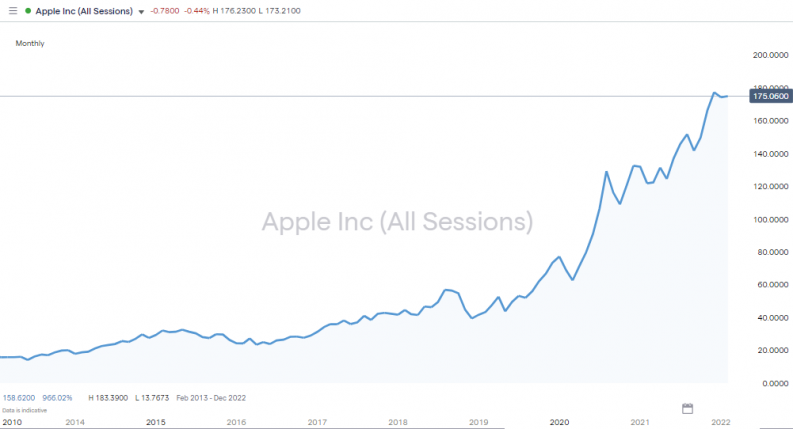

Apple Inc. – Share Price Chart 2013-2022

Source: IG

The functionality of Apple’s smartwatch is a step up from most of the peer group. It provides health, fitness, music, scheduling and voice assistance, whereas some smartwatches struggle in at least one of those categories. For its target market, the Apple smartwatch is a reasonably priced extension of the iPhone’s functionality ,which helps explain that in the run-up to the end of 2021, Apple’s product still held 21.8% of the global smartwatch market.

Apple Inc. – Fundamentals

Source: IG

Other reasons to buy Apple shares include the firm’s incredibly strong balance sheet. Surplus cash continues to be fed back to investors in the form of dividends and stock buybacks, which when combined have in recent years provided an effective return to investors of approximately 3.5% per annum.

Apple shares are listed on the Nasdaq exchange under ticker AAPL and are one of the most actively traded stock listings in the world. The extreme levels of liquidity mean that bid-offer spreads are tight and that most of the firms on this list of trusted brokers offer markets in the stock.

Will It Be Possible to Buy Huawei Shares in the Future?

Cyber security concerns about Huawei products have hit the firm’s prospects hard. Those who have been following Huawei for years and ruing the fact that they can’t buy shares in the firm might have actually dodged a bullet. Revenues in 2021 were lower than in 2020 as Western politicians blocked the firm from taking up contracts in sensitive and structurally important areas of the economy.

On 11th January 2021, a law forbidding US investors from investing in companies that were designated ‘Communist Chinese military companies’ came into effect. The ban currently covers 11 companies, and even if Huawei shares were tradeable, it is highly likely that the firm would be included on that list.

There is no suggestion that Huawei is going to make its shares available on the open market, but not being able to invest in Huawei might not be the handicap it at first glance appears to be. With the tech sector still offering long-term growth, there are plenty of innovative firms to buy into that don’t have the political complications that Huawei does – complications that it looks unlikely to be able to move away from.