Stock dividends may also be dividends issued in the form of extra shares rather than money. Most of the time, companies do this because they’re short of liquid cash or would rather the money to fund growth.

Since stock dividends will inform your trading strategies, it is imperative to understand the following as we will discover in this article:

- What is the dividend yield, why is it important to know, and how do you calculate it?

- How does the dividend capture strategy work?

- What are the risks of a dividend capture strategy?

- How can you identify the best stock dividends?

What is a Dividend Yield?

The dividend yield or dividend-price ratio of a share is the dividend per share, divided by the price per share. It is also a company's total annual dividend payments divided by its market capitalization, assuming the number of shares is constant. It is often expressed as a percentage.

How Do You Calculate a Dividend Yield and Can You Predict Future Dividends?

The dividend yield is a financial ratio that tells you how much a company pays out in dividends relative to its share price:

- The dividend yield is shown as a percentage.

- To calculate, divide how much was paid in dividends in dollars in a given year per share of stock held by how much one share of stock costs in dollars.

- The formula is annual dividends per share ÷ price per share.

To calculate yields for a current year:

- Take the previous year’s dividend yield, or take the last quarterly yield and multiply by four.

- For the latter, make adjustments and allowances for seasonality – it does not make sense to take a second-quarter yield as an absolute when traditionally the company always closes higher in the third quarter.

- Divide by the current share price.

In picking the best stock dividends, try estimating what an upcoming dividend may be by looking at the most recent yearly dividend payment or taking the most recent quarterly payment and multiplying by four.

This is called the ‘forward dividend yield.’ It’s not an absolute indication of anything, as estimates are estimates.

Companies also have no compulsion to declare any dividends in the first place. You could also compare dividend payments as measured against a stock’s share price over the last year to understand its performance better retrospectively. This is referred to as the ‘trailing dividend yield.’

Are Dividend Stocks Worth It?

Some people live for their dividend payout as a means to either:

- Generate a regular income from stock ownership

- Using the cash to buy other dividend-paying stocks

- Use the profits as part of a broader reinvestment strategy that includes buying stock as well as other securities

To this end, we will look at a trading strategy called dividend capture strategy later on, which is an aggressive way of going after dividend-paying stocks. It is also important to note that some individuals, such as stock market guru Warren Buffett, are not fans of dividends.

His company Berkshire Hathaway does not pay dividends. Buffet reasons that if a company is doing well, he would rather see those funds ploughed back into the company instead of being paid out to investors.

He sees this as part of a strategy to enable further company growth long-term – and paying out dividends means the company would have less internal capital growth. The company then becomes more valuable this way, as it is seen as more liquid, among other things, thus pushing the stock price up.

When all things such as tax are considered, he says that ultimately investors gain more by selling off a small amount of stock – which is now valued much higher – than by having received dividends.

The Potential Pitfalls of Dividend Capture Trading Strategy

When using dividend capture trade, the adage ‘buyer beware’ certainly applies.

The main pitfall is that the profit margins from dividend capture are extremely thin. For example, you may gain 0.29%, but this is before trading commissions and non-qualified dividend tax rates – which are usually the same as your ordinary investment income tax rate – are factored in.

What does this mean? You may need to place substantial orders if you are to gain any significant profit.

And therein lies another caveat: having to buy large volumes come with its own set of hazardous factors, one of them being that the dividend is not the only thing affecting the lower share price after the dividend.

The share price may go even lower due to other factors that were not taken into account.

So is there a way to select the optimal stock dividends in general?

There are thousands of dividend-paying stocks, but you only want stocks that meet specific criteria, such as high-yield ones with good volume, so that you are not penalised for changing a position too much. Consider consulting an experienced stock dividends guide, or read on for more suggestions.

How to Find Good Dividend-Paying Stocks

Now, you know how it’s like to invest in dividend stocks, how it can be profitable, and you are thinking of trying it out yourself. Here comes the tricky part.

How do you find a worthy dividend-paying stock to invest in?

There are literally hundreds of thousands of companies in the world that pay dividends to their shareholders, and not every company is worth investing in.

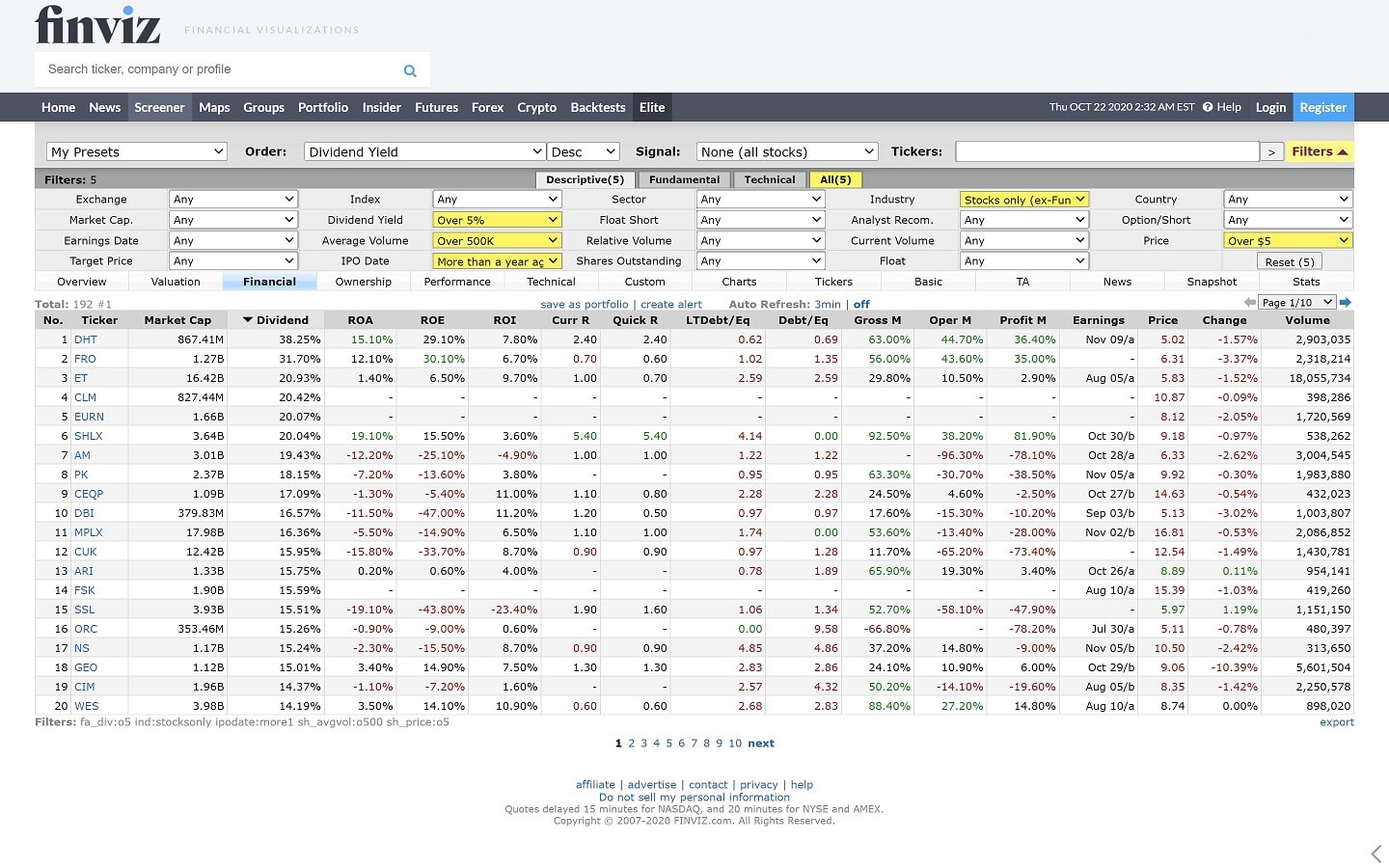

To help you select good dividend-paying stocks, most capture traders use a stock screener, such as Finviz. Let’s look at how it works in our example below.

- Click on Screener.

- Input dividend yield over 5%.

- Average volume above 500K. Adjust as required.

- Price criteria above $5.

- The IPO must be more than 12 months prior.

- Go to the Industry drop-down menu. Select Stocks Only or Exchange Traded Funds.

- Under Fundamental, insert your filters.

- Click on ‘financial’ to view results in this mode.

- Click Dividend twice to ensure your list is sequenced highest to lowest in terms of dividend yield.

- Alternate the view to ‘charts’ mode.

- Leave stocks trading near the high alone. If it’s trading near the low, take a closer look.

- Manually go through the stocks on your list. As you’re doing this, open the charting platform supplied by your broker and study a chart of the stock over five years or more. Consider purchasing it if it’s trading near a major support level over that time frame and meets the other critical relevant key filter criteria.

You can also conduct a broker comparison to find a similar service.

Best Brokers to buy Dividend Stocks

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookFrom 0% commission to low trading fees and top-tier regulation, these brokers are best-in-class when it comes to buying and selling dividend stocks.

Practical Example Of A Stock Dividend Pay-out

Stock dividends are paid out via extra shares rather than cash, perhaps because a company’s liquid cash flow is low due to new acquisitions, reinvestment, or any number of other reasons.

These distributions or pay-outs are generally acknowledged as fractions paid per share. For example, a company may declare a stock dividend of 0.05 shares for each share held by existing shareholders. This may be advantageous to shareholders who do not need immediate capital as part of their trading strategy.

Here is an example of how it could work.

Let’s say a company board approves a 5% stock dividend. In terms of this, existing investors receive an additional share of company stock for every 25 shares they own.

Therefore, in this example, an investor who owns 100 shares in a company may receive four extra shares due to this stock dividend – but there is a caveat. This also means that the basket of available shares has increased by 5% while its total market value remains the same.

This results in the price of the stock being adjusted downwards to reflect the new number of shares. A stock dividend is similar to a stock split in this instance.

Is it a Good Indicator if a Company is Paying Out High Dividends to Shareholders?

When trying to choose stock dividends to add to your portfolio, should you look for ones currently paying out high dividends to their shareholders?

Solely looking at dividends is not reliable, and evaluating a company based exclusively on the dividend will provide unwanted outcomes.

A way of evaluating the dividend’s quality is by looking to find the company’s payout ratio. What is the proportion of earnings paid out to investors? This ratio in the industry average will provide that sense check required when selecting the company.

Also, remember that a company may pay high dividends to its shareholders for a period and later change. Companies often curtail the extent of payouts in adverse economic conditions or when going through challenging internal periods.

This is why you cannot rely on consistent dividends permanently. Keeping this in mind also enhances your natural trading attributes.

There are also instances in which a company is not undervalued despite paying great dividends. This is particularly true of corporations in certain industries, such as banks and utilities.

They are often highly profitable with steady earnings and have been around for a long time, so they are not undervalued, although the high dividend yields keep coming.

How to Use Stock Dividends as Part of Your Trading Strategy

Now, we’ve arrived at the real deal. How to implement your knowledge of stock dividends into your trading strategy?

Dividend capture strategy is one of the popular strategies that incorporate stock dividends into the trading strategy.

If you are a dividend capture trader, then as the name suggests, you’d try to strategically ‘capture’ a dividend. This involves buying a stock just before a dividend is declared and then selling it afterwards – the enter-and-exit strategy revolves around the dividend.

Dividend traders buy a stock before the ex-dividend date. This ex-dividend date is when you must be a shareholder on record to qualify for the next dividend payment.

As always, there is something to note: future dividends are priced into the current share price of any dividend-paying stock. Consequently, on the ex-dividend date, the share price will go down.

This downward adjustment reflects the value lost due to what is being set aside monetarily to pay out the dividend sum. The real opportunity for dividend capture traders occurs when this downward adjustment is only marginal, for whatever reason, and does not accurately reflect the future lost value.

Conclusion: Stock Dividend Trading

Dividend growth investing can cushion you with immediate and future gain streams if you’ve chosen companies that offer consistent, reliable dividends.

They’re not often chosen as the main strategy because the margins are so low and because the gains pale compared to what can happen when a share price moves up. This is why, even in financial reporting, dividends are often underreported compared to up or down share price movements.

Dividend-paying companies usually declare interim or yearly dividends. They may also offer you the chance to profit through share price appreciation. As always, there are risks.

A dividend may not be declared, or it may be significantly smaller than before. If you were relying on this as your major income stream, you might want to change your strategy as soon as possible.

The best stock dividends are probably in companies that have adopted a progressive paying policy. In other words, you can see the dividend increasing every year.

Again, do not take this for granted. Market conditions can change at a drop of a hat, or a company may suddenly find itself in turmoil or go in a new direction. The company’s dividend-paying history should provide you with some comfort, but never see it as a given or a certainty.

People Who Read This Also Viewed:

- Check our eToro review

- Find out which are best small-cap stocks

- Discover the best UK renewable energy shares