There’s a distinct feeling that trading and investing in the financial markets has changed since early 2000. The Covid pandemic was followed by periods of heightened geopolitical tensions, resulting in increased price volatility. Some stocks have seen their price volatility levels go off the scale, and that scale is called Beta.

YOUR CAPITAL IS AT RISK

Beta is a calculation that measures the volatility of a stock in relation to a standard benchmark. Understanding how it works and why it’s important can improve your trading performance, and some investors specialise in the sector. High beta trading strategies are a relatively high-risk proposition, but the returns can be market-beating, so we’ll also list the best five high-beta stocks to buy now.

The Best High Beta Stocks to Buy Now

- SVB Financial Group (SIVB)

- Advanced Micro Devices Inc (AMD)

- Align Technology Inc (ALGN)

- Marathon Oil Corp (MRO)

- Commercial Vehicle Group (CVGI)

What is Beta?

Individual stocks have a beta score ranking which uses historical price data to convert the degree to which they deviate from the general movement of the market into a single number. The higher the number is above 1.0, the greater the volatility levels.

Beta works in both directions, so a high beta stock can be expected to fall to a greater extent than the chosen benchmark during a market crash. It would then rally harder once markets turn bullish. Given that this list of trusted brokers offers the opportunity to short-sell markets using CFDs, it’s possible to profit from trading high beta stocks whether they are rising or falling in value.

Personal preference can help you decide which benchmark is used to represent the average of market volatility. If you were trading one of the top five copper stocks, you might choose to use Beta calculated on the mining sector or to a more granular level by using an index of copper mining stocks. The most widely used benchmark is the S&P 500 stock index which tracks the performance of the 500 large companies listed on stock exchanges in the United States.

Beta is one of the key metrics used by fans of fundamental analysis who use the CAPM (Capital Asset Pricing Model) model as part of their trading strategies.

SVB Financial Group (SIVB)

Source: 123RF

The banking sector might not be your first thought when hunting out high beta stocks, but SVB Financial Group is an interesting proposition. Based in Silicon Valley, SVB specialises in loans for tech start-ups. Its esoteric client base also extends to winemakers, with the bank being one of the largest providers of financial services to Napa Valley.

Not only is SVB well positioned to benefit from technology’s next big thing or more growth in the thriving leisure sector, but banks could see profit margins improve as interest rates rise. It’s hard to make a massive turn on the difference between loan and savings rates when base rates are near zero, and 2022 looks set to be associated with successive rises in interest rate levels.

SVB Financial Group – Share Price Chart – 2019-2022

Source: IG

SVB has a Beta of 1.9, and the share price has fallen by 23.01% since 12th January 2022. That compares to the S&P 500 falling by 5.38% over the same time. That overshoot to the downside presents a buying opportunity for those expecting the good times to return. An idea of what could be possible is shown by the price rising by 476% between March 2020 and October 2021.

Advanced Micro Devices Inc (AMD)

Source: 123RF

Advanced Micro Devices Inc, better known as AMD, has been trading for more than 50 years and continues to generate impressive returns for its shareholders. It’s a prime target if you’re looking to get into a tech stock and have the patience to wait for a market sell-off before pulling the trigger on the trade.

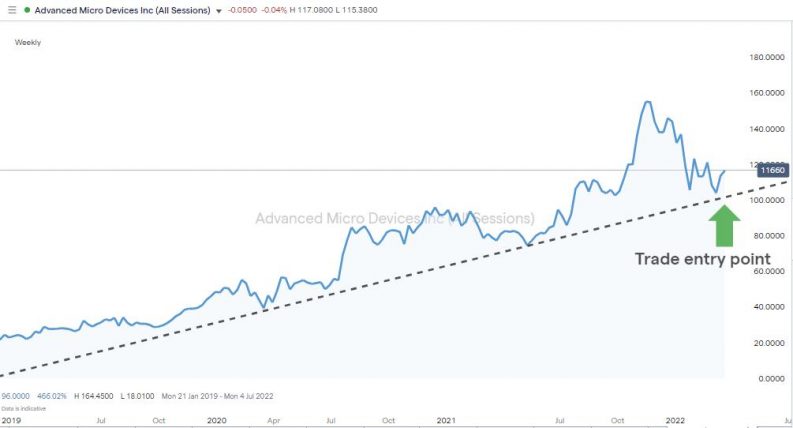

AMD – Share Price Chart – 2019-2022 – Nearing optimal trade entry point

Source: IG

Over the last five years, AMD has recorded a beta rating of 1.77. Whilst it can still be expected to experience price swings greater than the S&P 500, its beta could be due to falling in the future. That is because the firm has rationalised its business model and now concentrates on central processing units (CPUs) and graphics processing units (GPUs).

As long as the supporting trend-line holds, the stock will continue to print out a bullish price pattern, so entering into long positions when price gets close to touching the line would optimise your trade entry point.

Align Technology Inc (ALGN)

Source: 123RF

Align Technology is a high beta stock that offers investors exposure to the increasingly popular medical instrument sector. The stock posted a 12-month high of $737 in September 2021, which looked to be in the region of the firm’s intrinsic valuation.

Align Technology Inc – Share Price Chart – 2019-2022 – Trading below fair value

Source: IG

In line with the rest of the market, the price of ALGN has weakened during Q1 of 2022. Its high beta ranking of 1.7 means it’s overshot to the downside, and with the share price currently at $441, it’s a bargain waiting to be picked up.

Marathon Oil Corp (MRO)

Source: 123RF

The oil and gas sectors are excellent to look for high beta stocks. Supply-side constraints mean that surges in demand for energy can lead to dramatic price increases in the price of crude and gas, and that feeds into greater volatility in the share price of firms like Marathon Oil.

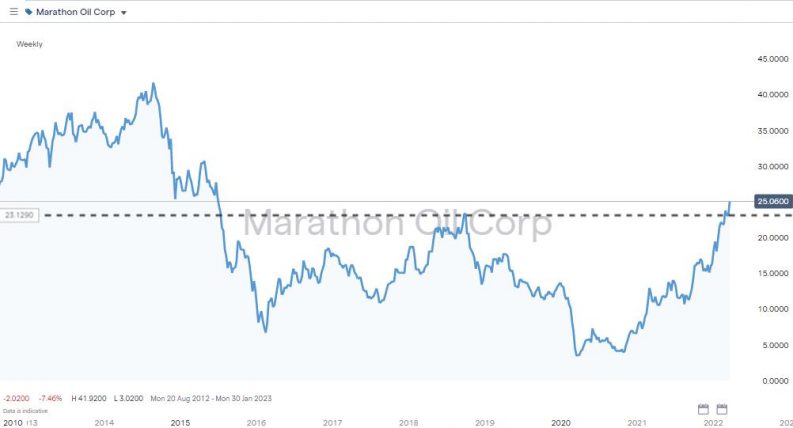

Marathon Oil Corp – Share Price Chart – 2012-2022

Source: IG

With a beta of 2.75, MRO can be expected to overshoot the broader market, which means there’s potential for the current bull run to continue. The stock has just surged past the resistance offered by the price high of $23.67 recorded in September 2018. There are now few technical analysis barriers between the current stock price ($25.06) and the $41.50 price high printed in 2014.

Commercial Vehicle Group (CVGI)

Source: 123RF

Commercial Vehicle Group operates in the Auto Parts sector and currently has a beta of 3.38. Turnover for the firm’s products is highly sensitive to the prospects of the broader economy, which goes some way to explaining why the CVGI stock price is 37.34% off the price high of $13.25 posted in May 2021.

Commercial Vehicle Group Inc – Share Price Chart – 2019 – 2022

Source: IG

With price forming a consolidation pattern, buying now could open the door to gains such as those seen between April 2020 and May 2021, when the stock increased in value by 867%.

Who Trades High Beta Stocks?

Some investors specialise in the high beta sector. If you make the right calls, significant returns can be made, and equities still represent one of the most convenient and cost-effective methods of getting exposure to the financial markets.

Other investors consider allocating a percentage of their portfolio to high beta stocks and smooth out aggregate returns by investing in other sectors which have lower price volatility.

The term ‘Trading Beta’ is often applied to Family Offices, which are boutique investment programs that manage the investment portfolios of super-wealthy families. With day-to-day cash flow not being an issue for those involved, they can invest to generate market-beating long-term gains. These are the buyers who will have kept some cash to one side to allow them to step in when markets crash and buy the bottom of the market. Buying high beta stocks at that stage just magnifies the gains; not only did they fall further than the market average, but if things go to plan, they’ll also overshoot to the upside.

Things to Know About Trading High Beta Stocks

Understanding Beta helps traders categorise different sectors of the financial markets and formulate trading decisions that are right for them. The characteristics of high beta stocks do need to be considered as there are inherent risks.

High Beta Stocks Are By Definition High Risk

The calculation used to measure Beta is based on how much a particular stock will move in price compared to the market average. This can be great if you trade with the trend but can cause eye-watering discomfort if you are on the wrong side of a trade.

Beta Can Change Over Time

Your high beta stock may go through a transitional process which makes its core business activities more stable. As earnings will be less volatile, so will be the swings in the stock’s valuation. Working in the opposite direction, a low beta stock might see its beta ranking rise if it decides to pursue a new path. Pharmaceutical companies that have a new wonder drug coming through their R&D pipeline might see beta levels drop after a regulatory decision is made on whether it’s safe to use.

Some High Beta Stocks Might Surprise You

High beta stocks can also be found in all the corners of the stock market, and the size of the firm is a guide rather than a hard and fast rule as to whether they’ll have greater price volatility or not. A small tech stock with one ‘Hail Mary’ style product in development might be seen as the typical high beta stock, but massive firms can also be high beta if they’re operating in a particular sector or undergoing a regenerative overhaul of their operations.

- Beta of 1.0 means the stock moves in line with the S&P 500

- Beta of 2.0 means the stock moves twice as much as the S&P 500, in the same direction

- Beta of 0.0 means the stock moves don’t correlate with the S&P 500

- Beta of -1.0 means the stock moves precisely opposite to the S&P 500

Final Thoughts

Every stock has a beta rating, and it’s a metric for investors to consider as much as dividends or market capitalisation because it provides one simple number which provides clues about what to expect. Risk-return is scaled up, but that could be an attractive proposition for those running their portfolio. If you consider your portfolio your own ‘family office’, then trading in the same style as those who target long-term outperformance could be worth trying.

Navigate to this list of trusted brokers who offer ways to buy into high beta stocks to take your trading to another level.