Short selling is betting that stock prices will fall in the future. It goes against traditional investment principles and has therefore become a contentious issue. Hedge funds managing the investments of billionaires can beat down the price of stocks of everyday businesses and household names. That means ‘real' businesses suffer, and jobs are at risk.

The moral case for short-selling is considered below; however, the most important thing for retail investors to factor in is that thanks to online CFD trading platforms, the little guy can also apply strategies which make profits when markets suffer a correction. In addition, short-selling has developed to become such an essential part of how markets operate that understanding how it works is also important, even if you only ever intend to use buy-and-hold techniques.

The Moral Case for Short-Selling

The actions of short-sellers in most stock markets can help keep a market ‘efficient'. Applying downward pressure on a share price in a gradual manner can be better than waiting for a share price bubble to form.

Illiquid markets that can't be shorted can overheat before finally experiencing a painful crash, resulting in some investors being wiped out. There are plenty of examples of markets turning ‘irrational', ranging from the Dutch Tulip Mania of 1634-37 to the Japan property boom of 1986 -91. In the case of the latter bubble, at one point, the square footage price of Tokyo real estate resulted in the Imperial Palace being calculated to be worth more than California.

In both of those markets, selling short was hard to do. You can't, for example, ‘short' your neighbour's house if they tell you it's been valued at a level far above what you think it is worth. When there is limited ability to bet against rising prices, exuberance can get out of control, resulting in a more brutal crash when the boom finally ends.

Short-selling is also perfectly legal. Regulators generally permit it and have proven more than willing to step in and put temporary blocks on the practice during periods when markets crash. Those investors who lend the stock to short-sellers also receive a passive income from stock-borrow fees.

It is also worth considering that short-selling developed out of a desire by investors to manage risk. Aware that markets naturally move through cycles, hedge-fund managers set up long-short strategies to help their clients make a market-neutral return regardless of whether the broader was up or down 10%.

What is Short-Selling?

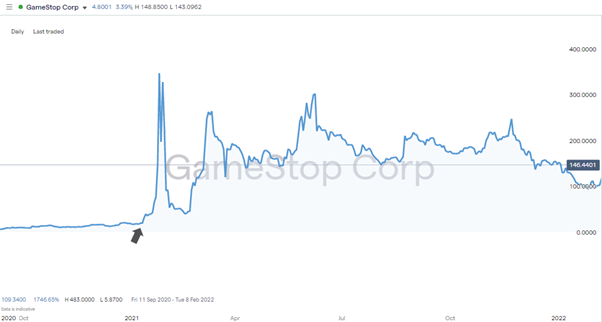

Short-selling happens all the time, and few stocks on any major exchanges will experience zero short interest. Even market darlings such as Apple and Microsoft will have some investors taking bets against the share prices rising higher. One example of a shorted stock-making mainstream headline news relates to GameStop (NASDAQ: GME). As the price of GameStop rose through January 2021, short-sellers started taking positions in the retailer, betting against the rise. Analysis of the company led them to conclude that current valuations were unjustified. They believed that if they borrowed stock, and sold it at current levels, then at some future point, they'd be able to repurchase the stock at a lower price.

GameStop Share Price 2017 – 20 – Successful Short Selling

Source: IG

In the case of GameStop, some high-profile hedge funds took positions that grabbed the headlines when the price didn't fall soon enough but instead surged higher. It ended up costing the funds billions as they closed out losing positions.

The impact the price move has on a trader's P&L is simple enough to understand, but there are aspects of short-selling of which it is worth getting a better understanding.

How Short-Selling works

If you're selling short on a retail platform, then it's just a case of clicking a button. It is as simple as that. The work that goes on behind the scenes, for example, at a hedge fund, will shed light on what happens after that click.

The hedge funds which shorted GameStop would have contacted their ‘prime brokers', such as Merrill Lynch and Goldman Sachs, before entering into a short trade. For a fee, the prime brokerage desk will lend stock to hedge funds, taking that stock from the long-only accounts of other clients such as pension funds.

It's an interesting concept that some investors who want the price of a stock to increase over the long term are willing to allow others to bet against it in the short term. Still, it generates an income that would not otherwise be available. Even any dividends which would be accrued are ‘made good' by the borrower, so even when stock has been loaned, dividends will be paid.

What is a Short-squeeze?

To be able to close out a short position and return the stock-borrow to a lender, a hedge fund needs to go into the market and buy stock at the current market price. That increases demand for the stock and drives up the price. In the case of GameStop, there was, in January 2021, a sudden realisation that short interest was on such a scale compared to daily trading volumes that covering all the shorts in the market would take some time. If a group of funds decided to close out immediately, at any cost, that would cause the price to spike, which is what happened on 15th January 2022.

Those funds which were still short with GameStop were faced with the dilemma of buying during a period when price was rising due to market mechanics or to hold on, in the belief that their analysis would ultimately be proven correct, and the price would eventually fall further.

To make matters worse, smaller investors in the Reddit / WallStreetBets community also spotted the extent to which short-interest was far more than daily trading volumes. Those traders then bought stock, realising that the hedge funds were caught in a short-squeeze. The new buyers were well positioned to benefit from the uncomfortable situation hedge funds had got themselves into. On 27th January 2021, the price of GME doubled overnight, and the funds running short positions were left facing unrealised losses, which posed an existential threat to their existence.

GameStop Share Price 2021 – Short Squeeze

Source: IG

Recalled Borrows

In the case of GameStop, the short-squeeze was primarily driven by buying activity from new entrants into the market. Another potential problem facing anyone shorting a market is that the stock-borrow they arrange is recalled.

The mechanics of this are explained by the institutional investor who first loaned the stock, deciding they want to sell their position. To process the sale, they need to recall the borrow from the fund which shorted it before going into the market and executing their sell trade.

Borrow recalls take days to complete and are part of the standard T&Cs of the stock loan market. They are essentially an arbitrary process. The prime broker deals with pools of supply and demand of stock loan and has to choose the hedge fund(s) from which to recall the borrow. Promises that the pain is being shared across all the hedge funds might not be believed, particularly as trades can be millions of dollars in size which means client relationships are at stake.

The second interesting point is that hedge funds sometimes take down stock-borrow positions a long time in advance. As it's a useful asset and allows the fund to go short at any time, they are willing to pay stock-borrow fees for weeks and months while they wait for their particular short-entry point.

Stock-borrow fees on long-held positions can be significant, so when a recall happens, the finger-pointing reaches another level.

Using Short-Tracker to monitor hedge fund shorts

Regulators began taking a greater interest in short selling in the early 2000s. A new reporting regime came in place in the UK, requiring short positions over a certain size to be disclosed. Each hedge fund posted its position, and the aggregated total was calculated.

A visit to Short-tracker will give you an insight into current shorts on the London Stock Exchange.

It's also possible to use short-position databases such as short-tracker to click down and identify the funds, the size of their positions, and their recent trading activity. This level of disclosure goes against the secretive nature of hedge funds, which allowed the Reddit / WallStreetBets community to identify GameStop as a target. It was the size of the aggregate short position in GameStop being so large in relation to average daily trade volumes that triggered the short squeeze. Both of those data points are freely available to anyone with access to the internet.

The debate about whether short-selling is an acceptable market practise or market manipulation brought about this need for disclosure. Hedge funds might have won the right to carry on shorting but losing the right to do it secretly is what inspired the Reddit community.

Now the secret is more widely shared, the question is whether we'll see similar instances such as the Meme Stock craze occurring in the future.

Understanding Short Selling

In terms of price action, short-sellers take the same risks shorting a stock as they do when buying it. It's just that they make money if the price goes down rather than up. However, some of the mechanics of the process are entirely different. For one thing, the risks are considerably greater if the short-selling strategy backfires. Losses on a short position are technically infinite, whereas losses on a long position are capped at the stock hitting zero.

The GameStop story caught the public's attention because it was a David and Goliath-style battle between hedge funds and retail investors. It offered opportunities for some to make dramatic short-term profits or losses, but short-selling is probably best thought of as an undercurrent in the market. It's always there and is something traders need to be aware of, even if they aren't looking to use short-selling strategies.

Final Thoughts

Whether you are an experienced investor or are new to trading, understanding the influence short selling can have on the markets is an essential part of being successful. If you want to try short-selling strategies, these trusted brokers are the ones to use as they have everything required to get you off to the best possible start.