International Distributions Services (LON: IDS) (Royal Mail) shareholders have, over the last few years, had a particularly bumpy ride. After being floated on the London Stock Exchange at 330p, the shares then peaked at 632p and just two years later printed lows of 118p.

YOUR CAPITAL IS AT RISK

Such levels of price volatility are more usually associated with Silicon Valley start-ups rather than a UK-based postal service, so naturally, they catch the headlines. Another reason the whipsawing price action is widely reported is that a large number of retail investors bought Royal Mail shares when it was first listed in 2013.

The market has something for everyone. Many of those retail investors have been left wondering if now is the time to sell IDS shares or if the worst is over and they should keep hold of them. Then there are short-term speculators looking to trade the noise and run strategies to catch upward and downward price moves. In the background, long-term investors with a buy-and-hold approach, have been taking positions with an aim of riding out the short-term fluctuations.

This article will outline the ways to make an informed decision on the firm’s valuation and how to find a reliable broker to help you turn your plan into action.

Table of contents

Overview of International Distributions Services

International Distributions Services, formerly Royal Mail, can trace its roots back as far as 1512 but has only been publicly listed since 2013. Its move to the stock market was the big UK privatisation story of the decade and one that stoked considerable controversy.

Following a tried and tested approach, the government floated the stock at a discount large enough to ensure the offering was fully taken up — a damp squib being politically unappealing. This meant all buyers, including large City institutions, benefitted from the government’s generosity.

Some of the day-one investors sold their positions and locked in a small profit. Others held on to the positions and might not have bargained for the rollercoaster ride that followed. In a report released in November 2020, the general public and Royal Mail staff were reported to still own 25% of the company.

Fast forward a couple of years to 2022, and Royal Mail, the business, changed its name to International Distribution Services, with the ticker “IDS.” Royal Mail still exists and operates in the UK, but the name change was meant to better reflect the structure of IDS's two separate companies, Royal Mail and GLS.

IDS Shares: The Basics

IDS is listed on the London Stock Exchange. The firm currently has a market capitalisation of over £2bn. With membership of the FTSE 250 index, International Distribution Services trades under ticker IDS.

IDS shares buy or sell?

Those asking the question, ‘Is it a good idea to buy IDS (Royal Mail) shares?’ need to establish whether the firm is undervalued or not. There are various factors in play:

- A history of high price volatility — There is little reason to believe price volatility levels are going to drop off in the near future. Those taking positions would need to be prepared for a bumpy ride.

- Political overhang — The Labour Party previously spoke of plans to renationalise the firm. While it has since retreated from that stance, the chance of the party revisiting the policy in the future can’t be dismissed. What this would mean for shareholders is unclear.

- Dividends — IDS is one of the best dividend stocks in the FTSE. This makes the firm particularly attractive to large institutions such as pension funds.

- Shareholder breakdown — A large portion of IDS shares are held by retail investors. For many, IDS is the only stock they own, and their willingness to actively buy or sell shares is hard to predict. At the other end of the spectrum, more than 50% of IDS shares are owned by just five investment companies. That buying power means those firms will have considerable influence on decisions made by the board of directors.

Steps to Buy and Sell International Distribution Services Shares

Once you’ve made your decision to buy or sell IDS shares, the process of putting your cash to work is incredibly straightforward. Online brokers have significantly changed the investment industry and represent one of the cheapest ways to buy IDS shares.

Step one is to ensure you’re using a regulated broker, one that operates under licence from at least one of the below tier-one regulators.

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

All of the brokers in the table below meet these criteria and have been operating for many years, making them trustworthy. Their success also comes down to the additional support services they offer clients, including free research and learning to assist with the skills needed to trade.

It’s possible to access and manage your account in a variety of ways, including on desktops or mobile apps.

Even if you’re still just considering whether to pull the trigger or not, then the risk-free demo accounts on offer can introduce you to the trading experience and offer the chance to trade IDS shares in a simulated environment.

1. Research IDS Shares

Buyers of IDS tend to have a long-term investment horizon. The restructuring of the firm is a multi-year project, meaning the returns generated from the overhaul are unlikely to come through in the very near future.

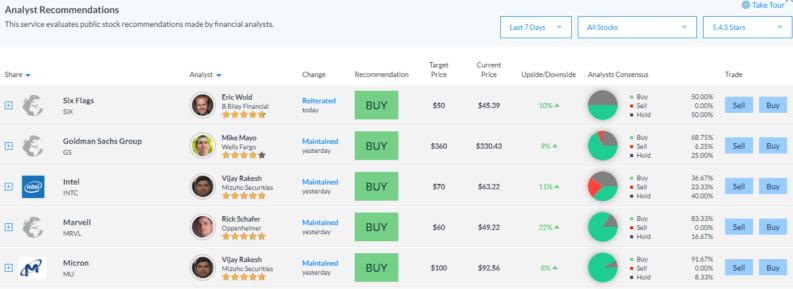

Source: Markets.com

As a result, a lot of the research on the firm focuses on the likelihood of that proving successful or not and the time it might take. The good news is that good brokers have an abundance of research notes, charting tools, and news reports to help those buying shares make an informed decision.

The following case study gives an insight into fundamental analysis and the life-cycle of a medium-term trade. The piece explores the types of resources used to spot the investment opportunity using publicly available information and how that plan was put into action.

2. Find a Broker

The research on offer can vary depending on the broker. Some brokers will prioritise client support, while others provide an adequate supply of materials and instead compete on price.

Opening a demo account is a good way to establish which approach is a good fit for you. It’s also a good idea to try out demo accounts with several brokers. Registering to buy shares in a virtual account only requires an email address and takes less than 60 seconds.

3. Open & Fund an Account

Upgrading to a full account and depositing funds requires a little more online form filling. Regulated brokers have a duty of care to their clients, which means they’ll ask Know Your Client (KYC) questions to build up a profile for you. This ensures they treat you in accordance with regulatory guidelines.

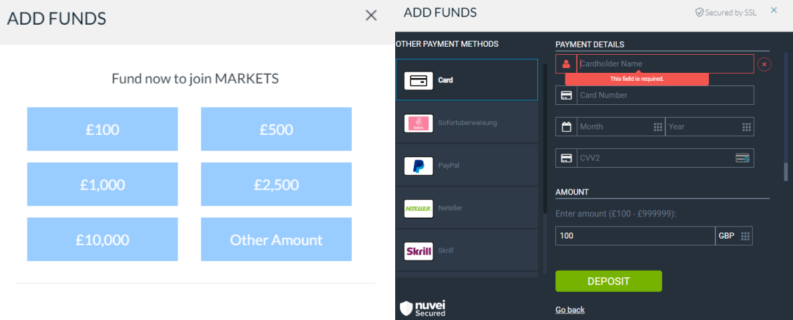

Source: Markets.com

After the form filling is completed, it’s a case of wiring funds to your new account. Brokers offer a variety of payment methods, including credit/debit cards and bank transfers, so the process has a feel of any other sort of online shopping. One thing to watch out for is that some of the payment methods are cheaper and quicker than others at checking the T&Cs can avoid unnecessary charges being applied.

4. Set Order Types

The trading monitor on your broker platform will offer a range of data fields so that you can build your instruction to buy or sell IDS shares.

Most brokers offer several order types, which build trading decisions into the system so you can trade in or out of positions automatically. These help mitigate risk and mean you don’t have to watch the markets 24/7.

- Market Order — An instruction to open or add to a position in IDS at current price levels.

- Limit Order — An instruction to automatically open or add to your position if the price reaches a certain price level.

- Stop Loss — A useful risk management tool, this automated instruction will close out part or all of your position if the price reaches a certain level.

- Take Profits — A built-in instruction to reduce your position and lock in some cash profits if the price reaches a certain level.

These other order types are optional but worth learning about because they can save you time and money. Another top tip is to check if stop-losses or take-profit orders are default settings on your account. If that’s the case, and you don’t override them, then you might check your account to find you unintentionally traded out of a position.

5. Select and Buy/Sell IDS Shares

Once you’ve decided to buy IDS stock, the final step is to enter the amount you want to buy and click the order confirmation button. Even if you’re looking to buy the shares for the long haul, there are ways to optimise your trade entry point, as explained in this article on the best time to trade.

After trading, be sure to check your positions. Even experienced traders make ‘fat finger’ errors, which are best corrected before the price moves too far.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, CFDs, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts.

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

Fees When Trading IDS Shares

Competition between online brokers is fierce, which has led to the costs associated with share dealing being driven down. It’s still important to make sure you’re familiar with the T&Cs so that you don’t rack up administrative charges that you could otherwise avoid. Fees to watch out for include:

- Payment processing charges — Most brokers don’t charge on deposits, but some do apply a fee on cash withdrawals.

- Third-party fees — These might apply if you choose a particular payment method. They don’t go to the broker but do need to be factored in.

- Commissions — Few online brokers charge a separate dealing commission when buying shares, but it is something to double-check.

- Bid-offer spread — Instead of charging commission, most brokers make their money on the bid-offer spread, which is the difference between buying and selling prices. This does make price comparison easier to do and you’ll note some brokers have tighter spreads than others.

- FX conversion — Your brokerage account will be denominated in a particular base currency. If that is different from the currency of the payment you use to fund it, then there will be charges relating to converting from one currency to another. One way around this is to use a broker that offers accounts in your base currency.

- Stamp Duty — Outright IDS purchases are subject to SDRT.

- Inactivity fees — Some, but not all, brokers apply charges on your account. These kick in if your account is dormant for a period of time. Inactivity can be defined in different ways with some brokers requiring a trade to be executed. Other brokers don’t charge an inactivity fee and Plus500 takes another approach. Consider logging onto your account with sufficient ‘activity’ to avoid the charge.

- Financing costs — Buying and selling shares outright avoids the overnight financing charges associated with trading CFDs.

| eToro | Plus500 | Markets.com | AvaTrade | |

|---|---|---|---|---|

| Live Account Fee | No charge | No charge | No charge | No charge |

| Demo Account Fee | No charge | No charge | No charge | No charge |

| Bid Offer Spread – RM shares | 0.52p | Variable | 0.46p | No market |

| Cash Deposit Fee | No charge | N/A | No charge | No charge |

| Cash Withdrawal Fee | Yes – $5 per transaction | N/A | No charge | No charge |

| Inactivity Fee | Yes – $10 per month after 12 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $50 per quarter after 3 months inactivity |

| FX Conversion Fee | Offers accounts in USD, only | Offers accounts in USD, GBP and EUR | Offers accounts in 14 base currencies incl. USD, GBP, EUR | Offers accounts in USD, GBP, EUR, CHF |

| Minimum Deposit | $200 (or equivalent) | $100 (or equivalent) | $250 (or equivalent) | $100 (or equivalent) |

Final Thoughts

IDS's large retail investor base means it’s likely to remain in the headlines for some time. Opinion is divided as to whether the stock is a ‘buy’ or a ‘sell’ and the wild share price moves reflect this.

There are a large number of shareholders waiting for the price to recover to levels where they can exit their legacy positions, but those who are new to the situation and not holding loss-making positions face a more exciting proposition. Nothing is ever guaranteed, and investors should always carefully assess a company before making a decision on whether to buy the shares.

RELATED: