The author and broadcaster have successfully managed the crossover between media and finance and have been fortunate that the perma-bull approach he often adopts has coincided with one of the longest bull runs in history. By his admission, he has benefited from market conditions matching his methodology as much as the other way around. Using Jim Cramer's investment profile, you can utilise his approach for personal gain.

If you’re looking to draw on the ideas of a seasoned investor to improve your trading returns Cramer’s easy-to-digest views could be for you. He doesn’t get it right all the time, unless there is a paradigm shift in the global economy, his bullish stock picks continue to be a good fit for the current markets.

“I made a small fortune. I made a lot of money, and I made a lot of other people wealthy.”

Source: BrainyQuote

- Jim Cramer’s Investment Philosophy

- Stocks Jim Cramer is Bullish on Now

- Jim Cramer’s Inflation Busting Stock Picks

- Jim Cramer’s Worst Ever Investment

Jim Cramer’s Investment Philosophy

You don’t make millions as a hedge fund manager without knowing how to read the markets. One key feature of Cramer’s thought process is that he appears able to gauge market sentiment and respond accordingly. His description of his USP gives an idea of how he’s managed to keep up with the changing nature of the markets.

“I think that there are changes that have occurred in technology that make it so that more people can have the same level of information that I have. My advantage is that I'm very good at interpreting the information.”

Source: BrainyQuote

Cramer’s investment approach is about more than reading momentum. His banking career includes stints as a market analyst where he picked up the skills needed to find the important clues buried within a company’s earnings report.

Combining fundamental analysis with a knack for picking up on market mood has worked well for Cramer who continues to be part of the management team of the fund Action Alerts PLUS (AAP) fund. The AAP is structured as a charitable trust and aims to distribute investment returns to non-profit organisations.

Two interesting features of AAP are that it includes some of the stock picks Cramer shares on his shows – unlike other TV presenters he puts his money where his mouth is. The second is that studies have established that the AAP has underperformed the S&P 500 Index.

One of the suggested reasons for the AAP not beating the market is that it consistently runs “under leveraged.” By not allocating all capital into the market, the AAP has missed out on returns made over a decade or more of bullish stock markets. That could be explained by the AAP taking a relatively low-risk approach due to the beneficiaries being charitable organisations rather than the stock picks themselves not being market-beaters.

Stocks Jim Cramer is Bullish On Now

Jim Cramer is known for having a bullish weighting but whilst reporting on the stock market unwind of 2022, he included some calls for caution. In early May 2022, he suggested stepping in to buy selected stocks rather than all stocks. Speaking on Mad Money he said:

“Right now, I think a curious mind would be buying stocks selectively, not selling them indiscriminately.”

Source: CNBC

Having spent 25 years on Wall Street Cramer has seen plenty of crashes before and knows they can last longer than bulls can afford to stay in positions. Speaking in April he saw the chance for further downside movement and made the right call that the price slide could last weeks, but his bullish DNA means that by mid-May he saw the near 20% fall in the S&P 500 Index as a chance to get into the market at lower levels.

Investors, he said, should be “poised for one incredible, tremendous, rally.”

He has quoted the oil sector as being an example of how firms that deal with the supply side issues the economy is facing can, and will, rally once the situation is resolved. The oil firms just got themselves into shape earlier than the rest of the market due to them facing an existential crisis in 2020 when crude traded close to zero.

“Right now, I think the market’s anticipating the worst-case scenario and there’s a good chance that we actually don’t get it.”

Source: Jim Cramer

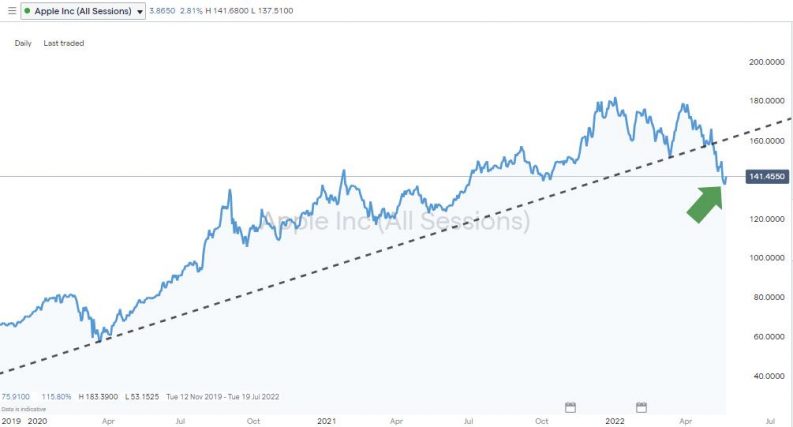

Apple Inc – Daily Price Chart – 2019 – May 2022

Source: IG

That means he’s a fan of large-cap stocks with a proven track record who have been dragged down by concerns over other sectors. Apple, Amazon, and Netflix stocks are down from their 2022 highwater marks by more than 20%, 36%, and 70%, respectively. Cramer has been a long Apple ever since his daughter bought her first iPod and speaking in May 2022 he said, “I want to buy it”.

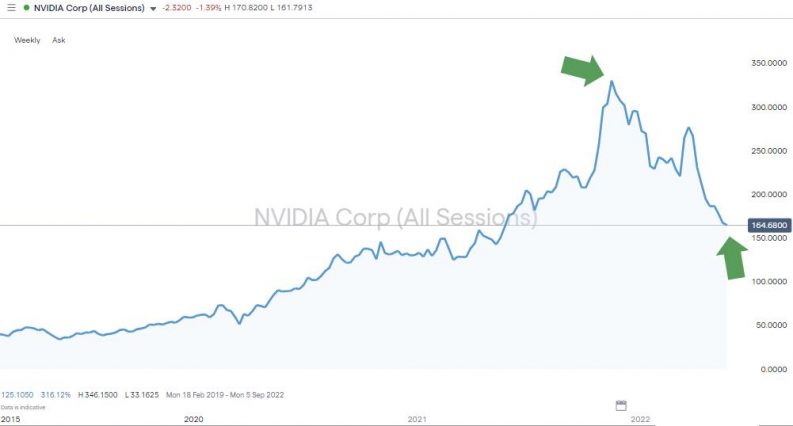

Chip-maker Nvidia is another stock tipped by Cramer. He points to the strong fundamentals which include $7.64bn of revenue in its fiscal fourth-quarter which represented 53% of the sales from the same period in 2021. Revenue from the all-important Gaming sector also increased 37% year on year.

Nvidia Corp – Daily Price Chart – 2019 – May 2022

Source: IG

Speaking on CNBC in May he commented on the Nvidia share price being more than 50% off its November 2021 highs. He said, “It’s the worst chart I’ve seen. Honestly, it’s so horrible that I want to buy it.” Source: Jim Cramer

Jim Cramer’s Inflation Busting Stock Picks

Cramer’s background as a market analyst means he’s well equipped to carry out a deep dive into a company’s financial reports. One sector which caught his attention in 2022 is banking. It might not be a sector with a particularly high beta but this call is classic Cramer. The argument for buying the bank was strong enough for him to approach the trade with conviction and ride it out till it comes good. He also likes the way banking stocks can take on and beat the challenge of inflationary pressures surging through the economy.

Higher inflation levels and interest rates might be causing alarm in certain areas of the economy, but Cramer sees them as creating the potential for banks to increase their profit margins. The bid- offer spread between borrowing and savings rates has been squeezed during the years when base interest rates have been near zero. A return to ‘normality’ means bank stocks could be one of the few sectors to thrive in the high inflation, high-interest rate environment.

Defaults on loans could increase as a result of an economic downturn but for Cramer, the opportunities outweigh the risks. Wells Fargo is a top pick because of its resilience to rising prices. “Most important, Wells is very sensitive to interest rates, so when you see bond yields surging, think Wells Fargo.” (Source: CNBC)

The first half of 2022 hasn’t been great for stock markets and on 23rd May, Wells Fargo was showing a year-to-date return of -11.11%. That return was strong though to the wider market with the S&P 500 index showing an equivalent year-to-date return of -17.24%.

Wells Fargo & Co – Daily Price Chart – March 2021 – May 2022

Source: IG

Cramer’s top pick from the investment banking end of the sector is Morgan Stanley. Speaking about the firm at the beginning of the year he said “They’re aggressively buying back stock. What’s not to like?” (Source: CNBC)

Cramer’s view is that good stocks, as well as bad, have been caught in the market-wide sell-off and that makes now the time to buy the dips in Morgan Stanley and Wells Fargo.

Jim Cramer’s Worst Ever Investment

Part of the appeal of Cramer’s approach is his candid transparency. His willingness to discuss his losses as much as his gains offer an insight into the mistakes even professional investors can make.

Those who take on board that lesson and learn from their losing trades can hope to become better traders. For Cramer, it’s not about always being right, but ensuring the bottom line shows a profit.

A speculative tech-stock trade from the 1990s is described by Cramer as, “the worst investment I ever made.” It’s a great example of the perils of falling in love with a position and failing to manage downside risk. Using extensive and detailed fundamental analysis, Cramer bought into Silicon Valley operation Memorex Telex.

“I was in touch with management … I did all the work. I looked at all the [company’s] filings. And I just kept buying it and buying it and buying it, thinking, you know what? What’s the worst that happens?”

As it turned out, the worst that could happen was being totally wiped out on an investment that had been worth hundreds of thousands of dollars at one point. The debt burden which had been factored in by Cramer couldn’t be overcome before Memorex Telex products became outdated and despite the ‘compelling story’ the firm filed for bankruptcy.

High-growth penny stocks can turn into trades of a lifetime and this shortlist includes the names of some worth considering right now, but take it from a seasoned veteran.

“When you have a low-priced stock, don’t think to yourself, ‘How much more can I lose?’ You can still lose everything.” (Source: Jim Cramer)

Final Thoughts

Tune into a Jim Cramer broadcast and you’ll struggle not to be excited about some of his stock picks. The delivery can come across as a slightly ‘hard sell’ but Cramer started as a market analyst and has learned the hard way that he needs to fight his corner over his positions if they’re going to be invested in and held on to.

Extra comfort can be taken from the fact he trades his own book and willingly shares updates on his failures as well as his successes. He’s an experienced market pro who realises the need to be honest with yourself and treat the market with respect, but when markets are selling off the greater risk could be to not step buy stocks.

Some of his investments have holding periods of months or years so it’s important to set up your account with a broker who offers a share dealing service as well as CFD markets. These shortlists of trusted brokers have been reviewed by the Ask Traders team to ensure they offer cost-effective, safe trading conditions which support beginner, intermediate and advanced traders.

Setting up an account with an online broker takes minutes to do and using tips from industry pros like Jim Cramer, and turning their ideas into profitable trades, has never been easier.

“I will stand up for what I believe and for what I have always believed: Every person has a right to be rich in this country and I want to help them get there.” (Source: BrainyQuote)