Jumia Technologies, a publicly traded company on the New York Stock Exchange is a company that aspires to be the Amazon of Africa.

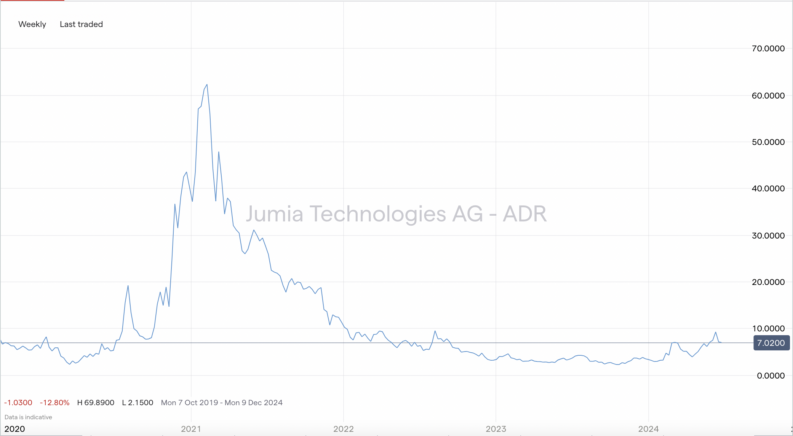

It appears that a multitude of investors have already driven the price to high altitudes, only for short sellers to attack it and bring its price tumbling back to reality. In recent months, the Jumia’s stock price has pushed out of this pattern, and trade up more than 100% on the year.

JMIA, its ticker symbol, was founded in 2012 and is now headquartered in Berlin, Germany. It did not go public until late in 2019. Jumia Technologies’ stock opening price of $14.50 quickly trebled, only to fall significantly over time, a fate that often befalls many overhyped new offerings.

Jumia has already developed and is operating an e-commerce platform, logistics and inventory infrastructure, and proprietary payment system to support online retail sales in Africa.

YOUR CAPITAL IS AT RISK

Where Will Jumia Technologies’ Stock Price Be in 12 Months?

Africa has the fastest-growing population on the globe – a plus for the near and long term. Jumia’s websites also rank highly in internet traffic ranking reports, and the firm has received several prestigious awards.

However, there are many investors and analysts that have significant concerns about the company. Due to these concerns, the market will not view any hiccups in growth or gross margins favorably.

Jumia Technologies’ stock predictions for 12 months out also involve a degree of speculation.

In recent weeks, Benchmark have also begun coverage on JMIA, and have set a Buy rating, alongside a lofty price target of $11. The belief that the company will benefit from a demographic transformation and capitalise on it’s position in Africa should stand the firm well in otherwise underserved markets.

Until recently, there had been only one analyst currently covering Jumia’s stock. That analyst is seemingly at Morgan Stanley. According to a post from TheFly, the investment bank upgraded the company’s shares to Equal Weight (Hold/Neutral) from Underweight in January. The bank raised its price target for the stock to $3.60, up from $3 per share. They stated they are positive on the internet sector in 2024 as order growth returns, cost discipline remains, and valuations are supported by decreasing interest rates. Morgan Stanley added that it believes Jumia has reached a floor on orders, while they also like its cost cuts.

Jumia Technologies News

June: Jumia announced the opening of two new integrated warehouses: a 30,000-square-meter facility in Isolo, Lagos, and a 5,000-square-meter facility in Bouskoura, near Casablanca, Morocco.

May: Jumia reported its Q1 earnings, with revenue coming in at $49 million, up from the $41.3 million reported in the same period last year. GMV was $181 million, up 5% year-over-year. Jumia reported an operating loss of $8 million.

The company said it aims to further reduce cash utilization compared to 2023. Based on the positive impact of its growth strategy, Jumia forecasted an increase in both orders and GMV in 2024, excluding the potential impact of foreign exchange.

Who Are Jumia Technologies?

Jumia Technologies operates an online retail marketplace for the benefit of sellers and buyers, primarily targeted at consumers in the African continent. It was founded in 2012 in Kenya by Jeremy Hodara and Sacha Poignonnec, both formerly consultants with McKinsey, along with fellow associates Tunde Kehinde and Raphael Kofi Afaedor.

After initial confirmation of its business model, it quickly expanded to Egypt, Morocco, Ivory Coast, Nigeria and South Africa. By 2018, Jumia had firm footprints in 14 African countries.

There are more than 110,000 active sellers on the Jumia e-commerce platform, which also provides delivery support and various payment and financing programs for the benefit of its consumer base. By 2015, revenues had soared to $234m, more than doubling its success from the previous year. Valuations of the enterprise soon exceeded $1bn, making Jumia Technologies the first ‘unicorn’ in Africa.

Part of this success story was due to its extensive range of product categories, which included fashion and apparel, beauty and personal care, healthcare products, home and living, cleaning supplies, fast-moving consumer goods, smartphones, and other consumer electronics. The firm is also in the service arena, offering restaurant food delivery, hotel and flight booking, classified advertising, airtime recharge, and instant delivery.

Following its early successes, the company began to focus on going public. In January 2019, the firm changed its name from Africa Internet Holding GmbH to Jumia Technologies AG. Two months later, Mastercard became a high-profile investor, adding €50m to the firm’s equity pool. One month after this capital infusion, Jumia went public on the New York Stock Exchange, raising $196m in new capital for its efforts. It opened at $14.50, but analysts talked up the price to between $27 and $40 in subsequent reports.

Jumia’s share price soon peaked close to $50 before a pullback occurred. Unfortunately, a group of short sellers published a report accusing the firm of fraud in its offering documents. The price fell precipitously until Citigroup, a key investor, published its own report refuting each of the charges.

Nevertheless, the damage had been done in 2019, and the stigma stayed until a year ago. During the pandemic, Jumia shares began to recover lost ground. After one false start, the share price soon skyrocketed from $12 to establish a new ATH of above $69. It has since retreated substantially.

Critics claim that the stock is overvalued and that the firm expanded too quickly into too many markets with too many product offerings. Management’s response was to close operations in Tanzania, Cameroon, and Rwanda but still maintain online commerce through selected portals. It also outsourced its travel and hotel booking service to Travelstart while trimming its dependence on high-cost electronic products, which tend to be one-off sales and not repeat business.

Restructuring programs are never quick or easy. According to one analyst: “Jumia is a company in transition. It has shifted its business model towards third-party marketplace sales, which has heavily impacted its near-term growth. Moreover, it aims to be less reliant on one-off sales such as in electronics towards higher-frequency product categories such as clothing, food, and others.”

While the market waits for measurable results, there are a number of positives that will be tailwinds for this company.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Jumia Technologies Long-Term Forecast

What are the Jumia Technologies stock forecasts for the long term? Jumia has yet to turn a profit. Forecasts five years out require a leap of faith that this enterprise will not be gobbled up by its larger competitors seeking inroads in Africa. Since there are no earnings to speak of at this stage of its development, future scenarios will depend upon assumed growth rates, the power of its business model, and whether management has focused on a long-term formula for success.

While just one analyst considers JMIA a ‘Hold’ at the moment, there are several reasons why investors can get excited about its long-term prospects. One clear distinction is that this firm’s vision is not something new. It has been attempted and succeeded most dramatically in other major marketplaces. If you had bought Amazon at its opening IPO bid, you would have had an astounding return of 160,000%. Even with MercatoreLibre, its South American cousin, the return has already reached 5,000%. From this perspective, JMIA definitely has upside potential.

Jumia is also positioned to take advantage of the burgeoning population growth in Africa, said to be the highest across the globe, and the readiness of its citizenry to embrace e-commerce and all that it has to offer. Could Jumia be Africa’s one-stop shop for online purchases, not just occasional one-off buys?

The build-out of the firm’s inventory management and shipping logistics has been costly but a necessary investment for the future. Also, its payment systems have yet to be monetized, which could add another revenue stream to its mix.

The hurdles, however, are growth-related. While the plan looks good, at some point, GMV growth must accelerate along with an accelerating customer base in tandem.

Jumia is a company that is transitioning for the future. It is assembling the building blocks in a better fashion after years of experience in the pan-African market. Its addressable market is considerable. The firm is presently operating in 11 countries where 600 million people could be potential buyers of its products and services. If Jumia can manage to execute even moderately on its business model, the potential is considerable.

If all goes according to plan, which means that accelerated growth will occur and profitability will soon become a reality, then it could be one to watch. However, it has, so far, failed to live up to expectations. The digital opportunity in Africa must become a reality for JMIA shares to reach this value.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Is Jumia Technologies a Good Buy?

As one analyst previously described the Jumia Technologies buy or sell demographics: “The opportunity is real, but it’s not being adopted as much as you might think.” In other words, the key variable is convincing African consumers to take part in the Jumia revolution. Similar e-commerce revolutions have taken place in the US, China, and South America. Why not in Africa? The jury is still out on whether African online buying will meet expectations.

Prudent investors will wait this one out until Jumia management demonstrates that it can move beyond current issues, attract more African consumers to its platform in large numbers, and grow the business profitably. If the party does start early, there will always be an opportunity to join in when more certainty is present.