Like most other market gurus, he makes mistakes; however, his ability to recalibrate his strategies and pick the next trend means that he is ranked #1 in the category of Americas Equity Derivatives. As importantly, Kolanovic is bullish now. The results of his technical and fundamental analysis have dug into the great 2022 sell-off and point to now being the time to buy the dips.

As he stated in March 2022, “A lot of risk is already priced in, sentiment is depressed, and investor positioning is low, so we would add to risk with a medium-term horizon”. (Source: Business Insider)

- Marko Kolanovic’s Investment Philosophy

- What Marko Kolanovic Is Buying Now

- Marko Kolanovic’s Use Of Technical Analysis

- Marko Kolanovic’s Use Of Fundamental Analysis

- Marko Kolanovic and Commodities

- Marko Kolanovic’s Views on China

- Marko Kolanovic’s Correct Calls on Covid

Marko Kolanovic’s Investment Philosophy

Marko Kolanovic and his investment team adopt a ‘macro’ approach. That means they try to profit from broad market swings, which can be triggered by technical analysis price support and resistance levels being reached, and fundamental changes to areas of the global economy or political events.

The quant side of his profile helps him to secure a niche other market pundits don’t have. Computer-based systematic funds account for 90% of US stock market trading volumes, and Kolanovic’s scientific background means he can interpret the actions of the funds run by rocket scientists. That is then overlaid with a helping of common sense and real-world pragmatism.

The approach considers a wide range of variables and can result in investment ideas covering a wide range of asset groups. News in the copper market might, for example, be a reason for taking a position in EV stocks or Tech ETFs. Bond yields, military conflicts, commodity prices, and consumer spending are all factored in. As a result, the views shared by Kolanovic are widely reported because when he speaks, there is usually something for everybody. There is also the fact that he has a market-beating win-loss ratio.

The below note from the J.P. Morgan team’s forecast for 2022 released in December 2021 hints at the wide number of variables they consider.

“Although we see clear potential for a more vibrant economic cycle, the environment is also fraught with cross-currents. We are confident the economic expansion will continue through 2022, but its strength will likely be determined by the monetary response to inflation, the relative success of Chinese policymakers in rebalancing their economy, and the pace of the transition from a pandemic to an endemic disease,”

Source: Marko Kolanovic

It’s not as easy to follow Kolanovic’s or J.P. Morgan’s trades as it is to follow those of other gurus such as Cathie Wood or Jim Cramer. Those two fund managers share a lot of their trading activity with the trading community on a real-time basis, and the funds they operate are required to comply with disclosure rules set out by regulators. The analysis Kolanovic carries out is monetised by being shared with the bank’s internal investment teams and external client base. So, you might not be the first person to hear his opinions, and big investors may have already taken sizeable positions as a result of his guidance,

What Marko Kolanovic Is Buying Now

Market corrections such as the one seen in the first half of 2022 can be excellent buying opportunities for those investors who time their entry into the bottom of the market. Kolanovic’s habit of doing just that has resulted in his thoughts on the current situation being widely reported.

The majority of Kolanovic’s analysis is channelled into stock picking. The size of the equity markets and the fondness J.P. Morgan clients have for stock tips make that an obvious step. Thinking outside of the box is very much part of the team’s investment process, so it is possible to find references to other ways of capturing market moves, such as ETFs.

Marko Kolanovic’s Use Of Technical Analysis

Kolanovic was speaking with Bloomberg on 5th May when he said that there are “great opportunities in high-beta, beaten-down segments that now include innovation, tech, biotech, emerging markets.”

High beta strategies thrive on trading those stocks which overshoot when markets go through peaks and troughs. The S&P 500’s +18% price crash between 28th December 2021 and 20th May 2022 has resulted in the weekly price chart recording an RSI of 30.2, which will be a buy signal for many such as Kolanovic, that study money flows. There comes a time when sellers just run out of momentum, and even if a rally is short-lived, all trends turn at some point.

S&P 500 Index – Daily Price Chart – 2018 – May 2022 with RSI

Source: IG

The growth sectors Kolanovic mentions – tech, biotech, and emerging markets – tend to be high beta, so the tip to be ready to step in and buy them is based on studies of broader market momentum.

Marko Kolanovic’s Use Of Fundamental Analysis

Kolanovic’s confidence in the prospects for the US economy has been maintained during the stock market sell-off. The coolest heads do a good job of not confusing the two things, and Kolanovic thinks the US economy and consumers are in good enough shape to navigate any recession which might materialise.

Households are running relatively low levels of leverage thanks to working from home, which allows middle earners to save on commuting costs. Unemployment is under control, and the balance sheets of major corporations are also relatively solid. Kolanovic also thinks a lot of the bad news relating to the current geopolitical issue has already been priced into share prices.

Short-term volatility can be expected, but those with a medium or long-term investment horizon should, according to Kolanovic, be buying into the market to take advantage of price dips. Speaking with Business Insider in March 2022, he said:

“We think that outright recession should not be a base case given continued favourable financing conditions, very strong labour markets, an unleveraged consumer, strong corporate cash flows, strong bank balance sheets, a turn for the better in the China policy outlook, and the COVID-19 impact should be fading further.”

Source: Marko Kolanovic

Marko Kolanovic and Commodities

The macro approach Kolanovic adopts means that commodity markets and equity markets fall into scope.

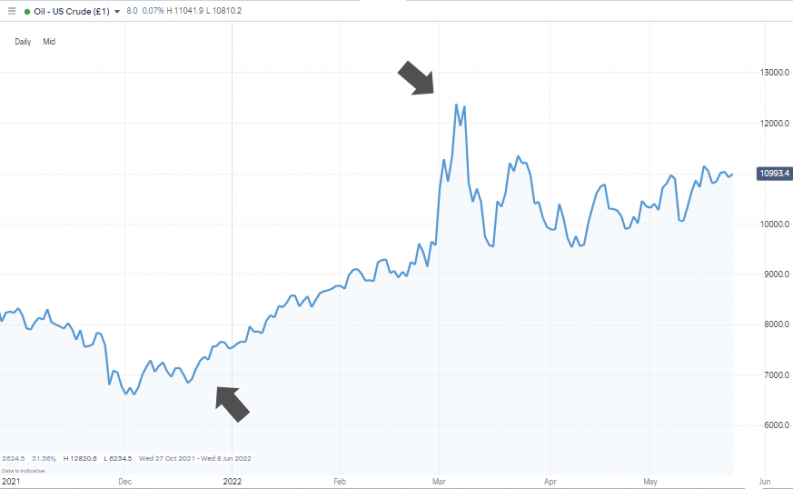

The impressive bull run in crude oil has been one of the main features of 2022. In December of 2021, when crude was trading in the region of $70, Kolanovic made the fairly aggressive call that oil would trade as high as $125 per barrel by the time the year was out.

For the forecast to come good, oil needed to nearly double in price, which unsurprisingly raised a few eyebrows in the investment community. Kolanovic was proved correct within just three months, with WTI trading at $128.20 on 7th March 2022.

US Crude Oil – Daily Price Chart – 2020 – May 2022

Source: IG

Marko Kolanovic’s Views On China

With such a broad investment mandate, Kolanovic can pick out whole countries as being a good bet. During 2022 he has grown increasingly bullish on the prospects for investments in China. This has come about due to selling pressure reaching panic levels. The L&G MSCI China ETF is down 24.9% on a year-to-date basis as of 24th May 2022.

L&G MSCI China ETF – Daily Price Chart – 2020 – May 2022

Source: IG

Stocks have plummeted to attractive levels mainly due to the stringent lockdown conditions applied to major cities in April 2022. These acted as a reminder that Covid hasn’t quite yet gone away but is the kind of problem which can be managed with a stroke of a bureaucrat’s pen.

Kolanovic is also drawn to China's “front-loaded stimulus, reopening and relative insulation from current geopolitical flashpoints”, which means he is telling his clients they should be moving to be ‘overweight’ China now.

Marko Kolanovic’s Correct Calls On Covid

The impressive call Kolanovic made regarding the oil market of 2022 is one of several examples where his data heavy approach spotted a trading opportunity. Another came only a few months earlier when he went against the negative narrative which permeated the market as the Omicron variant of COVID emerged.

In hindsight, it can be seen that Kolanovic didn’t have to rely on any under the radar information. Instead, he assessed a highly complex situation using the impressive tools at his disposal and came to a clear and correct conclusion.

Whilst the S&P 500 was selling off between 6th September and 11th October 2021, Kolanovic remained bullish. He said:

“While it is likely that Omicron is more transmissible, early reports suggest it may also be less deadly – which would fit into the pattern of virus evolution observed historically.”

Source: Seeking Alpha

That thesis was widely shared among the medical community but not immediately taken onboard by investors. The next stage for an investor with such an impressive track record is to look one step further, and Kolanovic continued:

“Should these trends be confirmed in the coming weeks, could the Omicron variant ultimately prove to be a positive for risk markets, in the sense that it could accelerate the end of the pandemic?… Could the Omicron variant be a catalyst to transform a deadly pandemic into something more similar to seasonal flu?”

Source: Seeking Alpha

Converting this proposal into investment advice, Kolanovic recommended buying the dip in cyclicals, commodities and stocks which would benefit from the reopening of the economy, such as airlines and leisure companies. A move which paid off with the S&P 500 index closing out the year 10.91% above the level it traded at in October.

Final Thoughts

Marko Kolanovic’s impressive track record on stock picks means many investors listen whenever he shares his thoughts. One of the reasons for the success rate is that he combines quantitative analysis with fundamental analysis and considers the markets on a macro scale. Everything is covered in every possible way.

The approach works, and factoring in the views of an experienced and successful investor is always to be recommended. There have been some notable ‘misses’ along the way. Still, like all seasoned pros, Kolanovic is transparent about where his methodology fell down, only so it can be recalibrated for his future trades.

The markets Kolanovic follows can be traded by setting up an account with an online broker. This shortlist of trusted brokers includes firms reviewed by the AskTraders team. They all have a strong reputation in the trading community. If you want to adopt a macro approach and trade commodities, ETFs, bonds, and stocks, then head to that list to compare the T&Cs. The market is competitive, setting up an account is easy, and the costs involved are super low.

Whether you’re new to investing or have been trading for years, there is always a benefit from listening to those industry pros willing to share their ideas. Turning their ideas into your next profitable trades has never been easier.

“We can climb out of this hole. There will be no recession this year, some summer increase in consumer activity on the back of reopening, China increasing monetary and fiscal measures.”

Source: Yahoo! Finance