With corporate buyouts being part of the normal cut and thrust of stock market activity, it isn’t only Twitter investors asking, what happens to my shares during a corporate takeover? What is clear is that there are some general principles involved in takeovers but that each situation is unique. Digging into the details of how the process works can help establish whether you are likely to see a financial gain or not.

Takeover events do offer opportunities to boost returns. Why else would successful hedge funds have dealing desks specifically set up to ‘event-arbitrage’, ‘merger-arbitrage’ and ‘pre-event’ strategies. It’s time to look at what happens during a takeover and what elements of event strategies all investors can use to ensure the best outcome for their portfolio.

What Is a Takeover?

Corporate buyouts, mergers, takeovers and reverse-takeovers are terms used to explain pretty much the same thing: one firm buying another. If you’re studying a situation, one first step is to consider the different language used, which usually reflects whether the deal is ‘hostile’ or not.

The takeover of cyber-security firm Mandiant, Inc. by Google (Alphabet, Inc.) in March 2022 made sense on a commercial level. Influential investors held significant positions in both firms and their analysis saw benefit from the two companies becoming one. There were opportunities for massive business divisions to integrate the innovative tech services of Mandiant, and takeovers also offer an opportunity to rationalise costs. After any deal is completed, there would be a need for only one CEO and one head office, and other elements of the cost base could be stripped back to make the new combined operation more efficient.

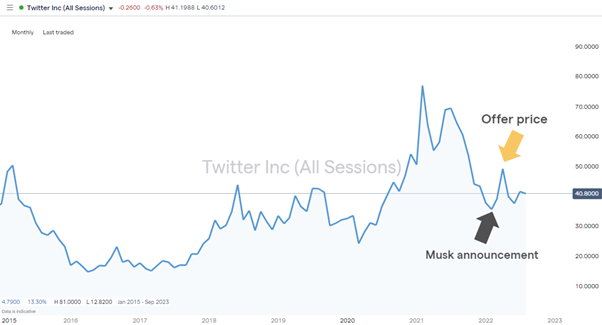

Twitter, Inc. – Monthly Price Chart – 2015-2022 – Takeover Target

Source: IG

The proposed ‘takeover’ of Twitter by Musk is about as ‘hostile’ as they come and has been associated with much more aggressive language as both parties pump stories into the press explaining their reasons for it happening, or not. Staff at Twitter have been quoted as being unhappy about the deal and willing to leave the firm if it completes. Following a sell-off in the broader market, Musk has come to the view that his initial offer is too high and is engaging in what many consider attempts to renegotiate the deal terms, to the consternation of Twitter management and shareholders.

How Takeovers Work

Regardless of whether a proposed deal is hostile or not, the situation ultimately comes down to one thing: price. One company’s management will announce that they are willing to buy shares in another company at a certain price, and once they own enough of the stock, they will be recognised as having been successful.

The percentage of a target firm that needs to be owned differs from stock exchange to stock exchange, but the threshold is usually in the region of 51%. That would represent a significant investment by the buying firm and that its interests were massively aligned with the prospects of the target. It would also mean that the acquirer would have sufficient voting rights to be able to put through policies at the target firm’s AGM. If they wanted to vote out the current management, they could do so by just ratifying a motion – so the game would be up for the target firm’s bosses.

From a technical perspective, there is the question of what happens to the remaining 49% of shares that the buying firm doesn’t yet own. To keep things simple, exchanges will enforce a process where all remaining stock undergoes a mandatory buyout at the offer price and shareholders will see their broker process the transaction in line with the deal terms.

Firms that launch a takeover for another typically offer a premium to investors by setting their offer price some way above where a stock is trading at the time of the announcement. This sweetener is intended to help it reach its ownership target, and it shows that they believe that the target firm is undervalued, possibly because of poor management, and that their business model can unlock potential for shareholders.

This does not prevent acquiring firms from buying stocks and building up a position at normal market prices before going public with their intentions. In an effort to prevent firms from being uncooperative significant shareholders in rivals, exchange rules stipulate that once a firm owns a certain percentage of shares, it is expected to launch an official offer. In the case of Musk’s proposed purchase of Twitter, he bought up 9.1% of TWTR before announcing his plans to buy the whole firm.

How Are Shareholders ‘Paid’ During Takeovers?

Takeovers can be structured in a variety of ways. The aim of the buying firm is to offer shareholders of the target firm just enough reward for agreeing to the deal, and as different shareholders have different objectives, the carrot that is dangled can take many forms.

One of the most straightforward deal types is a cash offer. In this instance, an offer price is announced, and if the deal completes, investors will after weeks of administrative processing receive the cash equivalent of their shares position.

An alternative approach is for acquiring firms to offer their own stock. Shareholders in the target firm that is bought out in this scenario would, at the time of the deal being completed, see its portfolio now holds shares in the firm that bought the other. A deal structured in this way may reflect that the bidding firm would rather not go to the expense of borrowing significant amounts of cash, which would end up as debt on its balance sheet and impact its ongoing attractiveness to investors.

Cash deals are ‘cleaner’ and generally considered to be more likely to be successful. Shareholders in the target firm have already made a decision to buy its stock and possibly even preferred it to taking a position in the acquiring firm. They would be forced to rotate from an investment they wanted to make into one they are forced to take. There is also the problem of valuing the target firm, as while the negotiations are ongoing, the share price of the bidding firm will fluctuate. Hybrid versions of cash and stock are also common.

Should You Sell Your Shares Once a Takeover Is Announced?

In June 2021, private equity firm Clayton, Dubilier & Rice (CD&R) announced that it was willing to pay 230p for shares in Morrisons PLC, the UK supermarket chain. This was an almost 30% premium on where the stock had been trading before the announcement was made.

Following the news, the price of MRW shares surged from the region of 175p to 228p. This was a bullish response from the markets as the deal had not been accepted by the Morrisons board, who stated that the deal “significantly undervalued” the business “and its future prospects”. Should negotiations break down, the stock price could easily crash back to previous levels.

The consensus in the market was that the CD&R bid was an opening offer and might be increased if not enough shareholders put pressure on Morrisons management to accept it. By going public, the US firm could also inadvertently flush out rival firms that might want to buy the supermarket giant and that would likely lead to a bidding war.

Those investors who bought stock after the deal was announced ended up making additional returns. The Morrisons deal finally completed in October at a deal price of 287p. The initial offer did trigger the interest of rival private equity firm Fortress, which stepped in to offer 286p per share.

Twitter Share Price During Musk’s Takeover

Twitter shareholders will be more than willing to share that takeover deals don’t progress as planned. They have had an uncomfortable ride since Musk made his initial offer in April 2022, which valued the social media giant at $43bn.

The deal was mired in controversy from the start. Twitter’s high profile resulted in some pointing to the firm offering some kind of ‘public service’. In this case, allowing one ‘maverick’ billionaire to have significant influence over it could be detrimental. At the same time, Musk was allowed access to confidential Twitter books and records and publicly announced that he thought that the firm had been overstating the number of ‘real’ users. He didn’t want to pay such a high price for a firm that advertisers wouldn’t want to engage with due to a high percentage of accounts being run by ‘bots’ rather than genuine consumers.

Danone SA – Monthly Price Chart – 2000-2022 – Takeover Target

Source: IG

There are plenty of other examples of deals breaking down. Political sensitivities come into play and can be particularly hard to call. Both The Kraft Heinz Company and PepsiCo, Inc. have at times made efforts to buy out the French dairy firm Danone SA. Their efforts were vetoed by the Paris government on the grounds that the French firm is of significant national importance. This kind of intervention is designed to allow governments to ensure that critical parts of their infrastructure, such as defence firms and energy providers, stay under local control. The management of Kraft Heinz and PepsiCo publicly shared their disappointment that a yoghurt maker could be deemed off limits.

Pre-Event Strategies

Price data indicates that the initial premium paid during a takeover is in the region of 20% to 30%. This means that shareholders can post an attractive overnight return, even if they decide to sell up after the first bid is announced.

Unsurprisingly, strategies have developed that involve taking positions in ‘pre-event’ stocks. These can be firms that have been identified as underperforming due to poor management, or are undervalued due to the vagaries of market pricing. Some firms, such as Mandiant, Inc., might have some special intellectual property or market advantage that a bigger firm would put a higher price on than the general market.

Mandiant Inc – Daily Price Chart – 2020 – 2022 – Bought by Google

Source: IG

Relying solely on takeovers is a risky strategy. Some of the perennial takeover targets are well-known in investment circles and being an ‘open-secret’ means some of the premium is already priced in. There is opportunity cost to consider as well as your shareholding in a pre-event stock could flatline for years before interest from buyers materialises.

Will M&A Activity Pick Up?

One way to apply a pre-event strategy is to monitor the broader appetite for merger and acquisitions which ebbs and flows over time. 2015 was a boom year for takeover deals and 47,000 deals were announced worldwide with the total value of the buyouts reaching $4.7trn. By 2019 the number of deals had more than halved and the total value of M&A activity was down to $2.8trn.

Launching a takeover is a costly business and involves engaging investment bankers to provide advice and finance, and their fees can run into tens of millions of dollars. But when market conditions are right, for example financing is ‘cheap’ or stock markets are seen as undervalued, there can be a surge in M&A activity.

Merger Arbitrage and Market Neutral Strategies

Small investors who wake up to news that their shareholding in a firm has spiked overnight would do well to consider how large hedge funds operate when deals are announced. As hedge funds are able to employ significant leverage and sell short, they can take positions in the target and acquiring firms which are hundreds of millions of dollars in size.

If they are long the target and short the bidder, then even if the stock market as a whole falls 10%, they can expect to incur limited losses – what they lose on one position, they make back on the other. Instead, they look to make a small percentage, but high cash value return on the chance that a better bid will materialise.

This approach isn’t necessarily recommended for retail investors but the short-interest in the bidding firm can result in the share price of that stock being artificially suppressed until the deal closes. Which makes buying that stock a potential strategy for those with a long-term view.

Final Thoughts

As the Twitter situation proves, takeovers and mergers can be times of high excitement. The egos of CEOs can lead to their judgement being clouded, rules about what is and isn’t allowed can be massaged by governments and regulators, and bidding wars can break out in an instant.

As with any investment decision it’s important for investors to keep a clear head and carry out research to establish their next step. If you decide to stick with your holding and work through the buyout process your stock might be tied up for weeks or months until the accounting formalities are completed. If you’ve set up your trading account with a trusted broker, then that shouldn’t be an issue, but it provides another reason why checking your broker is regulated by a Tier-1 regulator is a vital part of being a successful trader.