As we close the chapter on 2022, it is time to reflect upon the financial ups and downs and look forward to what 2023 might have in store, with our picks for stocks to watch in 2023. Stock markets worldwide have been retreating under the double-edged sword of runaway inflation and elevated interest rates.

As measured by the CBOE VIX volatility index, 2022 thus far has been the fourth most volatile in the last 25 years. Only the dot-com meltdown, the onset of COVID, and the global financial crisis had a higher average in the VIX index.

The Federal Reserve has rolled back the tide on easy money, raising interest rates while attempting to cap its ballooning balance sheet.

The Fed belt-tightening has weighed heavily on the technology sector. Consensus modelling leans heavily on US treasury interest rates as an input, and as they rise, tech stock valuations quickly go in the other direction.

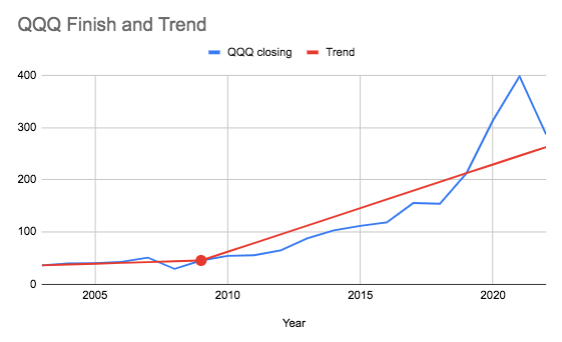

The Invesco QQQ Trust ETF NASDAQ:QQQ (QQQ) holds predominately large tech growth listed on the NASDAQ and is down 27% year-to-date.

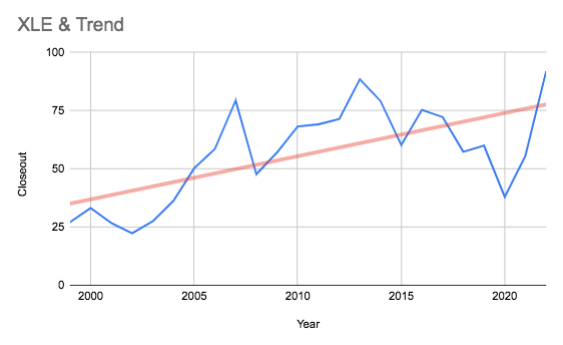

In contrast, the Energy Select Sector SPDR ETF NYSE NYSE:XLE (XLE) is up a whopping 67% year-to-date. It was powered ahead by the return to the office commute, the loosening of worldwide COVID travel restrictions, and the displacement of Russian oil on western markets.

Table of contents

Sectors to invest in next year

Before deciding on which specific stocks to invest in, it is first worthwhile selecting the sectors and markets that you believe have the greatest opportunity and, by extension, the greatest probability of success.

In the financial markets, 2022 has been the tale of two sectors. To date, rapidly growing companies that derive a capital valuation from a multiple of future profits over access to cheap capital have faltered as the price of capital has risen. Companies that self-fund on current profits and rely less on growth have increased in worth. This is the battle of value versus growth.

Firstly, let us look at the significant trends in both QQQ and XLE and then we can compare and contrast to attempt to decipher which sector has the greatest chance of success in the coming year.

QQQ

QQQ and growth technology stock valuation paths, in general, can be explained by four overarching trends.

Firstly, the dot-com boom of the late 90s forecasted the opportunity but rallied before the mass adoption of consumers. This bubble burst in 2000-2002, as capital was allocated too far in advance of the revenues required to replenish it.

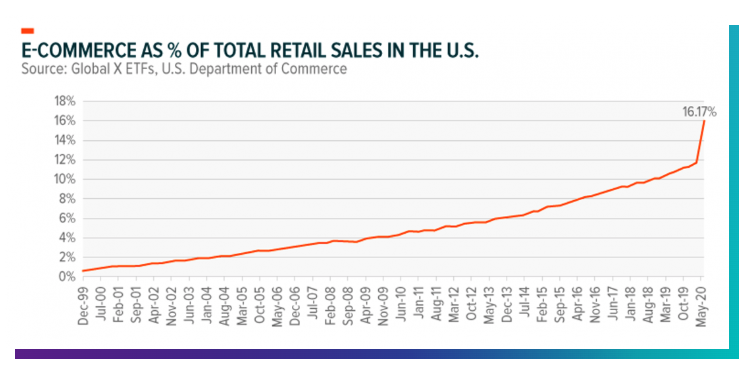

Secondly, the initial growth phase, as eCommerce commenced its accumulation of the conventional retail space, steadily clipping a percentage of retail sales and rapidly expanding its revenue. That came to a grinding halt with the GFC.

Following the GFC, the introduction of the iPhone and mobile purchases combined with cheaper computer chips, and more accessible laptops, saw eCommerce quickly start to devour more conventional retail wallet share. This resulted in a much sharper appreciation of the technology growth stock space. QQQ added in value an average of 17% between the years 2009 and 2019.

The fourth and final phase is the one that we are just exiting. The pandemic-led lockdown forced a massive shift to eCommerce that, in hindsight, was entirely artificial. It caused an enormous climb in revenues for everything remote and technology. The fourth phase saw a sharp rise in the valuation of QQQ before the reopening sent the valuations back to the trend line.

That is where we are today, continuing the trend from 2009 to 2019 QQQ is just now returning to that expected value, in line with the gradient of the eCommerce accumulation of conventional retail plus underlying GDP growth.

In a normal course of business and over the mean GDP growth of 2–3% for the US, plus eCommerce continuation of its trend in accumulating the conventional retail wallet share, we should expect the majority of the QQQ companies to grow between 10 and 15% in 2023.

XLE

After several years of capital destruction over the rapidly expanding US shale fields, oil supply growth went into consolidation mode following the onset of COVID. It is now reaping the rewards of more closely aligned supply and demand.

The promise of the US energy administration to replenish the strategic reserves will provide a slight tailwind, with 3% of the annual production of the US required to return to 90 days of import coverage.

With that being said, the present increase in recent production and the buoyant export market is heavily reliant on foreign demand, predominately from displaced Russian supply.

It is difficult to factor in how long this arrangement will continue, but the easiest answer would be to focus on the economics. The marginal barrels provided by the US to this new market are far less efficient than those piped barrels they’re replacing. The arbitrage opportunities presented to international oil traders are too great not to be rapidly closed by cheaper competing supply.

On top of this tenuous position as a supplier of last resort to European buyers desperate for oil, the US is entering what will likely be a slowing economy, self-inflicted to throttle inflation. This will probably temper the growth in oil and oil products.

At first glance, it appears that the sun-run in energy and XLE is nearing the end of its natural cycle and the most likely course of action is a return to the mean growth trendline of approximately 5% per annum.

QQQ v XLE

The battle for growth vs value this year has been resoundingly won by the value sector, and XLE has been leading that charge.

When looking at the 2023 outlook, it appears that growth may have a chance to shine again, and it is the opinion of this author that growth will outstrip value in asset appreciation, with QQQ taking the honours in 2023 over XLE.

This presents an excellent opportunity for the investor, and we will attempt to pick the four stocks from the QQQ basket that we believe have the best chance of success in 2023.

Four stocks to consider in 2023

- NVIDIA Corporation NASDAQ:NVDA (NVDA)

- Amazon NASDAQ:AMZN (AMZN)

- Apple NASDAQ:AAPL (AAPL)

- Microsoft NASDAQ:MSFT (MSFT)

1. NVIDIA Corporation (NVDA)

This chip-maker has trailed the S&P500 benchmark, following its main competitors in Intel Corp (NASDAQ:INTC (INTC) and AMD Corporation NASDAQ:AMD (AMD) lower with a loss of 45% on the year.

The return-to-work post-pandemic has lowered the perceived future requirements for cloud and remote server capabilities, pressuring current and future margins across the board.

NVDA does have a robust artificial intelligence (AI) and cloud AI offering. The rapid development of AI is reaching a breakout point, and applications will be wide and varied.

Following the high uptake in this sector, AskTraders’ opinion is that NVDA has every opportunity for another breakout year in 2023, boosted by an undercurrent of tech growth along with wider AI applications.

Already the firm has raised profit expectations for this final quarter of 2022. With increased concerns over protecting US intellectual property in this sector and a world-leading AI chip and cloud offering, NVDA is set to have a bumper 2023

2. Amazon Corp (AMZN)

AMZN is down over 40% on the year, feeling the pinch of the give-up of the headway made into in-store retail wallet-share during the lockdown.

The cash flow burn of their Alexa programme weighs heavily on investors’ minds as Meta (Facebook) has spent so freely on its new-age immersive technology – $36bn spent on the Metaverse.

Alexa spending has, as yet to be justified. However, there is still time for the developed intangibles and the gained understanding of the consumer to be applied to the company business model.

The underlying trend for eCommerce is one of growth, not only of the broader economy and new markets but the share that is being incrementally won every year from conventional in-store retail. The combination of economic expansion, new products and geographic markets, and the shift from in-store to online, will continue to serve AMZN well.

As Amazon approaches 2023, in all likelihood, this will return the business to stock appreciation as the cobwebs of 2022 are blown out, and the company will return to its pre-pandemic growth trajectory.

3. Apple Inc (AAPL)

This tech behemoth was favoured more than most other technology companies in 2022, down only 17% on the year and continuing to benefit from its oligopoly in the application download and its strong position in phones.

With an increased share of application download and advertising revenue, AAPL is positioned like no other in the booming mobile eCommerce market.

To position oneself in the most secure online retail sector, one should look no further than this technology giant. Already the most valuable company in the world, AAPL is showing no signs of slowing down. In 2023, it is unlikely to face some earth-shattering competition, given its massive competitive control over mobile.

With an average top-line revenue growth of over 15% for the last four fiscal years and a trailing PE ratio of 24, AAPL presents reasonable value for a technology company still finding avenues for growth.

Anticipated growth in the technology sector for 2023 provides additional security to an investment in one of the best-run and positioned companies on the planet.

4. Microsoft Corp (MSFT)

MSFT is presently experiencing a boom in cloud computing. MSFT’s Azure product has become a market-leading offering and continues to drive revenue growth.

The shift to the cloud is as inevitable as night is to day. The cost savings from outsourcing hardware combined with the added benefit of keeping computing capabilities at the cutting edge leaves little room for all serious companies to shift their processing to a cloud offering.

With stable average growth in top-line revenue of 16% over the last three years, MSFT’s appreciation in value has little to do with the swings in COVID versus the groundswell of customer shift to their offerings.

Currently trading at an acceptable PE multiple of 26 against this growth in top-line of over 16%, MSFT is presently offering good value to the prospective investor.

Azure’s positioning as the most widely available cloud offering presents an enviable opportunity for MSFT to capitalise in the coming years as the rate of computing processing only increases.

AI will require orders of magnitude more in microprocessing capability. To keep abreast of the rapid developments, most will turn to the cloud, as only centralised hardware operations will be able to keep up with the technological advancements.

Final Thoughts

After struggling for a year, the US’s technology sector is set for a rebound. As global product leaders in the cloud computing space and with the wider application of AI on the horizon, US technology companies will soon find their footing and continue to provide a healthy return for investors over the long term. For traders considering their brokerage of choice for 2023, AskTraders has compiled a list of the top online stockbrokers for your consideration.