Energy shares have shot up in price thanks to various factors creating a perfect tailwind for the sector. Trading with the trend is always a good idea, but by using technical and fundamental analysis techniques, we have identified the best energy shares to buy now.

YOUR CAPITAL IS AT RISK

The stocks on our best-buy list have different characteristics. One comes from the ‘traditional’ side of the sector, another is a world leader in terms of renewables, and the third looks well-positioned to attract attention from investors thanks to its ability to capture the current zeitgeist. They all offer up the prospect of immediate profits and long-term returns.

One development to factor in is the underlying change going on in the energy sector. Renewables are on the rise thanks to the global consensus shifting towards moving away from a carbon-based economy. New entrants and established firms fall into the growth stock category thanks to the energy sector coming back into favour with investors. Let's dive into the best long term energy stocks on the market.

Best Energy Shares To Buy Now

1. ConocoPhillips (NYSE: COP)

Source: 123RF

Renewable energy may be catching the headlines, but ConocoPhillips has been making progress using the old-fashioned approach of being a well-run company. The firm is a diversified oil and gas producer operating globally. It has operations in 15 countries and has found itself well-positioned to ride the increase in oil and gas prices successfully.

Full-year 2021 earnings were $8.1bn, equating to $6.07 per share and comparing impressively to the full-year loss of $2.7 billion in 2020. The long-term growth rate is currently an impressive 19.8%, and the COP share price has acted to this news by rising in value by an eye-watering 370% between March 2020 and March 2022.

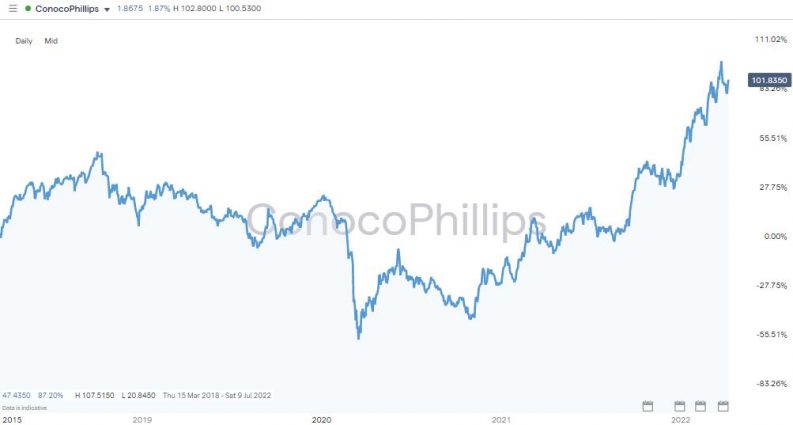

ConocoPhillips – Daily Price Chart – April 2018 – April 2022

Source: IG

The recent surge in the price of energy commodities has given the multi-month bull run further impetus, and the supporting trend lines are getting steeper rather than flattening out. The SMA’s on a Daily Price Chart support the move upwards, and any drop in price into the region of $85 would be a buying opportunity for those following a pullback trading strategy. The 100 Daily SMA currently sits at 85.69, just above the steeper of the two supporting trendlines.

ConocoPhillips – Daily Price Chart – April 2018 – April 2022

Source: IG

The firm is doing an excellent job of extracting and selling oil and gas, but its mission includes room for expansion into renewables. The stated aim is to

“power civilization, and consistent with our positions on sustainable development and climate change, we are evaluating and supporting the development of technologies for renewable energy. We are leveraging our expertise, intellectual property and physical assets in pursuit of economically viable, renewable energy business opportunities.”

Source: Conoco Sustainability

The good news for investors is that the firm has the cash to finance R&D into renewables and provide generous returns to shareholders. The most recent financial statement included news that the money is returned to investors in the form of dividends and stock buybacks were being upgraded to $8bn. Moves such as that provide base-level support for a share price, and with so much buying pressure due to playing a role in the market, the path of least resistance still appears to be upwards.

2. NextEra Energy (NYSE: NEE)

Source: 123RF

All new technologies experience bumps along the road, which is why our pick of the renewable energy stock with the best long-term prospects is NextEra Energy. With a market capitalisation of $148bn, the firm has the critical mass required to ride any storms while developing market share.

NextEra Energy is the world’s largest producer of wind and solar-generated energy and continues to report above-average market growth. Annual earnings growth is forecast to be 6-8% through to 2023, and although it’s an out-and-out renewables firm, its dividend policy is bang in line with traditional energy firms. The dividend payout to investors has increased over the last 25 years, and the yield currently sits at 2.25%.

The P/E ratio on the stock is currently 42.44, which points to a lot of the good news already being priced in. It also highlights the interest in the stock, and the firm certainly ticks the box in terms of being an ethical investment, so it is well-positioned to benefit from investors moving into the sector.

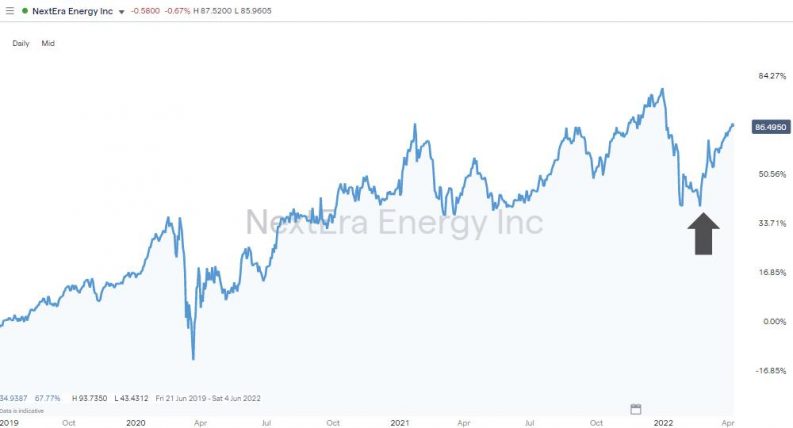

NextEra Energy Inc- Daily Price Chart – July 2019 – April 2022

Source: IG

If you’re looking to settle into a buy-and-hold style position in NextEra Energy, applying some patience could pay off. There is some volatility in the stock price, and after a recent dip, the NEE share price bounced on 25th February and gained +19% in just over one month. It’s good to have a short-term return to get your long-term investment off to the best start.

3. Dominion Energy (NYSE: D)

Source: 123RF

With two solid contenders representing the traditional and emerging elements of the energy sector, the next long-term energy stock on the list is a smaller challenger-style firm.

Dominion Energy is an American power and energy company headquartered in Richmond, Virginia. It supplies electricity in parts of the Eastern States and natural gas to states as far west as Utah. It has a market capitalisation of $62bn, a healthy dividend yield of 3.46% and a relatively modest P/E ratio of 21.75.

Part of the appeal of Dominion stock is the clear message from the management that they are ready to push the boundary on what an energy firm can be, and the stated aim is to become “the most sustainable energy company in the country”. That’s important because institutional investment companies have to pay more attention to ESG and CSR policies when pulling the trigger on stock purchases.

All bases are covered in terms of Dominion meeting modern governance standards, and that looks set to support the share price as the global economy and investment industry go green. The firm’s policies aim to deliver reliable, affordable, clean energy, protect the environment, serve its customers and communities, empower people, and create value for its shareholders.

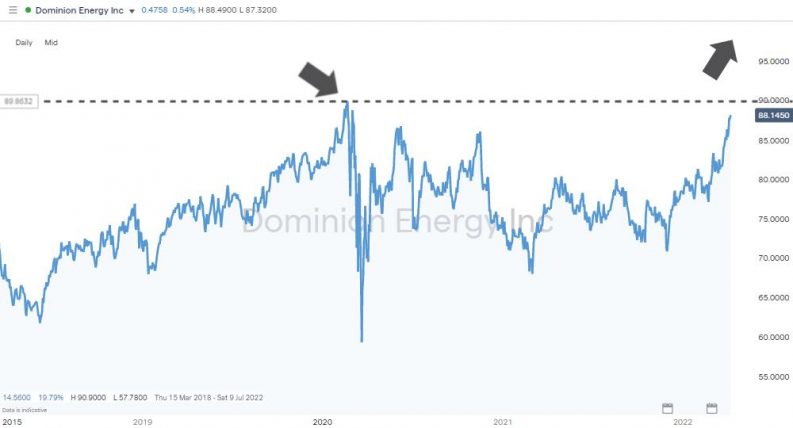

Dominion Energy – Daily Price Chart – April 2018 – April 2022

Source: IG

The Dominion Energy share price is building momentum and buying Dominion stock leaves room to capitalise on further growth. A break above the all-time-high of $90.90 recorded on 24th February 2020 would allow long-term investors to run a breakout trading strategy with technical resistance levels limited to the psychologically important $100 per share price bar.

Why Are Energy Shares Going Up in Price?

Energy firms have seen their stock prices soar since March 2020. That is partly due to a resurgence in demand for equities as an asset class and the raw materials they produce going up in price. During Q1 of 2022, gas, coal, and electricity prices have reached levels they haven’t seen for decades. Some of the catalysts for the record prices can be expected to influence prices over the long term.

Covid Hangover For Suppliers

During the Covid lockdowns, energy firms faced an existential crisis. As the global economy ground to a halt, demand for energy stocks plummeted. WTI crude oil even famously traded below $0 per barrel.

The extreme market conditions led to energy firms scaling back on production capacity to strengthen their balance sheets. Historically, the oil and gas industry has found that turning the taps back on is more complex than turning them off. Lost years of underinvestment in new supplies can’t be simply caught up but instead create an air bubble in the supply pipeline. Shale gas producers in North America were hit with numerous firms going bankrupt, and a crucial part of the world’s energy pipeline is still underperforming.

Resurgent Demand

At the same time as energy suppliers were struggling to resume full-scale operations, demand for energy commodities rebounded suddenly when global lockdowns ended. India’s domestic coal mining, which accounts for 80% of the country’s supply, has been unable to keep pace with demand.

Renewables

The transition to renewable energy sources can’t be directly blamed for higher energy prices. During the hand-over period, carbon and green energy should, in theory, be able to work together to increase supply. Weather-related events of 2021 did play a part in driving energy prices upwards. A cold winter in the Northern Hemisphere was followed by droughts that curtailed hydropower output in Brazil and elsewhere and lower-than-average wind generation in Europe.

Supply Outages

The amount of global LNG supply affected by unplanned outages in the first nine months of 2021 was up by an estimated 27% compared with the average for the same period throughout 2015-2020.

Geopolitical Events

The Ukraine-Russia conflict is an example of the curveball events which have added to an already potent cocktail of demand and supply issues. Russia is the world’s largest oil producer; with that supply being put at risk, futures prices in crude have shot up as buyers scrabble around to secure supplies.

Things to Know About Energy Shares

New Opportunities

Not too many years ago, picking the best energy stock involved filtering a relatively small pool of long-established oil and gas multinational firms such as BP, ExxonMobil, Chevron, and Royal Dutch. The switch to low-carbon energy use has resulted in stock picking metrics needing to change. One requirement is to be able to evaluate the capability of the big players toward the new way of doing things. There are also new, smaller energy firms focused on renewables to consider.

Growth Stocks or Defensives?

The change in the profile of the firms making up the energy sector means picking a top energy stock doesn’t, by default, mean you’re buying a relatively secure firm that pays an impressive dividend. Some still do, but the sector now contains exciting growth stocks as well.

The Role of Governments

The shift to greener energy is being driven and, to a large extent, financed by public spending. While the commitment towards achieving a carbon-free economy is nailed on, some of the funding can be expected to be tapered back as and when green energy firms become self-financing.

Commodity Markets

Buying into energy stocks allows exposure to two asset classes, equities and commodities. The price of your stock position will be determined by the market mood towards stocks and the price of oil, gas, and coal, which trade on commodity exchanges. These two price drivers can work in the same direction or against each other.

Energy Stocks are Easy to Buy

The critical role energy firms play in the global economy means good broker platforms offer markets in the companies. Opening and funding an account with an online broker takes moments and buying energy stocks requires little more than entering the number of shares you want to purchase and clicking ‘Confirm Order.

From that point on, your energy stock position will fluctuate in value according to live market prices until the time comes to reverse the process, sell your position, and crystalise your profit or loss. One crucial check to make is to ensure your broker is legit. Head to this list of trusted brokers to find a shortlist of firms that the AskTraders team has reviewed to ensure they are reliable, offer competitive T&Cs and provide the support needed to help you make the best of your trading decisions.

Practise Using a Demo Account First

Setting up a Demo account takes moments and often requires providing little more than an email address. Using one will allow you to test-drive the platforms of different brokers to find a good fit for your style of trading. The funds provided are virtual, which means practising buying and selling shares is risk-free and an opportunity to learn valuable lessons before upgrading to a live account.

Final Thoughts

Recent price moves in energy stocks point towards a growing upward momentum. Bull markets can run for years and offer the opportunity to make significant returns and picking the best long-term energy stocks can optimise your returns. Navigate to one of these trusted brokers to ensure you get off to the best possible start and benefit from the peace of mind that comes from knowing you’re set up with a good broker.