Using technical analysis and fundamental analysis methods to identify targets is the first stage of the process. It’s also important to devote some time to the second – choosing the right broker. This step-by-step guide will provide answers to the question ‘how to trade stocks in Singapore’ and draws on the knowledge of experienced traders. These are their top tips on what to look for in a broker, and how to go through the process of putting on a trade.

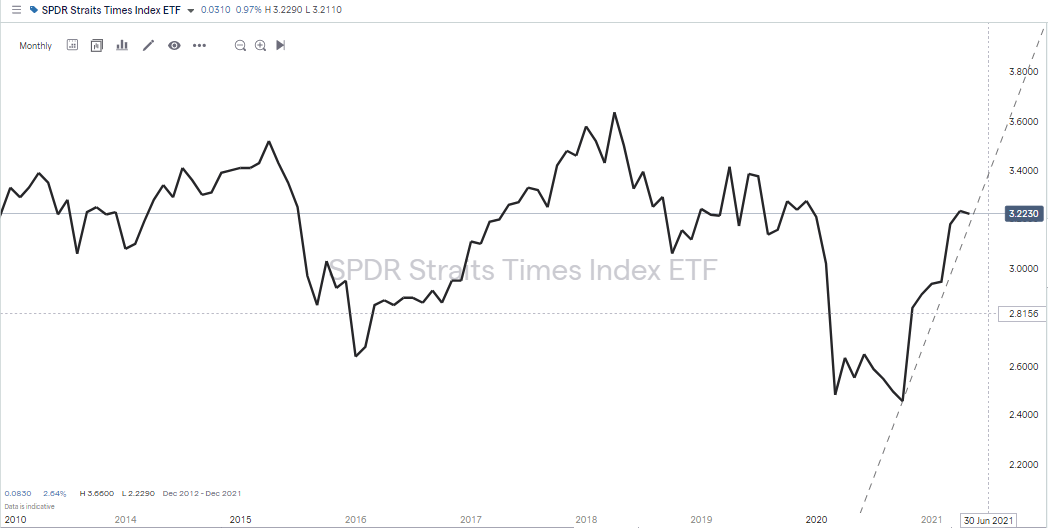

SPDR Straits Times Index ETF – 2010-2021

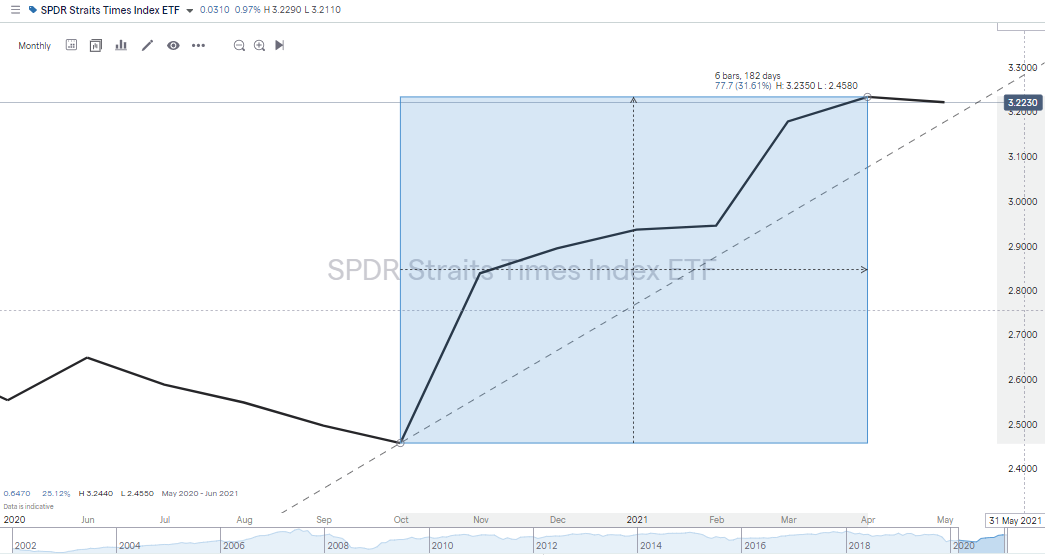

SPDR Straits Times Index ETF – Mar 2020-May 2021

Why Trade Stocks in Singapore?

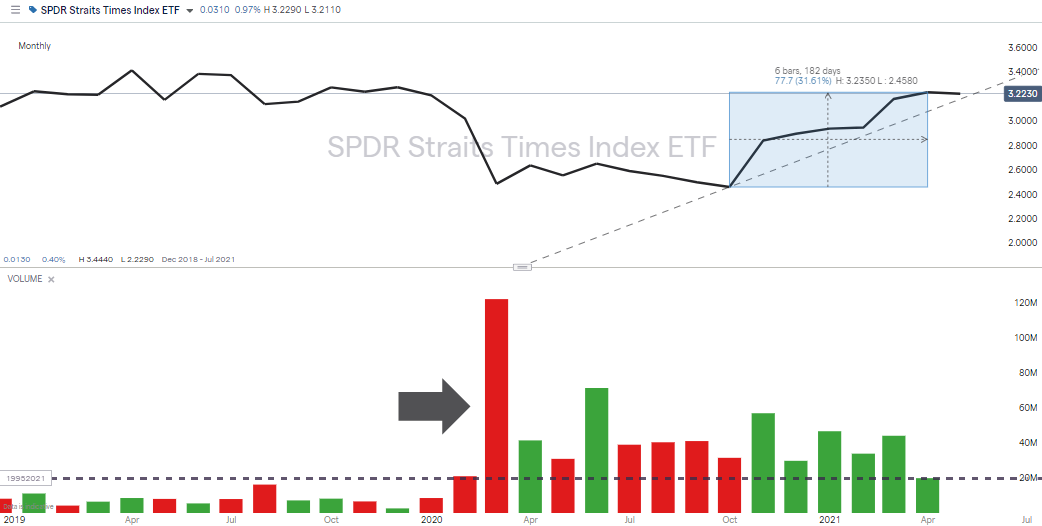

The influx of cash into the Singapore stock market has created a situation where price moves are built on the back of significant momentum. If you get on the right side of one of those moves, then the length they run for can convert into substantial gains. The chart of the Straits Times Index ETF shows just how much extra trading there is being carried out in Singapore. Each month since March 2020, trading volumes have been in excess of what they were in any of the previous 14 months dating back to December 2018.

The Singapore market is hot. This doesn’t necessarily make it easier to make the right calls, but it does mean that subsequent price moves can be more dramatic. Preparing to trade the Singapore market involves understanding some of the reasons that so many people give to explain why the market is good to trade.

Regulated

For starters, stocks listed on the Singapore Exchange are regulated by SGX, the organisation that operates the exchange. Firms that place their stock on this exchange have to comply with rules and regulations relating to transparency of reporting and corporate governance, and they have to undertake independent audits. This means that when you take a view on the prospects of a firm, you are basing it on hard facts. People looking to ‘spoof’ the markets can face severe consequences, which is a different situation from unregulated markets such as forex and cryptocurrencies. There’s enough underlying excitement about Singapore stocks to bring about extreme price moves, but trading activity and stocks are closely monitored.

Singapore – a ‘Good’ Pandemic

While the events of 2020 were largely unprecedented, Singapore is considered, in relative terms at least, to have had a ‘good’ pandemic, in the same way that tech stocks benefited from catering to increased home-working and a shift towards home entertainment. The extent to which Singapore was prepared for the COVID-19 pandemic has helped the firms based there. Efficient management and exemplary testing regimes limited the impact on supply chains and consumers. With the global economy emerging from lockdown, Singapore firms are now well positioned to make the most of the opportunities they face. The pandemic can be seen as a big shake-up of established business methods and the companies that are first out of the blocks will be able to expand market share. Some of that new business will ‘stick’ despite more sluggish economies eventually getting up to speed at some point. There’s also every likelihood that some rivals will go bust, leaving the door open to even further expansion.

Momentum Is Already Building in the Singapore Stock Market

The potential for Singapore companies to boost future income streams has already led to increased interest from investors. By the end of April 2021, the flagship Singapore stock index the Straits Times Index was up 12.55% on a year-to-date basis. From the March 2020 lows to the highs of March 2021, the STI rose in value by 45.1%.

The performance of Singapore stocks also compares well to their peer group. To the end of April 2021, the Japan Nikkei 225 was up 6.66% year-to-date and the Hang Seng index was up only 4.79%. Share price action is showing that Singapore firms are leading the charge and investors are already backing them to snap up market share from rivals.

Which Stocks to Buy?

Another reason for the popularity of the Singapore stock market is that the listed firms cover a wide range of sectors. There are banking giants that are some of the biggest players in Asian finance. These and other Singapore blue-chip stocks offer a relatively low risk-return option for investors. Then there are dividend stocks, which generate a consistent yield. Despite the increased interest in the market, there are still some seen as undervalued. Those with a more aggressive approach to trading can find small-cap property stocks, semi-conductor tech firms, and consumer-discretionary pan-Asian brewery firms that offer a different proposition in terms of risk-return.

The recent bull run isn’t a guarantee that Singapore stocks will continue rising in value, but there is definitely a sense that anything is possible. Even if there is a correction, more active investors can use CFD products to sell short and profit from the downturns. Predicting if the market will go up or down is notoriously difficult, but being prepared to trade the moves is not. Choosing a trusted broker that allows you to trade the downs as well as the ups requires some thought but is time well spent.

How to Buy Stocks in Singapore

Whether you are an experienced or novice trader, your path into the Singapore stock market is the same. Online broker platforms set up to support trading have extremely user-friendly functionality that allows clients to buy Singapore stocks at the click of a button. There are some other features to consider that will help tilt the odds in your favour. The first step relates to the trustworthiness of the broker and whether a broker is legit.

Market risk, the likelihood of your stock purchase going against you, is unavoidable. It’s for this reason that it is recommended that beginners start trading in small size so that they can familiarise themselves with the psychological aspects of trading. Operational risk, the possibility that your broker is a scam or might go bust, is another matter. One of the most disappointing things for a new trader to experience is to make the right call on a trade, register a paper profit, but find that they have been scammed and can’t even get their initial deposit back. The good news is that choosing a trusted and safe broker is a situation that can be managed. Below are some easy-to-follow guidelines that can help you limit the risk of making a wrong turn.

Choose a Broker

Financial authorities such as MAS help make choosing a broker easier to do. They are charged with regulating the financial markets and have a focus on protecting the little guys. To obtain a licence from a regulator, a broker has to jump through a lot of costly and time-consuming hoops. For example, they need to submit business plans that demonstrate that their business is viable and that their staff have the appropriate skill levels and experience to run the business. They also have to sign up for independent audits and ensure that they have sufficient capital on account to limit the risk of them going bust. That’s just for starters – the ongoing compliance commitments are considerable and include submitting reports and keeping up to date with new rules and regulations.

You’re making a good first move if you choose a broker that is regulated by a Tier-1 authority such as one of the below:

- Monetary Authority of Singapore (MAS)

- Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

Whether you’re trading stocks on a buy-and-hold basis or shorting them to profit from a downward correction in the markets, the reliability of your broker is key. New platforms might (or might not) offer some neat innovative features, but established brokers have proven track records, some stretching back decades. The longer a broker has been operating, the greater the ‘reputational risk’ should they short-change clients in any way. Whether you are long or short, choosing a broker that has been operating for five years or more could help you sleep at night. This short list of regulated brokers offering services in Singapore provides more information on regulated and trusted brokers that have been reviewed by the AskTraders team.

After establishing that your broker is legit, the next step is considering whether the platform and markets they offer are the right fit for you. There are subtle differences from broker to broker, and double-checking some of the details can save you having to switch brokers at a later date. Not all brokers offer markets in some of the smaller Singapore stocks, for example.

One way to learn more about a broker and practice trading at the same time is by signing up to a Demo account. These involve using virtual funds, so are risk-free and take seconds to set up. Onboarding for a Demo account typically requires you to provide little more than an email address. Once set up, the simulated platform you will practice on is exactly the same as the one you’ll use to carry out live trading.

Best Brokers to buy Stocks in Singapore:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

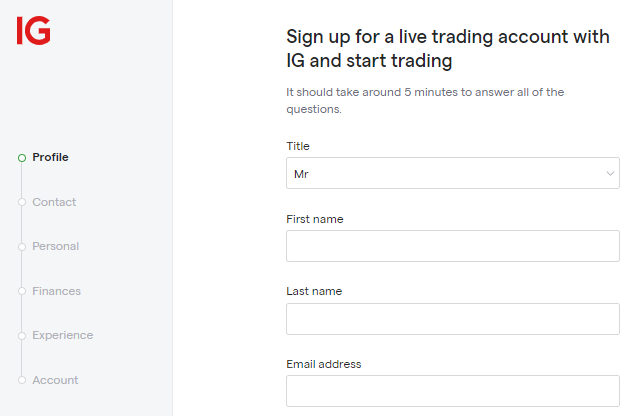

Open and Fund an Account

The form filling related to signing up for a live account is all done online, and can be carried out from a desktop or mobile device. You can start the registration process by following the ‘Open an Account’ links found on the broker’s home page. If you’re already using a Demo account, you’ll follow a similar path to convert your account to one that trades live cash.

The first part of the process involves supplying personal details and ID verification. After this, there is a series of questions relating to trading experience and investment objectives. These allow the broker to build a profile for you and comply with Know Your Client (KYC) protocols, which the regulators use to ensure that retail traders are protected properly. The whole process can ultimately help your trading as it offers a chance to reflect on your investment aims and is typically completed in a matter of minutes.

If you sign up with a regulated broker, an additional layer of protection is provided thanks to the anti-money laundering (AML) laws with which they have to comply. These are designed to prevent criminals moving money through brokerage accounts and on to someone else. AML regulations stipulate that any funds paid into a brokerage account can only be returned to the account from which they originally came. As a result, this limits the chances of a rogue party accessing your account and forwarding your funds to a scam account – a regulated broker just can’t process a payment of that nature.

Sending funds to your new brokerage account follows the same format as any other online transaction. You can use a variety of payment providers, but it’s worth checking the T&Cs to find one that doesn’t come with unnecessary administrative charges. The fastest and most popular payment methods are debit/credit cards and these are associated with near instant transfer times. Whichever method you use, once the funds hit your account, you’re ready to trade.

Open an Order Ticket and Set Your Position Size

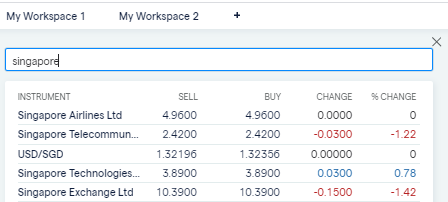

After registering your account, the next step is to run a search for your target stock’s name, or if you’re looking to invest in a range of Singapore stocks, filtering the market by country and sector.

Source: IG

Trade execution in the purest sense comes down to inputting the amount you want to purchase and clicking ‘buy’. It really can be as simple as that. There are some additional risk-management features that are worth considering before you make that final tap of the mouse.

Set Your Stops and Limits

Stop-loss instructions and take profit orders are designed to help you manage your risk. If price reaches a certain point, the system will automatically sell some, or all, of your position. You decide what that level is and submit the instruction into the system.

In the case of stop-losses, the intention is that if your investment does turn out to be a bad decision, you’ll sell out of your position, cut your losses and live to fight another day.

Take profit orders work in the same way but close out your position if price moves in your favour. They crystallise profits by selling some or part of your position if price reaches your target level.

Stop-losses and take profits are often recommended for beginners and those trading short-term strategies. Depending on what type of approach you are adopting, it might be worth considering the alternative arguments. In general, buy-and-hold investors might want to not use stop-losses or take profit orders, because they are willing to ride out a short-term price slump. Using stop-losses in some situations could lead to you getting kicked out of a position before it has time to come good.

In a similar way, take profits help you lock in some profits, but letting a position run can sometimes be preferable. Whether or not to use them is largely dependent on the strategy you are using and is something that you have complete control over.

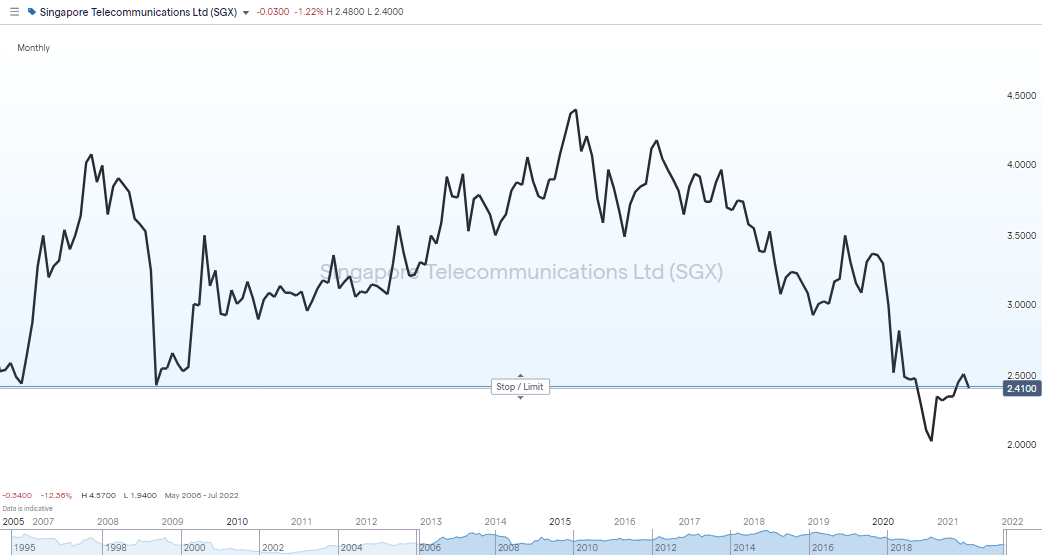

There is one final order type to mention: limit orders. These allow you to state a price at which you want to buy a particular stock. They are binding contracts and might not be ‘filled’ if price doesn’t reach your target level. If a stock is, for example, trading at $2.42 but you think that it will clip the $2.35 price level before heading upwards, you can build that instruction into your broker platform. There’s no guarantee that you’ll be filled at your target level, but if you can be patient, then you might optimise your trade entry point.

Make Your Purchase

After you’ve researched the markets and signed up with a legit broker, trading the markets ultimately comes down to clicking a mouse or tapping a screen. Buying stocks is very similar to other online purchases and any trade execution is followed by a moment when some of your cash pile is converted into a stock position. From that moment onwards, the value of your holding will be determined by market price.

One salient piece of advice offered by experienced traders is to check your trade as soon as it’s completed. By accessing the ‘portfolio’ section of the platform, you’ll be able to review your recent activity. If you’ve made any sort or error, now is the time to spot and rectify it. This area of the site is also where you’ll be able to monitor the performance of your trades. It’s also where you’ll go to close out your trades. When the time is right, log in, crystallise your returns, and decide whether to trade again or send cash back to your base account.