How to define share capital?

Let’s approach this question from a trading and investing viewpoint. The broadly accurate, but very high-level answer to this question, is that share capital is what you buy to take a position in a company.

Source: eToro

Online brokers offer markets in firms, ranging from oil giant BP (LSE:BP) to smaller start-ups, but the principle is the same. Buy low and sell high. Or if you’re short-selling, flip things around.

The brokers that offer you a simple and user-friendly interface to trade do a lot of the background work. They process the deal in their back office and convert your cash into share capital, which is actually more of an accounting term.

Share capital, also known as shareholders’ capital, contributed capital, equity capital or paid-in capital, is the sum that is invested by company shareholders for use in the business. They invest because doing so gives them a stake in the company and its future earnings.

Example 1

Take a start-up business that requires investment, for example. It prints out 100 share certificates and gives them a nominal value of $1. Investors who exchange cash for shares have a holding in the firm proportionate to the number of shares they buy.

Once all the share certificates are sold, the firm will mark on its balance sheet that share capital is $100. Other revenue generated through the day-to-day business of the firm will be recorded elsewhere on the balance sheet as earnings.

Those earnings will be retained or distributed at the discretion of the management. Some capital will be held back for future investment and some paid out as dividends.

It is in the interest of investors and management to get that balance right. Disproportionate distribution of the firm’s assets towards shareholders is part of the process known as asset stripping.

What are share classes?

Revisiting our example, it might be the case that a much-fancied management team requires capital investment but doesn’t want to give up control of the company.

Example 2

In this example, the management invests their own capital for $75 of Class A shares, which have voting rights. Other investors might still be happy to buy shares and not be too concerned about having voting rights. They trust the management and so buy up $75 of Class B shares.

The Class A and Class B shares are both share capital. They may (or may not) have equal rights to any profits, which will be distributed pro rata as dividends. They do, however, have different rights when it comes to voting at the firm’s Annual General Meeting.

Why is share capital important?

Share capital is a means to an end. It represents the formalisation of a process that allows investors and firms to build a relationship intended to be mutually beneficial. There are other factors to consider.

Voting rights

If the firm you are a shareholder in is subject to a takeover bid, then shareholders will have the right to approve or veto the buy-out.

It’s also the case that shareholders can veto what they consider to be unreasonable payments, such as bonuses or salary hikes to management.

Corporate actions

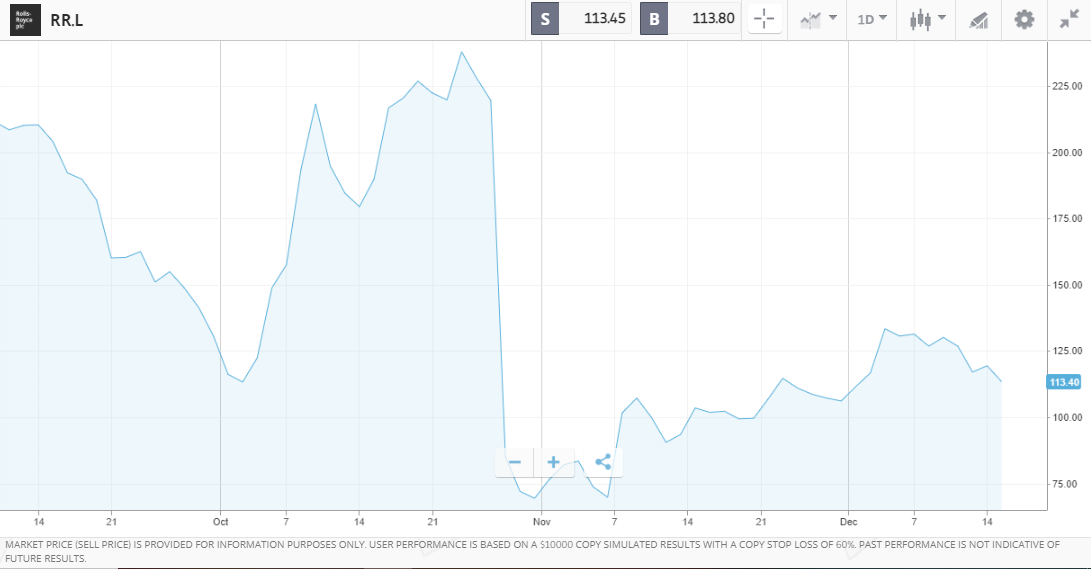

As businesses are dynamic, it might be the case that the firm in either of our examples requires additional investment. In November 2020, Rolls Royce approached investors to secure $2bn of additional funding and tie up holes in its balance sheet caused by the COVID-19 pandemic impacting its order book.

Rolls Royce offered its existing shareholders the opportunity to take part in a Rights Issue and buy 10 new shares for every three shares they already held. The price of the new shares was 32p compared to existing shares, which were trading on the London Stock Exchange at levels between 70p and 120p.

This article gives a blow-by-blow account of the share price moves leading up to and after the rights issue in Rolls Royce. It’s not atypical and is one of the reasons rights issues are seen as a necessary evil rather than a first choice when it comes to raising cash.

Source: eToro

When new share capital is issued, it provides an opportunity for investors to take advantage of buying new stock lower than market price. Firm’s such as Rolls Royce that face short-term cash-flow issues take the decision to prioritise securing investment and keeping the business alive.

Shareholders who take up the offer receive stock at a discount, but those who don’t see the net value of their holding diluted. There are now more shares in circulation, so their percentage stake in the company is smaller.

If you don’t keep up with corporate action announcements or if you don’t have the extra funds spare to take up the offer, you can effectively lose out.

Share capital — learn from the pros

Corporate actions and other events relating to share capital can be big business.

Large hedge funds tend to have specialist teams set up to scour the markets for upcoming events and opportunities to make a profit from them. There are even hedge funds set up solely to trade event-arbitrage and event-driven strategies.

The secret to their success is to keep up-to-date, understand the process and don’t be afraid to ask. If you have a shareholding in a firm and are unsure exactly what is involved in an upcoming event, then call the Investor Relations department at the company. A clear understanding is the first step towards, at best, making a profit, or at least protecting your interests.

Best Broker for Trading Stocks Online

Finding the right broker for you is perhaps the most important part of the process. While you can buy and sell stocks with most brokers on the market today, not all brokers are created equal.

Best Brokers to Trade Shares:

eToro: 68% of retail CFD accounts lose money

Open AccountIG: Negative balance protection

Open AccountPlus500 | CFD provider: Beginner-friendly

Open AccountIf you're ready to trade shares, you'll need to use a broker that is FCA regulated, has low trading commissions and a reliable trading platform. Finding one can be an arduous and daunting task, which is why we've hand-picked favourites that tick all of these boxes to help you get started.

Final thoughts

Analysing share capital might not be as intrinsically interesting as developing a new trading strategy or learning how to code and run your own algorithmic models. It can, however, be equally as important in terms of the impact it has on your trading performance.

The rights issue in Rolls Royce shares would have had a direct impact on the value of any shares in that firm you were holding. Rights issues are only one form of corporate action. Keeping on top of news relating to your portfolio positions is a relatively risk-free way of ensuring you make the best return you can from trading.