Three White Soldiers is a Japanese candlestick pattern that offers a bullish signal for new long positions. This price pattern indicates rising potential for a reversal (after a downtrend) or the emergence of a new uptrend after a long period of sideways trading activity. Three White Soldiers is a series of three long-bodied Japanese candlestick formations, each with an opening price inside the body of the prior candle and a closing price above the high of the prior candle.

As we can see, candlestick levels in each pattern should have short shadows and opening price that is inside the real body of each preceding candle. On trading stations, this price chart pattern indicates significant changes that are developing in market sentiment. When each candlestick has small shadows (or no shadows, as in the Marubozu Candlestick Pattern), expert traders understand that market bulls may have taken control and consistently held prices at elevated levels for three straight sessions. In some cases, these patterns will be preceded by other Japanese candlestick patterns typically viewed as reversal signals (such as a Doji pattern).

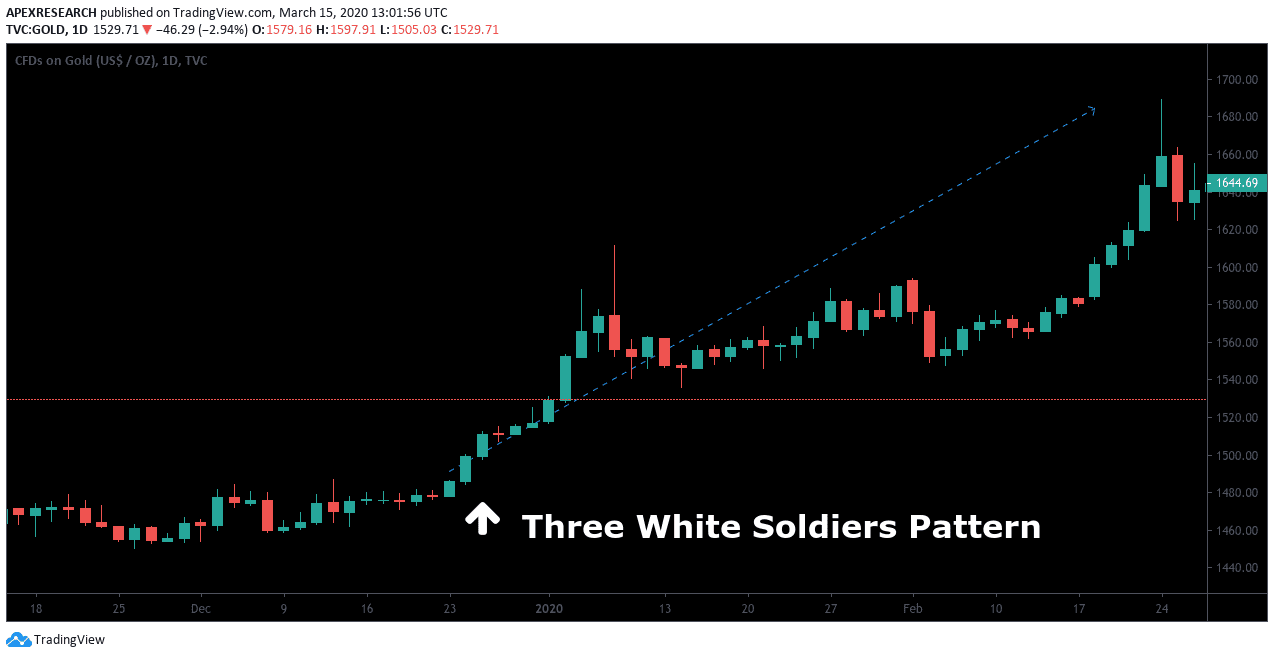

Essentially, Three White Soldiers patterns create an early signal that sellers have left the market and that an emerging uptrend might be forming in its earliest stages. Following is a live chart example of the Three White Soldiers pattern on the price history of gold. In this example, the price of gold trades in a sideways range for an extended period of time. The initial breakout of this trading range exploded in three large bullish candles that cleared prior resistance levels. In the months that followed, gold markets experienced a substantial rally that generated superior profits for technical analysis traders with long positions.

When trading using Japanese candlestick strategies and the Three White Soldiers pattern, it would also be important for traders with short positions to consider closing their trades to look for new opportunities elsewhere. Additionally, traders can use technical analysis indicators to confirm or deny trading signals that are generated by the Three White Soldiers pattern. This helps add another layer of objectivity to the technical trading analysis strategy and raises the probability that a given trade might end in profitability. Popular examples of technical indicators that are often used in conjunction with the Three White Soldiers pattern include the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD).

When the candlestick patterns occur during time periods that are considered oversold (RSI readings of 30 and below), there is stronger potential for an upside reversal in price action. In cases where there is no agreement between the technical indicator readings and candlestick trading signals, some traders will elect to wait on the sidelines and take no position in the market. In any case, candlestick trading strategies must use stop-loss orders to protect against unexpected market declines and these can be placed below the price low of the chart pattern.

Ask Traders Summary: Three White Soldiers Candlestick Pattern

- Three White Soldiers is a Japanese candlestick pattern that indicates rising potential for a reversal (after a downtrend) or the emergence of a new uptrend after a long period of sideways trading activity.

- Three White Soldiers formation is a series of three long-bodied Japanese candlestick formations, each with an opening price inside the body of the prior candle and a closing price above the high of the prior candle.

- Three White Soldiers candlestick formations can be confirmed by technical analysis indicators (such as the MACD or RSI).

PEOPLE WHO READ THIS ALSO VIEWED: