The real trick is finding an app that has the functionality you need to trade successfully. This can come down to user-friendly trade execution or charting tools that allow you to develop your strategies. With these points in mind, this article offer a comprehensive trading app guide through:

- Accessibility – instant access

- Trade execution – the crucial job of trading in and out of positions

- News and events – keeping up with events impacting your trading

- Market access – ability to trade a range of markets

- Strategy planning – having access to tools to improve your returns

- Price alerts – use your trading platform to notify you of entry and exit points

- Learning and education – being able to use spare time to improve your trading

- Account maintenance – managing your account effectively

- Security – even more important on devices that can easily go missing

Accessibility – instant access

Mobile trading Apps are, almost without exception, free to download and available on Android and iOS devices.

If you registered your account with a broker on a desktop device and are looking to trade on the move, you’ll only need your log-in and password to access the trading platform. If you’re starting at square one, it’s possible to set up demo and live accounts just by using your hand-held device.

Brokers that offer in-house and third-party trading platforms are doing their clients a great service – it’s always good to have choices. It probably isn’t a deal-breaker, but for many apps, you may find you have to set up two log-ins, one for your actual account at the broker and another for the trading dashboard.

Traders who use the MetaTrader platforms, MT4 and MT5 will notice that their account details are linked to the MetaTrader app, but that the app itself is very much MetaTrader’s project.

One house-keeping note is that downloading a broker’s app often leads to an improved trading experience. While it is possible to access broker platforms via web portals, this remains a crucial back-stop in the event you have connectivity problems. However, in any scenario, downloading and using the app is always to be advised.

The reality is that some broker apps are better at replicating desktop tools on a smaller screen. If you’re at all likely to be trading or even just monitoring the markets on your phone or tablet, an app is certainly recommended.

Trade execution – the crucial job of trading in and out of positions

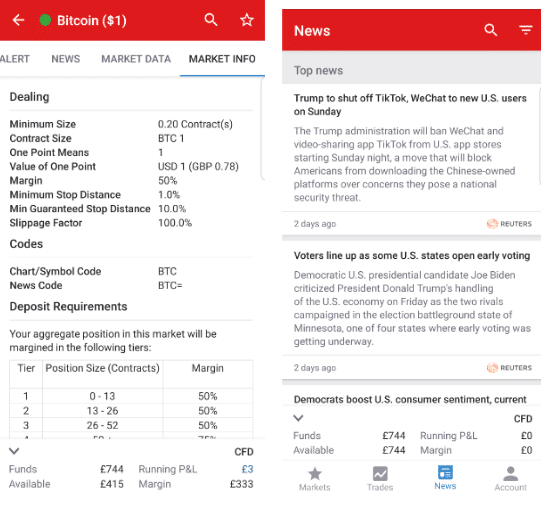

The trading interface is likely to be the screen you use most when trading on the go. Having direct access to live markets is increasingly important and having apps that let you manage positions is a big help.

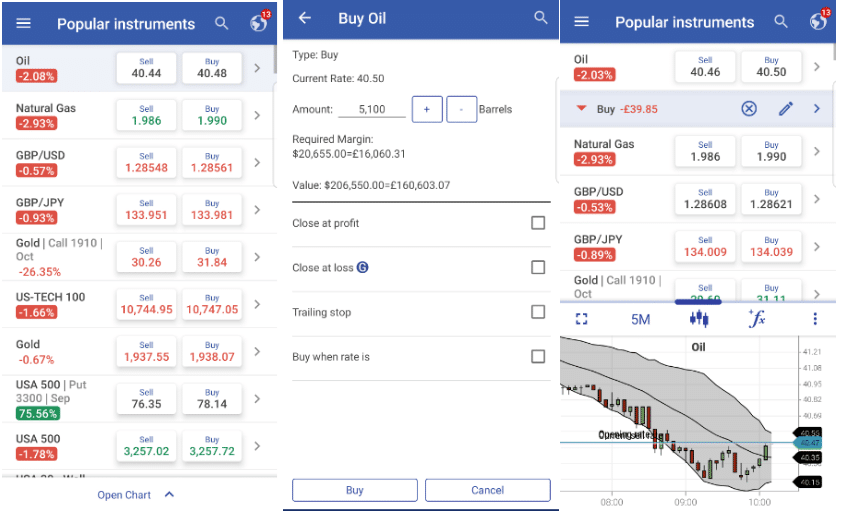

Most of the apps in the market have a home screen that displays the popular markets. Major forex pairs and global equity indices are usually included. Popular commodity markets like oil and gold are also likely to be there along with cryptocurrencies such as bitcoin.

From here, it’s possible to enter any of the markets and buy or sell. You’ll also note that price charts are also available to ensure you have a visual image of the market activity.

News and events – keeping up with events impacting your trading

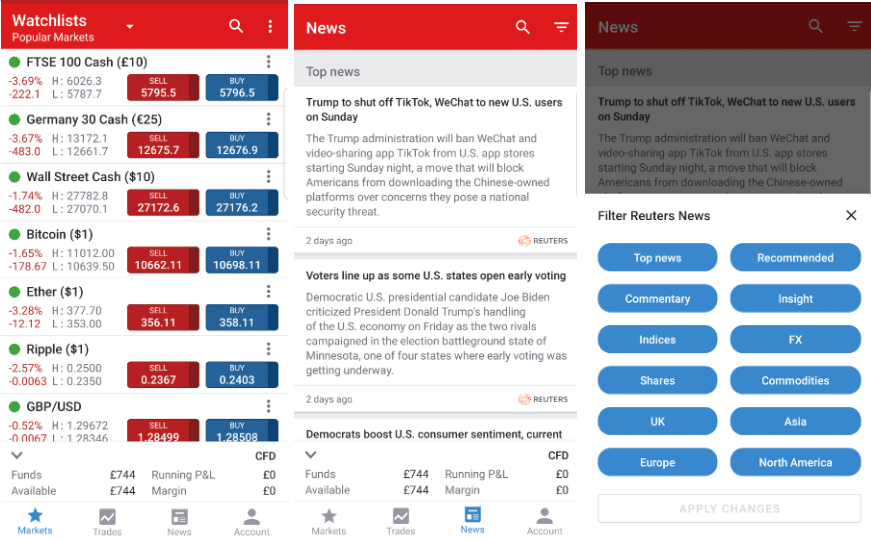

Something to also look out for is an app that offers tradable news. Some offer none, some offer some.

The reality is that it’s possible to tap into the news service provided by operators such as CNBC, Reuters and Bloomberg, but having an in-app news feed is always nice to have.

Market access – ability to trade a range of markets

The bigger brokers, which offer a greater number of markets on their desktop platforms, do a good job of ensuring mobile traders have the same opportunities.

Popular fast-moving markets such as forex and stocks are a good fit with mobile trading. There are other markets that can also be traded and some brokers also offer ETFs, options, bonds and even grey-market IPOs.

When working trading on a hand-held device, there’s no need to feel you’re missing out on market opportunities.

Strategy planning – having access to tools to improve your returns

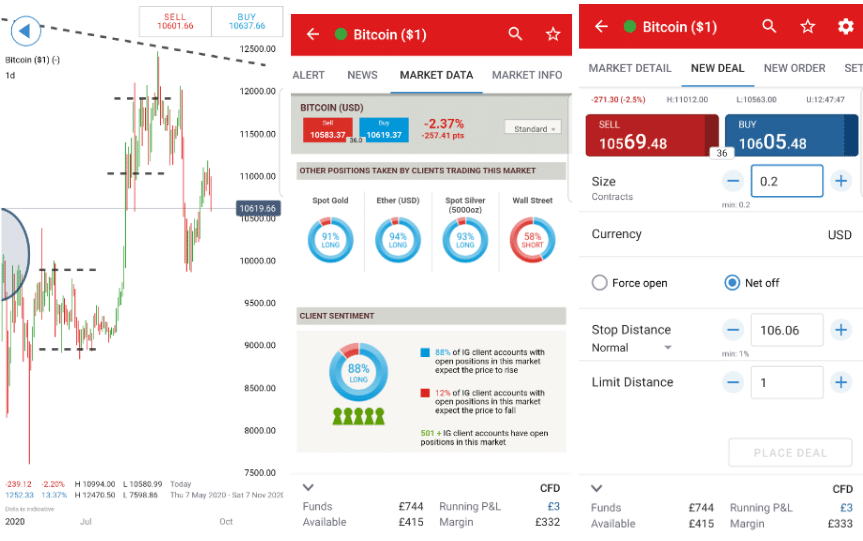

While it’s the case that research from third party-sources can of course be incorporated into your strategies, there’s certainly benefits from having the option to use them within the app.

App technology is constantly evolving, meaning that some platforms have better charting and analysis tools than others. When flaws are recognised, the good news is that consistent upgrades from providers ensures that the whole sector is continuously improving.

The tools on most apps permit you to research and develop your preferred strategy:

- Scalping

- Momentum

- Buy-and-hold

Price alerts – use your trading platform to notify you of entry and exit points

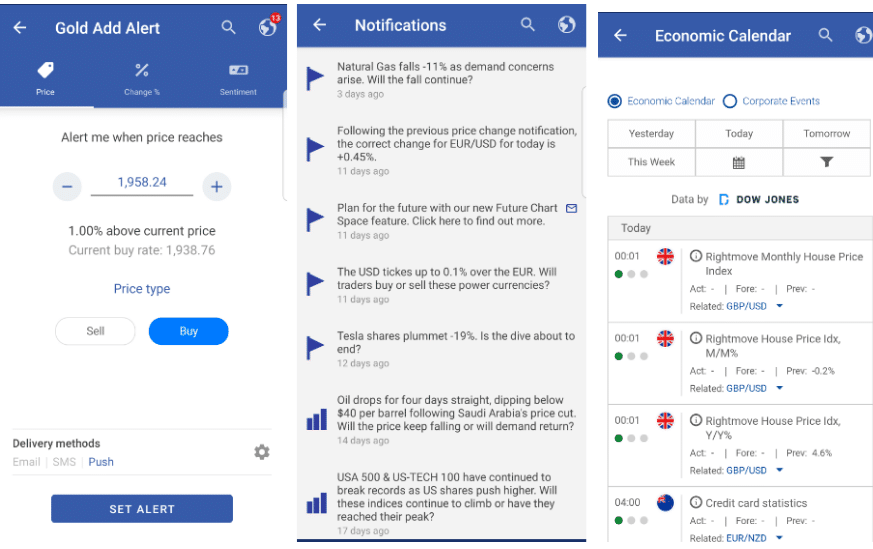

With mobile trading being all about keeping in touch with the markets, the ‘price alerts’ function is likely to be something you’ll want to utilise.

Simply choose your market, enter what price level you want to be notified at and set the alert.

You will find that different brokers offer different kind of notifications. So, there’s something for everybody, regardless of the nature of your usage.

If you’re just looking to keep up with broader market events, some apps also offer alerts for major breaking news. This could concern a significant price move in an asset or a story that is geopolitical in nature.

Learning and education – being able to use spare time to improve your trading

One of the tricky aspects of mobile trading when you find you have some time on your hands to perform some research. When using an app, this can be challenged by the fact that screen size is smaller.

It’s also the case that not all apps carry over exactly the same desktop functionality to the mobile set up.

This is one of the areas where there is currently most divergence between the different platforms.

Account maintenance – managing your account effectively

Mobile platforms offer all the account admin functionality of the bigger screen versions, which can impact your trading profit / loss account.

It’s all too easy to dismiss the ability to wire funds into your account quickly and easily, allowing you to take advantage of a trading opportunity.

Security – even more important on devices that can easily go missing

Handset choice may play a role here. Institutional investment firms offer guidance to their employees in terms of what handset they can use. The traditional view has been that Apple handsets compare less favourably to others.

However, all handsets can be misplaced, and if you’re starting out in trading, some precautions you can take include:

- Adjusting your screen’s lock-out functionality

- Choosing a broker with an app that automatically locks out

- Upgrading your handset access codes

As ever, the biggest risk to your cash is likely to be signing up with a fraudulent broker. This can happen, and it is essential you choose a broker that is regulated by at least one of these teir-1 regulators:

- Financial Conduct Authority (FCA) in the UK

- The Cyprus Securities and Exchange Commission (CySEC)

- The Australian Securities and Investments Commission (ASIC) in Australia

- Dubai Financial Services Authority (DFSA) in the UAE

These authorities have policies in place to protect account holders. If they’ve gone to the trouble of ticking all those boxes, you can take that as a sign of commitment to their clients.

The bottom line

All the apps provided at the quality-end of the broker sector provide clients with an effective means to keep on top of their trading. While there is something of a ‘space race’ going on as different brokers continuously roll out their upgrades, this is to be welcomed as traders take on fast-moving markets.

Although some of the heavy lifting in terms of training and research materials is missing on some apps, brokers with a more ambitious approach have transferred nearly all the desktop functionality over to their mobile trading platforms.

It’s an exciting area of the market, and the extent that full service has been replicated on smaller screens is quite an achievement. More importantly, it can have very real implications for your trading performance.

People who read this also viewed: