It’s no secret – investing has, historically, outperformed saving cash in a bank account. The Federal Reserve, Bank of England, and indeed most central banks currently targets an inflation rate of 2% each year, which means your cash loses its value over time as the cost of living increases.

Online broker platforms have revolutionised the investment industry by offering cost-effective and reliable ways of gaining exposure to the stock markets. The move by retail investors into stocks has been helped by share prices rallying, and retail investors who make the right decisions have posted significant returns. If you’d invested in the relatively sedate S&P 500 index in January 2023, by the end of the year, you’d have recorded a gain of more than 20%, with this year on track for similar gains with Q4 remaining. With that in mind we take a look at how to choose some of the best shares to buy for beginners.

Why Shares Are Ideal For Your First Trade

Nothing is ever guaranteed in the markets, but part of the appeal of stock trading is the impressive historical returns. Equities are also associated with relatively low-price volatility. There is enough opportunity to make returns, but less chance that wild price swings will blow up your account or cause you to sell up at just the wrong time due to panic starting.

Stocks listed on reputable exchanges such as the New York Stock Exchange, London Stock Exchange, and NASDAQ are regulated instruments. That means their markets are monitored to ensure trading is fair and efficient. The companies also have to comply with high levels of transparency in terms of reporting which means investors are less likely to be blind-sided by a company’s management or insider dealings.

YOUR CAPITAL IS AT RISK

What Are The Qualities of Great Beginner Shares?

Buying shares in a company means you own part of it and are entitled to a share of any future profits. Most share valuation models derive current share price from expected future earnings, so a firm with improving medium and long-term prospects should see its share price begin to climb.

Volatility & Dividends

Profits returned to investors are called dividends and can be in the form of a cash payment or more shares. Exact T&Cs vary from company to company, but many firms pay dividends quarterly or semi-annually. Firms in stable sectors with limited growth potential tend to pay higher than average dividends and are known as income stocks.

Management teams of firms with exciting new projects in the pipeline may choose to re-invest profits in new schemes. Companies that take this approach can expect their share price to outperform the market average and are called growth stocks. In this case, investor gains are in the form of capital gains, when, or if, those new projects come good.

The greater number of variables involved in valuing a growth stock results in differences of opinion on what the share price should be. The greater the difference, the larger the price swings when news updates are released, and certain groups adjust their view of the firm’s prospects. Growth stocks tend to be associated with higher price volatility. That can be a problem for novice traders as P&L swings can cloud decision making.

Share price history & Technical analysis

Historical share price performance is tracked by those who use technical analysis to help their decision making. The brokers mentioned in the above list of trusted brokers provide charts and technical tools which can be used to help spot the next move.

These technical analysis tools include SMA’s (Simple Moving Averages), Fibonacci levels and Heiken Ashi candles. Some traders base their strategies around these metrics, whilst others lean more towards fundamental analysis.

Source: IG

Holding periods and what to avoid

One top tip for beginners is having a clear strategy and establishing trade entry and exit points. Consideration also needs to be given to how long you intend to hold your position. The answer to that question is down to individual circumstances. One common error carried out by beginners is over-trading which involves not giving positions enough time to develop. It’s essential to keep up to date with market events, but it is also advisable to choose a strategy and stick with it.

Beginner-friendly Stock Analysis and Trading Strategies

If you’re new to trading, there are certain questions to ask which can help improve your chances of being successful.

The first is to establish how much time and resources you can commit to trading. Some strategies are more labour intensive than others, and buying a basket of shares in a sector you think will do well using Exchange Traded Funds (ETFs) might be an alternative to purchasing single stocks.

The second important check is that your chosen strategy is the right one for current market conditions. The market correction in January of 2022 highlights how market sentiment can change due to a reappraisal of the underlying economic situation.

Demo accounts are helpful tools for beginners getting to grips with the practicalities of trading. They’re also used by experienced traders who want to test a new strategy in a virtual environment. If you’re considering using any of the below strategies, it is important to familiarise yourself with them before putting hard cash into the market.

- VWAP Trading Strategy

- Pullback Trading Strategy

- Heiken Ashi Trading Strategy

- Trendline Trading Strategy

- 52 Week Trading Strategy

- Price Action Trading Strategy

- Volume Trading Strategy

- Intraday Trading Strategy

Five Top Stocks For Beginners

The below list of five stocks include our thoughts on some of the best shares to buy for beginners, using fundamental and technical analysis to pick out suitable targets for novice traders to purchase given the current market conditions. It also factors in a degree of diversification.

One thing that hasn’t changed is the functionality of the online platforms that keeps getting ever more user-friendly. Opening an account is done online and can be completed in minutes.

Here are five of the best shares for beginners to buy today:

| Name | Symbol | Exchange | Market Cap | P/E Ratio |

| Amazon | AMZN | NASDAQ | 1.553T | 47.16 |

| Johnson & Johnson | JNJ | NYSE | 429.52B | 17.02 |

| Britvic | BVIC | LSE | 3.24B | 20.5 |

| BHP Group | BHP | LSE | 174.39B | 12.6 |

| Bank of America | BAC | NYSE | 376.14B | 12.87 |

Amazon (NASDAQ: AMZN)

Source 123RTF

Amazon.com Inc stock has been hard to ignore for some time, but the latest earnings update suggests that momentum continues to build. That report released to investors on 3rd February 2022 included an eye-watering statistic relating to Earnings Per Share (EPS), which came in at $27.75 per share. Forecasts had predicted $3.77 per share.

It can be challenging to ignore the FOMO around Amazon. An investment in AMZN in April 2014 would currently be showing a +900% return, but the good news for investors making decisions for 2022 is that the firm’s success has been well managed and was backed up by investment in new high-growth sectors.

The online sales platform has an almost unchallengeable position as the world’s go-to shop, but the AWS (Amazon Web Services) division is booming. AWS also has higher profit margins, so whilst it accounts for 12% of total revenue, it generates 60% of the group’s total operating profit.

The Covid inspired global shift to online working and socialising looks set to continue, which puts Amazon stock at the top of the list of best beginner shares.

Johnson & Johnson (NYSE: JNJ)

Source 123RTF

The threat of higher inflation and interest rates has blown some of the froth off the top of high-growth tech stocks, and a rotation into more defensive stocks such as Johnson & Johnson looks set to be one of the stock market trends to keep an eye on.

JNJ’s share price has posted consistent returns over the last three years, up 8.14% in 2021, 7.97% in 2020, and 13.03% in 2019. Its market cap of $429bn means the firm has the critical mass to develop new product lines, and its pharmaceutical products are well insulated from the risk of an economic downturn. It also has a dividend yield which is currently an impressive 2.59%

These returns might not be life-changing, but stocks with lower price volatility can be some of the best beginner shares as they take the emotion out of investing. That can help newbies hold their nerve during the price corrections, which inevitably hit the markets from time to time.

Britvic (LSE: BVIC)

Source 123RTF

UK drinks manufacturer Britvic has a portfolio of leading brands and investing in BVIC continues the theme of investing in firms that offer some protection against economic uncertainty.

This could be a good year to diversify capital across different sectors. Britvic might be an excellent long-term bet thanks to Covid and the lockdowns that suppressed its stock price over the last two years.

With popular and government opinion moving towards the world learning to ‘live with Covid’ future full-on lockdowns appear less likely than they did 12 months ago. The firm has a £2.35bn market cap, pays a dividend yield of 2.75% and has a P/E ratio just above 20. With strong brands such as J2O, Robinson’s, and Tango supported by tie-ups to produce Pepsi and 7UP in the UK until 2040, the stock looks set to benefit from a return to normality. Currently trading at 879p, there is plenty of room for share price growth before BVIC stock has to contend with pushing past the all-time-high share price of 1,079p recorded in October 2019.

BHP Group (LSE: BHP)

Source 123RTF

Commodity prices are notoriously volatile, but the recent surge in the price of metals and energies looks set to continue. They’re already influencing BHP, which has global interests in copper, iron ore, nickel, petroleum, potash, and metallurgical coal.

BHP ticks a lot of boxes. The firm recently announced a 61% increase in pre-tax profit for the six months to the end of December 2021. It has a dividend yield of 9.12% and a P/E ratio of 12.7.

There are two potential kickers for those looking to buy BHP. The first is that copper stocks are due to play a part in the global economy’s transition away from carbon dependency. The other is that a commodity super-cycle could be forming. These multi-year trends are moments when commodity investors really cash in.

Bank of America (NYSE: BAC)

Source 123RTF

The banking sector is one of the few areas of the economy positioned to benefit from the anticipated interest rate rises. Increased numbers of defaults by borrowers have to be factored in, but higher interest rates lead to improved profit margins.

US banks have struggled to make a return on the difference between savings and borrowing rates due to base rates being close to zero. Offering savers negative interest rates on cash balances is just too hard an idea to push through. With the US Federal Reserve due to start sending rates higher, BAC, with its $376bn market cap and exposure to all areas of the North American economy, could be one of the best-undervalued stocks.

Getting Into Share Trading As A Beginner

Buying shares in a company has always been a relatively straightforward process, but online broker platforms have taken ease and convenience to another level. The platforms have been designed to minimise user error and are robust and reliable, and intense competition between brokers has resulted in cost savings being passed on to clients. Buying into companies with good prospects has never been simpler.

Diving straight into the markets is one option but registering for an online Demo account is highly recommended. That way, you can practice picking and buying stocks using virtual funds and upgrade from risk-free trading to a live account when the time is right. As Demo accounts are free to use, they also offer a chance to test out different brokers to find the best fit.

Online brokers

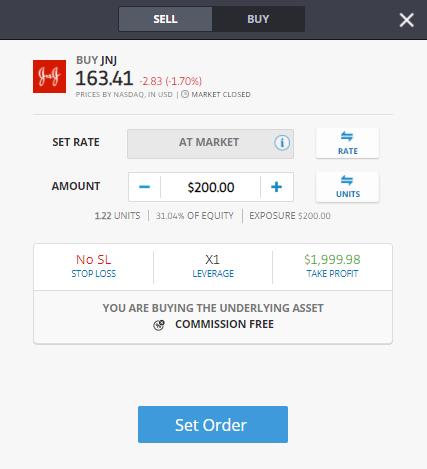

Firms that offer free to use share trading accounts include eToro and IG. The process of executing a trade can be as simple as entering the quantity you want to buy and clicking a button. At that point, cash in your account is converted into a stock position. Developing an understanding of how to get the best out of your platform can help the trading bottom line, and the below breakdown of the process and some of the technical terms used has been compiled by experienced traders.

Putting on a trade

Locating the stocks you want to trade at eToro can be done by filtering by sector or using the search function.

Different order types to consider

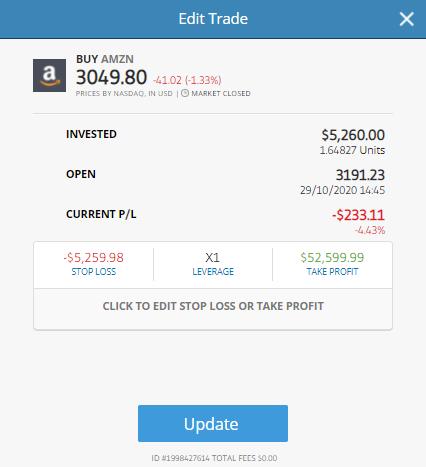

It’s possible to click and buy or use a Limit Order where you input the price level at which you want to enter into a trade. Applying some patience can help optimise trade entry points. Once in a trade, Stop Losses and Take Profit orders allow you to manage your positions using automated instructions to sell at specific price points. That way, you don’t need to monitor your portfolio 24/7.

Source: eToro

Profit & Loss

After executing a trade, the stock position you have bought will have its value determined by live market prices.

Source: eToro

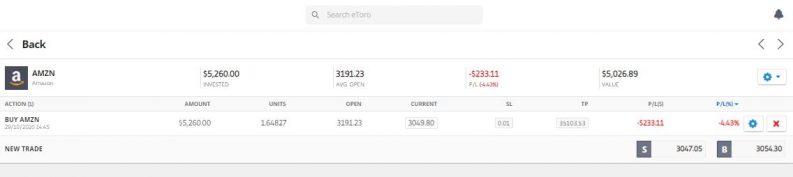

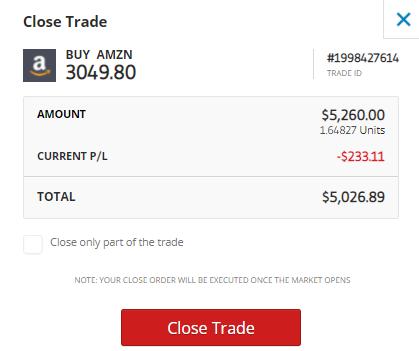

Performance can be monitored in the Portfolio section of the platform, which is also the area of the site to visit when the time comes to sell all or part of your position. When trades are closed out, P&L converts from being unrealised to realised, and gains or losses are crystalised and reflected in the cash balance. That capital can then be used to buy other positions or returned to the bank account which funded the brokerage account in the first place.

Source: eToro

Some brokers offer price alert messaging systems to keep you updated on market events and stop-losses and take profit orders can be adjusted at any time during the life of a trade. Checking the site’s Portfolio section soon after executing a trade is highly recommended. Even experienced traders make ‘fat finger’ errors, so spotting and correcting them before market prices move too much can prevent any mistakes from becoming costly.