Trading financial markets such as forex on spread betting platforms is getting easier. Not easier to be successful, that takes as much hard work as ever, but to actually execute trades is becoming a simpler exercise, largely as a result of an improving suite of trading platforms offered by spread betting firms in the UK.

New entrants into the industry, increased competition among brokers, and a more tech savvy trading community is also feeding through with improved terms, as well as improved choice for spread bettors.

How Does Spread Betting Forex Work?

Spread betting in Forex is a type of derivative trading that allows you to speculate on the price movements of currency pairs without owning the underlying currencies. You are effectively calling whether you believe the price of a currency pair, such as EUR/USD or GBP/USD, will rise or fall.

This type of trading is popular in the UK, where it is tax-advantaged, as profits are not subject to capital gains tax. The commonly used term “spread” in trading refers to the difference between the buy (ask) and sell (bid) price of a currency pair, or other instrument, and is not to be confused with spread betting. You are speculating whether the price or value of the underlying asset will be higher than the ask price or lower than the bid.

When spread betting forex you place a trade based on the amount you wish to stake per point of movement, typically measured in pips in Forex. Your profit or loss will depend on how far the market moves in either direction. This is different from regular forex trading, in that you are not placing a total trade amount, but an amount per incremental move.

Getting Started, Or Not…

The process of spread betting Forex begins with selecting a currency pair and evaluating the spread quoted by the broker. Once you decide to trade, you can either go long (buy) if you expect the currency to rise, or go short (sell) if you predict a fall.

Forex Spread Bet Example:

- Choosing a Currency Pair: You select the currency pair you want to bet on, such as EUR/USD, GBP/JPY, etc.

- Pay Attention To The ‘Spread‘: The broker will quote two prices — a bid (the price you can sell) and an ask (the price you can buy).

- Placing Your Trade: You place a bet per point (pip) movement in the currency pair. For example, if you bet £1 per pip, and the market moves 50 pips in your favour, your profit will be £50.

– If you believe the currency will rise, you would go long (buy).

– If you believe the currency will fall, you would go short (sell). - Profit or Loss: Your P/L is determined by the size of your bet per point and the number of points (pips) the market moves relative to the direction of your bet.

Leverage plays a key role in this type of trading, allowing you to control larger positions with a smaller initial capital outlay, known as margin. With a leverage ratio of 30:1 (the maximum allowed in the UK for forex trading), you can control a position worth £30,000 with only £1,000 in margin. This carries a lot of additional risk, and position sizing is something you will need to consider very carefully when managing the risk on your account.

Many traders try and fail in forex, whether via CFD or spread betting. The Forex market is complex, and influenced by a wide array of factors including economic data, central bank decisions, geopolitical events, and general sentiment, all of which can make price prediction challenging so it is important to go into this type of trading with your eyes open to the risks.

The use of leverage also brings the risk of margin calls. If a trade moves against you and your account lacks sufficient funds to cover the position, you may receive a margin call, requiring you to deposit more money to keep the position open. Failure to meet a margin call can result in the forced closure of your positions, locking in potentially large losses. The fast-paced, ever active nature of Forex markets, combined with leverage, can create intense psychological pressure on traders, leading to emotional and often poor decision-making. Even though stop-loss orders can help mitigate risks, they do not guarantee protection during periods of extreme volatility or market gaps, where prices jump from one level to another, bypassing the stop-loss trigger.

If you are looking for something a little less volatile, spread betting brokers will provide access to a wide range of markets beyond Forex, including indices, commodities, and stocks, offering other opportunities for diversification and differing levels of leverage. The stock market is often considered a better entry for beginners than fx.

UK Regulated Spread Betting Platforms

If you are just starting out, the safest approach is to begin with a demo account while focusing on learning the fundamentals of trading, technical analysis, and market behaviour. This way, you can gain experience without risking real losses while you are still learning.

Below we include five of the best spread betting platforms in the UK, and why they might be a good fit for you. All of the brokers offer the security of being authorised and regulated by the UK’s Financial Conduct Authority (FCA). This means that the firms have to comply with strict rules and regulations relating to client care.

Any cash held in your account (up to £85,000) is also protected by the Financial Services Compensation Scheme (FSCS), in the same way that funds in high street banks are protected.

Pepperstone – a choice of three top-grade platforms and award-winning customer service

Spreadex – more than 20 years on the market, great trading conditions, and intuitive platform. Took home two awards for Best Spread Betting Provider 2024 and Best Spread Betting Platform 2024 recently.

City Index – front-to-back set-up designed to support those new to trading

IG – a truly multi-asset broker, offering over 17,000 markets and all the tools you need to trade them

FXPro – packed full of some of the best trading tools in the market

1. Pepperstone

A relatively newer entrant into the spread betting space is Pepperstone. The firm has an established reputation as one of the best forex brokers around, and if you are spread betting forex, or indices, you will be in trusted hands. The broker has extended its product offering to include spread bets, which will be welcomed by many in the trading community, particularly due to the very wide selection of trading platforms you can choose from.

The firm’s global expansion plans bring new users a chance to enjoy the quality and service that the firm is known for. It often tops the charts in terms of customer service ratings, and this could be particularly useful if you are new to trading or spread betting.

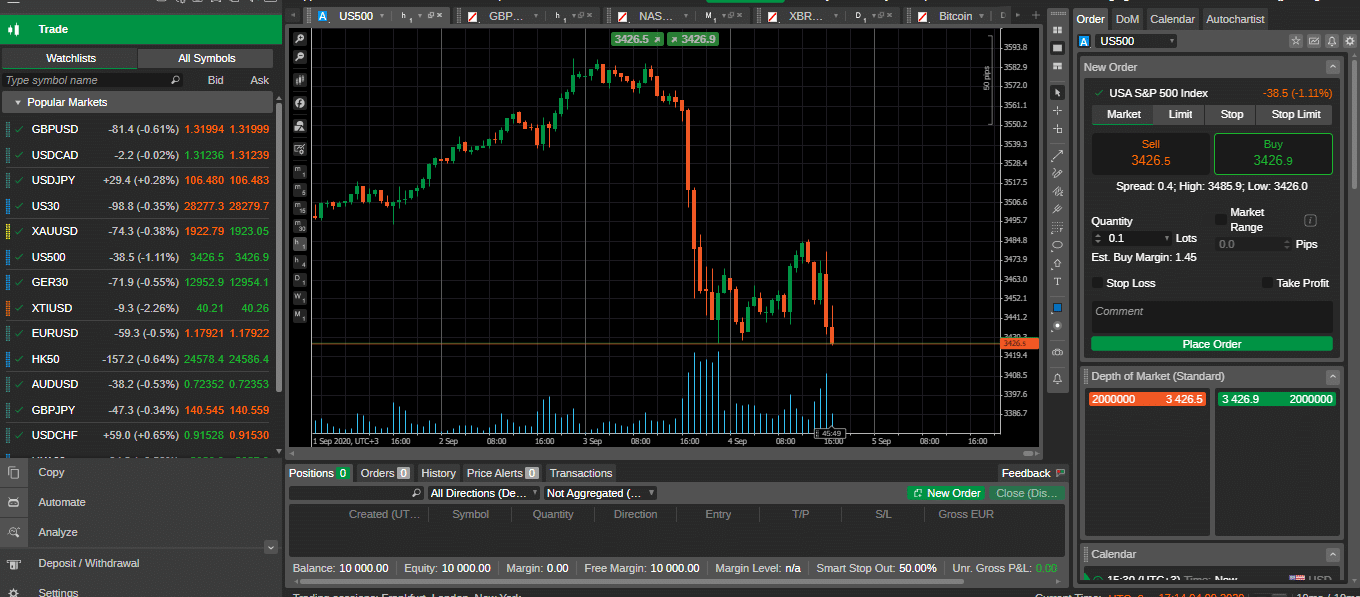

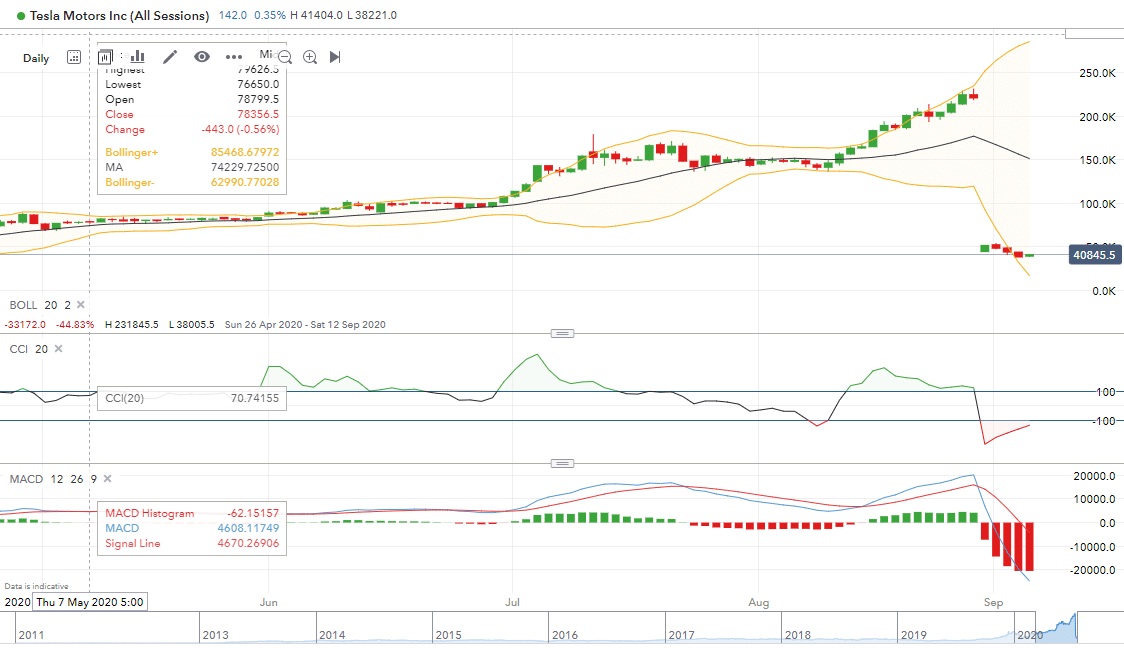

Pepperstone clients can enjoy tax-free profits while spreade betting forex, commodities and indices on the industry-leading platforms MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView and cTrader. Trying them out using a Demo account is a possible first step if you are looking to sample what is on offer.

The firm processes on average more than $12bn of trades per day. From a client perspective, this feeds through as consistently low trading spreads, low latency and lightning-fast execution.

The research and learning materials are also a notable highlight. They range from ‘how-to’-style tutorials to ‘week ahead’ presentations to help you navigate a profitable course through the markets.

There is also the opportunity to bolt on your own automated trading models to the platforms. If it appeals, the Expert Advisors service that comes with MT4 and MT5 provides another route towards a more hands-off trading approach.

The range of markets on offer might not run into the thousands, but there is enough variety to suit all standards of traders. The nice-to-have features of the Pepperstone spread betting platform are enough of a draw to keep the broker’s client-base loyal.

What we liked about this broker:

- Strong regulatory framework involving Tier-1 authorities

- Award-winning customer support

- Research materials specifically designed to help your bottom line

- A choice of top-of-the-range trading platforms

- Low forex trading costs and quality trade flow

2. Spreadex

Established with a solid foundation of trust and regulatory compliance, Spreadex offers a unique blend of financial (and sports) spread betting, coupled with stocks, CFDs and options trading. There is a seamless onboarding process, with two main account types (for CFD trading and spread betting), ensuring you can easily select the option that you need right off the bat.

This is a spread betting platform that as far as financial trading goes, was spread bet first, and everything else later. It just so happens that everything else that followed has provided a really good all around user experience, that has kept the broker right near the top of all best spread betting platform lists we can find.

With more than 80% of reviewers on Trustpilot awarding the platform a full 5 stars, this one remains deserving of it’s place year after year.

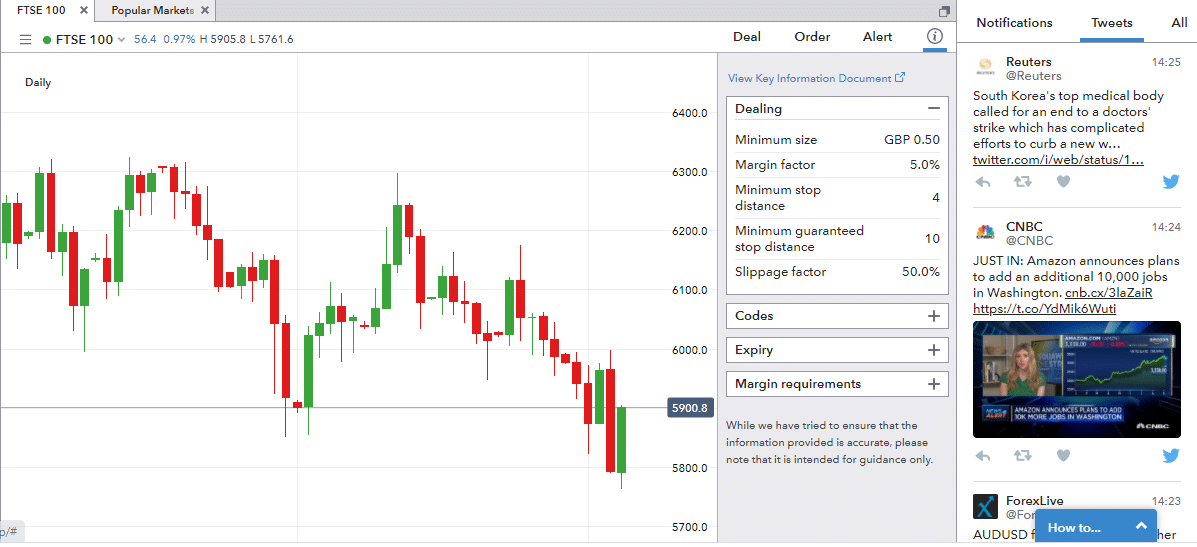

The Spreadex trading experience is bolstered by its proprietary trading platforms, available on both web and mobile. These platforms are lauded for their reliability, customizability, and array of advanced charting tools. You can enjoy some of the expected features such as trade via charts, pattern recognition, and a suite of advanced technical indicators.

The platform offers a rich selection of educational materials, including a financial trading blog, video training center, and platform tutorials. Additionally, advanced charting tools and a comprehensive economic diary are available to assist with your market analysis.

In the realm of trading fees, Spreadex is positioned really competitively as far as spreads go. The simple fee structure could be particularly appealing to traders who are looking for straightforward costs vs some of the competition.

What we like about Spreadex :

- Regulation – FCA-regulated, ensuring high standards of security and trust.

- Market Variety – Over 10,000 trading products including forex, shares, and commodities.

- Platforms – User-friendly, proprietary platforms available on web and mobile. Also the ability to trade via TradingView.

- Account Types – Tailored accounts for spread betting and CFDs, with no minimum deposit requirement.

- Educational and Analytical Tools – Comprehensive tools and resources for market analysis and trading education.

3. City Index

London-based broker City Index has been offering its clients spread betting markets since its foundation in 1984.

Having a strong pedigree has not diminished the firm’s ambitions, and in the Online Personal Wealth Awards of 2019, the firm was awarded the title of ‘Best Spread Betting Provider 2019’.

Spread betting with City Index provides a tax-free way to trade over 8,000 global markets.

The firm picks up points for the transparency it offers regarding pricing. Not only does this allow traders to carry out a fair appraisal, but it’s also a sign that it is comfortable that its prices match up with its competitors. As the site states:

“We are upfront about the costs of trading with us and our transparent pricing means you’ll always know our charges.

View a full list of pricing and charges at City Index across all of the markets we offer.

- We offer fixed and variable spreads

- Our retail client margins start from 3.33%

- Benchmark UK financing is LIBOR +/-2.5%”

The firm’s trading platform is particularly user-friendly, and also includes a great range of software tools designed to make your trading a success. The Market News and Training areas on the site have for many years provided just the kind of information that traders need.

What we liked about this broker:

- Strong regulatory framework (FCA and FSCS).

- Great range of entry-level research and learning materials

- In-house trading platform designed with beginners in mind

- Tight spreads and thousands of markets to trade

- Ultra-transparent T&Cs

4. IG

IG is another strong contender for the title of ‘best spread betting platform’. Founded in 1974, the broker has established a reputation for being a great entry-level broker and also one that comfortably supports intermediate and advanced spread betters.

The firm prides itself on its continuous innovation, customer service and range of markets. The proprietary platform offers granular-level information on thousands of markets and is very easy to use.

What we liked about this broker:

- A vast library of learning and research materials

- Over 16,000 international equity markets to trade

- Out-of-hours markets in US stocks

- Authorised by six Tier-1 regulators

- User-friendly site functionality that suits both beginner and advanced spread betters

5. FXPro

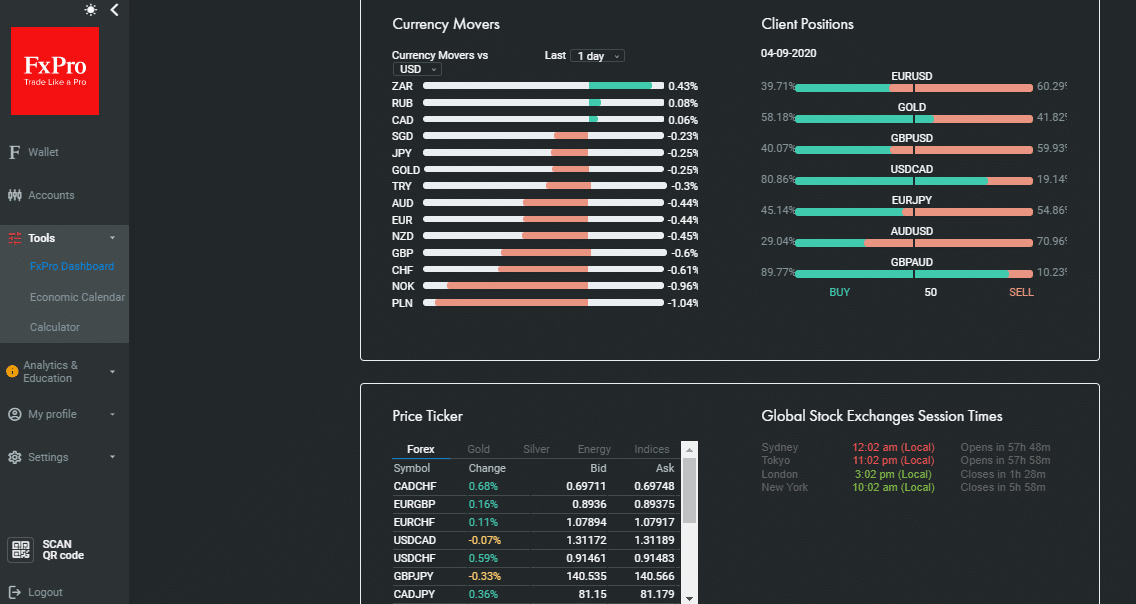

The trading platform FxPro Edge is a really big plus point for FXPro. It is highly customisable and can be accessed on any device, through any browser, and takes away the need for a desktop download.

Not only is it easy to get onto the FXPro platform and trade, but there is also an extensive range of markets to choose from, including forex, shares, spot indices, spot metals and spot energies.

Other platforms are available, including MT4, MT5 and cTrader, but the Edge platform is the broker’s flagship offering. The great line-up of tools is finished off by the leading research and analysis site Trading Central and the in-house news service Live Squawk also being provided.

The supporting trading infrastructure is equally impressive. The firm has posted a record number of 199,397 orders filled in a single day. These are processed via ultra-fast order execution, with most client orders filled in under 11.06 milliseconds.

What we liked about this broker:

- Super-tight trading spreads

- Great app and mobile trading experience

- Trading into the heart of the markets

- High-quality Edge platform

- Additional news and research from Trading Central and Live Squawk

The five brokers all have a claim to be the best spread betting platform. With that in mind, broker selection will ultimately come down to personal preference. The different approaches taken by the respective brokers means that finding one that is right for you is now even more likely.

The classification of spread betting as gambling or not depends largely on one’s perspective. There are certainly elements that resemble gambling, such as the speculative nature of the activity and the risk of loss. Yet it also incorporates strategic and analytical elements that can differentiate it from pure gambling. To some, the speculative nature of spread betting will be considered a form of gambling due to its risk and potential for loss but it is in of itself a financial trading product.