The truth is that both instruments can get you to where you want to go. But when you face up CFD vs and ETF, what are the key differences? This review will help you decide which direction you want to take and will cover the following:

- What are ETFs?

- Why are ETFs so popular?

- What is CFD trading?

- Why is CFD trading so popular?

- CFDs vs ETFs – pros and cons

- The bottom line

What are ETFs?

An exchange-traded fund (ETF) is a type of investment fund. It’s very similar to a traditional mutual fund in that you buy one product but get exposure to a basket of other underlying assets.

ETFs first came on the scene in the 1990s and the growth in the market has been staggering. Current forecasts are that the value of the ETFs market will be close to $50tn by 2030.

Why are ETFs so popular?

ETFs provide a user-friendly and flexible way to trade the markets.

Convenience

If you buy an ETF that relates to emerging market equities, then in the background, the ETF provider will be busy buying a range of global equities – possibly hundreds of them – so that you get the exposure you desire.

The alternative is to spend time buying shares in each emerging market firm yourself. So, you can see that ETFs make it easier for you to put that type of position on.

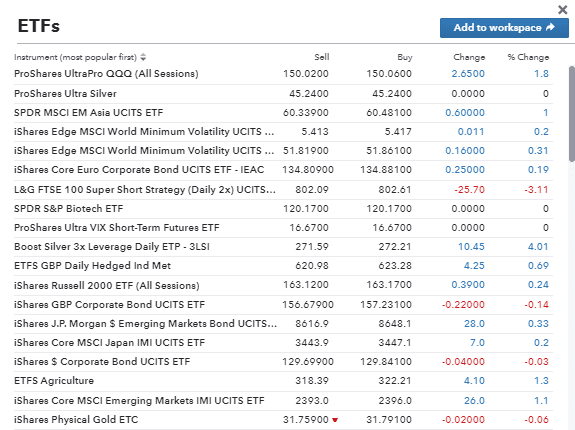

Source: IG

Live prices

The ‘exchange-traded’ aspect of ETFs is the new and exciting feature of the product. It goes a long way to explaining the product’s ever-increasing popularity.

Mutual funds have traditionally been priced once a day, at the close of business. This makes it easier for the fund manager to reconcile their position. If you decide to buy or sell your holding, it’s done based on that valuation.

ETFs, on the other hand, can be bought and sold throughout the day. They are listed on stock exchanges and traded using live prices, which means that they offer a lot more flexibility.

ETF tax breaks

Tax rules differ from country to country, but ETFs are generally seen as being a tax-efficient investment vehicle. They tend to have exemptions from transaction taxes and capital gains tax, and can also receive special treatment in terms of dividend credits.

The devil is in the detail, but the good news is that research into the tax treatment of ETFs is likely to throw up a few nice surprises.

What is CFD trading?

CFDs (contracts for difference) are also user-friendly. Buying a CFD in gold, for example, means that you will benefit if the price of gold goes up and lose money if it goes down.

The CFD you buy is a contract between you and your broker. The money you place in your account at the broker will act as a guarantee should you make a loss.

If you wire $1,000 and your gold trade loses you $200, the broker will debit your account and your balance will then be $800.

If you get the call on gold right and make $100, the balance on your account will read $1,100.

With CFDs, the relationship is between you and the broker – however, the broker will take live prices from the real-world market.

Why is CFD trading so popular?

The broker’s role as a middle-man actually means that there are several benefits to trading CFDs.

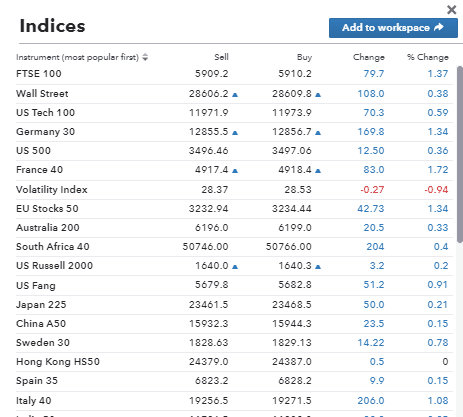

CFDs offer an opportunity to trade a variety of markets

Once you get to grips with the basic principles of CFD trading, you can use them to trade nearly any financial market. CFD markets offered by the broker IG include:

- Stocks

- Forex

- Cryptocurrencies

- Share indices

- Commodities

Convenience

Online broker platforms are designed to make CFD trading as simple as possible. There’s an incredible amount of supporting materials, such as research and training tools, available. In terms of executing a CFD trade, it really does come down to the click of a button or the tap of a screen.

The top-grade brokers also offer the option of trading on handheld devices. This means that you can keep on top of your trading throughout the day.

Source: IG

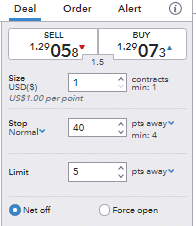

Short selling

When you take a long position in a CFD, you don’t actually own the underlying asset. You are instead entering an agreement to pay or receive cash depending on whether the price moves in your favour.

Turning this around a little means that you can also sell something you don’t actually own. This is selling short.

If you think that Tesla stock is overvalued and that the market valuation is a product of CEO Elon Musk’s charisma rather than business fundamentals, then you can sell short. After entering into that trade, you’ll make a profit if the price falls and a loss if it rises.

Source: IG

There are tax advantages when trading in CFDs

In the UK, buying shares incurs a 0.25% SDRT charge. Opening a trade with the P&L already underwater is obviously worth avoiding it at all possible.

As CFD trading means that you do not actually hold the underlying instrument, you can avoid the SDRT charge. It’s worth checking the T&Cs of the situation, but part of the popularity of CFDs is the opportunity to take a more tax-efficient approach.

CFDs vs ETFs – pros and cons

CFDs and ETFs are both incredibly popular ways to trade the markets. The reality is that many traders and investors might use both instruments to put positions on. Understanding their relative strengths helps explain why one might be preferred over another.

Ease

One of the advantages of ETFs is that the fund manager does a lot of the work for you. Their investment mandate will be quite specific. For example, if it states that they are going to hold the world’s top 100 equities by market capitalisation, then that is what they will do.

Being ‘passive’ funds, they follow the market, but just make sure that they do that to the letter.

If an individual wants to take a position in the world’s top 100 equities, not only is that a lot of clicking, but it’s also a lot of ongoing management.

If you have $1,000 that you want to invest in the top 100 tech stocks and choose to use CFDs, then each individual trade will be small in size and might be below your broker’s minimum trade size.

With ETFs, you just execute one trade and immediately benefit from having a well-diversified portfolio giving you exposure to a whole sector. These sectors can range from ethical investing to exposure to oil & gas.

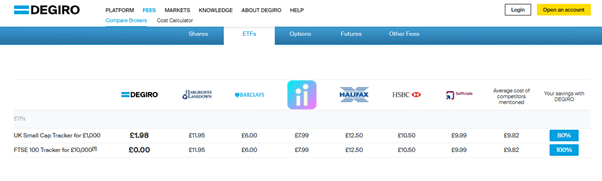

Cost

Comparing the costs of the two products is made tricky by their different nature.

CFDs can have ultra-tight bid offer spreads and higher holding charges. This reflects, and indeed facilitates, their use for short-term trading strategies.

Source: Degiro

The popularity of ETFs is proof enough that the fees associated with trading them are far from being an issue. The fees are particularly competitive when comparing ETFs to other fund products. The broker Degiro deserves a special mention in terms of low ETF fees – more information on that opportunity can be found here.

Financing

ETFs involve buying something outright, but CFDs are a margined product, which means that you place a deposit of funds and hold a derivative position.

As a result, it’s usually more cost-effective to hold a long-term position in ETF form.

Leverage

Leverage is the process of scaling up your position size so that your exposure to the market is greater than if you bought something outright. It cuts both ways, so any losses or profits you make are multiplied by the amount of leverage you use.

Trading on leverage involves additional risks and is something that’s best left to more experienced traders. If it is something you want to use, then CFDs typically offer greater variety.

Leveraged ETFs use a combination of derivatives and debt instruments to double or triple the movement of an underlying asset or index that it tracks.

In contrast, leverage ratios on CFDs can reach multiples as high as x30.

The bottom line

With so many new ways to trade the markets, it’s no surprise that people ask which approach is the best.

In answering that question, there is some benefit in studying how the majority of the trading community approach the subject.

A very broad generalisation is that CFDs are usually used for short-term strategies. In contrast, ETFs tend to be used to generate more moderate gains over a longer period of time.

ETFs have developed to offer some of the same features as CFDs. It is possible to use leverage and even hold ETFs that effectively short the market.

There is a sense that by copying these features of CFDs, ETFs are forcing the issue – possibly unnecessarily. More to the point, they never quite match CFDs in terms of leverage or short-selling functionality.

ETFs’ unique selling point is their role as an exchange-traded product that offers exposure to a wider sector. For many, this is enough to make them their instrument of choice.