The below analysis and the following points covered in this article will look at CFDs Vs. stocks, including:

- What is stock trading?

- Why buy stocks?

- What is CFD trading?

- Similarities between CFD and stock trading

- Differences between CFD and stock trading

- Final thoughts

What is stock trading?

Stock trading is a centuries-old method of investing. Stock exchanges grew organically out of the need to hook up investors and businesses. As the process became more popular, more formal exchanges such as the London Stock Exchange and New York Stock Exchange became centres of stock trading activity.

Stock trading is big business today and billions of dollars worth of shares are listed on global stock exchanges. People’s livelihoods are tied up in them, maybe as part of their pension, and speculatory trading can make or lose fortunes in moments.

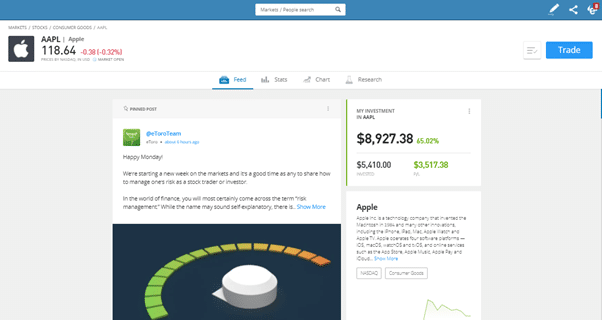

Source: eToro

The key feature of stock trading is that a firm’s valuation is based on the company’s future earnings. In return for their capital investment, stockholders take a cut of any future profits. The greater the size of your stock holding, the greater your allocation of the firm’s profits, which are paid out as dividends.

The valuation process can include aspects such as:

Why buy stocks?

For hundreds of years, making the right call on a stock purchase has been a great way to make a return for value investors.

Between 1989 and 2019, the average annual rate of return on the S&P 500 stock index was about 9.4%.

When you consider that global interest rates are currently near or below zero, it’s easy to understand the allure of stocks. Market risk, the risk that the value of your holding goes down is unavoidable but it is at least possible to find reliable and robust exchanges to trade on.

- Stock exchanges are regulated, offering investors greater security.

- Brokers facilitate trading in different shares by investors. It is strongly advised that you use a regulated broker.

- Stocks can be held in electronic or physical format. If they want to, investors can actually hold certificates confirming their stake and their right to any corporate profits.

The question is, if stock trading is so well established and has such a good track record, then why develop CFDs?

What is CFD trading?

CFDs were developed in the 1990s and are a specially designed instrument that allows investors to gain exposure to an ‘underlying asset’. Trading CFDs — where the underlying instrument is actually a stock — is, as you might expect, very similar to trading the stock itself.

When you are trading stock CFDs, you hold a derivative of the shares in the underlying company, for example Tesla Inc.

Whether you’re trading stocks or stock CFDs, the aim is the same — to profit from the price of the asset changing in your favour. This occurs when other market participants take the same view that the stock you hold is mis-priced. Then the forces of supply and demand come into play and move the price.

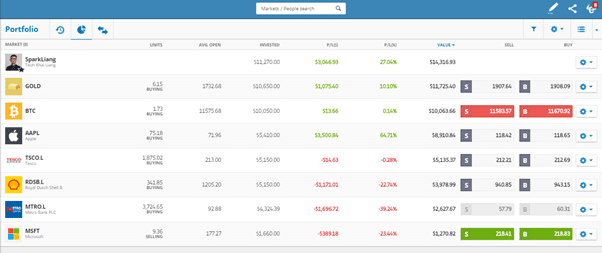

Source: eToro

Similarities between CFD and stock trading

If you are trading a stock and a stock CFD and the price of the stock in the underlying firm goes up $1, then both the CFD and stock position will go up that amount. A CFD in Apple Inc stock for example, would have the same price as the Apple Inc stock listed on the Nasdaq exchange.

- If price of Apple Inc on the NASDAQ rises, so will the price of the CFD equivalent.

- The profit and loss moves will be the same whether you hold the stock of the stock CFD

- Both stock and stock CFDs pay out dividends — but do watch out for how each instrument is treated in terms of withholding tax.

- You can hold a position in CFDs and shares for as long as you want to

Convenience

If you’re using a top-level online broker, you can trade all of these markets with ease. Modern trading allows you to make CFD trading decisions at the click of a button or a tap of a screen. Trading of both stocks and CFDs can be done using desktop PCs or on mobile devices.

Differences between CFD and stock trading

There are some differences between CFD and stock trading. CFDs represent a contract between the broker and their client. It’s a two-way agreement.

In contrast, stock positions, even if bought via a broker, are recorded at a registrar. The registrar is responsible for keeping and updating the details of all of the holders of stock.

Different risks

If you hold shares, your risk is limited to the price of the firm you have invested in and seeing its share price fall. This can happen and is an unavoidable aspect of trading.

If you hold CFDs, then as well as this market risk, you also have to consider counterparty risk. If the CFD broker you are using goes bust, you stand to lose out.

Tax treatment

In the UK, buying stocks incurs a 0.25% SDRT charge. Buying CFDs does not. This quarter of one percent hit might not look like being too onerous but frequent traders in particular try to avoid it. A large part of the reason for CFDs being ‘invented’ was to work around this issue.

Leverage

CFDs can be leveraged. This means a broker allows you to put on a trade that is larger than the size of your initial capital deposit. Stock dealing is unleveraged.

Different types of investors

Some investors are restricted to buying stocks. Pension funds, for example, are often bound to trade in stocks rather than CFDs. In the same way, individual investors in the USA are prohibited from trading CFDs.

Market coverage

CFD trading can cover markets other than stocks. It’s possible to trade, forex, commodities, stock indices and cryptocurrencies and other instruments in CFD form. Once you get a hold on the basics, as detailed in this handy guide you can trade any markets — not just stocks.

Source: eToro

Trading CFDs involves financing costs

CFDs are derivative products, so incur overnight financing charges. Stock trading can incur similar administrative charges, but the stock trading sector is set up for longer term holding periods. The charges to hold your position tend to be less of a burden with stocks than with CFDs.

Short selling

Unlike stocks, CFDs allow for short-selling. You can sell something you don’t already own.

Stock trading ‘long only’, you buy and sell but never ‘go short’.

Final thoughts

The popularity of CFDs largely comes down to their versatility. Once you understand the basic principles, you can trade a whole range of financial markets.

If your investment objectives involve holding stocks rather than forex or commodities, then you might want to consider buying them outright, not in CFD form. This is because stock trading can be more cost-effective if you are holding the position for the medium to long-term.

In contrast, short-term trading strategies such as day trading and scalping have strong associations with CFD markets. For this type of trading, the convenience of CFDs outweighs the potential holding charges.

The ability to short sell is another important point for short-term traders looking to profit from downwards as well as upward price moves.

Both CFDs and shares offer a route to making a profit in the global financial markets. Choosing which approach suits you largely comes down to personal preference and your trading strategies.

The good news is that stocks and CFDs can both be traded with ease using online trading platforms. The process of executing and monitoring trades is very similar for both instruments. It’s the small differences between the two that can be surprisingly important.