The trading of copper is growing in popularity, owing to an increase of attention being put towards the red metal.

The below 10 year chart of copper prices tells its own story. Having spent 5 years between 2015-2020 largely trading in a range between $2.00 and $3.00, a breakout was set to take place. Copper prices doubling in 12 months from May 2020-2021 brought increased activity to trading circles, and recent all time highs hit May 2024 show that bulls, and demand are on the rise.

Why The Demand For Copper?

Dr. Copper and the red metal are two popular nicknames used for this flexible base metal. Copper is a commodity mined from the earth and can be used for several applications.

The red metal is highly conductive and used heavily in electronics. Copper is also used in manufacturing and construction but in most recent times, it’s use in our energy grids, EVs, and thriving semiconductor industry have brought significant attention.

Copper can also be used as a constituent of various metal alloys, such as sterling silver used in jewellery, as well as a gauge for temperature measurements. Copper gets its name from the Latin word the ‘aes сyprium’ which means metal of Cyprus.

Copper is part of the base metals family and is the most actively traded and liquid base. Most of the liquidity comes from copper futures traded on the London Metals Exchange. Liquidity is also robust on the Chicago Mercantile Exchange.

You can also trade copper via an over-the-counter contract, as a contract for differences as well as an exchange-traded fund.

How to Trade Copper

You can trade copper using physical bullion or coins but the liquidity is weaker than many other instruments. In addition to physical trading, you can also trade copper futures contracts on both the LME and the CME. You can also trade customized products such as contracts for differences (CFDs), or over the counter (OTC) with a specific lot sizes. Besides, you can trade copper exchange-traded funds (ETFs).

What are Futures Contracts?

A copper futures contract is the obligation to purchase or sell copper at a specific date in the future. The LME copper futures contract is grade A copper and is priced in US dollars per metric ton.

Grade A copper has one of the following specifications. BS EN 1978:1998 – Cu-CATH-1, GB/T 467-2010 – Cu-CATH-1, ASTM B115-10 – cathode Grade 1. Each contract has a lot size of 25-metric tons.

All copper deliverables against LME contracts must be of an LME-approved brand. The LME copper futures contract is physically delivered.

Copper futures also trade actively on the Chicago Mercantile Exchange. These futures contracts are also physically delivered. The contract is for Grade 1 Electrolytic Copper Cathodes in either full plate or cut format and shall conform to the specifications for Grade 1 Electrolytic Copper Cathode as adopted by the American Society for Testing and Materials.

While both the LME and CME provide physically delivered copper futures contracts, most traders exit their position before taking delivery.

Trading Copper Futures Or CFDs?

An alternative to copper futures contracts is copper CFDs. A contract for difference is a security that tracks the movements of another asset. Contracts for differences are also customized, with specific lot sizes, by CFD brokers.

For example, a contract for difference on copper tracks the underlying movements of copper prices. The benefits of trading a copper CFD is that you are only responsible for the difference in the price of the CFD. You never have to own physical copper or take delivery.

There are several benefits to trading contracts for differences, including leverage. CFD brokers provide leverage through a margin account which allows you to increase the returns that you receive on the money that you are expected to post for each trade.

Leverage

Leverage is provided via a margin account. Leverage allows you to increase the notional value of the underlying product using borrowed capital. The initial margin needed to purchase one contract of CME copper is $3,750. This initial capital allows you to control nearly $59,000 of copper, providing leverage of more than 15 to 1.

OTC Copper Contracts

Copper is actively traded in the over the counter market. These forward contracts are customized contracts between two parties to buy or sell assets at a specified price on a future date and are privately negotiated and traded over-the-counter. OTC contracts can look like futures contracts. Some are even called futures look alike. OTC contracts might not have a standardized contract. They also might combine several different periods allowing a copper producer the opportunity to hedge more than 2-years out into the future.

Copper is offered through specific exchange-traded funds that hold copper futures in a trust. Copper exchange-traded funds (ETFs) are designed to track the price of copper. They handle this by providing investors exposure to futures contracts. The fund will buy and roll futures contracts to provide a seamless opportunity to speculate on the direction of copper futures contracts.

Why Trade Copper

Commoditize products like coppers are actively traded because there is robust supply and consistent demand. Copper is used in nearly every industrialized nation, which provides the backdrop for an active financial securities market. Copper is used in electrical wiring due to its’ excellent conductivity. Copper is attractive for industrial use because the red metal does not oxidize.

Approximately 43% of the copper used today is in building and construction. About 19% is used for electrical and electronics. Nearly the same percentage is used for transportation equipment. Approximately 12% is used for consumer products and 7% for machinery.

Market Participants

- Commercial/Investment Banks

- Investment Funds

- Corporate Producers

- Corporate Consumers

- Retail Traders

Commercial and investment banks are intermediaries for corporate producers and consumers. They generally will provide access to over-the-counter swaps and options that are used to hedge production or supply chain consumption. Investment funds, on the other hand, speculate on the future direction of copper. Retail investors will also speculate on the future direction of copper.

Trading Strategies

There are several different copper trading strategies you can use to forecast the future direction of this base metal. You can evaluate supply and demand as well as macro factors which would be categorized as fundamental analysis. You can look for patterns or momentum using technical analysis. You can also analyze open interest using sentiment analysis.

Fundamental Analysis

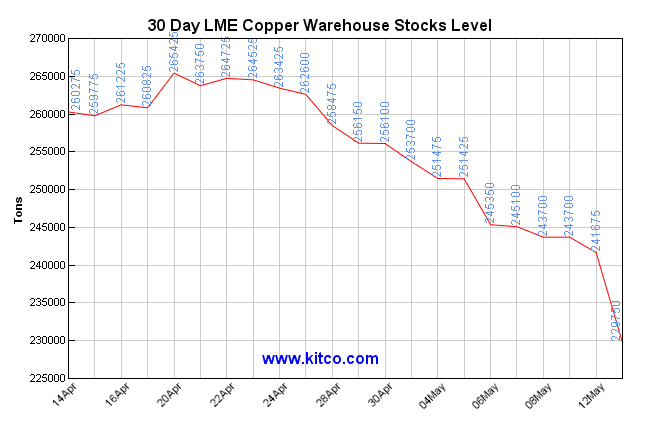

The most common form of fundamental analysis is supply and demand analysis as well as evaluating the value of the US dollar. The largest copper storage is with the London Metals Exchange. The LME provides robust inventory information, that describes the volume of copper currently held in storage. The charts of the storage levels, give an investor a history of inventories which can help determine supply and demand. For example, you can see from the chart of LME copper inventories that stockpiles have declined from late April into mid-May.

Additionally, the value of the dollar plays an important role in determining the value of copper which is quoted in US dollars. Generally, as the value of the dollar exchange rate rises relative to a basket of currencies the price of copper will fall to compensate for the increase in its value due to the dollar. When the dollar falls, copper prices will often rise to offset the decline in the value of copper in US dollars.

Evaluating Sentiment

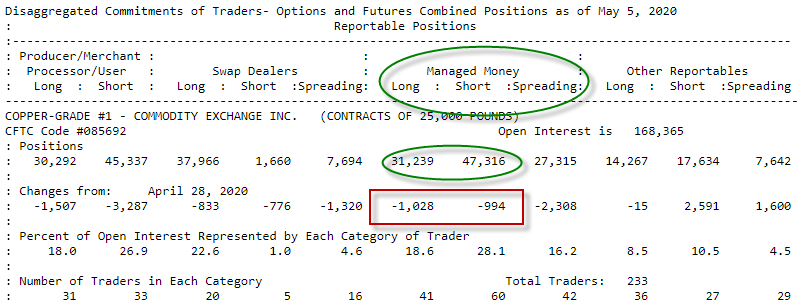

One of the best ways to determine if other traders are betting on copper is to evaluate the commitment of traders’ report, released every Friday by the Commodity Futures Trading Commission. This report will provide you with information about investor sentiment. The report shows any increases or decreases in futures and options contracts held by swap dealers, hedge funds, or retail traders.

The commitment of traders report focuses on US exchanges, which does not take into account the London Metals Exchange where most of the copper is traded. By evaluating long and short open interest, you can tell where there is speculative interest. This report from May 5, 2020, shows that hedge funds (managed money) are short 47K contracts and long 31K contracts. This means that hedge funds have a net bearish bias.

You can also see that hedge funds slightly reduced both long and short positions in futures and options during the lastest week. This report is often used as a contrarian tool. When hedge funds line up on one side, a move against them could generate a rush to the exit door, creating a sharp move in one direction or the other.

Technical Indicators

Technical indicators can help you determine support and resistance, as well as trends and momentum. This includes:

- Trend Following

- Momentum

- Mean Reversion

- Oscillation

Trend Following

You can evaluate trends using moving averages. A moving average is the average of a specific period. You can use any period, to create an average. When a 20-day moving average, crosses a longer-term moving average, like the 50-day moving average a short-term uptrend is considered in place. You can use the same moving averages to find a short-term downtrend. You can also change the moving average to be longer or shorter depending on your strategy.

Momentum

The MACD (moving average convergence divergence index) describes momentum. This indicator subtracts the 26-period moving average from the 12-period moving average and compares that to the 9-period moving average of the spread. When a MACD crossover sell signal occurs momentum is turning negative. When a MACD crossover buy signal occurs momentum is turning positive. You can see that momentum occurs before trend crossovers and in some cases has divergent signals.

Overextended

Momentum oscillators such as the fast stochastic can tell you when prices are overextended. When the fast-stochastic prints a reading above 80, the price of copper is considered overbought and points to a potential correction. When the fast-stochastic prints a level below 20, the price of copper is considered oversold and could rebound.

Common Base Metals

- Copper

- Aluminum

- Lead

- Nickel

- Zinc

Copper is part of the base metals family. Base metals are defined as any nonferrous metal because they contain no iron. Base metals are neither precious metal or noble metals. Base metals are more common and more readily extracted than precious metals.

Copper is the most liquid of the base metals. The red metal is actively traded as a copper futures contract on the London Metals Exchange (LME) as well as the Chicago Mercantile Exchange (CME).

The Bottom Line

Copper is a reddish colored metal that is actively traded around the globe. The metal is well known for its conductibility of electricity and is used industrially, as well as in construction and manufacturing. There are several ways to trade copper including buying and selling physical bullion, futures contracts as well as contracts for differences (CFDs). Additionally, you can buy and sell exchange-traded funds (ETFs) and over the counter contracts.

You can also use many different trading strategies including using fundamental analysis, sentiment analysis, and technical analysis. Strong demand for copper generally occurs when economic growth is accelerating. The demand generally weakens during economic contraction.