Following the below five top tips offered by experienced investors will help you make the most out of the process of improving your portfolio with Stock Diversification.

- Start with an ETF

- Tips on diversification when trading single stocks

- Check your real exposure

- Consider the different types of diversification

- How to trade your way to a diversified portfolio

1. Start With an ETF

If you’re new to trading, then an ETF (exchange-traded fund) can be an ideal way to gain exposure to a wide range of assets with the click of just one button. ETF fund managers will then buy a collection of assets on your behalf. Trading in and out of them can be done at any time when markets are open, rather than having to wait for a month-end dealing date as with traditional funds.

Most of the firms on this shortlist of good brokers offer ETF markets on the same platform that supports trading in other assets such as forex, bonds, commodities and crypto. This means that you only need to register once, but as your trading experience grows, you can access a wide range of asset groups.

The L&G Global Equity UCITS ETF aims to track the performance of global-developed market equities. According to the funds term sheet, it invests in large and mid-cap publicly traded companies from various developed market countries. The target stocks have to satisfy minimum criteria relating to size and liquidity and also considers ESG factors, which means that firms engaged in pure coal mining, or controversial military weapons, are excluded.

In other words, the L&G Global Equity UCITS ETF invests in reliable, safe, blue chip stocks across the world and is an ideal instrument for anyone looking to put on their first trade. The risk of one of the positions turning sour and jeopardising total returns is mitigated by the ETF spreading its capital across up to 1,665 different stocks. As of April 2021, the top 10 positions accounted for less than 20% of the total size of the fund.

Diversification Doesn’t Have to Be Boring

Even those investors with established positions can benefit from using an ETF and at the same time target growth stock sectors. Many of the funds, such as those recommended for beginners, offer broad exposure, but some are more specific.

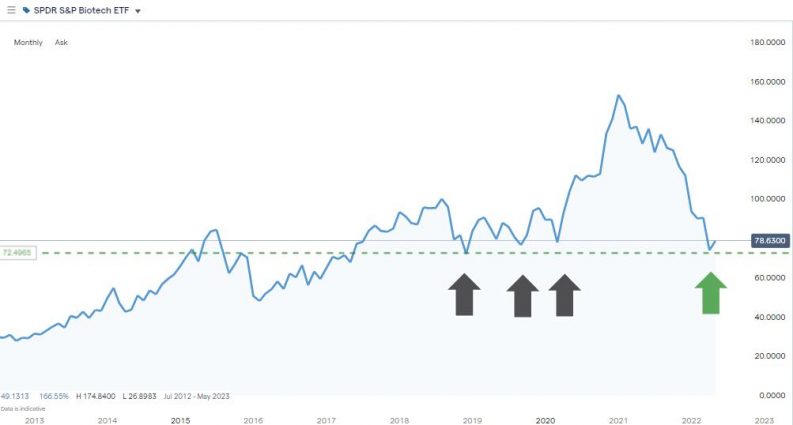

SPDR S&P Biotech ETF – Monthly Price Chart – September 2012-April 2022

Source: IG

The SPDR S&P Biotech ETF available at IG, for example, looks to match closely the returns and characteristics of the S&P Biotechnology Select Industry Index and has returns of 387% since its inception. The ETF reached an all-time high of $152.88 in January 2021, and the subsequent pullback leaves headroom for anyone buying it now in the region of $75. There is also a key technical price support in the region of $72.40, which has been tested on three occasions and held firm, suggesting that down-side risk could be limited.

If a position in US-focused biotech stocks would bring something extra to your portfolio, then you could diversify into a sector with a higher risk-return and an ETF that is currently trading at a technical analysis-backed trade entry point.

ETFs also offer a safer route into some of the riskier areas of the financial markets. An experienced investor with a large existing portfolio and an inquisitive mind might consider staking a small amount of cash on crypto – just in case Bitcoin or Ether do become the currency of the future. Instead of having to set up a new account with a specialist (and unregulated) exchange, it’s possible to buy a crypto ETF that offers broad exposure to the sector and insures against FOMO should the crypto-bulls end up being correct.

2. Tips on Diversification When Trading Single Stocks

ETFs have many advantages, particularly in the way that they allow broad exposure to a basket of assets to be gained with one buy order, but they do also charge annual fees. These are small in relation to actively managed funds. For the SPDR S&P Biotech ETF, the gross expense ratio is 0.35%, but buying single stocks outright can be more cost effective. Self-trading also allows for individuals to take direct control on what is, and isn’t, in their portfolio.

If you’re building your own portfolio using individual trades, then there are some tips and tricks to use to optimise returns.

Trade in Small Size

The greater the number of stocks in your portfolio, the less chance of a single stock blowing up your returns. In fact, as each stock will interpret shock market events differently, the average return should be smoothed out and have fewer peaks and troughs.

To make this strategy cost effective, it is important to find a broker that doesn’t charge commissions on individual trades. Those fixed costs could stack up and impact returns, but some brokers, such as IG and eToro, offer a trading service where they make their money on the bid-offer spread instead. The cost per share will be the same whether you’re buying 100 or 1,000, and that allows you to drip-feed your cash into the market in a cost-effective way.

Share Dealing vs CFDs

Choose the right broker and you’ll avoid the kind of management costs associated with ETFs. However, buy-and-hold investors with investment timelines of months rather than days or weeks should avoid using CFDs but buy the shares outright instead. This is because CFD trades incur daily financing fees.

Effective diversification of a portfolio does require some thought to be given to the make-up of each position. Overlap between assets can result in accidental concentration in one area, and that leaves your returns exposed to single-stock risk.

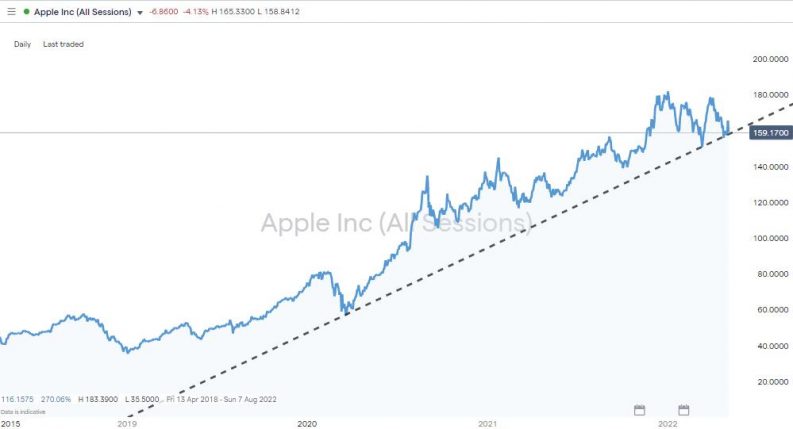

Apple Inc. Case Study

A case study would be a portfolio where 10% of the capital is allocated to one stock – for example, Apple Inc. Regardless of the potential for AAPL to continue its phenomenal multi-year price surge, taking the position size higher than 10% would pin a greater percentage of total returns to the fortunes of just one stock.

An attempt to diversify risk by buying into the L&G Global Equity UCITS ETF would appear to make sense as the stocks in that fund come from a variety of sectors and countries – 8.5% of the fund is invested in eurozone stocks and 6.7% in Japan. The detail of current holdings does show that the fund’s largest single position, which accounts for 5% of the ETF’s capital, is in Apple Inc. While buying the ETF does bring in some other names, it also increases exposure to the success, or not, of the next iPhone rollout.

Apple Inc. – Daily Price Chart – May 2018-May 2022

Source: IG

Check Currency Exposure

One element of investing that is sometimes overlooked is currency exposure. If your base currency and that of the instrument you invest in are different, then your P&L will be a function of both the change in price and the change in the currency rates.

Take, for example, a UK resident whose wealth is denominated in GBP. They buy a dollar-denominated stock or ETF that goes on to make a 10% return over a period of 12 months, but the realised profit in sterling terms will only be 10% if the USDGBP FX conversion rate is the same as it was at the start of the year. If the value of USD in relation to GBP fell by 10% over that time, then the net profit on the trade would be zero.

4. Consider the Different Types of Diversification

Diversification across sectors is the starting point for ensuring that risk management is factored into your investing, but other aspects need to be considered.

A portfolio that is too heavily concentrated in one country or region runs an array of risks. These stem from natural disasters to a paradigm shift in political leadership, levels of market regulation and good old-fashioned economic downturns.

You can’t buck the market, so a realistic definition of a successful investment portfolio is one that will generate consistent returns over a long period. Diversification of assets and strategies in terms of their time horizon can help achieve this aim. Identifying trades that are expected to mature in three months, 12 months and five years will smooth out returns, as when each one is closed out, the ‘churn’ in the portfolio will likely impact returns.

5. How to Trade Your Way to a Diversified Portfolio

Some of the principles relating to diversification can be applied to other areas of trading and investing and include the following:

Don’t overtrade – Overtrading is a common error made by beginners. It can result in additional costs and flip-flopping in and out of positions in an inefficient way. Given that diversification by definition involves putting on new positions and potentially closing out others, there is some degree of trading required, but adopt a clear strategy that can offer a clear path towards achieving your aims.

Play the percentages – One investment approach that found favour in the US in the 1970s was the 60:40 strategy. This involved allocating 60% of available capital to domestic equities and 40% to government bonds. Times have moved on since then and international markets have opened up, but adopting a similar approach and being aware of what percentage of capital you have assigned to what sector will help you stick with the programme.

Follow the markets – Change is the only certainty in the markets and a well-diversified portfolio can easily become skewed due to changes made by each of the underlying assets. BlackBerry Ltd, for example, started out making and selling mobile phone handsets but is now generating more than 60% of its revenue from the cyber security sector. Recent guidance from the firm is that it’s looking to expand into providing tech services for the EV industry.

Remember alpha – Successful trading is ultimately about buying low and selling high. Focusing on alpha, the extent to which your investment beats a market index, is still crucial, and there is room for aggressive strategies in a well-diversified portfolio. In fact, diversification is best thought of as the safety net that allows you to consider strategies such as trading high-beta stocks to ensure that there is some extra juice in your trading.

Know your starting point – If you’re new to trading, then there are some advantages relating to starting with a clean account. A well-thought-out strategy with itemised trade entry and exit points will get you off to a great start. If you already have an established portfolio and are trying to manage risk, then diversification is one way to do that.

While it’s hard to find any experienced traders who would talk you out of following that path if the perceived risk is short term in nature, there are different routes to take. Using options to hedge your portfolio is one alternative approach. Traded correctly, they will offer insurance against price moves and the cost to your account will be the premium paid to take on an options position.

Final Thoughts

The aim of diversification is to manage risks and enhance returns. Aiming to achieve perfection is hampered by the ever-changing nature of markets, so a realistic target is for a portfolio to be more, or adequately, diversified.

The P&L returns on your portfolio will be the clearest sign of whether your portfolio matches your trading style and investment objectives. Overtrading is a very real risk, but if you choose one of the cost-effective platforms from this list of trusted brokers, then your account will be set up with a firm that will help you navigate the markets.