The principles behind diversification are simple enough, but our team of experienced traders provide below a step-by-step guide on how to optimise your decision-making and diversify your stock portfolio designed to successfully navigate the current markets.

What is Portfolio Diversification?

Diversification is a strategy that involves combining different kinds of assets with different risk profiles. Assets can be categorised by instrument type (for example, equities or commodities), by business sector (for example, large-cap and small-cap equities), or by geography (for example, US government bonds and emerging market corporate bonds).

The timeless appeal of diversification means that it has its own adage, ‘don’t put all your eggs in one basket’, but analysts have optimised the process and developed several approaches.

The 60:40 Portfolio

This approach found favour in the US in the 1970s and the instruments used reflect those widely available at the time. Implementing it required allocating 60% of available capital to domestic equities and 40% to government bonds. The equity element offers long-term capital returns and the bond allocation would balance out returns when equity markets sell off as bonds pay a consistent and regular yield.

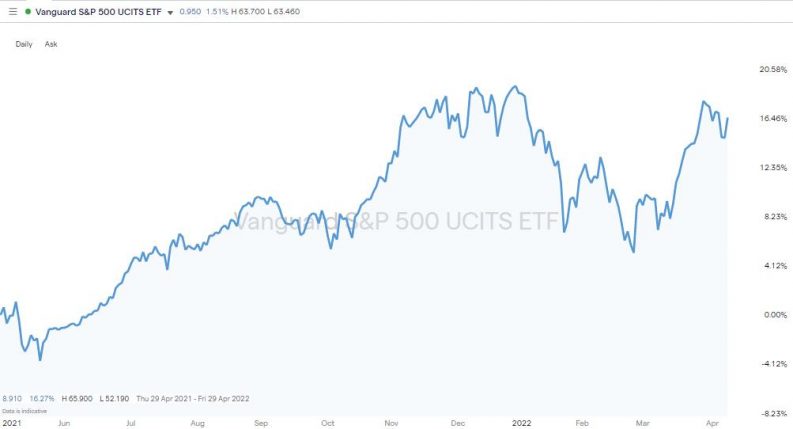

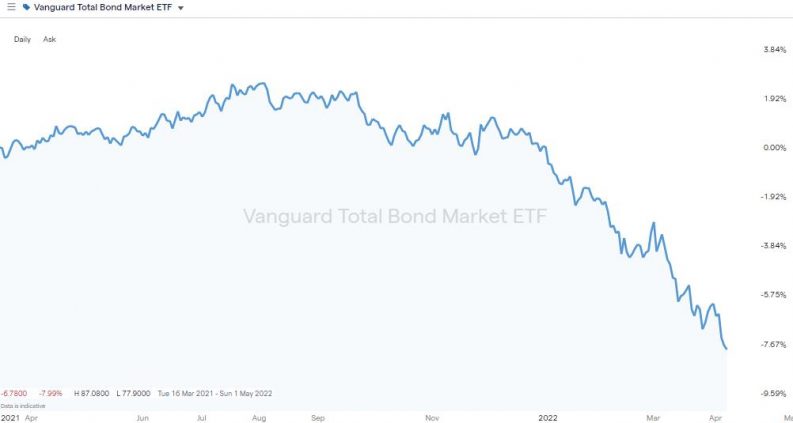

Two ETFs (exchange-traded funds) that give a visual representation of the returns in both markets are the Vanguard S&P 500 UCITS ETF and the Vanguard Total Bond Market ETF, which can both be traded at this trusted broker.

Vanguard S&P 500 UCITS ETF – Daily Price Chart – April 2021-April 2022

Source: IG

Not only do the total returns of the two instruments differ, but the levels of price volatility do also. The 7.67% loss on the bond position is more than counterbalanced by the 16.46% gain in the equity ETF. With the 60:40 weighting factored in, the total return on the portfolio over 12 months is 6.80%.

Vanguard Total Bond Market ETF – Daily Price Chart – April 2021-April 2022

Source: IG

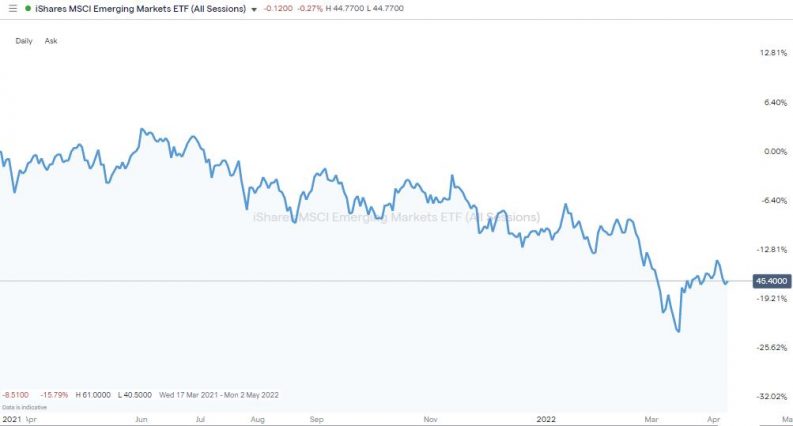

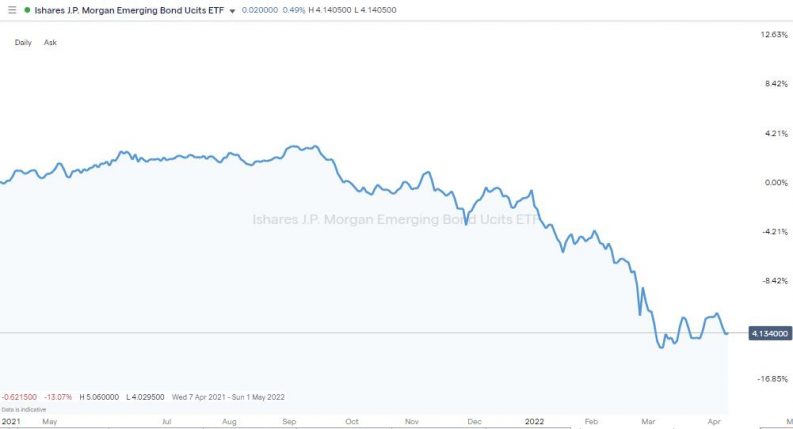

The Geographically Diversified Portfolio

As an increasing number of markets have become accessible, diversification strategies began incorporating equities and bonds from non-US exchanges. Due to the relative instability of emerging markets, the volatility of both the equity and bond allocation would be increased. Instruments that still offer exposure to these markets include the iShares MSCI Emerging Markets ETF and the iShares JP Morgan Emerging Bond UCITS ETF.

iShares MSCI Emerging Markets ETF – Daily Price Chart – April 2021-April 2022

Source: IG

iShares JP Morgan Emerging Bond UCITS ETF – Daily Price Chart – April 2021-April 2022

Source: IG

Diversification Using Factors

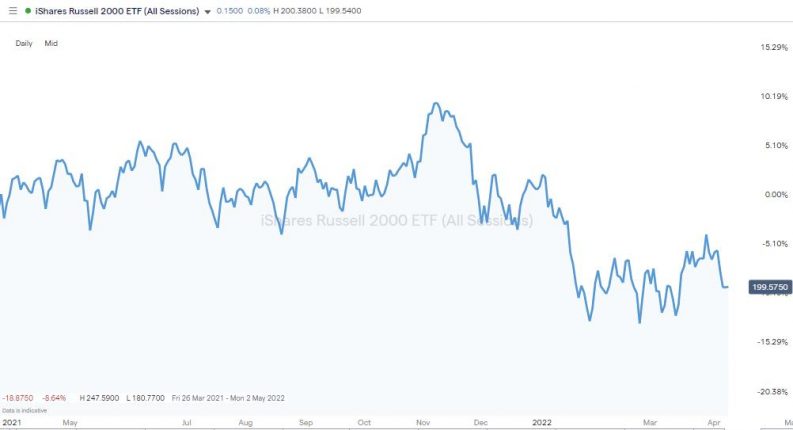

The introduction of computers in the 1990s allowed analysts to carry out granular-level research of assets. Equity markets could be easily categorised using quantifiable characteristics, known as factors, and these groups filtered to allow instruments with particular characteristics to be bought. One example is the Russell 2000 Index. This is made up of small and medium-sized US equities, which have a stronger correlation to the US domestic economy rather than the global markets.

iShares Russell 2000 ETF – Daily Price Chart – April 2021-April 2022

Source: IG

What Are the Benefits of Diversifying Your Portfolio?

Portfolio diversification is designed to manage risk, and, in the process, smooth out returns.

Take, for example, the expected returns of $10,000 invested in just one stock position against a collection of $100 positions in 100 different stocks.

Single-Stock Risk

The total capital allocation is the same, but if one of the positions in the diversified portfolio goes bad, the remaining positions can be expected to counterbalance that underperformance. A list of firms that have gone bust includes household names such as Blockbuster, Polaroid, Enron and Pan Am. Nothing is guaranteed in the markets, so portfolio diversification can mitigate the risk that technological advances or corporate mismanagement take your $10,000 down to zero.

Diversification Averages Out Returns

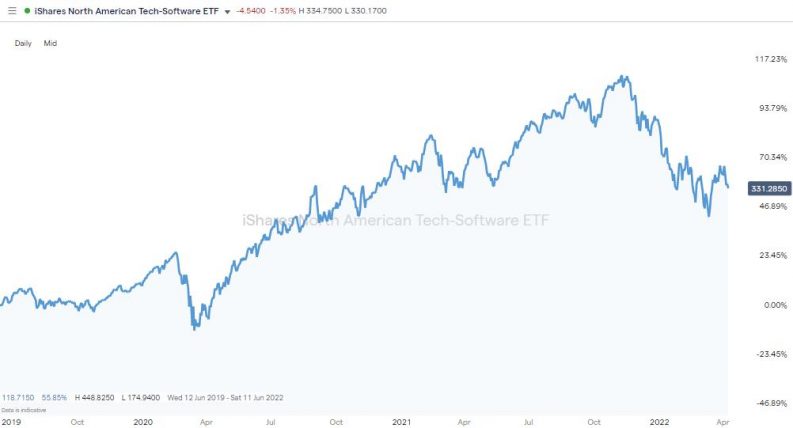

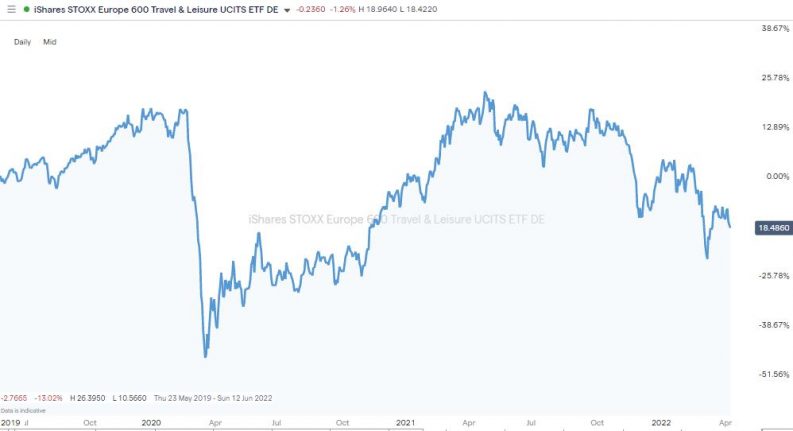

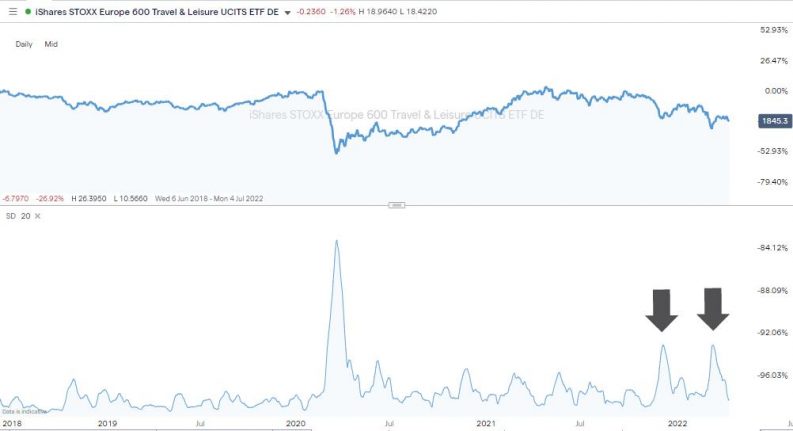

Asset groups and types of instruments react differently when shock events such as COVID-19, wars or interest rate hikes come into play. Compare, for example, the differing price moves of tech stocks and travel stocks following the announcements in 2020 that the global economy was going into a pandemic-related lockdown.

iShares North American Tech-Software ETF – Daily Price Chart – June 2019-April 2022 – Up +52%

Source: IG

iShares STOXX Europe 600 Travel & Leisure UCITS ETF – Daily Price Chart – June 2019-April 2022

Source: IG

Gold is an example of an asset that has historically seen its value be negatively correlated to equity markets, and this partly explains why some proponents of diversification have held small positions in the metal.

Diversifying to Capture Alpha

Diversification isn’t all about managing risk. Some sectors with high-risk-return profiles, such as biotech penny stocks, include a handful of firms that offer exponential returns, but picking the winner is never easy. Building a portfolio with exposure to a wide number of stocks, rather than just one, might result in smaller total returns but increases the risk of there being returns of any kind.

Develop a Trading Psychology

Successful investing involves hoping for the best, but also planning for the worst. Markets don’t go up in a straight line and pullbacks and corrections can be hair-raising moments. One of the ways to be in a position to make the best decisions when markets sell off is to go into them with a diversified portfolio. This reduces the risk of a panic decision being made and selling at the wrong time.

Should You Be Diversifying Your Portfolio Now?

Given that diversification is a tried-and-tested way of enhancing returns, it’s safe to say that diversification should play a role in your portfolio. The details of how your portfolio is structured will come down to personal preference and investment aims. It can also be driven by market events.

Since Q1 2020, the global markets have been buffeted by COVID-19, lockdowns, issues with global supply chains, and military conflict. Inflation rates are rising, and interest rates look set to also move upwards. In short, the global economy is entering a phase that is very different from that seen between 2010 and 2020. It’s hard to call how any of these fundamental changes will impact prices, or what other surprise events that are currently off the radar might come into play. Reacting to the increased levels of uncertainty makes now an ideal time to diversify your portfolio.

iShares North American Tech-Software ETF – Daily Price Chart – June 2019-April 2022 – Increased Vol

Source: IG

How to Diversify Your Portfolio

The steps taken to diversify your portfolio are as simple as buying new positions, but there are some tips to help you start off in the right way.

Trade in Small Size

If you’re new to trading, one recommendation is to start trading in small size. Not only does that reduce the risk of a whipsawing price move causing you to sell out in a panic, but it also ensures that free capital is on hand to buy other positions that diversify your portfolio.

The alternative approach of having to sell out of positions to free up cash generates frictional costs. These can take the form of commissions or the price difference between buying and selling prices in markets – the bid-offer spread. Protecting your trading bottom line requires avoiding costs wherever possible.

Select the Right Type of Instrument

Some research is required into the instruments you require to build a collection of assets that perform in different ways during a variety of market conditions.

Equities

Historical returns suggest that your aim might be to devote a large part of your portfolio to equities, but the subcategories of the stock market throw up some interesting propositions. High-yield dividend stocks, particularly those in defensive sectors, can hold their value when the rest of the equity market sells off.

Not only is their business model one that suggests that they will be able to cope with a temporary downturn, but also some big fund managers have to keep a certain percentage of their capital in the market. This can result in them rotating out of growth stocks and into the relative security of UK blue-chip stocks.

Bonds

Bond markets are known for regular and moderate fixed returns. The yield on a bond is denoted at the time of issuance, so as long as the bond issuer doesn’t default, coupons will be paid to bondholders in line with the stipulated terms.

Bonds still reflect certain underlying economic factors. As the risk of the US government defaulting on US treasuries is smaller than that of a corporate junk bond, the US T-bill will pay a lower yield. To put it another way, a large tech stock may be less of a credit risk than an emerging market bond.

ETFs

ETFs are a way of buying a ready-made highly diversified product with the click of a button. The fund manager will manage the process of allocating capital across multiple firms so that you don’t have to. The core risk-return of the different instruments will remain the same, but the process of spreading risk is made a lot easier when using ETFs.

Commodities

The commodity markets are typically regarded as being relatively high up on the risk-return scale, but finding a place for them is still recommended. The first reason is that we could be entering into a commodity supercycle, which is a period of time when substantial returns are made. The second is that they behave differently from equities and bonds when price drives such as inflation come into play.

Commodities are an example of an instrument where it might be difficult to decide if the price will go up or down, but there is some degree of confidence that it will be uncorrelated to price moves in other asset classes.

Forex

The US dollar is regarded as a safe-haven asset and recent market crashes have seen demand for the greenback increase. Not only does a ‘dash for cash’ ensure that investors improve the overall liquidity of their asset holding, but also the US economy and its currency are regarded as the most secure in the world.

Cryptocurrencies

If you’ve previously considered investing in crypto but held off, then the idea of a small position in Bitcoin or Ether might be what tips you over the edge. As with commodities, the position in this asset group is as much about building a portfolio where different positions react differently from the same events.

Select the Right Broker

Rule number one of successful risk management is to ensure that you trade with a legit broker. If you fall for a scam, then the hard work carried out diversifying your portfolio will count for nothing. This list of trusted brokers includes established firms that have been reviewed by AskTraders to ensure that they are legit.

Once you’re happy with your shortlist of regulated brokers, filtering down to one might be helped by establishing if they offer the markets you want to buy into. This process is fast-tracked by setting up a demo account and test-driving platforms using virtual currency. Not only is this kind of trading free and zero-risk, but it also helps you practice building a diversified portfolio and seeing how it performs in live market conditions.

What You Need to Know About Diversification of Portfolios

You might struggle to find any experienced investors who argue against diversification of a portfolio being a good idea in principle. The devil is in the detail, and running the below checks can help you get off to the best start.

Check What You Are Buying

It’s important to check the historical performance of different assets to establish if they can be expected to perform the balancing act you require of them. The price of copper mining stocks, for example, is influenced by both the general market mood regarding equities and the price of copper. So, if you’re buying equities to set off the risk associated with a copper position, then stocks from other sectors would be a preferable target.

Remember the Core Principles

It’s also important to keep in mind that successful trading is ultimately about buying low and selling high and focusing on strategies that involve investing in undervalued stocks. Holding off on entering a position might mean that you run additional risk for a short period of time, but if you’re expecting a price dip in that market, then that might be a risk worth taking.

Returns Might Be Lower

There is, of course, a trade-off in terms of risk-return should your favourite position zoom up in price as expected. That potential for FOMO can be managed by setting out and following a clear strategy and accepting that more moderate and consistent returns are your aim.

Buy the Dips

Trading returns can also be helped by adjusting your portfolio in line with market developments. A change in market sentiment could act as a catalyst for adjusting the structure of your portfolio. Also, remember that cash can be considered as part of your portfolio. Strategies designed to trade high-beta stocks adopt an approach where some capital is purposefully held back so that new positions can be taken when market prices fall.

Overtrading

Moving in and out of positions incurs frictional costs and holding certain assets can incur financing costs. Your aim should be to achieve some degree of diversification, not perfect diversification.

Final Thoughts

Diversifying a portfolio starts with booking a trade, and navigating to one of these trusted brokers listed on AskTraders will ensure that you start the process from the best possible position. With price volatility levels and general uncertainty on the rise, the time to do so is now.