The S&P 500 tracks the fortunes of the largest 500 US stocks and includes names ranging from Apple Inc to Under Armour Inc. The index was originally designed by the agency Standard & Poor’s to track the performance of the biggest stocks listed in the US. As a result, it is a reliable indicator of the state of the stock markets in general which is why many investors choose to invest in the S&P 500.

Building on that idea, household name investment firms have set up instruments that track the performance of the S&P 500. Those ETFs (Exchange Traded Funds) can be bought by retail investors and offer a cost-effective and user-friendly way to invest in the most important stock index in the world. Read on as we investigate what the S&P 500 Index is and how to invest in it.

What is the S&P 500 Index?

The S&P 500 index is a weight-adjusted index of approximately 500 of the largest firms listed on US stock exchanges. The weight-adjusted element means that market giants such as Apple and Microsoft make up a larger proportion of the index than smaller firms, but more importantly, it offers a way to track the health of the overall stock market.

Due to many of the firms being big multinationals with a global client base, it is not as US-centric as it might first appear. The international nature of the business operations of the firms means the S&P 500 acts as a barometer of the world economy. However, the stocks included in the index offer additional security as they are all listed on Tier-1 US stock exchanges such as the New York Stock Exchange and NASDAQ.

As the price of the stocks that make up the index go up and down, so will the value of the index, which is constantly monitored by Standard & Poor’s. As and when new up-and-coming stocks merit inclusion in the index, they will be added at quarterly rebalancing dates. Subsequently, stocks that no longer meet the criteria for inclusion are removed.

Why Invest in the S&P 500 Index?

One of the major selling points of the S&P 500 index is the diversity it offers. With the click of one button, it’s possible to get exposure to all the big household names that make up the top 500 firms. Many of these firms pay dividends, which are credited to the account holder. As such, returns can include income as well as capital gains.

As there are 500 stocks in the index, it also covers smaller firms, which can offer greater growth potential. Spreading risk in that way can smooth out returns and mitigate against single stock risk. If the stock of one company does crash, there is less chance of it skewing your overall returns.

Diversifying your portfolio is recommended by experienced investors, but a decision to buy the S&P 500 isn’t only a risk management exercise – the index has produced some stellar returns over recent years. While past performance isn’t a guarantee of future profits, the index has a distinct long-term trend in place.

S&P 500 Index Long-Term Performance – Monthly Price Chart – 1986 – 2022

Source: IG

Another reason to invest in the S&P 500 is that it’s easy to track the performance of your returns. The prominent role the index has in the financial markets means it is covered by mainstream media and top-rated market analysts. Updates and insight are readily available, meaning that while your investment can be ‘hands-off’ in nature, it’s easy to keep in touch with how the index is performing.

Investing in the S&P is also extremely cost-effective. The daily volume of trades in the individual stocks is extensive. That liquidity results in bid-offer spreads and trading commissions being beaten down thanks to so many brokers being active in them. There are some additional charges if you choose to use a tracker fund, but these are some of the lowest in the market, again, because of the high liquidity and intense competition between firms offering the service.

Funds That Track the Performance of the S&P 500

The S&P 500 index itself remains the proprietary property of Standard & Poor’s. That firm’s business is collating and interpreting market data rather than offering direct investment opportunities. As such, Standard & Poor’s doesn’t offer funds that track the index.

As a result of the important role the index plays, and the benefits of investing in it, big-name fund managers have set up ways for investors to buy the S&P and track its performance. The fund managers of these instruments take instructions from clients who want to track the S&P 500 and go into the market to buy and sell the individual stocks that make up the index.

While tracker funds are cheaper to operate, there can be a risk that the discretionary input from the individual fund managers turns out to be a poor decision, which can result in that fund underperforming the S&P.

Three popular ETF S&P 500 tracker funds that are ideal for long-term investors can be found at IG. They vary in size, from as small as $13bn up to $308bn, but the overall performance of the different funds is similar because they aim to track the same index. Any deviation in return can be expected to be minimal and comes down to tracking error or marginal differences in administrative costs.

- SPDR S&P 500 ETF Trust (All Sessions) – market capitalisation $308bn

- iShares Core S&P 500 ETF – market capitalisation $220bn

- Guggenheim S&P 500 Equal Weight ETF – market capitalisation $13.2bn

One of the big selling points of ETFs are their user-friendly nature. It’s possible to trade in and out of ETF instruments whenever their markets are open. There’s no need to wait for a month-end dealing day to respond to news events and enter into or close out a position.

SPDR S&P 500 ETF Trust (All Sessions) – Weekly Price Chart – 2017 – 2022

Source: IG

ETFs also allow investors to use leverage. The SPDR S&P 500 ETF Trust’s margin rate is 20%, which means that if desired, the total position size can be five times the size of the initial deposit. This increases the net gain or loss on the position. While leverage must be handled with care, the underlying instrument, in this case, has lower price volatility than higher risk instruments such as the tech stock NASDAQ 100 index.

A Step-by-step Guide to Investing in the S&P 500

The first step towards investing in the S&P 500 is to choose a trustworthy broker. To make the selection process easier the AskTraders team has carried out reviews on the most significant operators in the market and provided a summary on their pros and cons.

All of the names on AskTrader’s list of brokers meet the basic requirements in terms of regulatory approval. Many will also offer above-average quality features such as market research, news alerts, or pricing terms. Using a demo account to try out different brokers is also a good way to find a personal best fit and to practise trading using virtual funds.

Transaction costs and ongoing costs do need to be considered. Most brokers don’t charge a commission on trade execution, they make their money on the difference between the bid-offer spread. There are also annual management fees to consider when buying ETFs. These are expressed as an expense ratio.

As of July 2022, the annual expense ratio of SPDR S&P 500 ETF Trust was 0.0945%. This ratio is low relative to actively managed funds such as hedge funds, whereby clients have historically been charged around 2% per annum as a management fee and have also been subject to a 20% cut of any profits. The charges for tracker ETFs relate to the work that the broker does to allow clients to get exposure to 500 different stocks with the click of just one button – not for any value-added input from fund managers.

Once you’ve chosen the broker and ETF you want to use to track the index, it is time to open an account. This part of the investing process has been made much more user-friendly over recent years and can take as little as a few minutes to complete.

You will be required to share your ID documentation with your broker, so they can run KYC (Know Your Client) checks as stipulated by their regulator. Providing those details can be done by uploading documentation such as a driving license to the broker portal. Such checks also ensure that you, and only you, have access to your trading account.

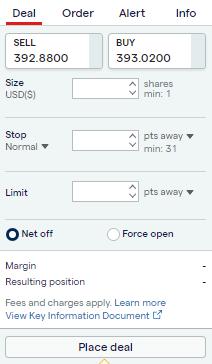

Once you’ve set up and funded your account, you’re ready to navigate to the area of the online broker platform where you can input a trade instruction to buy the S&P 500. Simply enter the quantity of shares you want to buy in the chosen ETF, decide if you want to use stop-loss instructions or not, and click ‘buy’.

Trading Execution Interface at The Broker IG

Source: IG

After your trade has been executed, the amount of cash in your online broker account will be reduced. In its place, your account will report a position in the S&P 500. Your account will then show real-time P&L (profit and loss) readings as the price of the index goes up and down.

When the time comes to close out your position, it’s simply a case of reversing the process. Head to the ‘Portfolio’ section of your chosen platform, click on your position and follow the instructions to sell some or all of your S&P holding and crystalise the P&L on your trade.

Final Thoughts

An S&P 500 tracker fund is the best instrument for investors aiming to get exposure to the stock market. There are plenty of other asset groups and sub-sectors to consider, but for mainstream stock investing, the S&P 500 is certainly the name to look out for.

It’s a great entry-level product because of the sheer number of shares that make up the index – there are about 500 of them. Having a large number of names diversifies risk – particularly as they are all large-cap blue chip firms with relatively low volatility.

Furthermore, although being relatively stable, the index has at the same time established a track record of generating returns far superior to other asset classes such as cash or bonds.

S&P 500 ETFs are easy to trade and setting up an account with an established and trustworthy broker takes moments to do. Even better news is that intense competition between brokers has driven down fees and resulted in clients being offered additional free services.

Whether you are an experienced investor or beginner, funds that track the S&P 500 index can be a sensible cornerstone of your investment portfolio.