Silver is one of the longest-traded commodities and is still widely bought and sold by traders and investors. Historical reasons for holding silver largely relate to the diversification that the metal offers investors and its use as a store of value. New trends are also in play, with silver’s use in industry, specifically the renewable energy sector, generating new interest in the market.

If you’re new to commodity trading, the good news is that gaining exposure to silver is exceptionally straightforward. There are various ways to buy silver, ranging from holding the metal in physical form to buying silver futures. One of the easiest ways to buy silver is to take a few minutes to set up an account with an online broker and trade the metal using contracts for difference (CFDs) or buying silver mining stocks.

How to Start Trading Silver

Several strategies can be used to determine the future direction of silver prices. These include those based on fundamental analysis, technical analysis, market sentiment and relative value. Before you begin, you should have some idea as to which direction you think the price is going if you are taking a longer term view. For short term trading that wont be as necessary.

Planning a few scenarios for your silver price forecast can be helpful, giving you the ability to make quicker decisions than many others. These help to identify the price drivers and optimal time to enter into a trade. With many analysts claiming that a commodity supercycle is forming, there is renewed interest in silver trading, making it one of the hottest markets right now.

There are several ways to trade silver. The six most common include:

- Futures contracts

- Contracts for difference (CFDs)

- Silver mining stocks

- Exchange-traded funds (ETFs)

- Options

- Physical silver bullion

Futures Contracts

One of the most popular ways to trade silver is to use futures contracts. Futures are bought and sold on exchanges by the big players in the market, including mining companies, corporations and speculators. The high trade volumes mean that the market is liquid and efficient. The price of silver on the Chicago Mercantile Exchange (CME) is quoted in US dollars and cents per troy ounce. The minimum price fluctuations are 0.005 per troy ounce or $25 per contract. The spreads are tight at 0.001 per troy ounce. The listed contracts are for three consecutive months as well as any January, March, May and September in the nearest 23 months and any July and December in the nearest 60 months.

A futures contract is an agreement to purchase or sell a specific asset (silver) at a certain date in the future. The silver futures contract listed on the CME is physically delivered. This means that if you hold the contract beyond the delivery date, you are required to take delivery of silver in a CME-regulated warehouse. Most of the silver volume traded on the exchange is not taken to delivery. Most traders exit or roll their position and never take physical delivery. The CME also offers an e-mini contract that is financially settled.

One of the benefits of trading futures contracts is that the futures exchanges provide margin to customers. This means that you can borrow money to leverage your position and enjoy enhanced returns. The CME does have the right to change the leverage it will offer at any time, and this can result in traders having to stump up more margin or be forced out of positions. Another potential downside of trading futures is elevated costs. You will need at least $9,000 to post the initial margin needed to buy one contract.

Contracts for Difference (CFDs)

Another popular and more convenient way to trade silver is using the CFD markets provided by good online brokers.

A CFD is an agreement between a broker and its client where one will pay the other according to how the price of an asset moves. You don’t own the underlying asset (silver), but you do make a profit or loss according to whether your trade picks the way that the market is heading.

CFDs have some neat features. One is that it is possible to sell short if you think that the silver market is overheating. You can also use leverage, with the market standard cap on borrowing being in the region of 1:10. This means that if you deposit $1 with your broker, you’ll be able to put on a trade in a Silver CFD with a value of $10.

CFDs are liquid and user-friendly, but there is a cost related to borrowing and daily financing charges, which, while small, can stack up over time. It is also important to consider the risk that your broker will be solvent and able to pay you if your trade goes the right way. This can be managed by making sure that you sign up with a reliable firm such as one of these trusted brokers that the AskTraders analysts have reviewed.

Silver Mining Stocks

The share price of companies that mine and sell silver will be influenced by the price of the metal. Buying into mining stocks is a route that many beginners take, as equity markets are regulated, liquid and cost-effective to trade.

Exchange-Traded Funds (ETFs)

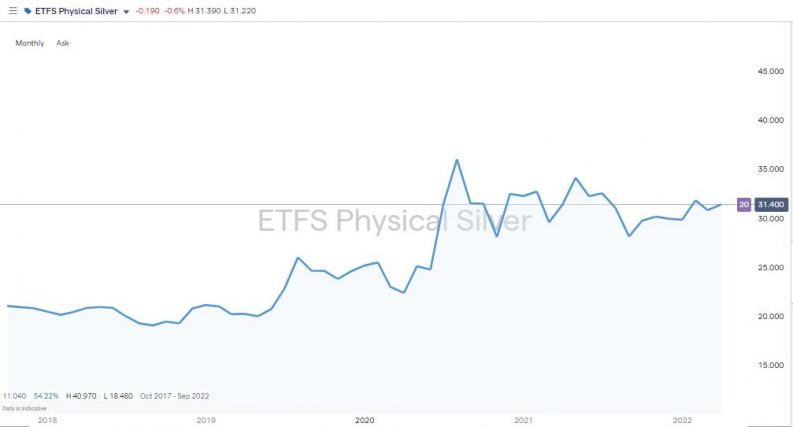

You can also trade a Silver ETF. An ETF is a basket of assets that can be bought with the click of a button. The basket can be made up of specific types of assets, such as small-cap silver mining stocks or assets that are designed to track the price of silver itself.

The fund manager will do the background work to ensure that the investment mandate of the ETF stays on course, and as most ETFs involve passive rather than active management, fees are relatively low. The average annual expense ratio of an ETF is 0.44%, which is relatively modest considering that they offer a very user-friendly way to smooth out returns and mitigate risk.

ETFs are liquid and trade actively during market hours. Most ETFs are traded on regulated exchanges, which minimizes credit risks. While Silver ETFs hold futures contracts and bullion, they do not always track the underlying movements of the commodity tick-for-tick.

Silver Bullion, Bars and Coins

The most common forms of physical silver are bullion, bars and coins. It is also possible to include silver jewellery as a way of holding the metal in physical form.

You can purchase silver online or at several different dealers. If you plan to purchase a lot of physical silver, you should consider holding it in an official silver vault. The CME provides several official vault operations. Alternatively, you can store your silver in your home or safe deposit box.

While owning physical bullion substantially reduces credit risks, the liquidity is much lower than the liquidity of futures contracts, CFDs and ETFs, and the costs and risks associated with holding it in this form is another downside.

Silver Options

If you are interested in trading options, they are available on futures contracts as well as ETFs. A silver option is a right but not the obligation to purchase or sell a silver futures contract or ETF someday in the future. There are two basic types of silver options. A call option is the right to buy silver at a specific price on or before a certain date. A put option is the right to sell silver at a specific price on or before a certain date. When you trade options, the buyer pays the seller a premium for the right to either buy or sell silver.

Silver Trading Strategies

The impressive array of ways to trade silver comes down to the market’s enduring appeal for investors. Strategies adopted are typically based on the metal’s ability to offer diversification and the demand for the metal from industrial buyers.

Many analysts also use fundamental and technical analysis to determine the future price of silver. Fundamental analysis considers macro trends and global influencers of supply and demand, while strategies based on technical analysis use historical price data to predict future movements.

The Gold-Silver Ratio

One phrase that is often referred to in the silver market is the gold-silver ratio. This considers the relative price of these two metals, and investors who have traded the 80/50 rule have historically had some success. At times when it takes 50oz of silver to buy 1oz of gold, silver is considered overvalued.

When the ratio is at 80, silver is undervalued. Silver generally outperforms gold during periods of higher expected GDP and underperforms during recessions and moments of market uncertainty.

What Is Silver?

Silver is a precious metal that is widely traded as a commodity throughout the globe. In trading terms, it is often associated with other precious metals – gold, platinum and palladium. Silver is relatively rare. If all of the metal that has ever been mined was collected, it would form a cube with sides just 55 metres long. It is, however, more common than gold, with geologists estimating that there is 19 times more silver than gold in the Earth’s crust.

How Are Silver Prices Determined?

Prices in the silver market are driven by two main factors. The first is the role of the metal as a store of wealth, and the second is its use in industry. The latter, specifically the metal’s use in one of the world’s major growth markets, the renewable energy sector, is worth giving particular attention to.

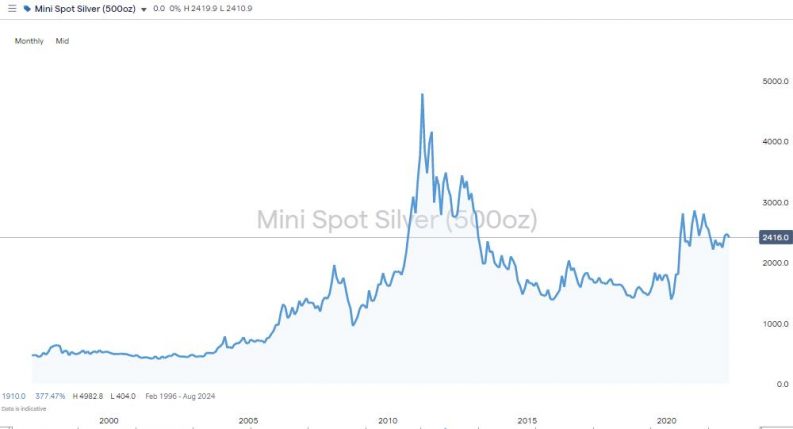

Silver – Monthly Price Chart – February 1997-April 2022

Source: IG

A Safe-Haven Asset

Four countries account for 55% of known silver, which means that prices of the metal can be influenced by geopolitical events in any of those big players. Another influence on the price of silver is the global view on risk. As silver is seen as a safe-haven asset, its price can increase during times of political or financial market uncertainty.

Hedge Against Inflation

Demand for silver also comes from those looking to hedge against inflation. When inflation is increasing and interest rates are climbing, silver and gold are considered hard assets that are immune from rising prices. The value of silver has historically held up better than fiat currencies, and with reports of inflation once more dominating the news headlines, attention is turning to silver as a way to protect wealth.

Silver and the US Dollar

Interlinked with inflation is the relationship that silver has with the US dollar. Silver commonly rallies when the dollar comes under pressure. Over a 25-year period when the dollar increases in value, silver prices generally decline and vice versa. Statistically, you might consider silver and the US dollar negatively correlated. Because silver is priced in US dollars, as the value of the dollar falls, the value of silver climbs for investors who have a base currency that is not USD.

Industrial Use and Renewable Energy

Unlike gold, silver is widely used in manufacturing processes. Approximately 10% of the world’s gold demand comes from industry, but approximately half of silver production is bought by businesses making items ranging from electronic devices to photovoltaic (PV) conductors, which convert sunlight into electricity. One of the reasons for renewed interest in buying silver is the metal’s role in one of the world’s booming markets, the production of EVs.

Is Silver a Good Investment?

Silver is a good investment for several reasons:

- It assists in the diversification of your portfolio

- It can be used to hedge future inflation

- It is viewed as an industrial and precious metal

Silver is an excellent investment vehicle and can assist in helping you diversify your portfolio. Historically, silver is uncorrelated (does not move in tandem) with stocks and bond prices and is viewed as a safe-haven asset. Assets such as silver are also seen as a hedge to future inflation, making the shiny metal an attractive candidate for fixed-income investors.

ETFS Physical Silver – Monthly Price Chart – September 2017-April 2022

Source: IG

The Bottom Line

Some investors specialise in trading silver, but for the majority, silver positions would make up a small but important part of a broader portfolio. The historical reasons for trading the metal have been supplemented by the role that the metal plays in the move to a carbon-free economy. Whatever your reason for trading silver, navigate to one of these trusted brokers to take advantage of the research and support they offer and ensure that you get your introduction to the market off to the best possible start.