The short lead-time on raw material extraction to consumption means that the consumer feels fluctuations in prices almost immediately. Consequently, it is not surprising that as oil prices climbed sharply in the first half of 2022, measures of inflation followed suit. Read on as we explore the consequences of this trend, one that was ever-present in 2022, and impact of changing oil prices on the market.

Measures of Inflation

Measurements of inflation are varied and in a large and complex marketplace, at times, do not move concurrently. Some gauges remove the impact of energy so as to not conflate goods and services. The fact that this segregation would even be attempted speaks more to the influence of energy prices on your pocketbook than the nuances of economic statistics.

The reality is that energy is the lifeblood of any good or service, and a very large proportion of that energy is still derived from crude oil.

WTI and CPI

One oft-referred to measure of inflation is the US Consumer Price Index (CPI) for urban consumers, published monthly by the Bureau of Labour Statistics (BLS).

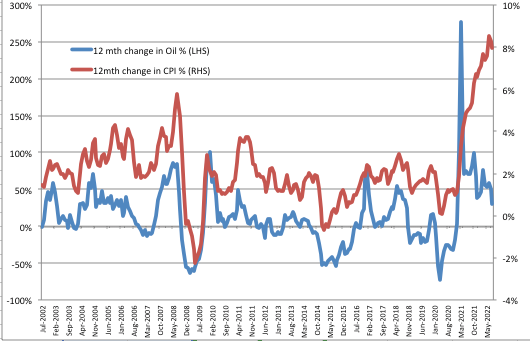

When CPI is plotted against the monthly US oil price benchmark (WTI), the relationship is clearly illustrated:

Source: Author

A statistical method for deriving how closely the two parameters are related is the correlation coefficient. Correlation operates on a scale from -1 to 1, with 0 suggesting no relationship, 1 being intertwined and -1 inversely related.

The correlation coefficient of CPI and WTI is a very high 0.75. Over time, when US crude oil prices have moved up or down, the CPI has generally moved in the same direction. The result of 0.75 suggests that today and into the future, we can expect the same relationship to continue.

Impact of Changing Oil Prices – Home and Abroad

When oil prices move up and down, a large proportion of the price of the basket of goods and services you buy on a daily basis will track the change.

When there is a squeeze or a drop in the oil price, there is generally a knock-on effect to the country-wide inflation for those countries that are oil importers.

As a result of this effect, a country’s policymakers pay especially close attention to the price of oil in order to keep track of prices and fulfil their mandate of general price stability.

If the cost of goods and services outstrips the productivity of a country, then the quality of living of its residents will decline. Through fiscal and monetary policy toolkits, it is the responsibility of the policymaker to ensure that this doesn’t happen.

Policymaker Toolkits

So far, we’ve outlined that when oil prices rise and fall, broad measures of inflation will follow suit. As indicated, if prices rise too quickly, the living standard will fall. On the other side of the coin, if prices are too low, future productivity will be hindered by a lack of investment today.

Policymakers walk this tightrope by raising and lowering the benchmark interest rates. The desired outcome from interest rate changes is twofold:

- It will influence the relative purchasing power of its currency by adjusting the interest rates. This can boost or stymie capital investment by adjusting the cost of capital. It will have an immediate impact on the cost of oil for the citizens of oil-importing countries not denominated in US Dollars. The raising of interest rates attracts more buyers of the currency through higher deposit and debt security yields. A higher British pound, for example, makes the cost of oil denominated in US Dollars lower for its citizens.

- It will have a longer-term impact on the cost of oil. Lower rates make a wider array of investment start-ups more attractive, generating productivity, driving wage growth, lowering unemployment and increasing spending. Ultimately, prices rise through increased demand, with more money circulating in the economy. Higher rates are designed to slow economies, making investment hurdle rates to profitability more challenging, slowing productivity, and reducing wage growth, employment and spending. The reduction in spending will lower demand for goods and services and send prices lower.

The adjustment is inherently a demand-side adjustment. Scientific advancements that might boost supply through productivity gains are difficult to predict. As a result, they are rarely factored into the US Federal Reserve’s (FED) calculations.

Policymakers raising borrowing costs make it more difficult for marginal supply to come to the market. These price-scalping entities tend to be uncompetitive under normal business conditions and do little to temper wage inflation. Ultimately, the only desired new supply entrants are those new companies that can make big gains on raw materials produced per unit expensed versus the existing suite of market participants.

The FED’s Scorecard

Chairman of the Federal Reserve, Jerome Powell, is currently trying to walk the tightrope of reigning in prices and not derailing progress. With oil and gas supply from Russia to Europe rerouted and squeezing existing supply from the North Sea, North Africa, the Middle East and the US, energy prices have climbed from 2021. The rising costs are starting to be felt not only abroad but in the US also.

The US CPI year over year is at 8.3%, levels not seen since the early 80s. The UK CPI is nudging 10% and the story is more of the same in Europe and across the world.

With prices climbing so quickly, retail sales are starting to suffer and consumer credit is starting to tick upward as consumers run into the red. Inflation has plateaued of late as oil prices have retreated over 25% from June 2022. However, it is critical that a broader base of goods and services comes down to insulate consumers from overextending themselves.

Source: iStock

The Near-Term Outlook

The job isn’t finished yet. The Federal Reserve and others will continue to raise benchmark lending rates to slow wasteful economic expansion and moderate prices to protect businesses from terminal overspending.

We can expect several more rate rises from the low near 0 starting point and history points to a high ceiling should prices not respond.

Rising benchmark lending rates will come with higher costs of borrowing. This means a greater share of your income going to your floating rate mortgage, and a higher interest bill from more costly loan arrangements for collateralised and uncollateralised debt.

We can expect the trend of raising rates until the demand for a broad basket of goods and services starts to plateau and retreat, or, indeed, new competitive supply undercuts the current more costly arrangements.

The Outcomes

One of the less desired effects of slowing an overheating economy is that reduced spending will abate new business applications and force the less fiscally disciplined to the wall. A reduction in business activity will raise the unemployment level.

The more desired outcomes include lower costs of critical food and transportation services as well as housing – serving to protect the most vulnerable.

Impact of Changing Oil Prices – Final Thoughts

Oil and energy prices are intertwined with a vast array of goods and services. Presently elevated fossil fuel prices are serving to ratchet up inflation and heap pressure on consumers.

This cycle of rate rises is not complete. We can expect the upward momentum of benchmark lending rates in most countries to continue in order to shield from the less desired effects of sticky inflation.

Given the extended lead time on capital expenditure and the unpredictable and patchy introduction of scientific advancements that materially impact productivity and, ultimately supply, it is the demand-side of the curve that will fall first.

A demand-first approach to prices will send a large number of businesses to the wall as they deal with reduced top-line revenue and elevated wage inflation, rising unemployment and hardship for many citizens.

We are on the path to turning the inflation ship, but we are set on a difficult course for the economy and the stock market as a whole. The weeks and months ahead will be turbulent and likely weighted to the downside meaning we will still see the Impact of Changing Oil Prices for months to come.

When considering any investment in the oil sector, due diligence is essential. Keep up to date with the latest trends and updates with our news and market analysis and be sure to trade based on the recommendation of our top brokers.