Markets don’t move up in a straight line, so sell-offs are actually guaranteed, but their timing, scale, and duration are harder to call. This means investors and traders are faced with the question of what to do during a market sell-off, but the good news is that although each rush for the door is different, the playbook is pretty much the same.

How to Profit from a Market Sell-off

The first step towards navigating a market sell-off is to establish a clear understanding of your starting position and investment aims. Long-term buy-and-hold investors who have been holding stocks for years will have a different approach to someone who is new to trading and approaching the situation with no current holdings.

For both traders, one real temptation is to trade with the trend and profit from falling prices. Even the investor with an existing portfolio can take advantage of online brokers offering small investors instruments that can help them make profits during a market sell-off.

Short CFDs

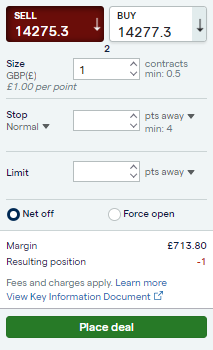

CFDs (Contracts For Difference) offer functionality that traditional share-buying services do not. Gone are the days of only being able to go ‘long’ on a stock, buying a share certificate and putting it safely in a draw somewhere. CFDs can be used to make gains from falling prices in a wide range of markets. It’s possible to best against, and go short, single stocks, stock indices, commodities and currencies.

NASDAQ 100 Index – 2021 – 2022 – Short Selling Opportunities

Source: IG

CFDs work by the client having and their broker having an agreement that one will pay the other depending on how a market moves. The client isn’t obliged to ‘buy’ into a market, and if they decide to sell 10 units of stock ABC trading at $14 and buy it back in the future when the stock is worth $12 then they’ll make a profit of $20.

Clicking on ‘sell’ at time of trade is as easy as clicking on ‘buy’. All that is required is to input the quantity of the instrument you want to trade and then clicking ‘Place Deal’. At that point, you’ll open a short position and benefit from price falls in the market and make a loss if the price goes up.

How To Sell Short Using An Online Broker

Source: IG

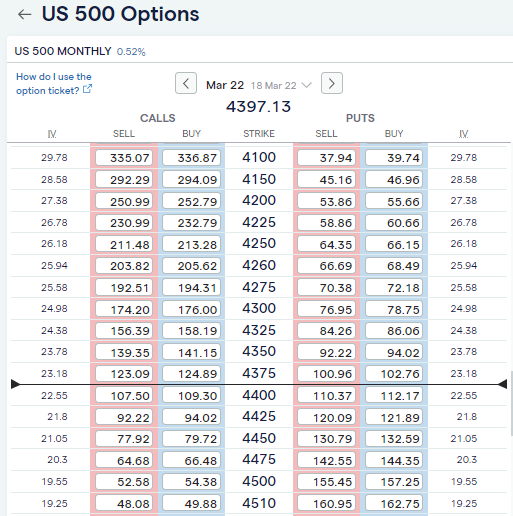

Buy Put Options

Options are derivative instruments that allow but do not oblige the holder to be able to carry out a transaction at a future date. The below options market provided by IG on 18th February offers put options – the right to sell the S&P 500 index on 22nd March at a price level of 4,200. It will cost you $55.60 to buy that option. If price goes below the strike price of $4,200, those options will be in the money. They could be sold before the expiry date or held so that the profit is crystalised when the option is exercised. If price doesn’t fall to below $4,200, they will expire worthless, and the $55.60 premium paid for the option will be accounted as a P&L loss.

S&P 500 Index Options Markets Monitor – March 2022 Expiry

Source: IG

Derivative instruments are associated with being higher risk. This is largely because it’s important to get a full understanding of the technical nature of how they work. They were originally developed to manage risk. Institutional investors with billions of dollars of long equity positions are able to hedge some of that position by buying ‘put’ options that are ‘out of the money’ as a form of insurance. If the market crashes, the losses on the stock positions are to some extent balanced off by the gains on the options.

Good online brokers now offer option markets to retail investors – buying ‘put’ options isn’t only for those with existing portfolios they want to hedge. The instruments can be used to profit from a market correction and might be the only position an investor takes in the market.

Buy Safe Haven Assets

Assets such as gold, which are considered ‘safe haven’ assets, can see their value rise while the rest of the market is selling off. The US dollar often sees its value increase during times of geopolitical stress thanks to its role as the world’s base currency. Some also argue that cryptocurrencies are developing a correlation pattern, which sees investors move into the likes of Bitcoin during times of uncertainty.

Gold Price Chart 2021 – 2022 – Rise In Value During Stock Market Sell-off

Source: IG

Adopt Market Neutral Strategies

If you bought Amazon stock in 2001 and swore you’d never sell it, but also think the market as a whole is overvalued, there is another way to hedge your downside risk, and possibly even enhance your returns.

Long-short strategies are a popular technique used by hedge funds that take a profit on the respective prospects of two stocks. The long-position in Amazon could be counterbalanced by a short position in Facebook/Meta. Amazon’s Q4 2021 earnings were stellar and indicate the firm has better prospects than Meta, which is challenged by some of its platforms, particularly Facebook, having an ageing demographic. After Facebook announced its disappointing Q4 2021 earnings results, its stock tanked 26% overnight.

If the stock market sell-off you envisaged doesn’t materialise, and both stocks continue to rise in value, your Amazon gains will be offset by losses in the short Meta position. If a correction does take place, then the expectation is that Meta’s falls will be greater than that of Amazon. The premise of the ‘Bezos vs Boomers’ strategy is that the differential in performance between the two firms will see you make a profit, regardless of whether the broader market goes up or down.

Buy The Dips

Historical price performance isn’t a guarantee of future returns, but for many decades, the price of stocks has gone up. Price rises and falls in stock markets are different in nature. The days, weeks and months of a bull market are associated with a steady drip-feed of cash coming into the market to support prices. Price corrections tend to be sudden and short-lived as panic and fear grip the markets.

Timing an entry point into a long position can be difficult to do hence the trading floor phrase that describes it as ‘catching a falling knife’. Working into a position gradually to average out the trade entry price level is one technique to consider.

Technical indicators such as the Relative Strength Index (RSI) can offer up clues to whether the sell-off has run its course, or not. If a market is ‘oversold’ on a short-term basis, then that could suggest a bounce in stock prices is imminent. Whether it’s the bottom of the market or a ‘dead cat bounce’ is another question, but long-term investors with some capital to invest might even patiently wait for a stock market sell-off before buying into weakness.

Rotate Into Defensive Sectors

Market sell-offs impact different sectors in different ways. Defensive stocks such as utility companies tend to experience falls in value that are proportionately smaller than sectors that rely on discretionary consumer income.

If you were thinking of realigning an existing portfolio, then a sell-off might be the catalyst to put through that change.

Hold Tight

For those who have existing positions in stocks, a market sell-off can raise the question of whether to lighten some of the risk on their portfolio – possibly with the intention of buying back in at a later date.

The risk is that selling out positions at the bottom of the market can mean investors miss an opportunity to get back in and benefit from the rebound. Sitting tight and weathering the short-term noise can be seen as the obvious alternative option to take. Tax implications may also need to be factored in if a portfolio has been built up over the long term using individual tax allowances.

Many experienced long-term investors hold some cash to one side to buy into market sell-offs, in the expectation to lighten risk levels after the bounce. This approach can work well when applied to high beta stocks.

What Are The Potential Downsides Of CFD Short Selling?

All trading comes with a degree of risk. However, the warning notices provided by CFD trading platforms are intended to flag up the functionality of CFDs to investors. This means there are some additional risks to factor in.

One such notice is the following from Pepperstone:

“CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading derivatives is risky. It isn't suitable for everyone. You don't own or have rights in the underlying assets. Past performance is no indication of future performance and tax laws are subject to change.”

Source: Pepperstone

Broker Choice – When trading CFDs, it’s important that your broker is creditworthy and reliable. Any profits you make in paper terms are worthless if they aren’t in a position to pay up when you close your trade out. That is why choosing a platform from this list of trusted brokers is crucial. These firms are all regulated by financial authorities with compliance requirements, including a need to hold sufficient funds to pay clients.

Margin – Your side of the agreement requires putting up a deposit to finance your short position. If you, for example, place $1,000 with a broker, they’ll allow you to run your positions until any losses get close to $1,000. At that point, it’s likely your account will be stopped out.

Leverage – The broker may allow you to take on positions using leverage. In the above example, the $1,000 deposit could be used to take on a position valued at $5,000. This represents 5:1 leverage, meaning the same percentage point change in a price in a market will have a five-fold increase on the profit or loss (P&L). If a trade goes wrong, you’ll burn through the $1,000 deposit five times as fast as you would without leverage.

Administration costs – T&Cs vary from broker to broker, but it could be that you are charged daily financing fees for taking on your position. These are likely to be small in relation to the P&L moves but need to be factored in if you’re running a long-term short position.

Short-squeeze – Losses on long positions are capped. If you buy $100 of a stock and its price falls to zero, the loss is $1,000. If you short the stock at the $100 price level and its price sky-rockets to $2,000, then your losses are greater than $1,000. There have been notable occasions when stocks such as GameStop have been subject to a short-squeeze where losses are technically infinite.

Summary

It’s important to understand the nature of any stock market sell-off as that will help formulate the best response.

During January 2022, the fall in stock market values was attributed to valuations being questioned as the global economy transitioned into becoming a high inflation, high-interest rate environment. An unusually strong Santa Rally in December 2021 took stock prices to levels where the bears could take over the market.

The earlier stat about the NASDAQ 100 giving up all of the gains made since June 2021 highlights how anyone who has bought into that index since then is likely sitting on a P&L loss. That’s not a particularly comfortable position to be in but could be seen as being in line with normal market activity for long-term investors.

Compare this to the sell-off in 2008-9 when initial price weakness caused a vicious circle where banks and institutional investors had to liquidate assets to remain solvent. This selling pressure drove prices down even further and caused more and more selling.