AvaTrade's move into the copy trading space has resulted in them offering their clients an impressive and extensive range of social and copy trading services. As might be expected from a broker as well-regarded as AvaTrade, the service is high-quality and comprehensive catering to beginner and advanced traders, with a strong list of AvaTrade Copy Traders.

Sorting through the list of AvaTrade copy traders might initially seem daunting, but it is worthwhile. This shortlist has been compiled to ease the selection process. It opens the door to AvaTrade clients letting someone else do the research and portfolio management for them and potentially make low-maintenance returns.

Please Note: Copy trading involves automatically copying the trades of other traders, but it carries risks. The performance of the copied trader may not be replicable, and there is a possibility of losing your entire investment.

CFDS ARE COMPLEX INSTRUMENTS AND COME WITH A HIGH RISK OF LOSING MONEY RAPIDLY DUE TO LEVERAGE. 79% OF RETAIL INVESTOR ACCOUNTS LOSE MONEY WHEN TRADING CFDS WITH THIS PROVIDER. YOU SHOULD CONSIDER WHETHER YOU UNDERSTAND HOW CFDS WORK AND WHETHER YOU CAN AFFORD TO TAKE THE HIGH RISK OF LOSING YOUR MONEY.

Table of contents

Selecting the Best Copy Trading Platform at AvaTrade

The proprietary AvaSocial platform is an app-based copy trading platform which offers clients the chance to directly follow the trading ideas of the best traders using AvaTrade. It's possible to share ideas with experienced traders or set up your account to take on the signals offered by investors running a wide range of strategies.

Three other copy trading platforms are available to AvaTrade clients – ZuluTrade, DupliTrade, and MetaTrader Signals. Each is an established operator in the copy trading sector, and they have been offering their services to traders for many years.

One advantage of the DupliTrade service is that the lead traders listed on it are actively managed. The platform's team audits and monitors lead traders' performance to ensure only the best is offered for others to follow. Lead traders must also use their own money rather than generate returns using virtual funds in Demo accounts. That means the interests of the leader and copier are more closely aligned.

ZuluTrade, in contrast, offers a broader range of signal providers. They can be ranked using various metrics, including maximum drawdown and average profitability. Similar filtering functionality is provided by the MetaTrader Signals copy trading service. MT Signals was one of the early movers in the copy trading space, and it has been successfully providing automated trading services to clients of MT4 since 2012.

Selecting the Best Copy Traders on AvaTrade

Selecting the best copy trader follows the same ground rules as developing your own strategy and trading yourself. It involves considering what you want to achieve and how to do so. Different traders specialise in different asset groups and run various types of strategies. Some will be a better fit for a user than others. The main difference with copy trading is that the day-to-day process of booking trades uses the ideas of others and is automated.

To help copy traders find a best-fit trader to follow AvaTrade offers easy-to-use filtering tools. It's possible to establish not only the overall performance returns of other traders but, more importantly, to develop an understanding of ‘how' they trade. That allows AvaTrade clients to factor in risk management, and given that copy trading involves putting a third party in charge of a lot of the decision-making process, some care is needed.

Top Copy Traders and Their Strategies

The DupliTrade platform, which AvaTrade offers its clients, has a range of filters and metrics, making it easy for copy traders to get a good idea of what they might be signing up for. The shortlist comprises lead traders carefully selected by AvaTrade, but there is still a wide range of strategies to choose from.

Some DupliTrade strategies are fully automated, some use AI, and others allow for greater discretionary management by human operators. There are also differences in terms of asset classes they trade. But they all have in common that they allow copy traders to follow signals from clearly successful traders.

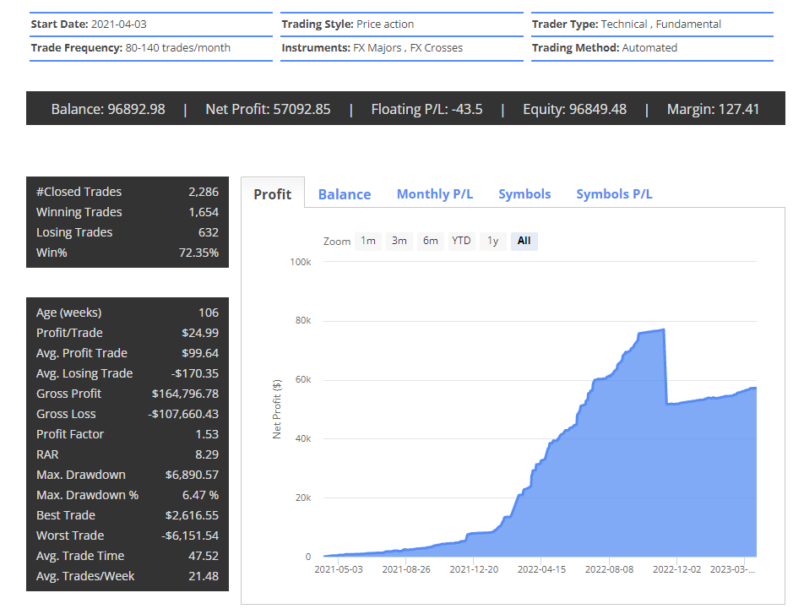

Boost

The fully automated Boost Strategy Provider started trading in April of 2021 and trades in major and minor currency pairs. It uses technical analysis-based custom-coded indicators refined over a period of years and books 80-140 transactions per month. It also uses fundamental analysis tools.

The hard-coded stop-losses the Boost plan operates have resulted in the maximum drawdown being only 6.47%. The lifespan profit on the strategy is 139.68%.

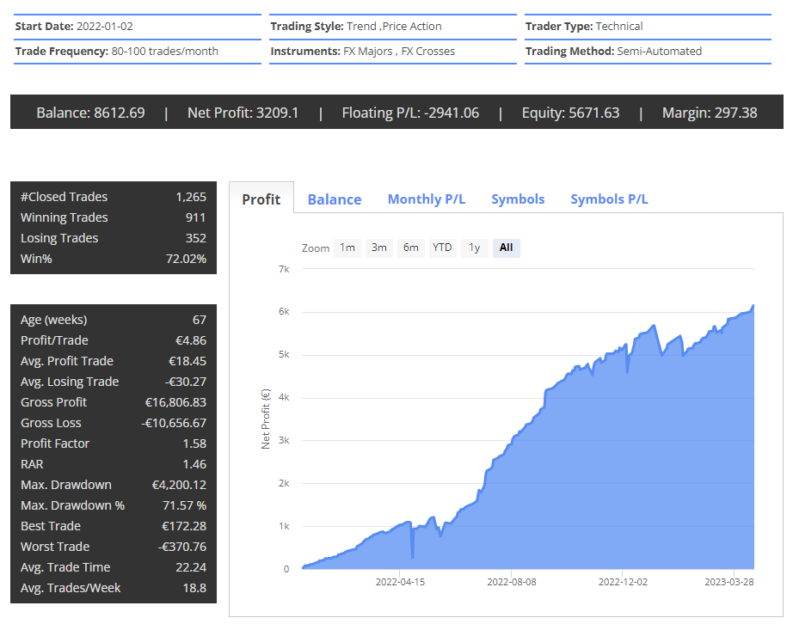

Jedi

The Jedi Strategy Provider is a relatively low-risk copy trading opportunity. It dates back to January 2021, with a lifespan profit gain of 71.54%. Boost has recorded only two down months, which reflects the operator's risk control measures have been effective. In months when the strategy posts profits, they are modest compared to some of the more volatile copy traders available at DupliTrade.

The Jedi strategy is semi-automated and is constantly monitored by the strategy operator. It trades in major and minor currencies, aiming to profit from forming trends.

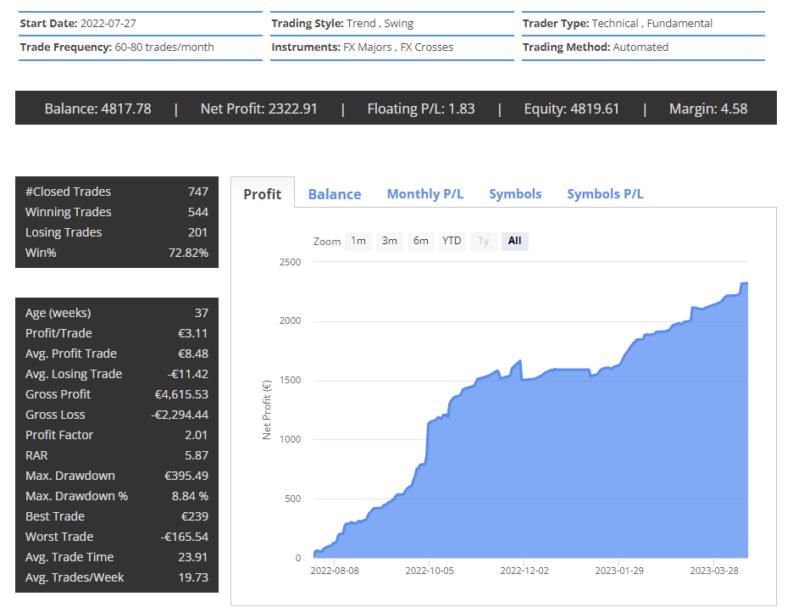

Fox

Fox Strategy Provider is a fully automated trading system focusing on major FX pairs. It scans markets using volatility indicators and looks for moments when price overshoots. Risk management is a key feature of Fox. The maximum drawdown is 8.84% representing the strategy that gives substantial weighting to the importance of equity protection.

The lifetime profit return on Fox is 117.91% which is an impressive return for a strategy which sets out to embed risk management into its decision-making. The win ratio is 72.82%, and nine of the last ten months have seen the strategy post a positive return.

Recent Success Stories and Scale of Returns

As market conditions change, strategies become more or less effective. No particular strategy is always the best option. Copy traders can move their capital allocation between different strategies with the click of a button, which means time also needs to be devoted to spotting emerging managers. The chart below of the current top performers provided by DupliTrade is an excellent place to start when considering which traders are on a hot streak.

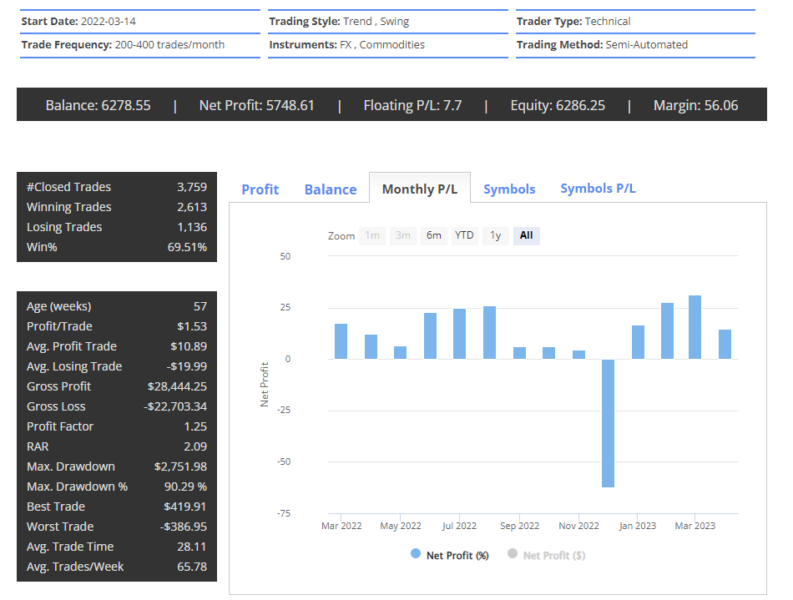

Dragon

One strategy which is performing well in the current market conditions is the Dragon Strategy Provider. It first came to the market in March 2022 and has posted positive monthly returns on all but one occasion. That down month saw the strategy's net profit fall by a massive 62.35%, but overall lifetime returns are still +190.95% and three of the last four months saw the strategy post profit gains above 15%.

The Dragon strategy uses semi-automated trading techniques to buy and sell forex, commodities, indices, and stocks. Using technical analysis, it aims to identify and follow market trends and “strategy operators are constantly analysing the market trends and conditions to set the trading range, adjust the market exposure and manage the applied risk.”

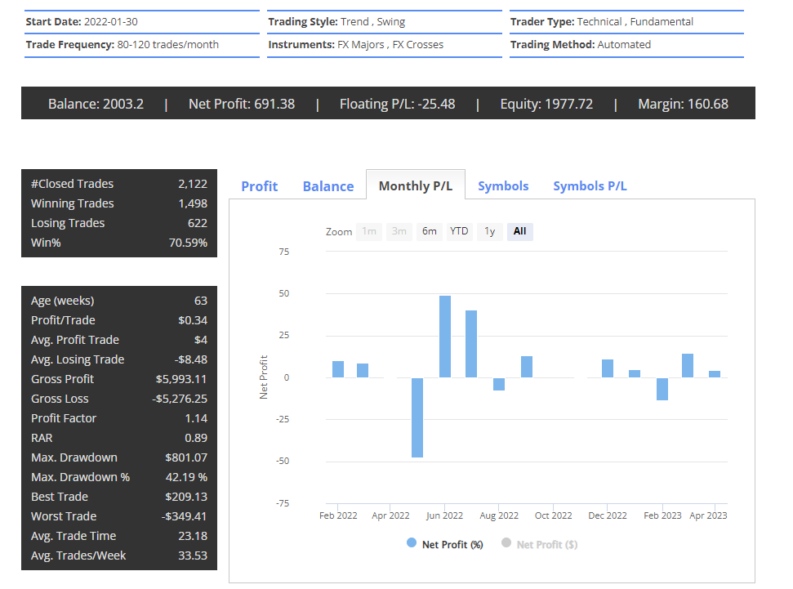

Compass

The DupliTrade Compass Strategy Provider concentrates on trading the forex markets. It trades frequently and has opened and closed 2,122 trades since its inception in January 2022. Short-term strategies rely on a high win-loss ratio to be successful, and that metric for Compass is an impressive 70.59%. Five of the last six months saw that approach post positive returns, and the lifetime profit on the strategy is 68.32%.

The monthly P&L loss of 47.76% in May 2022 has dragged on the overall performance of Compass, but if events such as that can be avoided, the strategy could be set to head up the rankings.

Copy Trading Best Practices

An inherent risk of trading is that the assets you buy might fall in value. That's the case whether you invest based on your own decisions or follow trading signals provided by a third party. There are also some golden rules of copy trading which cover the unique nature of the processes involved.

Research and due diligence are crucial. Time taken to understand the strategy and behaviour of a lead trader can help optimise returns. It can also help spot potential ‘red flags' such as establishing if there is a divergence between the stated aim of a trader and what trades are booked.

One question which copy traders face when signing up to receive signals is whether to book trades to mimic the existing positions or just start copying new trades. The lead portfolios will usually have been built up over time, and deciding what approach to take is best done on a case-by-case basis. It is also likely that lead traders will offer guidance on what approach might be the best fit for their strategy.

Headline performance figures are important, but other key metrics must also be considered. They can offer an insight into ‘how' a trader operates. The win-loss ratio and maximum drawdown numbers will indicate whether the trader holds onto losing positions for possibly too long. There is a temptation to stick with losing trades until they come good, which can lead to accounts being wiped out.

Traders who offer a more disciplined approach and use stop-losses are a lower-risk option. While their performance returns may, at face value, be lower, they often provide a better chance of long-term returns not being binary.

Diversification is as important to copy traders as it is to those building their own portfolios. Allocating capital to lead traders running different strategies mitigates risk and smooths out returns. That is particularly useful when markets are stressed.

Copy Trading can be relatively low maintenance, but some monitoring is required. Rotating out of one relationship and into another can help traders catch the next trend, and checking reports also helps copiers spot if a lead trader has changed their approach.

If you're still considering the pros and cons of copy trading and whether it is for you, one way to become familiar with the processes is to copy traders using a Demo account. Those use virtual funds, offering a risk-free way of exploring the approach.

Trader Discretion Advised

The risks associated with Social Trading Features include but are not limited to, automated trading execution, whereby the opening and closing of trades will happen in your account without your manual intervention. Trading foreign exchange (“forex”), commodity futures, options, contract for difference (“CFDs”) and spread betting on margin (the “investment products”) carry a high level of risk and may not be suitable for all investors. Past performance results are not necessarily indicative of future results. No representation is made that any account will or is likely to achieve profits or losses similar to those shown.

Both social trading and copy trading are helpful trading strategies. It is, however, essential to select a system that suits your trading needs and preferences at any given time. AvaTrade offers a range of solutions, including its AvaSocial trading app and copy trading platforms. Selecting the one that meets your trading needs and preferences is vital.

Conclusion

The benefits of copy trading are clear. Taking on the trading signals of more experienced traders with a track record of making positive returns sounds straightforward. Things can change, of course, and some degree of portfolio management is still required. But when copy trading works successfully, it offers a chance to gain exposure to the financial markets and simultaneously outsource much of the day-to-day work involved with trading.

People Who Read This Also Viewed:

- The Best Starter Stocks for Beginners

- Political Factors that Could Affect the Stock Market in 2023

- Best Broker Guide

- Practical Risk Management – Part 1

- Best Trading Strategies