Buying on RSI Positive Divergences can be a tricky trade as one is going against the trend and only the momentum has stalled during a positive divergence. Also when the trade does not work out there could be a gap down and can give a much bigger loss than expected. For that reason most prefer to wait for a price confirmation through candlestick formations.

Another way to take this trade is to focus only on Indices where the gap down risks is relatively lower as indices are derived from a bunch of stocks.

This is the setup we are looking out for

- RSI Triple Divergence to be seen mainly post a good 10% correction from the peaks. Larger the correction better.

- The 3rd bottom does not stay for a long time and hardly gives you a chance to jump in.

- Acting either on 2nd bottom or post the confirmation of Triple Divergence is an equally good strategy.

- Triple Divergence is a great time to Invest as well as Trade.

- Ideally it should work similarly on finding Tops but it does not as Topping out is a slow process. Panics happen faster.

- Triple Divergence is not seen often and one has to wait.

- The tough part is not to spot but to be able to act contrarian and digest the short term pain after entry.

- The only time it did not work was in October 2008.

Strategy

- Buy in Parts below 2nd bottom in a range of 1-2%. Keep a stoploss of 3% from entry price.

- Buy on candlestick reversal or 3 day high after the triple divergence.Stoploss of the candle lows.

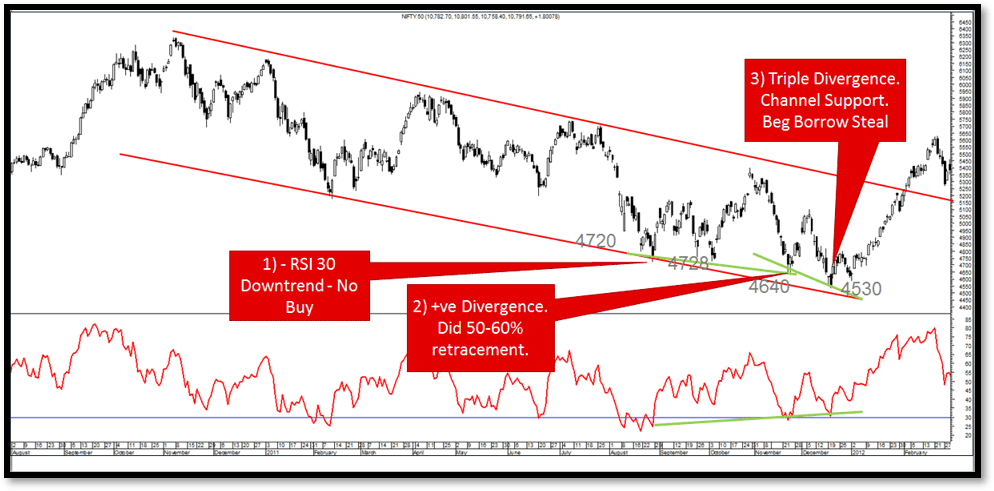

Nifty – Triple Divergence in 2011.

- The first time Nifty hit 30 RSI the bottom was 4720.

- The next bottom at 4640 and RSI was higher. 2nd

- The third bottom at 4530 and the RSI was higher. Triple Divergence.

- The third bottom was around 2.5% lower than the 2nd

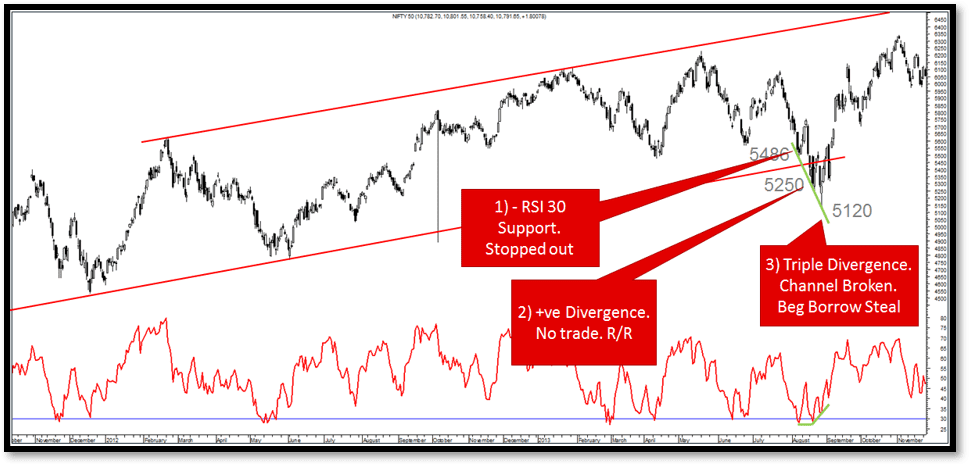

Nifty Triple Divergence in 2013

- The first time Nifty hit 30 RSI the bottom was 5486.

- The next bottom at 5250 and RSI was higher. 2nd

- The third bottom at 5120 and the RSI was higher. Triple Divergence.

- The third bottom was around 2.5-3 % lower than the 2nd

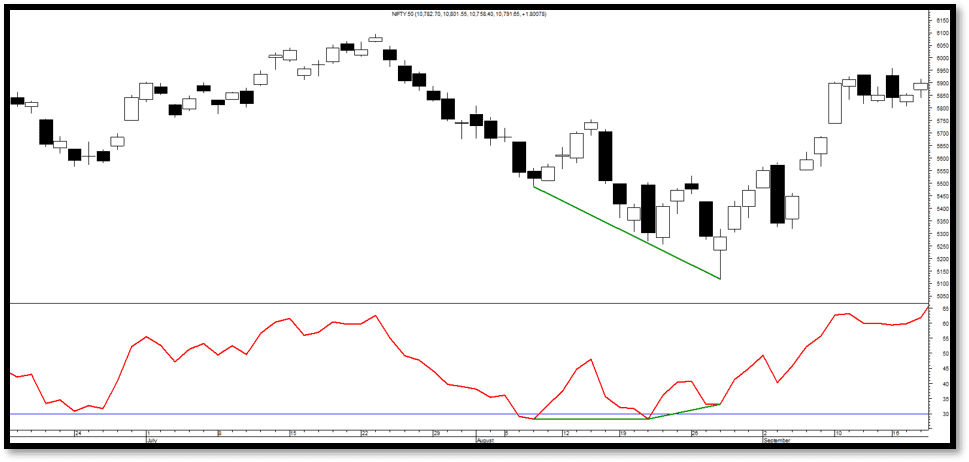

The zoomed in chart for 2013 bottom

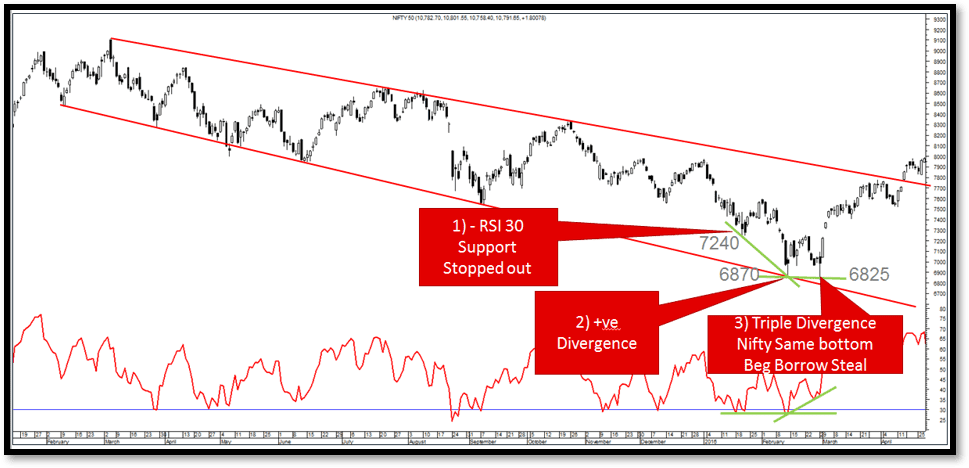

Nifty Triple Divergence in 2013.

- The first time Nifty hit 30 RSI the bottom was 7240.

- The next bottom at 6870 and RSI was higher. 2nd

- The third bottom at 6825 and the RSI was higher. Triple Divergence.

- The third bottom was around 1 % lower than the 2nd

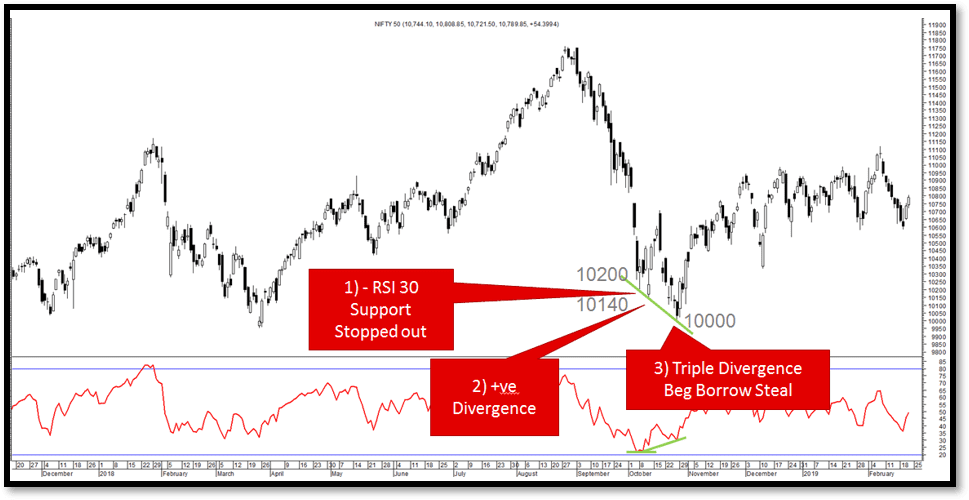

Nifty Triple Divergence in 2018

- The first time Nifty hit 30 RSI the bottom was 10200.

- The next bottom at 10140 and RSI was higher. 2nd

- The third bottom at 1000 and the RSI was higher. Triple Divergence.

- The third bottom was around 1-1.5% lower than the 2nd

Conclusion

- In the last 4 major bottoms in Nifty most have shown similar patterns.

- 3 bottoms with higher RSI.

- After the first oversold bottom the next 2 bottoms take a few weeks and another 5% drop with the difference between the last 2 bottoms being less than 3%

- The upsides have been a good 10-20% from the lows.

- Also all the 4 bottoms have never been visited again in the next few years.

- The Triple Divergence becomes an excellent entry point for a trade as well as a long term investment.