Commodities, such as wheat, corn, crude oil, and gold, are fundamental goods and essential materials traded on exchanges or speculated upon using derivatives contracts. These commodities encompass a wide range, from agricultural products to more challenging-to-extract raw materials.

But which commodities are the most sought-after and traded?

YOUR CAPITAL IS AT RISK

Top 10 Traded Commodities

Below is a list of the top 10 most-traded commodities according to data from The Futures Industry Association (FIA). The most heavily traded commodities in the world are:

- Brent crude oil

- Steel

- WTI crude oil

- Soybeans

- Iron

- Corn

- Gold

- Copper

- Aluminum

- Silver

abrdn Bloomberg All Commodity Longer Dated Strategy K-1 Free ETF

Brent Crude Oil

Brent crude oil is a type of crude oil that is considered one of the key benchmarks for oil prices around the world. Its fluctuations directly impact transportation costs, energy prices, and stock markets. Geopolitical and economic conditions can heavily impact oil prices. For example, when the COVID-19 pandemic hit, various economies globally ground to an almost halt, and as a result, oil prices plunged as demand sank.

Steel

Steel is the backbone of modern infrastructure, finding applications in construction, automobiles, ships, and much more. Its demand can closely mirror economic growth. For example, steel is used in the manufacturing of vehicles. If steel demand slows, it can be an indication that demand for products, such as cars, is also on the decline. As a result, steel can be considered an indicator of global industrial activity.

WTI Crude Oil

WTI crude oil is another crucial oil benchmark. WTI stands for West Texas Intermediate, as it primarily originates from the United States and influences North American energy prices. Its correlation with Brent crude often reflects global supply and demand dynamics. Just like its Brent counterpart, its price is impacted by economic and geopolitical conditions.

The World Bank said that “energy prices, after dropping by an estimated 29 percent in 2023, are expected to fall 5 percent in 2024 as subdued global growth reduces demand pressure.” In addition, they state energy prices are “then projected to edge further down 0.7 percent in 2025.”

Soybeans

Soybeans serve as a significant source of protein for livestock feed and human consumption. In addition, soy is used in various products outside of food. Its derivatives, like soybean oil and soymeal, extend its reach, making it a widely traded commodity. China is the world’s largest importer of soybeans, accounting for over 60% of world trade. Meanwhile, Brazil and the US lead the way when it comes to soybean exports.

Iron

Iron is a primary constituent of steel, and iron ore ranks high in traded volume. Its extraction and processing fuel entire industries (think iron mining), impacting construction, infrastructure development, and manufacturing sectors worldwide.

Corn

Corn is a widely used cereal grain. While it is used for food, it is also processed into a multitude of food and industrial products, such as starch, sweeteners, corn oil, and beverage and industrial alcohol. The commodity’s price volatility can have knock-on effects on food security and the biofuel industry.

Gold

Gold, or the yellow metal, as it’s otherwise known, is often seen as a safe haven asset. As noted in a research paper from the World Bank, “metal prices have edged down 1 percent since the onset of the conflict. However, gold prices— which usually move in tandem with geopolitical concerns—have increased 8 percent.”

Gold’s value transcends its use in jewelry and electronics. Its long history as a store of wealth means investors always try to gain some exposure, especially during uncertain times. In addition, it has an inverse correlation to US bond yields, making it a top-traded commodity.

Copper

This highly conductive metal powers our technological world. Copper is used in various products, such as electrical wiring, renewable energy infrastructure, and consumer electronics. Due to the fact it is used in so many products, copper demand is considered a reliable indicator of economic health.

Aluminium

Aluminium is crucial in the transportation (aircraft), packaging, and construction industries. It is used in the production of trucks, cars, boats, trains, airplanes, and so much more. Reports state that aluminium demand will rise by 40% by 2030.

Silver

Silver is another precious metal. It boasts industrial applications in electronics, batteries, and medical devices. Its investment value, alongside its industrial use cases, contributes to its demand and high trading volume. If you are looking to trade silver, note that its price movements are also closely correlated with gold.

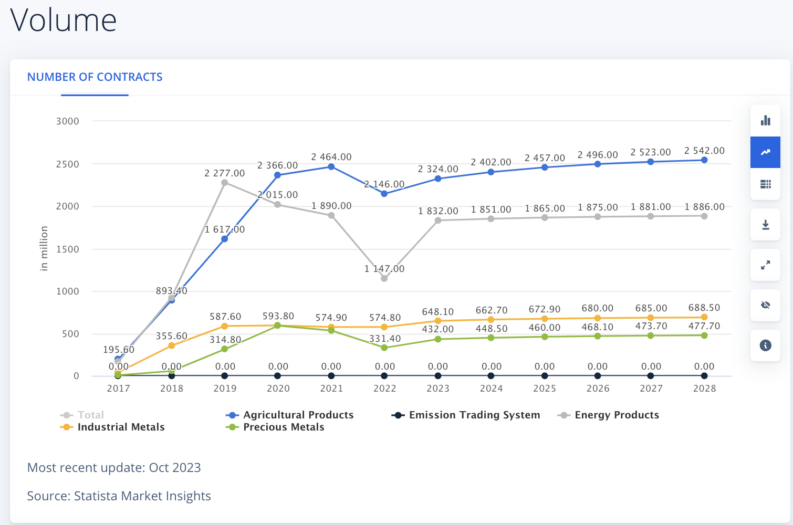

As you can see in the chart above, agricultural products are the most traded by volume, while energy products are the second most traded commodity by volume, according to data compiled by Statista.

Where to Trade Commodities

If you want to trade any of the commodities mentioned, or maybe some that aren’t mentioned in the list above, then you need to sign up for an online brokerage account.

There are various factors to consider when looking for an appropriate broker, such as regulation and the platform’s ease of use. Below, we have picked out some of the top brokers that allow you to trade commodities.