Key points:

- Rolls-Royce shares are largely, 0.5% unchanged on trading statement

- This is the update to accompany the AGM today

- Guidance for 2022 is unchanged so what should our decision be?

- Are Rolls Royce, RR, Shares A Buy On Nuclear Approval Predictions?

Rolls-Royce (LON: RR) has released the usual trading update to accompany the AGM. The reason for this being that clearly the management will say things about how the business is going at the meeting, so make a release to the whole market as well.

The actual information in that trading update is reassuringly boring. In fact, guidance for this year is unchanged. Results of business so far this fiscal year are what management thought they would be and also what they’ve told us they thought they would be. So, the net result of this is simply that we face a little less uncertainty about what we already thought we knew about how RR was going to do this year.

Given that it is new information that moves share prices this explains the decidedly modest move in the Rolls Royce share price. A reduction in uncertainty is worth something but clearly not very much.

This puts us back to having to do real basic research to try to produce a valuation and therefore a trading position in Rolls Royce. There’s always the basic one, RR is a good name, sensible company, and it’ll grow with the economy, why not have a long-term stake? But then if that were how we made our trading decisions we’d not be trading personally.

Also Read: How To Buy Rolls Royce Shares

So, we need to step up a level in our analysis. There is some long-term excitement at Rolls Royce. That modular reactor business could become very valuable indeed. The truth here being that designing and making such nuclear reactors isn’t difficult. Sure, lot’s of detailed engineering – something RR is good at – but we’re not exactly breaking the bounds of nuclear physics here. The risk, the reward as well, is in whether those reactors can be deployed. That’s a political risk and the wind does, currently, seem to be behind the idea. But whether that’s going to persist when it comes to actual installation, who knows?

The valuation of that future depends therefore on a calculation of the probability of those reactors going into service – politics.

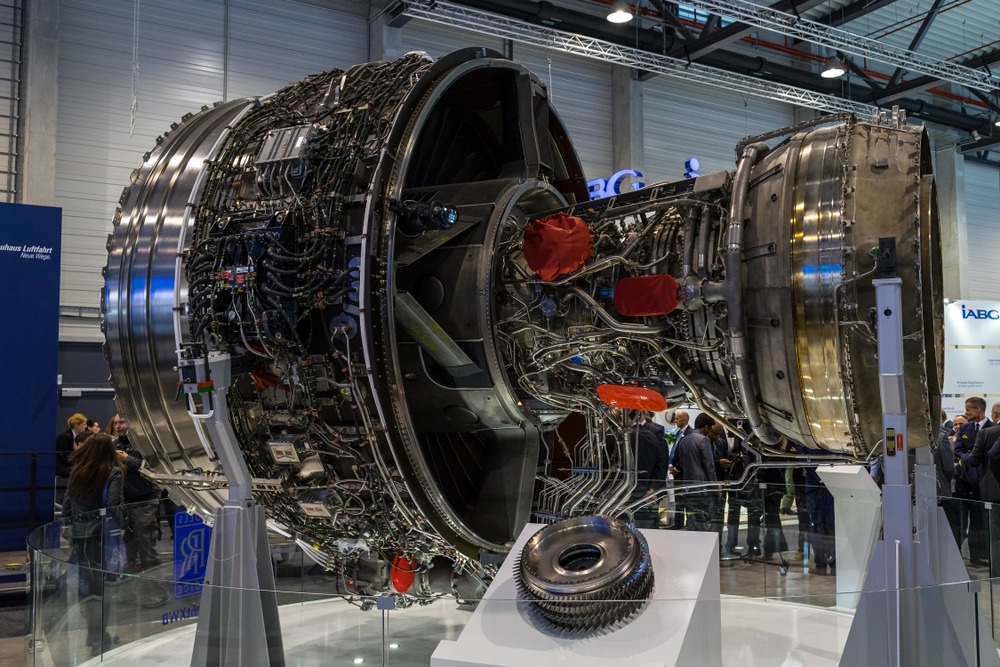

As to the core business of jet engines, this is clearly going to recover from lockdown. We can see from the airline (TUI, here, for example) estimations that flying is coming back. Given that a substantial part of Rolls-Royce's revenues come from hours in the air for each engine out there this is good news. But that’s pretty much baked into the price already.

There is the one more grand speculation about the RR future. All this climate change thing – flying is in the crosshairs here as we all know. Yes, there are electric planes and Rolls Royce has a toe in this water. But the basic physics of weight and batteries mean long haul is never going to be solved that way. So, how will it be? Perhaps we’ll all fly less – meaning that RR has a long-term problem in that jet engine business. But there’s an entirely different solution just being trialled at the moment which is synthfuel. If we can gain green hydrogen – so, made from the electrolysis of water from renewable power – then the chemistry of making aviation fuel is fairly simple and also rather well known. At which point long haul travel becomes entirely possible using current airframes, current jet engines and RR has a great future as an engine supplier.

It’s possible to take the view that this is the long-term determinant of RR share value. Will synthesised jet fuel become economic? On such things, trading positions might be determined.