The S&P 500 is a stock market index that tracks the performance of 500 of the largest companies listed on stock exchanges in the United States. It is widely regarded as a leading indicator of U.S. equities and a barometer of the overall US economy. Some of the top companies in the index include Apple, Amazon, Meta Platforms, and Alphabet (Google).

Composed of companies across various sectors, the S&P 500 provides a broad representation of the US stock market. As such, it is often used as a benchmark for the performance of investment funds and is a popular choice for index-based investment strategies.

S&P 500 Price, Chart & Dividend Yield

The S&P 500 had a tremendous 2024, climbing to all-time highs after gains of more than 24%. With the US Federal Reserve expected to slow the rate cutting in the year ahead, many analysts and investors are expecting a slower rate of growth than we have seen over the past two years.

It is important to note that the S&P 500’s recent volatility comes on the heels of two consecutive years of outsized returns, each exceeding 25% in both 2023 and 2024, a rare feat since the index’s inception in 1957. Historically, such streaks are often followed by periods of more moderate gains or even corrections. Indeed, market corrections of 10% or more occur roughly every two and a half years, while 20% declines happen every six years on average.

Dividend Yield: 1.319%

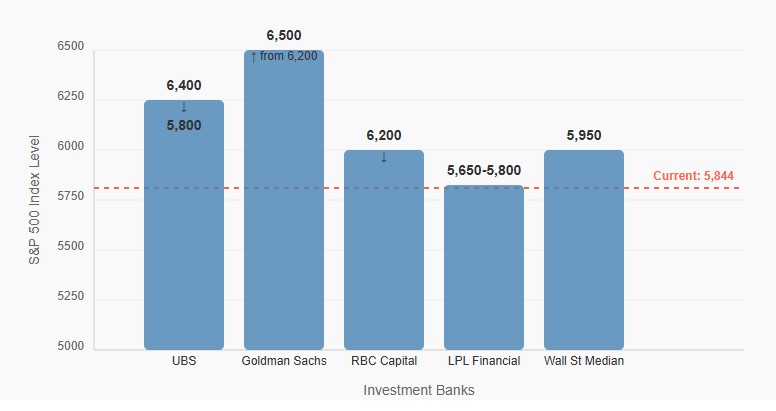

S&P 500 Price Forecast

Given the potential for rate cuts and the emergence of GenAI over the last couple of years, analysts are mostly bullish on the prospects for the S&P 500 this year. Nevertheless, there are still a few who remain cautious. Despite the generally positive consensus, some analysts warn that current valuations are stretched. The S&P 500 is now trading at about 24 times expected 2025 earnings and 22.5 times for 2026, levels well above the 17x multiple seen just a few years ago. Here is one bull and one bear argument for the S&P 500:

The Bull Argument:

Upward revisions to 2025 and 2026 EPS forecasts (e.g., UBS and Goldman Sachs) signal strong corporate profit momentum. Easing tariff concerns, particularly with China, are seen as having the potential to support further gains, especially in tech and growth sectors. The potential for accommodative Fed policies or fiscal stimulus to offset headwinds from tariffs or higher rates is seen as another potential catalyst, whilst continued earnings growth may help justify elevated multiples, especially if GDP growth remains robust.

The Bear Argument:

Renewed or expanded tariffs could stoke inflation, dampen growth, and pressure profit margins. The index’s high P/E ratios also leave little room for disappointment and could exacerbate any downturn. Whilst not the base case for many, the percentage changes of a recession have been growing, and slower-than-expected GDP or earnings growth, could also trigger further corrections. Rising bond yields are also seen as a threat, potentially undercutting equity valuations, especially for high-growth segments.

Analyst Targets

Goldman Sachs has been particularly active in revising its outlook. After cutting its S&P 500 forecasts twice in March due to higher recession risk and tariff-related uncertainty, Goldman has now raised its target. The investment bank sees the S&P 500 reaching 6,500 in the next 12 months, up from 6,200 previously. Goldman forecasts earnings per share (EPS) growth of 11%.

- BMO Capital : 6,700 (from 6,100)

- UBS : 5,800 (from 6,400)

- RBC Capital Markets : 6,200

- LPL Financial : 5,650–5,800

- Morgan Stanley: 6,500 (from 5,400)

- Oppenheimer: 5,950 (from 7,100)

- Wells Fargo: 7,007

- Barclays: 5,900 (from 6,600)

- JPMorgan: 5,200 (from 6,500)

- BofA: 5,600 (from 6,666)

- Deutsche Bank: 6,150 (from 7,000)

- Citi: 5,800 from (6,500)

Who Should Buy the S&P 500

The S&P 500 works by offering a broad exposure to the U.S. economy. It’s not a direct investment but rather a representation of a basket of stocks. However, understanding who might benefit from exposure to it and which investors may prefer to invest in it can be helpful.

Long-Term Investors: Those seeking to participate in the long-term growth of the US economy often find the S&P 500 a suitable investment. Historically, the index has delivered positive returns over extended periods.

Diversification Seekers: As a broad-based index, the S&P 500 can be a core holding for investors aiming to diversify their portfolios across various sectors and industries.

Passive Investors: Those preferring a hands-off approach to investing can benefit from index funds tracking the S&P 500. These funds, the SPY being one notable example, offer low-cost exposure to the market.

Bullish on the US Economy: Investors who believe in the continued growth and strength of the US economy may find the S&P 500 a suitable investment vehicle.

Retirement Savers: Many retirement plans offer S&P 500 index funds as a default investment option due to their historical performance and diversification benefits.

Trading The Index

The S&P 500 index is one of the most commonly traded instruments globally, but not everyone trades it in the same way.

If you have heard of trading the SPY, or the SPX, those are both avenues into the S&P 500 index, but they are not one and the same thing. This is how the S&P is traded via leveraged products such as futures, or options, via ETFs. You cannot buy the S&P 500 index in the same way you would a direct stock, and ETFs remain the most popular investment angle for those with long-term horizons in mind.

If you are looking for a volatility hedge on the S&P 500, the VIX is designed for just that purpose and is a good indicator of what can expected over the coming days.

There are also various sectors of the S&P 500, with each offering a way to trade part of the index, selecting only those sectors you wish to be exposed to.

S&P 500 Top 10 Companies

| Company | Market Cap |

|---|---|

| Apple | |

| Microsoft | |

| Nvidia | |

| Alphabet | |

| Amazon | |

| Meta Platforms | |

| Berkshire Hathaway | |

| Eli Lilly | |

| Broadcom | |

| Tesla |