Scalping is a short-term trading style that aims to utilize short time frames to capture small profits. Scalpers are looking to open multiple trades across the day to capture small moves in the market.

In this guide, you’ll learn:

Table of contents

What is Scalping?

Scalping is a trading strategy that involves a high number of opened trades focused on smaller profits. Essentially, scalpers believe that it’s easier to profit from smaller market moves.

Ultimately, many small profits can result in large gains if a strict exit strategy is used. This approach is the opposite of long-term trading which is more based on fundamentals.

Scalping trading strategies and techniques revolve around using technical indicators, and chart pattern recognition in order to identify opportunities.

Best Scalping Trading Strategies (with examples)

Now that we know what scalping is, let’s explore some Scalping strategies you can deploy on a daily basis. Scalpers typically employ technical analysis strategies as a way to identify potential trading setups.

Some of the most popular technical indicator tools used by expert scalpers include:

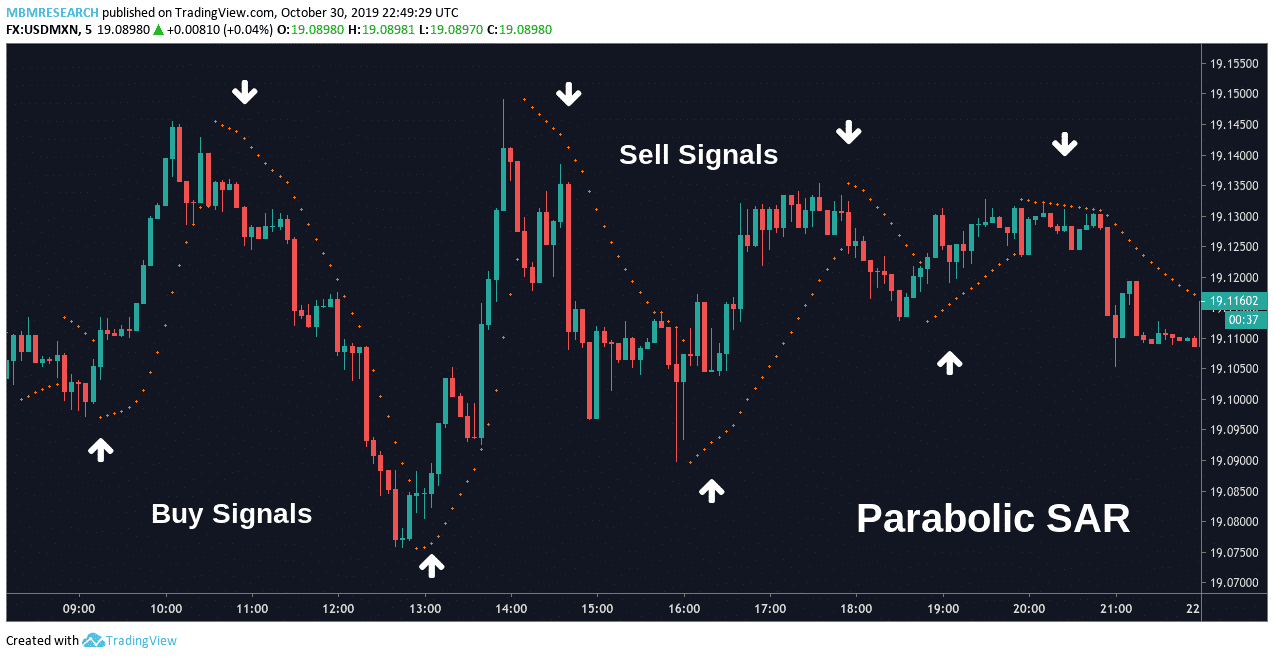

1. Parabolic SAR Indicator

One of the best technical indicators to use in scalping these types of scenarios is the Parabolic Stop and Reverse (SAR), or Parabolic SAR. This scalping trading strategy will identify many contrarian trading opportunities throughout each day.

Overall, the Parabolic SAR flashes “buy” signals when the indicator is visible below Forex market prices. In contrast, “sell” signals are present when the indicator moves above-market prices.

What’s most interesting about the Parabolic SAR is that it also offers its own signals to close each position. Essentially, long positions can be maintained until the indicator “stops” and “reverses.” When this happens, the indicator is essentially sending a new signal and the opposing trading stance should be adopted.

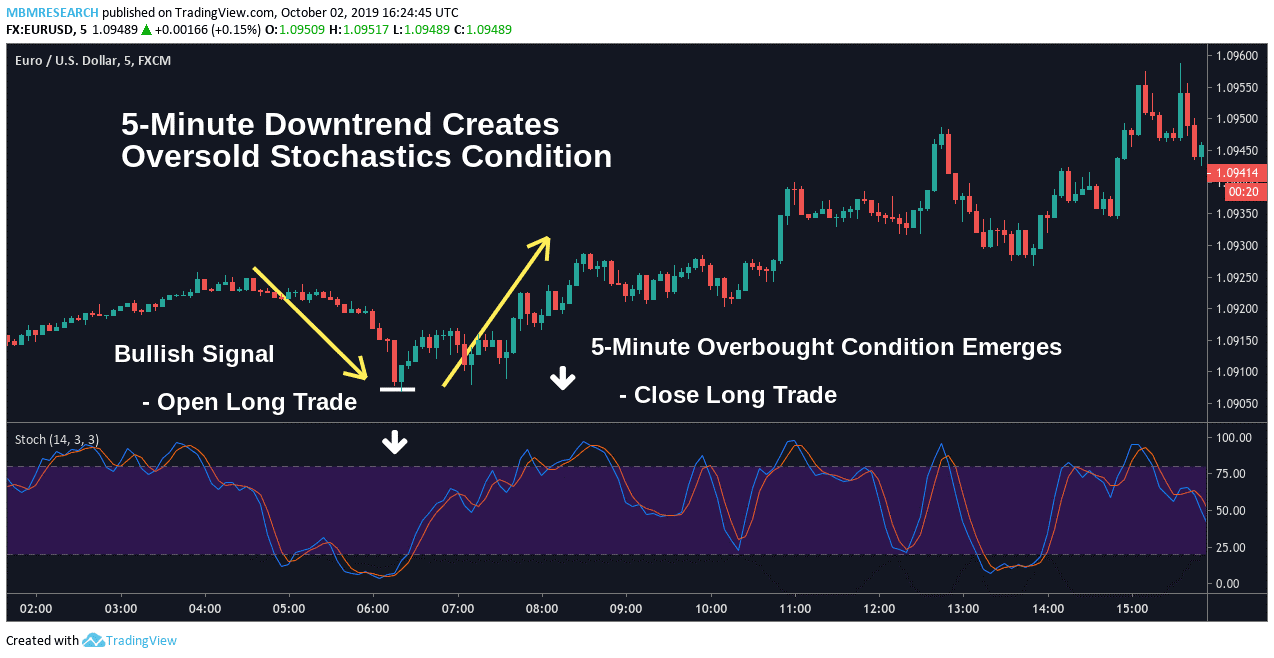

2. Stochastic Indicator

The stochastic oscillator is a momentum indicator that identifies overbought and oversold market conditions. The 5-minute chart below starts with a downward price move that creates an oversold condition in the historical stochastic readings.

Scalpers could have spotted this short-term price change as a new opportunity to initiate long positions. Stop losses on this scalp trade would be placed below the price low that created the oversold reading on the Stochastics indicator.

Once the position is open, it is important to look for an opportunity to close the trade at a profit. Of course, this means capturing trading gains that are greater than any trading costs that will be charged by a broker.

From a technical perspective, the first signal to close the trade comes as the stochastic readings move back into overbought territory. This event removes the original reasoning behind the trade and suggests market prices might be ready to turn lower.

As this occurs, expert scalpers would close the long trade and collect small profits on the position.

YOUR CAPITAL IS AT RISK

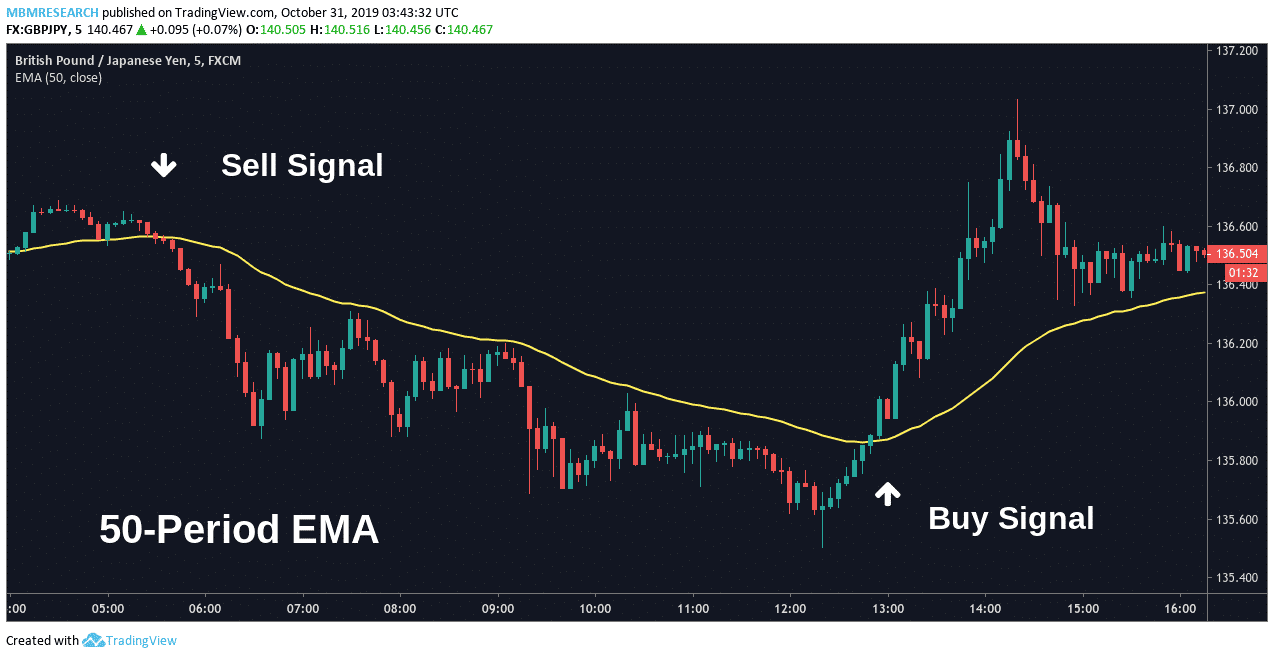

3. Moving Average

A moving average is one of the most popular technical indicators. In the chart below, we can see how scalpers use Exponential Moving Averages (EMAs) to establish positions. EMA is a type of moving average that places a greater weight and significance on the most recent data points.

When prices cross below the 50-period EMA, a sell signal emerges and short positions can be established. Conversely, buy signals become visible when market prices cross above the EMA dividing line and long positions can be established.

EMAs can be a great way of determining trend direction as specific trading parameters can be adjusted. Shorter EMA settings (i.e. those below 50 price periods) will send a larger number of buy/sell signals during each trading session.

Conversely, longer EMA settings (i.e. those above 50 price periods) will generate a smoother moving average line that produces fewer trading signals. Individual settings choices will depend on the number of trading signals a scalper would like to see each day.

4. Relative Strength Index (RSI)

Similar to the Stochastic indicator, the Relative Strength Index, or RSI, is looking for extreme market conditions. Scalping with the RSI works very well during more volatile market conditions, such as news events. In the gold chart, an expert scalper would have seen the negative momentum to initiate a short position at $1,510 (bid price).

Once indicator readings on the Relative Strength Index (RSI) reached oversold territory, scalping traders would close the position at a profit. Similarly, another short trade becomes apparent as prices fall through trendline support a second time. Using this scalping technique, traders could open new short positions at $1,509.80.

A signal to close the second short trade emerges, as gold prices break above the downward trendline on the 5-minute charts. This turns the trading bias to bullish (positively) and this creates new interest in long positions.

YOUR CAPITAL IS AT RISK

How A Scalping Trading Strategy Works

Scalping requires a trader to closely monitor the trading station. This is because a trader is essentially required to open/close a large number of positions to make scalping profitable.

Charting time frames also play a critical role in determining when to enter and exit trades. Forex scalpers tend to focus on 1-minute or 5-minute price charts. It’s very rare that a scalper will monitor charting time frames that are longer than 15 minutes.

Most scalping techniques aim to identify extreme moves in price action. Once identified, scalpers take a position in the same direction or in the opposing direction.

In order to make scalping works, this type of trader usually opens at least five trades per day. Ultimately, scalpers will hope that multiple positions each day and rely on substantial position sizes in order to drive profitability. This is because traders are only able to capture small moves in the market.

Scalping vs Day Trading

Scalping is closely associated with day trading. However, these two trading strategies are different, especially in the context of time frames and position sizes.

Day traders aim to close all their positions within the same day while for scalpers, this time frame is too long. Sometimes, they open numerous positions within 30-minutes or 1-hour. As outlined above, scalpers tend to focus on 1-minute to 15-minute charts.

Day traders, on the other hand, usually trade on 30-minutes or 1-hour charts. Positions are opened and closed within a few hours, and all closed on the same day.

Given they are focused on small profits, scalpers must rely on bigger position sizes. This is the opposite of day trading, as well as swing trading, who usually rely on the average account and position sizes.

Advantage of Scalping

There are numerous advantages of scalp trading. First, traders are less exposed to trend reversals. Some financial assets tend to trend in one direction and then head in another.

Secondly, the win rate – a percentage of successful trades – will very likely be higher. More experienced traders advice to target a win rate of at least 80% to make scalping work.

Another benefit of scalping is that a trader does not need to know much about the asset in question. Unlike long-term traders who rely on fundamental information, scalpers’ focus is more on technical analysis.

Disadvantages of Scalping

The biggest disadvantage of scalping is associated with risk management. Maintaining a large position size also carries a high risk. For this reason, stop losses are absolutely critical in scalping strategy and especially for Forex scalping.

When scalpers fail to use hard stops in their positions, substantial losses can accumulate. This is especially the case if short-term trend reversals are encountered in currency pairs.

YOUR CAPITAL IS AT RISK

Managing Risk in Scalping

Having stop-loss orders active is absolutely critical for scalpers. This is due to the enhanced risks that are often associated with scalping strategies. Thus, traders must always deploy protective stop losses in their positions.

Failing to place hard stops in positions may result in substantial losses. Moreover, scalpers usually place their stop losses around 5 pips below their market entry due to large position sizes.

Bigger positions are also tied to the used leverage. For this reason, it is advised to use lower leverage. This way, traders decrease the level of risk associated with a given trade.

In addition to stop-loss orders, risk should be managed by reducing market exposure. By spending only a few minutes in the market, a trader reduces the possibility of running into volatile events.

Which Time Frame Is Best for Scalping?

Traders generally build their scalping strategies on a 1-minute chart to a maximum of 15-minutes. A 1-minute and 5-minute time frame are the most common among scalpers.

The former is more suited to traders looking to spend the least possible amount of time in markets. These scalpers are looking for a profit of no more than 5 pips. The latter, on the other hand, is for traders aiming to book 5-10 pips from a single trade.

After some time, you should be able to identify your preferred time frame that fits your skillset.

Scalping Tips

Before you get started, here are five scalping tips for beginners:

- Always place a stop loss

- Trade using the most liquid financial instruments

- Trade during the most active time of the day (European + American sessions)

- Work to identify your preferred time frame that fits your skillset.

- Spend as little time as possible in the market

Final Thoughts

Scalpers aim to generate profits from small price movements in the market. The basic idea behind scalping is that is easier to profit from smaller market moves than focus on long-term trades. This approach includes opening a large number of trades focusing on small profits.

For this reason, scalping strategies work very well in volatile markets, such as Forex. Market news events usually create opportunities for traders using the scalping approach.

Traders are either scalping in the same direction (a trend-following approach) or in the opposing direction (a contrarian approach). Scalping strategies require traders to closely monitor the trading station and to open/close a large number of positions.

Traders generally build their scalping strategies on a 1-minute chart to a maximum of 15-minutes. Given the enhanced risks that are often associated with scalping strategies, traders must always deploy protective stop losses in their positions.