UK Stock News

Will National Grid Shares Rise? These Analysts Believe So

Despite the almost 10% decline in shares of National Grid (LON: NG.) (NYSE: NGG) this year, analysts at both Goldman Sachs and Citi are bullish on the stoc

UK Supermarket Stocks Have Mixed 12 Months – Who Stands Out? (TSCO, SBRY, MKS)

Inflation has been rearing it's head a lot in recent years, and supermarkets and retailers have been feeling the pressure more than most, as central banks' fight stands against profit margins.

London Stock Exchange in Talks To Take Over Parts of PrimaryBid – Sky News

Sky News reported late Tuesday that the London Stock Exchange (LSE) is in advanced talks to take over parts of PrimaryBid, a leading British fintech company.

3i Group Shares (LON: III) Look Set To Retest All Time Highs After Consolidation Phase

3i Group shares (LON: III) gapped up on this morning's open, starting at a new all time high at 2997p, up from Tuesday's close of 2770p. The stock is now on the verge of breaking through a significant resistance level, signal

DFS Furniture Cuts FY24 Expectations as Demand Levels Hit ‘Record Lows’

DFS Furniture (LON: DFS), the UK furniture retailer, lowered its profit and revenue forecast for the financial year ending June 30th, 2024, citing weak consumer demand and ongoing shipping issues.

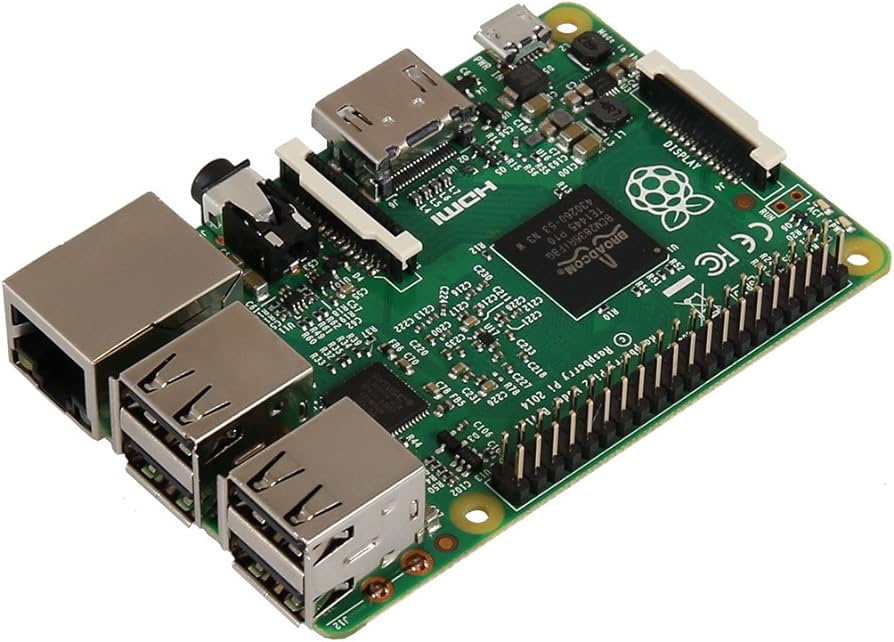

Raspberry Pi Shares (LON: RPI) Up Strong As IPO Buzz Hits

In a triumphant public offering that has energized the London financial scene, shares of popular computing firm Raspberry Pi surged by as much as 40% after its

M&G Shares Preferred Over Aviva at JPMorgan

Analysts at JPMorgan upgraded shares of M&G (LON: MNG) but downgraded Aviva (LON: AV.) in a note Monday, also removing the company's shares from its Analyst Focus List.

GSK Starts Appeal Process for Zantac Ruling

Drugmaker GSK (LON: GSK) said Tuesday that it is appealing a recent Delaware court decision that allowed certain expert testimony to be used in ongoing lawsuits over Zantac (ranitidine).

Down 9% YTD, Land Securities Share (LAND.L) Price Target Cut

Land Securities Group shares (LON: LAND) have had a difficult start to 2024, with the stock price down 9% YTD. A recent price target revision to the downside at Berenberg Bank is not as bad as might first seem, when consideri

Value In Vodafone Shares (LON: VOD) With Dividend Cut Looming?

The Vodafone share price (LON: VOD) has undeniably seen better days. Once a beacon of Europe's market, now its share price stands at a humble 71.5p, a drastic contraction from its maximum heights around the turn of the millen

FTSE 100 Slides: Key Events to Watch This Week

The FTSE 100 has started the week on the back foot, currently down 0.6% to 8,196.35 in early Monday trading on June 10, 2024, following Friday’s 0.48% decline, which saw London’s blue-chip index closed down almost 40 points a

GSK’s RSV Vaccine Approved By FDA For High-Risk Adults in Expanded Age Range

GSK's (LON: GSK) RSV vaccine, Arexvy, has been approved by the FDA for use in adults aged 50-59 who are at increased risk of severe RSV outcomes, the company said late Friday.

UK House Prices ‘Static’ in May, But Stability Should Instil Confidence – Halifax

Halifax said May 2024 house prices were "static," edging slightly lower from April. In its House Price Index, Halifax revealed average house prices were stable during the month, down just -0.1% to £288,688, from £288,862 the

Bellway Shares (LON: BWY) Up Early As Firm Raises Average Selling Price Outlook

Bellway plc (LON: BWY) reported a positive trading update for the period from February 1 to June 2, 2024, indicating stronger demand and an improved outlook for the housebuilder. The Bellway share price has traded up on the g

Deutsche Bank Optimistic on Rio Tinto Amid Copper Rally

In a recent update, Deutsche Bank has adjusted its target for shares in global mining giant Rio Tinto (LON : RIO), as copper prices experience a robust surge. The target for

LON: BPT – Bridgepoint Chair William Jackson to Exit

Bridgepoint Group (LON: BPT), a prominent asset manager, has announced a significant shift in its leadership as founder and outgoing chair William Jackson prepares to step down from his role on the board this summer. Jackson,

Fever-Tree Shares Jump as Brand Continues to Drive Market Share Gains

Fever-Tree (LON: FEVR), the premium drink mixer brand, saw its stock rise 3% at Thursday's opening bell, fuelled by continued market share growth.

BHP Group Has ‘Attractive Valuation’ Says Goldman Sachs

Investment bank Goldman Sachs has identified BHP Group as having an "attractive valuation" in a note this week.

Shorted Stocks in the UK – Which Names Make The Most ‘Unwanted’ List

Short-selling is a controversial topic but one that investors need to know about. The practice involves selling shares in a company that you don’t already own, in the expectation that at some later date, the price will have f

FTSE 250 Dips Slightly As 100 Gains – Rate Cut Expectations Growing

London stocks have endured a mixed start to Wednesday, following a weaker-than-expected report on US jobs. The FTSE 100 index was up 0.288% at 8,255 as speculation over upcoming rate cuts by major central banks, yet the FTSE

Carnival Corp (CCL) Shares: Analysts Get More Bullish on The Stock

Carnival Corp (LON: CCL) has had to navigate a turbulent last few years. However, with what looks like clear skies ahead, analysts are turning bullish on the cruise line giant.

B&M Revenue Rises 10%, ‘Volume Driving Profitable Growth’

Discount retailer B&M European Value Retail (LON: BME) reported Wednesday that FY24 revenue rose 10.1% to £5.5 billion for the financial year ending March 30th, 2024.

Darktrace (LON: DARK) and Vistry Group (VTY) Contending For FTSE 100 Inclusion

The FTSE 100, the index representing the 100 largest companies listed on the London Stock Exchange, has its rebalancing coming tomorrow (with data used from close of markets today). Adjustments to the index occur quarterly, r