Inherent structural issues in the uranium industry continue to result in extreme price volatility for stocks in the sector. Firstly, there is the issue of demand and the fact that plans relating to nuclear production are highly susceptible to political manoeuvres.

It’s hard to gauge how decision-makers will balance the need for carbon neutrality and the long-term problems relating to nuclear waste. Then there is the issue of supply. Finding the metal in the ground and then building the plant needed to extract and process it takes years. That causes supply to find it hard to react to short, medium and even long-term changes in demand.

The high levels of risk-return involved make trading uranium stocks a proposition for the ‘diamond hands’ style investors. The adage that investors should only use funds they can afford to lose completely is particularly relevant in the sector.

Best Uranium Stocks To Shortlist

Traders and investors with a view on trends in the industry and the potential price moves they might cause can buy uranium stocks as a means of gaining exposure to the nuclear power industry. Trading uranium itself can’t be done in the same way as gold, silver, copper, and oil, so buying uranium stocks acts as a proxy to an investment in nuclear power.

1. Cameco Corporation (NYSE: CCJ)

Delve into the world of uranium stocks, and one name which keeps cropping up is Cameco. The Canada based firm is the world’s second-largest uranium producer and accounts for 18% of global output. From an investor perspective, the good news is that the firm has extensive operations in North America. As the security of energy supply is the primary driver of demand for building nuclear power plants, having a reliable, local source of the raw materials required also makes sense.

Investor interest in the stock has taken the Cameco market capitalisation to $17bn and the Cameco stock price from $7.65 in March 2020 to $39.34 in August 2024.

Technical resistance in the form of the previous all-time-high (May 2007) was recently tested and surpassed, before markets took a turn. The moving averages are also providing bullish indicators. Looking at the 5 year weekly chart below, barring this recent pullback, strength is with Cameco, and 350%+ in gains are impressive.

Due to its size and important position in the sector, Cameco is followed by institutional analysts, with eight out of nine giving the stock a hold, buy or strong buy rating. While uranium miner stocks remain a highly volatile proposition, Cameco even offers investors a dividend. The yield of 0.24% may not lead to them being grouped in the ‘high-div’ bracket but still beats savings deposit rates.

2. Uranium Royalty (NASDAQ: UROY)

Cameco may have critical mass and a fine pedigree, but Uranium Royalty which IPO’ed in April of 2021, offers an edgier ‘new kid on the block’ proposition. Insiders still own an impressive 20.51%of shares in the Nasdaq listed firm (at the time of writing). A signal that executives and directors still see growth potential is always a good sign.

The ability of the firm’s staff to be able to hold onto positions of such size is thanks to them being seasoned pros in the industry. The uranium market is hard to navigate, and UROY is set up in a way that demonstrates the management has experience of finding an edge in terms of squeezing out the best potential gains for their firm and investors. The company’s website explains how the firm is about more than just digging uranium out of the ground.

As the company’s site states:

“Uranium Royalty Corp is focused on gaining exposure to uranium prices by making strategic investments in uranium interests, including royalties, streams, debt and equity in uranium companies, as well as through physical uranium transactions. The Company’s strategy recognises the inherent cyclicality of valuations based on uranium prices, including the availability of capital in different pricing environments.”

Source: Uranium Royalty Corp

The ‘value added’ element of the proposition is that the management has experience developing relationships that help them optimise performance along different stages of the uranium production process. These extend to mine finance, project identification and evaluation, mine development and uranium sales and trading with leading companies and institutions in the uranium and nuclear energy industries.

As the firm has a shorter history, data such as dividend yields is hard to come by, and technical indicators such as moving averages carry less weight. The opaque nature of some of the data reporting might put some off, but the ‘insider holdings’ number is one to watch and while it holds at current levels, plenty of investors will be using this stock as a way to play the nuclear power trade.

The two year chart on a daily below looks set to retest support from the lows, and we will watching for signs of a reversal.

3. Westwater Resources (NASDAQ: WWR)

US-based Westwater offers various ways to play the low-carbon energy trade. The firm’s graphite operations form a vital element of the North American lithium battery production process, and it also has interests in uranium mining.

Its North American operations were sold in 2021 to enCore Energy Corp of Vancouver. The sale helped Westwater improve its balance sheet; however, WWR also maintains an interest in the New Mexico and Texas uranium fields thanks to holding 1.5% of enCore and further royalty rights.

Back in 2020/21 the WWR share price experienced two huge price spikes. Both of these related to White House political initiatives to ringfence domestic supply of materials needed for battery production rather than for uranium-based reasons. Now trading back at lower levels, WWR offers an opportunity for those who want to gain exposure to uranium miner stocks and other low-carbon fuel sectors.

The fundamentals highlight how buying into WWR is a risky proposition. The firm has a market cap a little under $25million. The bad news for Westwater is that although it’s possible to argue a business case for investing in the firm, there are more attractive candidates on any shortlist of the best uranium stocks.

Looking at the 2 year chart below it is easy to see the bears are in control here. Zooming into the 6 month chart, and you would want to see a breakout from the $0.56 level, followed by a retest and support. This could signify that resistance turning to support and the beginning of a breakout, but fundamentals and news will likely drive this one, whichever way it goes.

4. Energy Fuels Inc (NYSE: UUUU)

As the share price of Energy Fuels demonstrates, the firm ticks a range of boxes for investors. The firm is one of the leading uranium producers in the US and has exploration and mining operations in Wyoming, Colorado, Texas, New Mexico, and Arizona.

The US is the world’s largest supplier of nuclear power, accounting for 30% of the global total. That means Energy Fuels and their domestically sourced uranium are closely positioned to the biggest buyer in the market. The firm also has other divisions, such as one related to mining vanadium which offer something of a kicker to the share price, which rose by more than 450% between November 2020 and October 2021.

Having pulled back significantly in recent years, UUUU may be re-entering a buy zone, with a retest of 2021 support around $4.50 potentially proving key to the next leg. Bears have been in charge here over the past 12 months, but over 5 years, there remains more than 180% of gains for Energy Fuels holders. Until the trend looks to reverse, this would be one to keep on shortlists, potentially for some big news, or a breakout above $6 to hold.

5. Uranium Energy Corp (UEC)

Uranium Energy Corp has a few add-on services to catch the eye of investors, but its core operations are US-based and very much about getting uranium out of the ground and to where it is needed, now.

The hub-and-spoke operations in South Texas centre around the fully-licensed Hobson Processing Facility, which is central to the Palangana, Burke Hollow and Goliad ISR projects. It also boasts the largest permitted, pre-construction ISR uranium project in the US, which is found in Wyoming. The firm’s operations are primed to take advantage of any short-term spikes in uranium prices.

The firm is in something of a sweet spot for investors. Its $1.8BN market capitalisation means it’s big enough to have critical mass but small enough to look like the next big thing. .

The company’s operations are managed by an experienced management team with a recognized profile for excellence in their industry. They have many decades of hands-on experience in the key facets of uranium exploration, development, and mining and in the last six months have upped their stake in their own firm.

Strong on both the yearly, and the 5 year (gains of 380%), UEC has retraced 45% from recent highs, with key levels to watch being the psychological levels of $4 and $5 for an indication of direction. As always, keep an eye on the fundamentals which could hold the key for longer term momentum.

Bonus – Global X Uranium ETF (NYSE: URA)

As outlined, the decision to buy uranium stocks has to factor in the potential risks associated with the sector. One way to manage the situation and mitigate ‘single stock’ risk is to invest in a fund style product. The Global X Uranium ETF is an example of such baskets of different stocks. In one trade, clients can gain exposure to a collection of firms that are a targeted play on uranium mining and nuclear power production. The benefits of a fund style product mean that if one stock does go bad, it doesn’t wholly tank investment returns.

The ETF is listed on the NYSE. It doesn’t just take positions in those firms digging the metal out of the ground. Its investment mandate offers it room to take positions in firms involved in the production of nuclear components, including those in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries.

ETF’s offer a way to spread some of the risks associated with uranium investing. It also allows investors to get exposure to different parts of the production chain in just one trade.

As the Global X Uranium ETF offers a comprehensive view of the broader uranium market, zooming out to a long-term price chart provides a glimpse of the potential for the sector. As you can see on the 5 year above, technically a head and shoulders coincided with the recent breakdown, but $23 has acted as a key support level a few times in the past. With prices close to that level, this could be a time to take a closer look.

How To Buy Uranium Stocks

Despite the inherent risks associated with investing in uranium stocks, the good news is that there are plenty of trusted brokers who, in terms of operational risk, offer a safe form of trading.

In fact, the interest caused by uranium and other hot stocks such as lithium mining stocks has seen several brokers spring up, and the extra competition is trickling down to investors. T

he range of services provided by brokers is constantly changing and finding the best fit for you will largely come down to personal preference, but rule number one is to make sure they are legit.

1. Choose a Broker

One major feature of the recent revolution in the finance sector is that trading and investment has gone online. The account opening and trading processes are all carried out virtually, dramatically reducing the workload associated with the process. It has also meant that the benefits of new efficiencies can be passed on, so there are now plenty of cost-effective ways to set up and trade uranium stocks.

Differentiating between brokers usually comes down to fine margins and personal preference. Some will prioritise support features such as 24/7 customer service, while others will break down cost analysis to a granular level. These nice-to-have features are important and can help you get set up; however, the first task is to check if the names on your broker shortlist are safe.

Importance of Regulation

If you choose a scam broker, you’re almost certain to lose your initial stake as well as any potential profits you make. To avoid retail traders getting wiped out, financial regulators have set up schemes that oversee the markets and provide licences to firms that meet specific criteria.

The US financial market is overseen by a variety of Tier-1 authorities, which are widely regarded as setting the gold standard in terms of regulatory compliance. You take the first step towards trading safely by choosing a broker licensed by one of the below highly regarded regulators.

Tier-1 US Regulators

- The U.S. Securities and Exchange Commission (SEC)

- Commodities Futures Trading Commission (CFTC)

- National Futures Association (NFA)

Tier-1 International Regulators

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

The exact details of what regulatory protection applies to which person is determined by the country of domicile and citizenship of the account holder. It’s essential to check the details, but the rubber stamps from tier-1 regulators count for a lot and point towards a trustworthy broker.

What is important is that to comply with the license terms of regulators, brokers are required to pass a series of tests. These range from demonstrating they hold enough cash to be viable business operations. There can also be a requirement to hold client funds in segregated accounts. There is also a need for independent audits of processes and plenty of other client safety protocols to comply with. More information on the regulatory pros and cons of different brokers can be found here.

Picking a regulated broker is an excellent first step towards safer trading. It doesn’t negate market risk, the risk of the market moving against you, but one way to manage that situation is to practise using a demo account. These allow newbies to put on virtual trades in a risk-free environment. They are also a safe way of testing the functionality of your broker.

Opening a demo account requires you to provide little more than an email address, and they typically take less than 10 seconds to open.

2. Open and Fund an Account

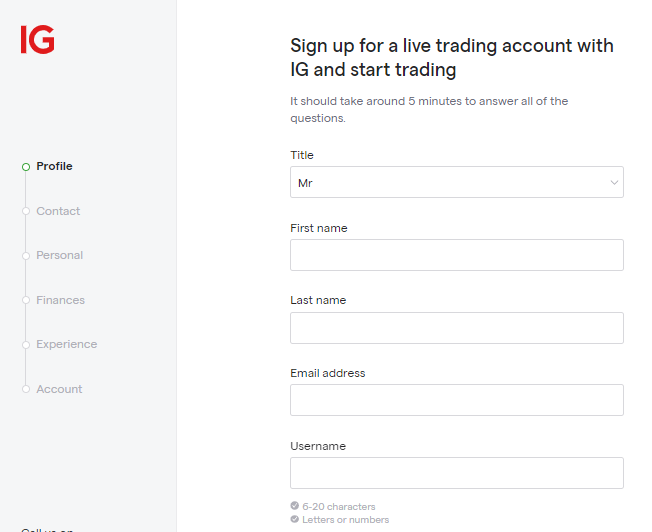

Whether you are upgrading from a Demo account to a Live one or simply signing up for a Live account from scratch, the process is completed online and takes minutes to complete. The onboarding process is relatively generic across the different brokers, as the questions asked are often related to the same prompts by regulators.

The first requirement is for the broker to be able to identify you. This helps you keep control of your funds and helps them build a profile to apply client care protocols. The process of submitting KYC (Know Your Client) information might require uploading i.d.

Source: IG

Once your account is set up, the next step towards buying uranium miners is funding your account. It’s possible to wire funds in various ways, with the simplest and fastest methods traditionally being debit or credit card payments. These are typically associated with immediate transfer of funds, but other payment services, particularly e-payments, are increasingly popular. Whichever one you use, you’ll find the process is designed to get you trading as fast as possible, and most brokers don’t charge any fees on cash deposits.

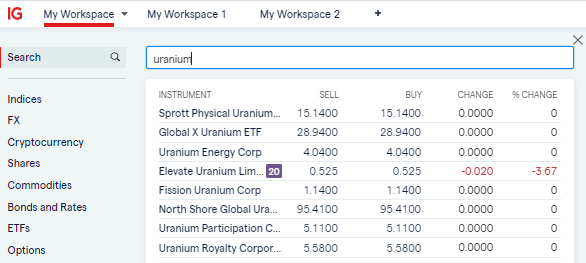

3. Open an Order Ticket and Set Your Position Size

Once set up on the platform, it’s a case of locating the uranium or uranium miners stocks your research identified. You can do this by using the search function or filtering by sector.

Source: IG

Each stock will have a dashboard that includes price charts, the latest news, and company information. Entering the number of shares you want to buy into the appropriate data fields is the next step.

Source: IG

As stock exchanges have set trading hours, you will either need to trade whilst the exchange is open or set a limit order, a binding contract to buy at a certain price when the market next opens. Getting ‘filled’ on a limit order does require market price reaching the level you stipulate, so it can lead to severe cases of FOMO.

4. Set Your Stops & Limits

Stop Loss instructions and Take Profit orders are risk-management tools built into the trading system. They instruct the broker to partially or fully close out some of your position if price reaches a certain level.

Stop-losses come into play if price moves against you. They prevent loss-making positions from making further losses. Take profits, work in the other direction and lock in gains should the price of your uranium stock suddenly sky-rocket.

Investing in uranium stocks can be a long-term proposition. As a result, some buy-and-hold investors don’t use stop losses and take profit orders, instead they take the view that a short-term price crash might be something they even expect and intend to ride out. If a sudden price crash is only temporary, then the uranium stock position might be closed out at the stop-loss level only for price to recover back to normal levels soon after.

Longer-term investors might also consider take profit orders as putting an unnecessary cap on potential gains. The decision of whether to use them comes down to individual appetite for risk-reward. Other risk management techniques such as portfolio diversification and trading in small size can also be considered.

5. Make Your Purchase

Once everything’s been checked, it’s simply a case of clicking or tapping ‘Buy’. Executing trades or monitoring activity on your account can be done using a handheld as well as a desktop device.

At the time of your uranium stock purchase, the cash balance in your account decreases. In return, you will be credited with a holding in a uranium or uranium mining stock. Live market prices will determine the value of your stock position, and you’ll be able to monitor the P&L (profit and loss) by accessing the Portfolio section of the platform.

The site’s portfolio section is also where you head when you want to sell up some or all of your position. The process for selling is very similar to buying, just in reverse, so your stock holding goes to zero, and you convert it to cash according to the market price at the time of sale.

One top tip is to, at this stage, run some final checks. The online systems are reliable enough, but human error can come into play, and even experienced traders suffer from ‘fat finger’ errors. If there are any errors in the uranium trade you just booked, they are best corrected before prices move too far.

Summary

Most of the work associated with building a portfolio of uranium and uranium mining stocks is front-loaded. It involves working through trade ideas and research notes and choosing the right broker for your trading strategy.

There is a lot of freely available information to be found online, and good brokers also have specialist analyst reports on offer, but the trick is to develop a clear strategy. One which incorporates the principles of technical analysis and fundamental analysis can help tip the scales in your favour but always keep risk management in mind.

As uranium stocks are a hot topic, there is also a lot of ‘chatter’ about them on social media channels. Whilst it might not be wise to base investment decisions on the internet sourced ideas of strangers, keeping up to date with the market’s mood is essential.

The levels of excitement in the uranium sector make it a proposition worth considering. That being said, the basic principles of investment still apply, and given the sector’s risk profile, only funds that can afford to be lost should be used. Spreading capital allocation across a range of uranium stock names can improve your chances of holding a position in one which takes off and minimise the pain should one of them prove to be a poor choice.